New Hampshire Self-Employed Groundskeeper Services Contract

Description

How to fill out Self-Employed Groundskeeper Services Contract?

If you wish to be thorough, download, or print valid document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

Step 6. Choose the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the New Hampshire Self-Employed Groundskeeper Services Contract. Every legal document template you obtain is yours for a long time. You will have access to each form you saved in your account. Select the My documents section and choose a form to print or download again. Stay competitive and download, and print the New Hampshire Self-Employed Groundskeeper Services Contract with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Use US Legal Forms to obtain the New Hampshire Self-Employed Groundskeeper Services Contract in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download option to access the New Hampshire Self-Employed Groundskeeper Services Contract.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct area/region.

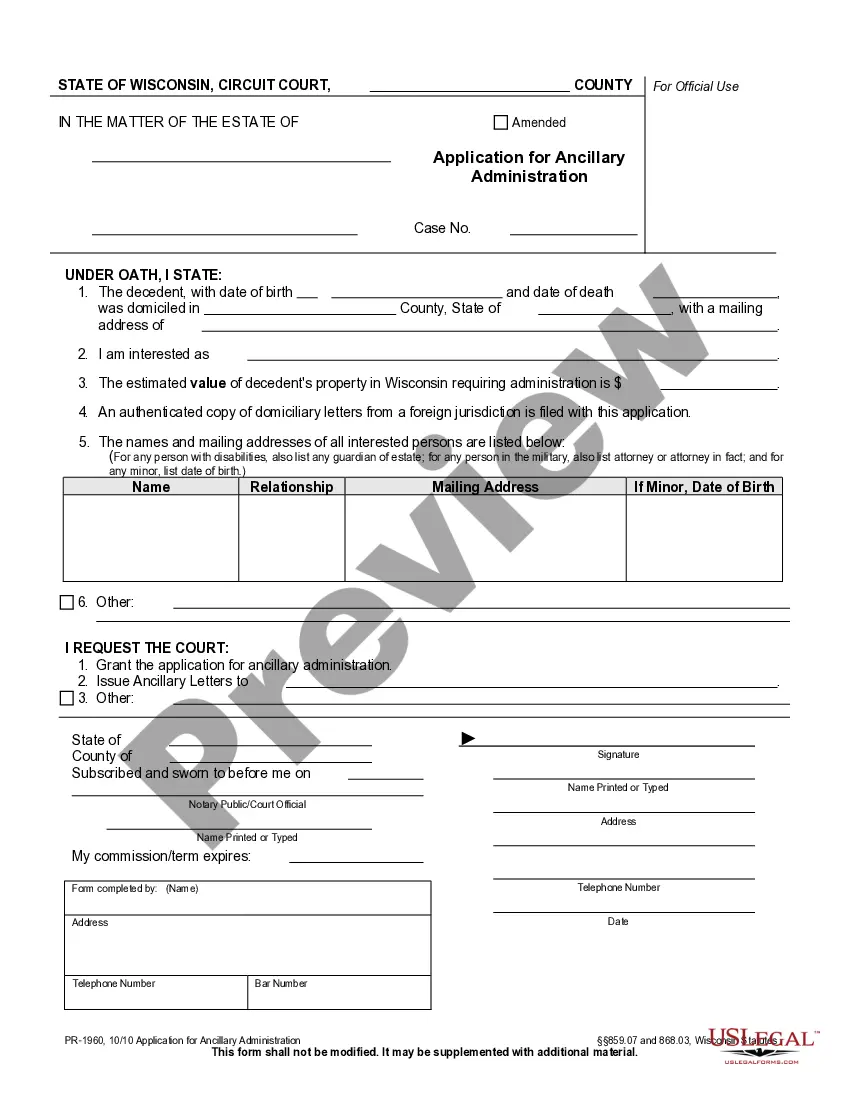

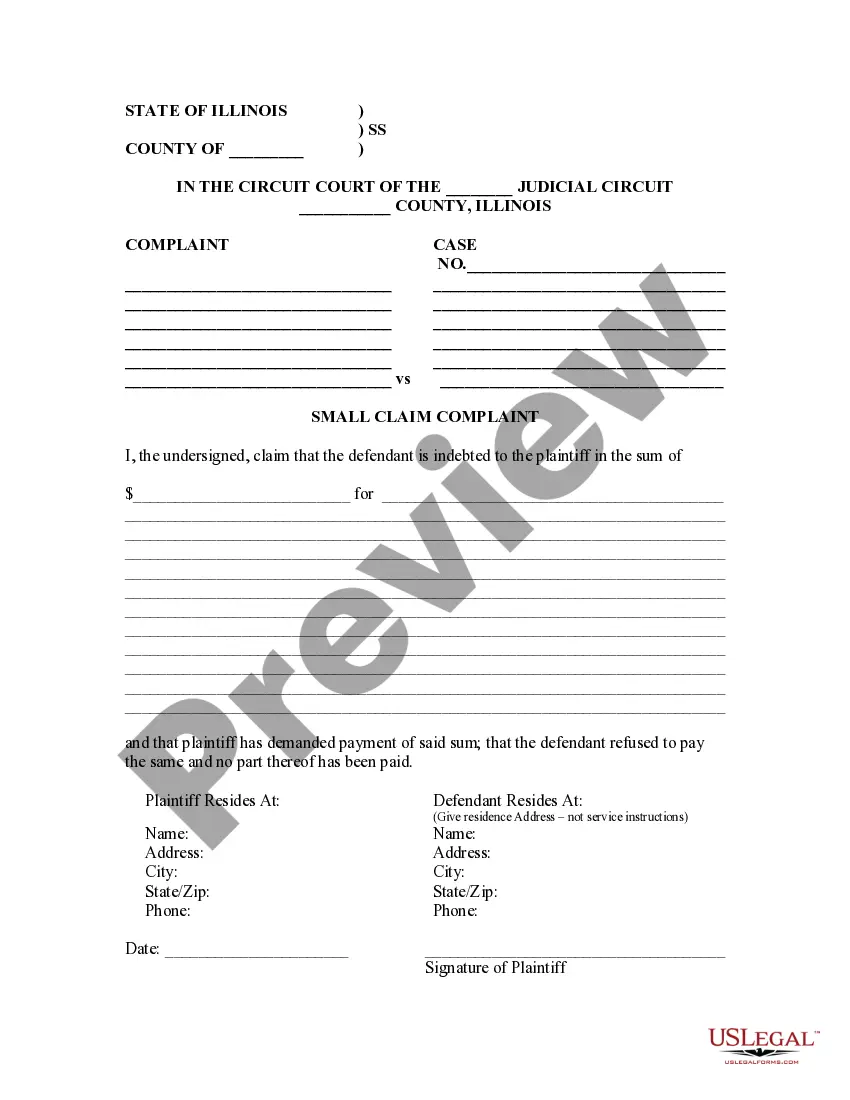

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternative templates of the legal form.

- Step 4. Once you have found the form you need, click on the Buy now option. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

To secure contracts for lawn care, focus on building relationships with local businesses and homeowners. Attend community events and join local business associations to increase your visibility. Additionally, using a New Hampshire Self-Employed Groundskeeper Services Contract can make your proposals more appealing, as it demonstrates professionalism and a commitment to clear communication. This strategy can enhance your chances of winning contracts.

Writing a landscaping contract agreement involves outlining the scope of work, payment terms, and timelines. Start by detailing the services you will provide, such as mowing, trimming, or landscaping design. Including a New Hampshire Self-Employed Groundskeeper Services Contract template can simplify this process, as it provides a framework for necessary legal stipulations. This ensures both you and your client understand expectations and responsibilities.

To obtain a lawn maintenance contract, start by networking within your community and promoting your services online. Building a professional website and leveraging social media can attract potential clients. Additionally, consider using a New Hampshire Self-Employed Groundskeeper Services Contract to formalize agreements, ensuring clarity and professionalism in your dealings. This approach will help you establish trust and credibility with clients.

