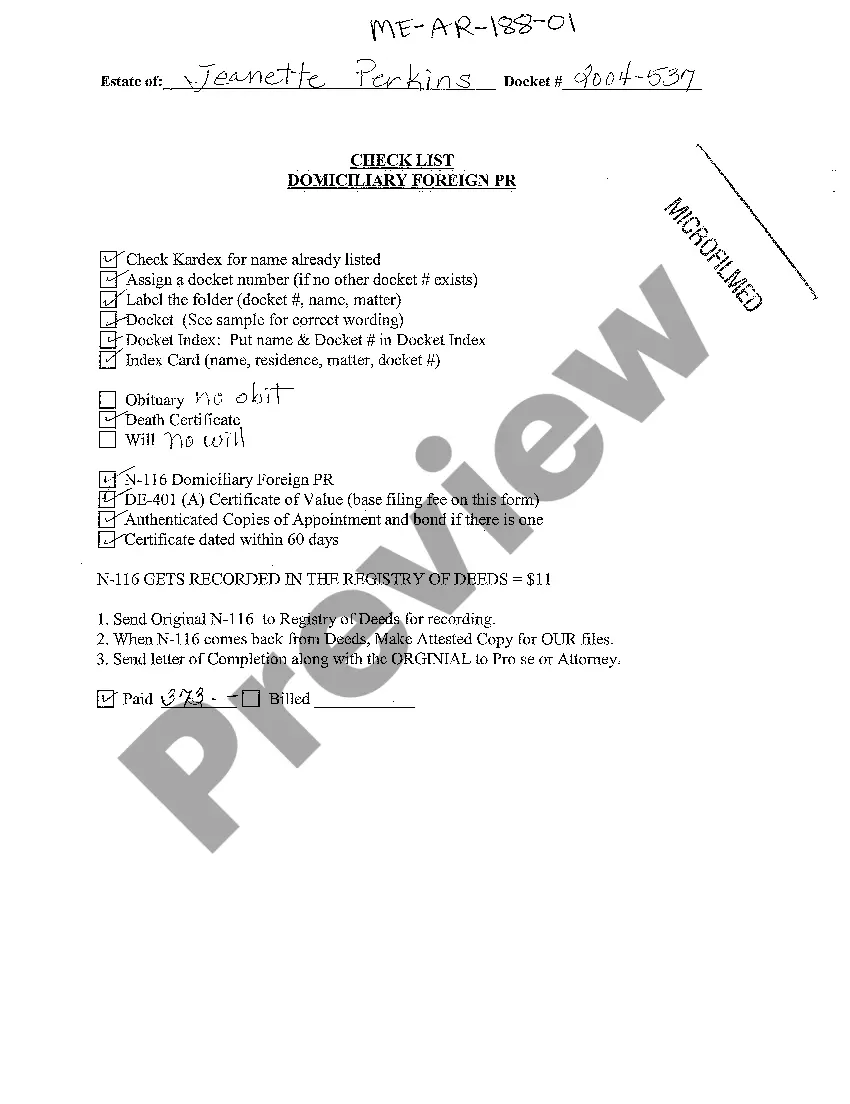

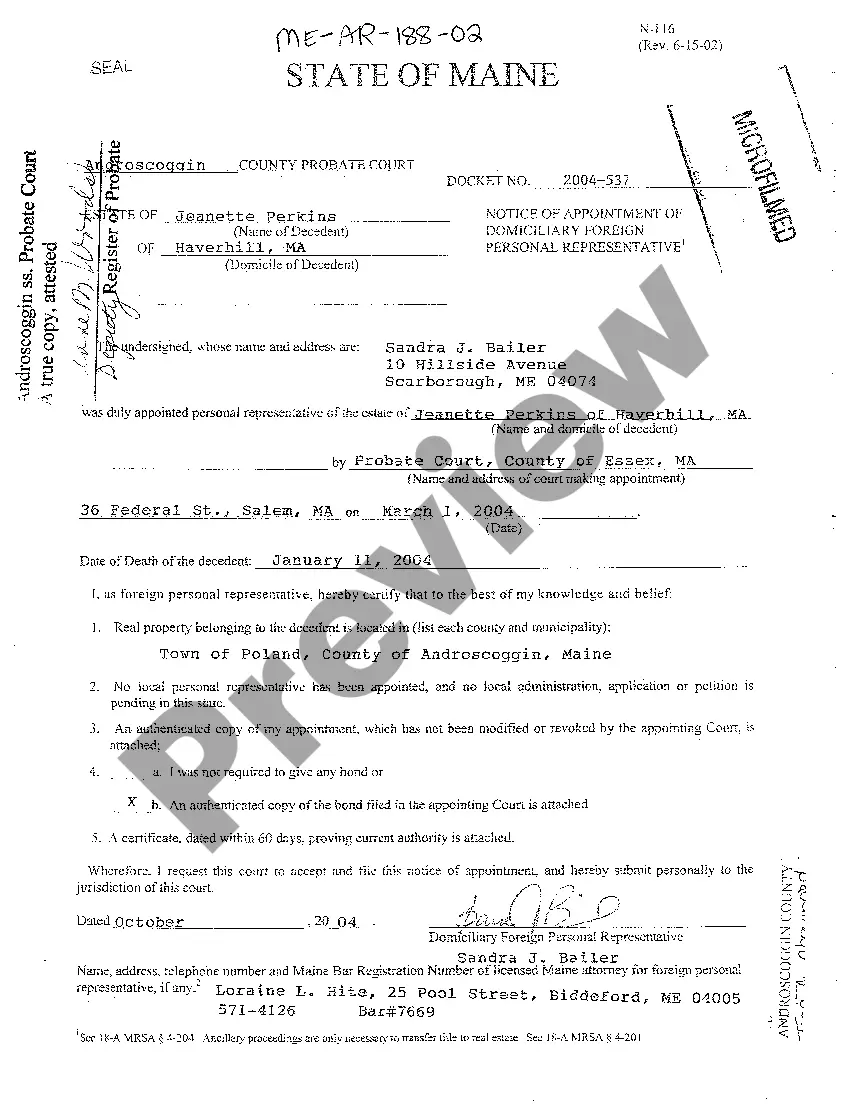

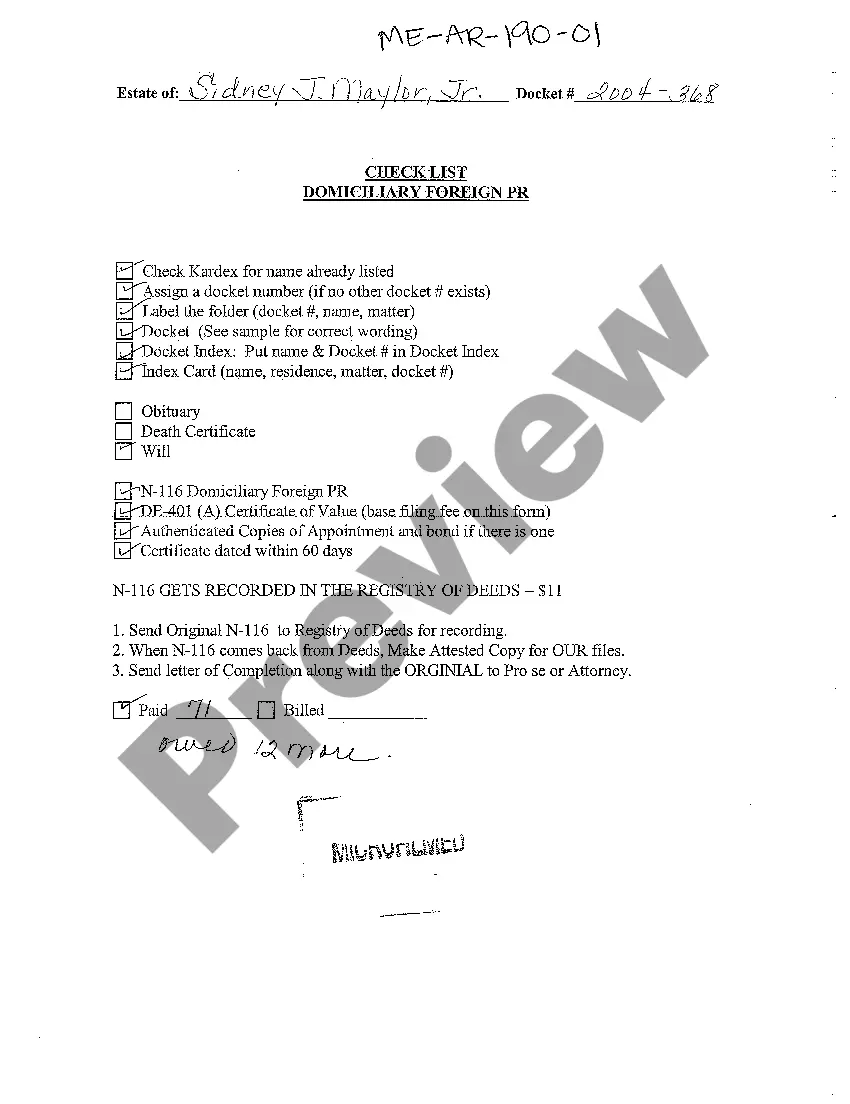

Maine Checklist for Domiciliary Foreign Personal Representative

Description

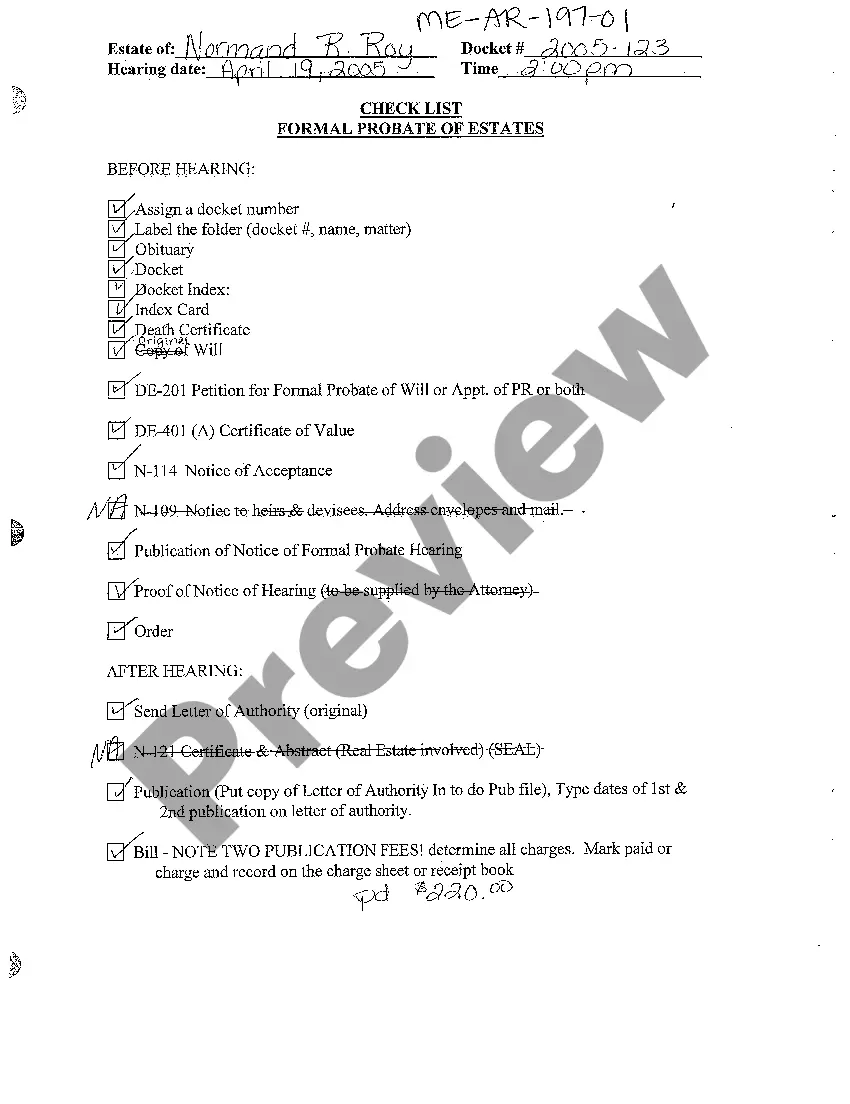

How to fill out Maine Checklist For Domiciliary Foreign Personal Representative?

Among numerous paid and complimentary examples that you encounter online, you cannot be certain of their reliability.

For instance, who created them or if they possess the necessary expertise to handle your specific needs.

Always remain calm and utilize US Legal Forms!

Proceed by clicking Buy Now to initiate the ordering process or search for another template using the Search field found in the header. Choose a pricing plan and set up an account. Complete the payment for the subscription using your credit/debit card or Paypal. Download the document in the desired file format. After you’ve registered and paid for your subscription, you can utilize your Maine Checklist for Domiciliary Foreign Personal Representative as frequently as required or for as long as it remains valid in your area. Edit it with your preferred software, fill it in, sign it, and print it. Achieve more for less with US Legal Forms!

