New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form

Description

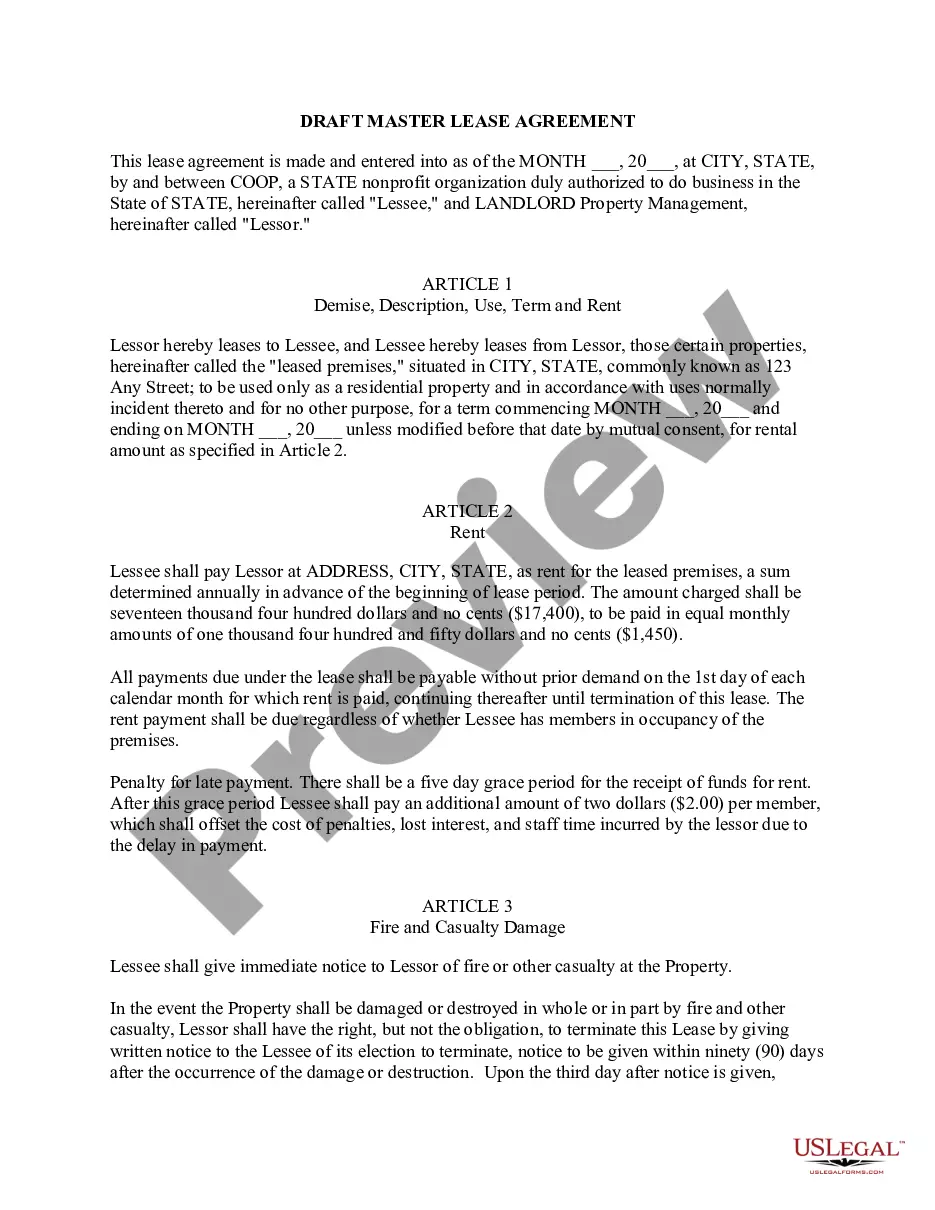

How to fill out Self-Employed Tree Surgeon Services Contract - Short Form?

If you desire to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site’s straightforward and user-friendly search to locate the documents you need.

An assortment of templates for business and individual purposes are organized by categories, states, or keywords.

Step 4. After locating the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase. Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, review, and print or sign the New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form. Every legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Stay competitive and acquire, and print the New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to retrieve the New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to find the New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

Starting a tree surgeon business involves understanding the industry, acquiring necessary tools and equipment, and developing a business plan. You should also focus on marketing your services to attract clients. A New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form will provide a structured approach to your service delivery, making it easier to communicate with clients and manage expectations.

Self-employed arborists typically earn between $30,000 and $80,000 annually, depending on their skills, location, and business model. Factors such as the demand for tree care services and seasonal variations can also influence earnings. By utilizing a New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form, arborists can establish clear service agreements that may help optimize their income potential.

The income of a self-employed tree surgeon can vary based on factors such as location, experience, and the range of services offered. On average, self-employed tree surgeons can earn a competitive income, especially when they build a loyal customer base. Implementing a New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form may also enhance your professional image, potentially attracting more clients and increasing earnings.

Starting a tree removal business involves several key steps, including market research, business registration, and acquiring necessary permits. You should develop a solid business plan that outlines your services and target market. Additionally, using a New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form will help you define your service agreements and build trust with clients from the outset.

Becoming a self-employed tree surgeon requires a combination of skills, training, and business planning. Start by gaining experience through working with established tree care companies or obtaining certifications in arboriculture. After that, you can create a New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form to formalize your services and ensure that you operate legally and professionally.

In New Hampshire, tree law involves regulations concerning the rights and responsibilities of tree owners and neighbors. It includes aspects such as property lines, tree maintenance, and liability for damages caused by fallen trees. Understanding these laws is essential for self-employed tree surgeons to navigate their responsibilities effectively. Utilizing a New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form can help clarify these obligations and protect your business.

As an independent contractor, you must follow specific rules, such as setting your own rates and managing your own work schedule. Additionally, you must provide your own tools and materials, and you cannot be classified as an employee of the company you work for. A New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form can help you understand these rules better and protect your interests.

Independent contractors must comply with various legal requirements, including obtaining the necessary permits and licenses for their work. Additionally, maintaining accurate financial records and filing appropriate taxes is essential. Utilizing a New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form can simplify these processes by providing a clear framework for your services.

Yes, a tree surgeon is considered a tradesman. This profession requires specialized skills, knowledge, and training related to tree care and maintenance. By using a New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form, you can formalize your services and demonstrate your expertise in this valuable trade.

As an independent contractor, you can earn up to $600 before needing to report your income to the IRS. However, it is wise to maintain thorough records of all earnings and expenses. A New Hampshire Self-Employed Tree Surgeon Services Contract - Short Form can assist you in keeping track of your work and financial responsibilities.