New Hampshire Self-Employed Seamstress Services Contract

Description

How to fill out Self-Employed Seamstress Services Contract?

You can devote hours online looking for the lawful file format that meets the state and federal requirements you want. US Legal Forms offers 1000s of lawful types that happen to be examined by specialists. It is simple to download or print out the New Hampshire Self-Employed Seamstress Services Contract from the support.

If you already have a US Legal Forms bank account, you are able to log in and click the Down load option. Following that, you are able to full, edit, print out, or indicator the New Hampshire Self-Employed Seamstress Services Contract. Every lawful file format you buy is your own forever. To obtain an additional backup of the bought form, go to the My Forms tab and click the related option.

If you use the US Legal Forms internet site initially, keep to the basic instructions listed below:

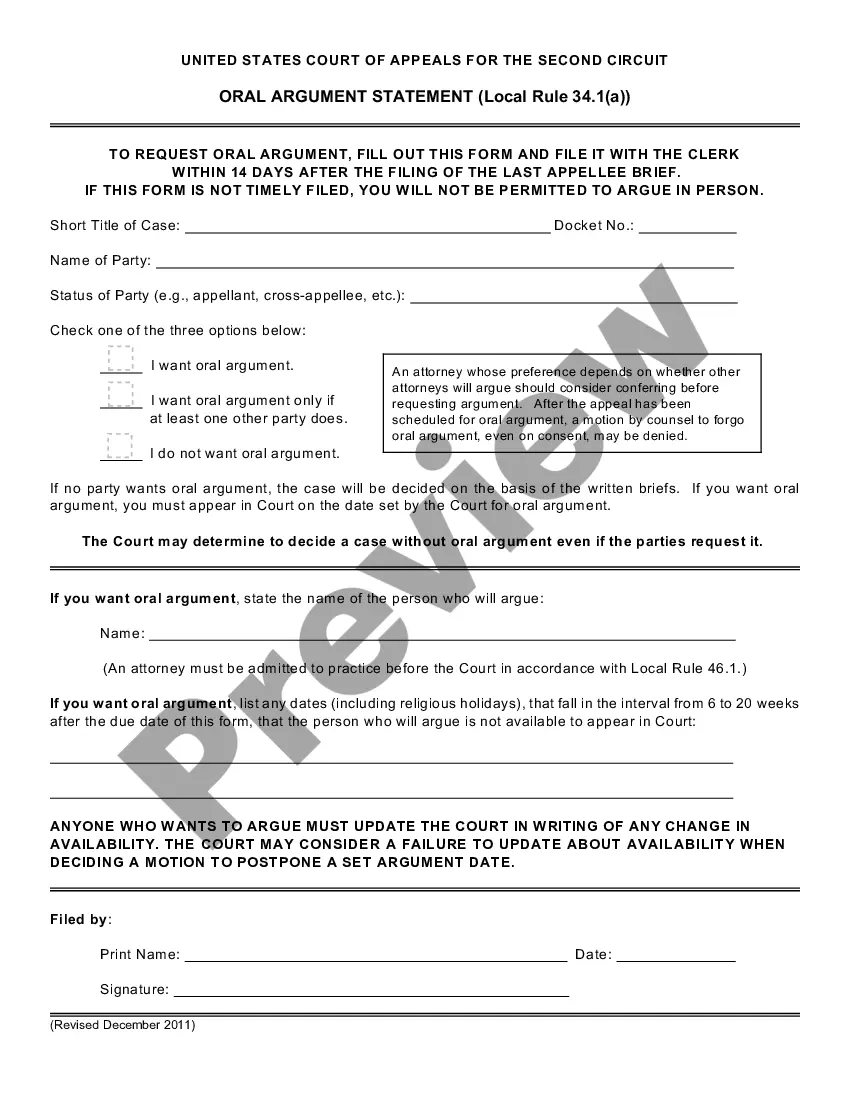

- First, ensure that you have chosen the proper file format for the state/city of your choice. Look at the form description to make sure you have picked the right form. If readily available, make use of the Review option to appear from the file format too.

- If you want to get an additional version of the form, make use of the Lookup industry to discover the format that meets your needs and requirements.

- Upon having discovered the format you want, click on Acquire now to move forward.

- Pick the prices program you want, type in your accreditations, and register for an account on US Legal Forms.

- Total the financial transaction. You can utilize your bank card or PayPal bank account to purchase the lawful form.

- Pick the structure of the file and download it for your gadget.

- Make changes for your file if required. You can full, edit and indicator and print out New Hampshire Self-Employed Seamstress Services Contract.

Down load and print out 1000s of file templates utilizing the US Legal Forms site, which offers the biggest assortment of lawful types. Use skilled and status-distinct templates to handle your company or specific needs.

Form popularity

FAQ

Notices Requesting Documentation for the Pandemic Unemployment Assistance (PUA) Program: If you received notices asking you to provide documents for the PUA program, please go to your dashboard and click the UPLOAD BUTTON and submit the documents as requested.

The minimum earnings required for eligibility are $2800 ($1400 each in 2 separate quarters), which would result in a $32 weekly benefit amount. The more earnings in your base period, the higher your weekly benefit amount, to a maximum of $427 for $41,500 or more in earnings.

Mentioning a client is not mandatory. You can name your employer, but then indicate where you did the work, and parenthetically note that: Consultants-R-Us (Employer); BigBank (Client).

A. The New Hampshire new employer tax rate is 2.7% (UI Rate: 2.3% / AC Rate: 0.4%).

Independent contractor, an individual must meet the requirements of all 7 points: 1. The individual possesses or has applied for a federal employer identification number or social security number, or in the alternative, has agreed in writing to carry out the responsibilities imposed on employers under NH wage laws. 2.

Yes, with the passing of the CARES Act, independent contractors, gig workers, and self-employed individuals are eligible for unemployment insurance if they are unable to work due to COVID-19.

In New Hampshire, the new employer SUI (state unemployment insurance) rate is 2.3% on the first $14,000 of wages for each employee. Employers are also charged a surcharge tax called the Administrative Contribution (AC) rate, which is 0.4% for a total contribution of 2.7%.

Self-employed individuals, independent contractors, and other individuals who are unable to work as a direct result of COVID-19 public health emergency and would not qualify for regular unemployment benefits under state law may be eligible to receive Pandemic Unemployment Assistance.

You can either go directly to the new jobs portal at or just click the above button for 'Covid-19 Response Recruitment'. Starting May 23rd the department will once again be requiring claim filers to conduct a weekly work search as a condition for being considered eligible for unemployment benefits.

Self-employed individuals, independent contractors, and other individuals who are unable to work as a direct result of COVID-19 public health emergency and would not qualify for regular unemployment benefits under state law may be eligible to receive Pandemic Unemployment Assistance.