- Obtain Maine Checklist for Domiciliary Foreign Personal Representative templates crafted by experienced lawyers and avoid the costly and time-consuming task of finding an attorney and subsequently paying them to draft a document that you can easily locate on your own.

- If you already hold a subscription, Log In to your account and find the Download button adjacent to the form you are seeking.

- You’ll also have access to all your previously acquired documents in the My documents section.

- If you are visiting our website for the first time, adhere to the instructions below to quickly obtain your Maine Checklist for Domiciliary Foreign Personal Representative.

- Ensure that the document you find is applicable to your location.

- Examine the template by reviewing the description using the Preview feature.

Form popularity

FAQ

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

4% of the first $100,000. 3% of the next $100,000. 2% of the next $800,000. 1% of the next $9,000,000. 0.5% of the next $15,000,000. and reasonable compensation as determined by the California Probate Court for any amount above $25,000,000.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

This will most likely be your spouse or a close relative, but not necessarily the person in your life who is best suited to the task. When handling finances and personal affairs, you would like your personal representative to be someone close to you and honest, whom you can trust.

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.

A personal representative is the person, or it may be more than one person, who is legally entitled to administer the estate of the person who has died (referred to as 'the deceased'). The term 'personal representatives', sometimes abbreviated to PR, is used because it includes both executors and administrators.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.

A beneficiary, or heir, is someone to which the deceased person has left assets, and a personal representative, sometimes called an executor or administrator, is the person in charge of handling the distribution of assets.