Lawn maintenance owners can earn a wide range of incomes depending on factors like location, services offered, and client base. In New Hampshire, self-employed groundskeepers typically make between $30,000 to $70,000 annually. By establishing a solid customer base and offering diverse services, you can enhance your earnings. Utilizing a New Hampshire Self-Employed Groundskeeper Services Contract can help you secure steady income through clearly defined agreements.

Yes, you can write your own service agreement. Just ensure you include all relevant details, such as the scope of services, payment terms, and responsibilities of each party. For a New Hampshire Self-Employed Groundskeeper Services Contract, using a platform like uslegalforms can provide you with templates and guidance, making it easier to create a comprehensive and legally sound agreement that meets your needs.

To write a simple service level agreement (SLA), outline the services that will be provided and the expected performance levels. Clearly define metrics for measuring service quality and include the responsibilities of both parties. If you're creating a New Hampshire Self-Employed Groundskeeper Services Contract, it's crucial to specify what constitutes acceptable service standards. This clarity helps ensure accountability and satisfaction on both sides.

A short form service agreement is a concise version of a traditional service contract, summarizing the essential terms without excessive detail. It typically includes the parties involved, a brief description of services, payment terms, and other vital clauses. For those seeking a New Hampshire Self-Employed Groundskeeper Services Contract, a short form can be an effective way to quickly establish terms while still protecting both parties.

When structuring a maintenance contract, begin with an introduction that identifies the parties and the services offered. Next, detail the specific maintenance tasks, schedules, and payment terms. It's important to include clauses regarding termination and liability. Utilizing a template for a New Hampshire Self-Employed Groundskeeper Services Contract can streamline this process, ensuring you cover all necessary elements.

To write a simple contract agreement, start by clearly defining the parties involved and the purpose of the agreement. Use straightforward language to outline the terms, including payment details, services provided, and timelines. For a New Hampshire Self-Employed Groundskeeper Services Contract, make sure to specify the scope of work and any obligations of both parties. This clarity helps prevent misunderstandings and ensures a successful working relationship.

The independent contractor rule defines the relationship between a worker and the business that hires them. In New Hampshire, an independent contractor operates under a specific agreement, like a New Hampshire Self-Employed Groundskeeper Services Contract, which outlines the terms of work and payment. Understanding this rule is essential for self-employed individuals, as it affects tax liabilities and legal responsibilities. If you need guidance on drafting a contract, consider using US Legal Forms for reliable templates.