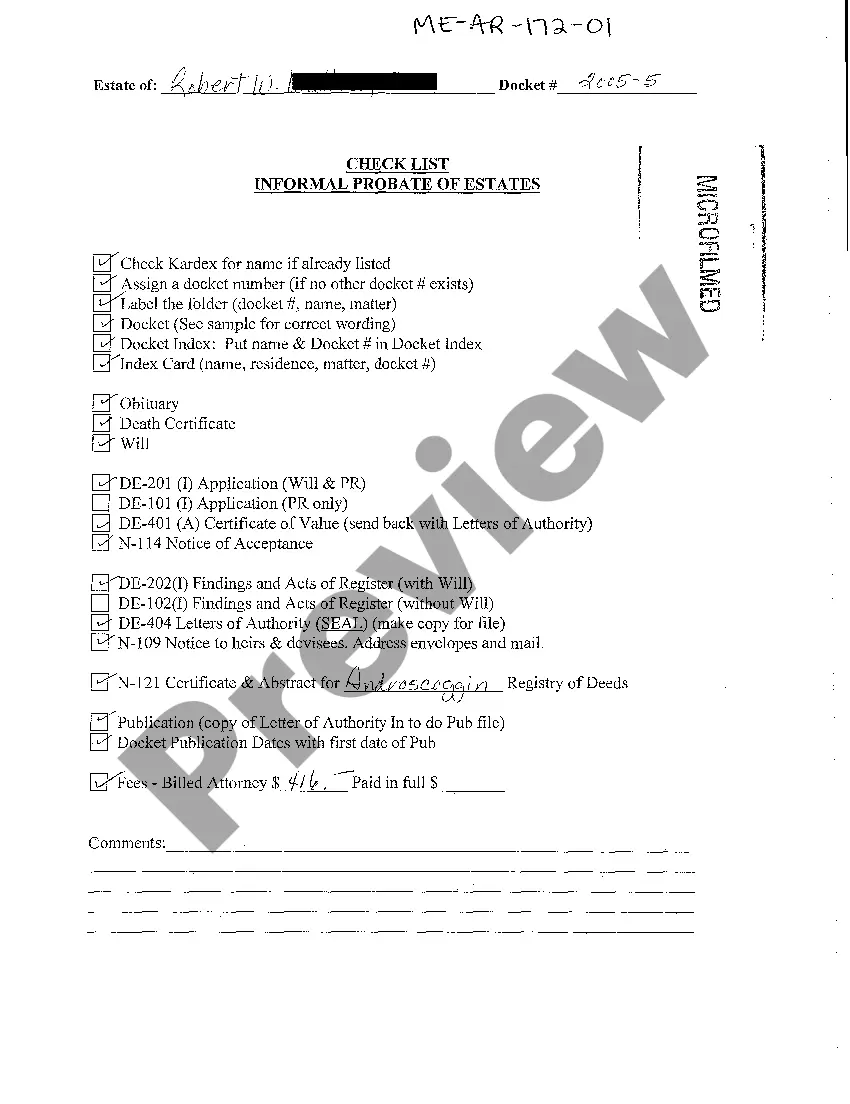

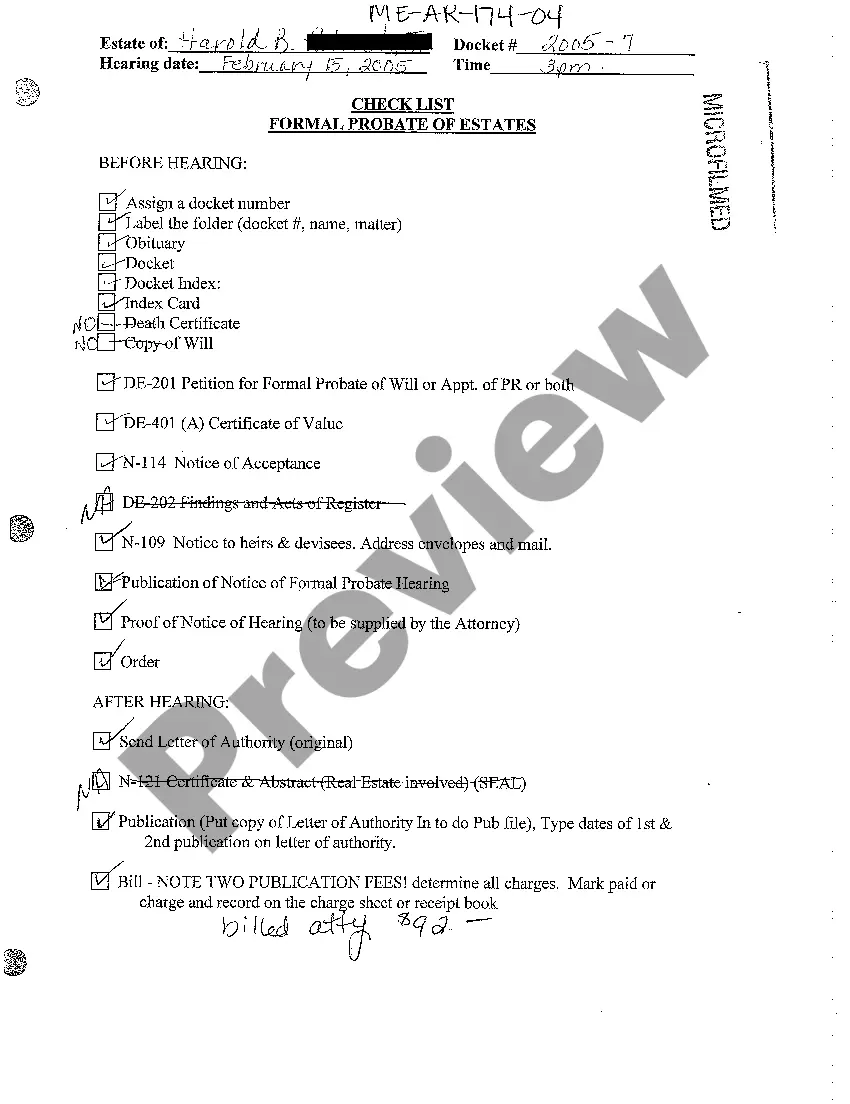

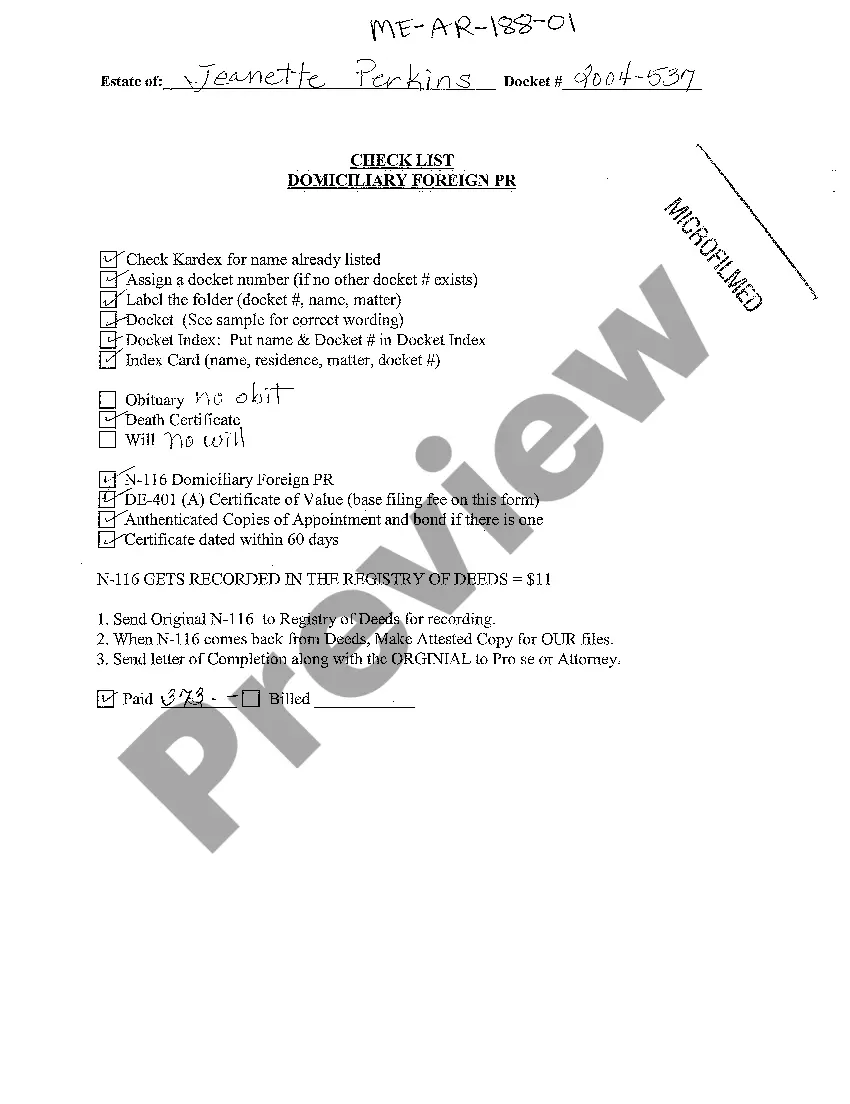

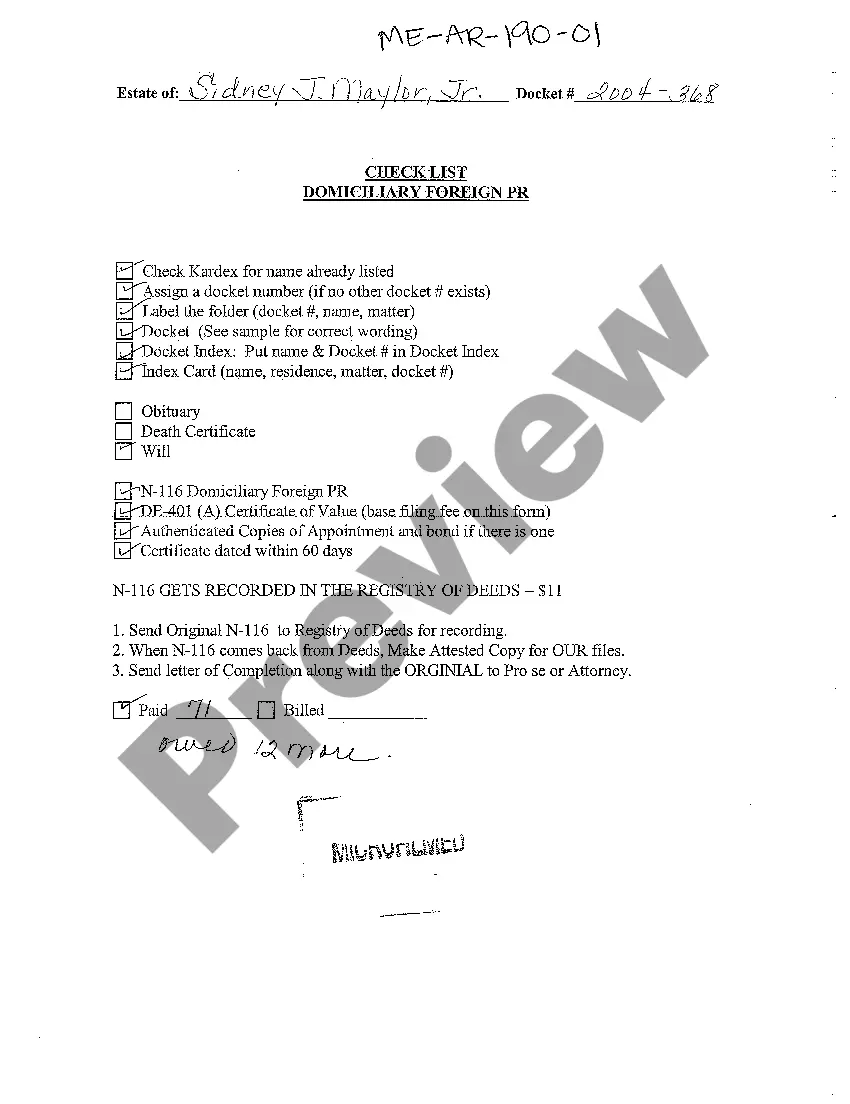

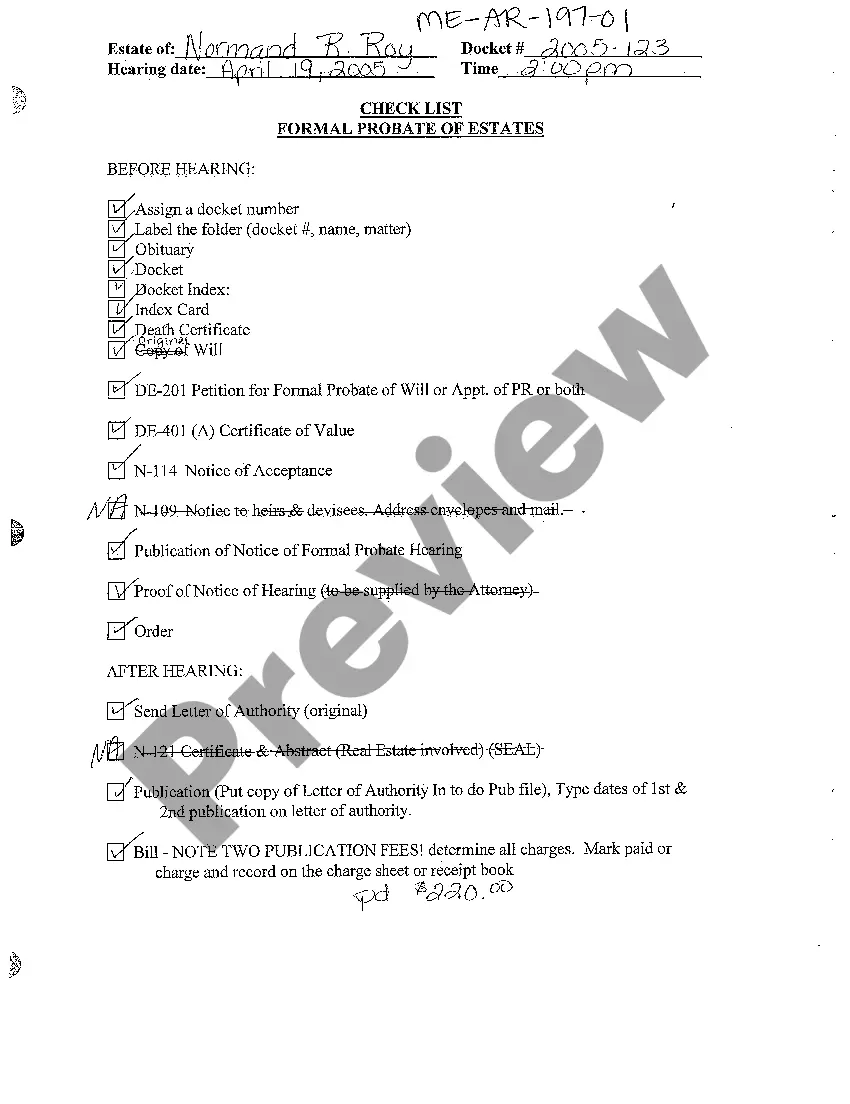

Maine Checklist - Formal Probate of Estates

Description

How to fill out Maine Checklist - Formal Probate Of Estates?

Among countless paid and free instances that you can locate online, you cannot be certain about their precision.

For instance, who developed them or if they possess the necessary expertise to manage what you require from them.

Always stay calm and utilize US Legal Forms!

Select Buy Now to initiate the purchase process or discover another template using the Search field in the header. Choose a pricing plan to register for an account. Complete the payment for the subscription using your credit/debit card or Paypal. Download the document in the required format. Once you’ve registered and bought your subscription, you may utilize your Maine Checklist - Formal Probate of Estates as many times as you wish or for as long as it remains active in your region. Modify it in your preferred editor, complete it, sign it, and print it. Achieve more for less with US Legal Forms!

- Uncover Maine Checklist - Formal Probate of Estates templates crafted by experienced attorneys and bypass the costly and time-consuming process of seeking an attorney and afterward compensating them to create a document for you that you might find yourself.

- If you already maintain a subscription, sign in to your account and locate the Download button adjacent to the form you seek.

- You’ll also gain access to your previously acquired templates in the My documents menu.

- If you’re visiting our platform for the first time, adhere to the following instructions to obtain your Maine Checklist - Formal Probate of Estates quickly.

- Ensure that the document you view is valid in your region.

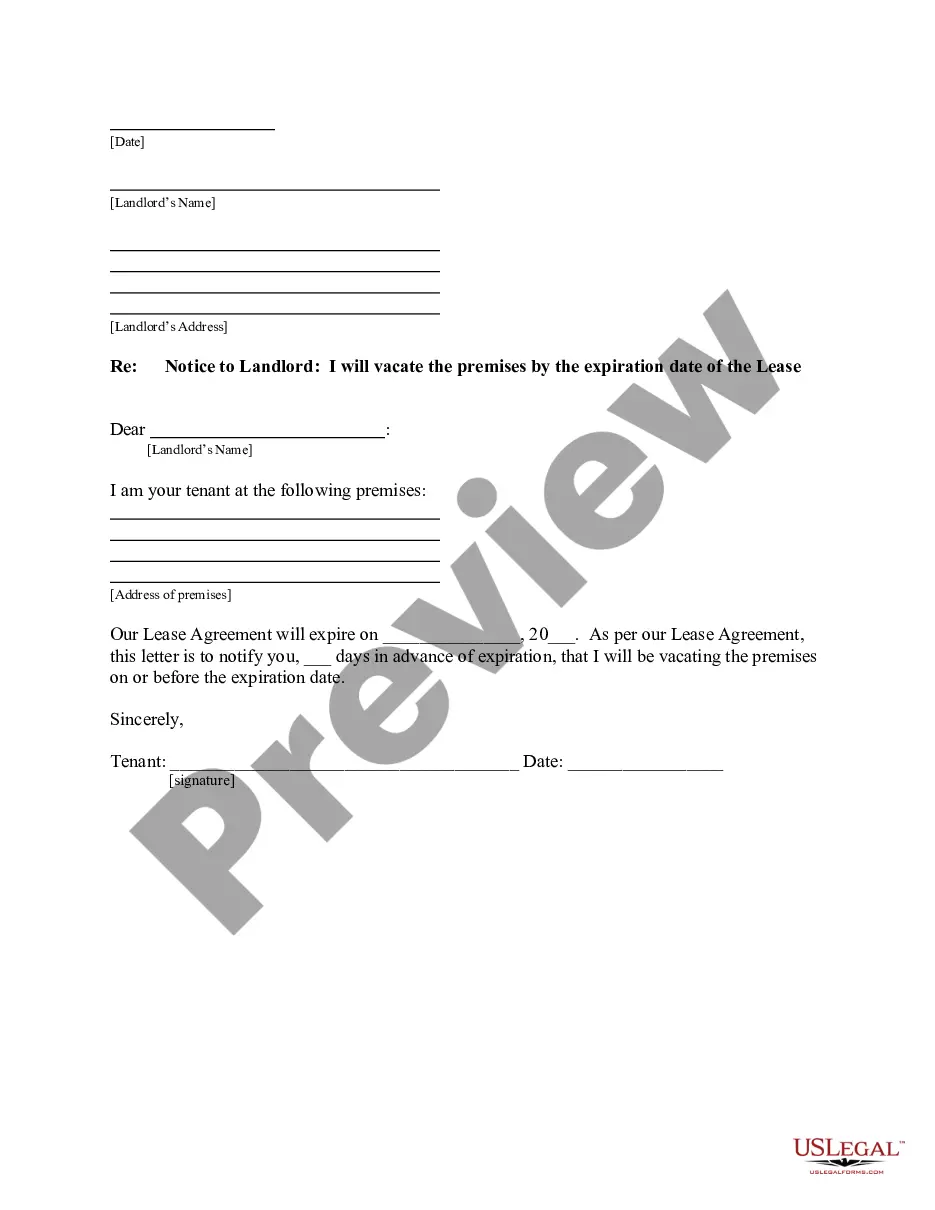

- Review the document by consulting the description to use the Preview feature.

Form popularity

FAQ

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

An inventory and appraisal is a required filing in California probate. The inventory and appraisal is a single document that (1) inventories the property in the decedent's estate and (2) contains an appraisal of the property in the inventory. California Probate Code § 8800(a).

Gathering any assets, eg, money left in bank accounts. Paying any bills. Distributing what's left according to the will.

Your inventory should include the number of shares of each type of stock, the name of the corporation, and the name of the exchange on which the stock is traded. Meanwhile, you should note the total gross amount of a bond, the name of the entity that issued it, the interest rate on the bond, and its maturity date.

To start the probate process, you need to file an Application for Probate in the probate court in the county where the decedent lived. In Maine, each county has its own probate court. If there is a Will, it needs to be submitted to the probate court. The probate judge will decide whether or not the Will is valid.

The first step in probating an estate is to locate all of the decedent's estate planning documents and other important papers, even before being appointed to serve as the personal representative or executor.

Non-probate assets include assets held as joint tenants with rights of survivorship, assets with a beneficiary designation, and assets held in the name of a trust or with a trust named as the beneficiary.Your Will does not control these assets.

Pass real estate and other assets owned in joint tenancy to the surviving joint tenant. transfer bank accounts and securities registered in "payable on death" form to beneficiaries. transfer funds in IRAs and retirement plans to named beneficiaries.

Determine Your State's Laws Regarding Inventory Forms. Review the Instructions Provided. Identify Real Property. Identify Personal Property. Identify Bank Accounts. Identify Retirement Accounts. Identify Non-Probate Assets. File the Form With the Court.