New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor

Description

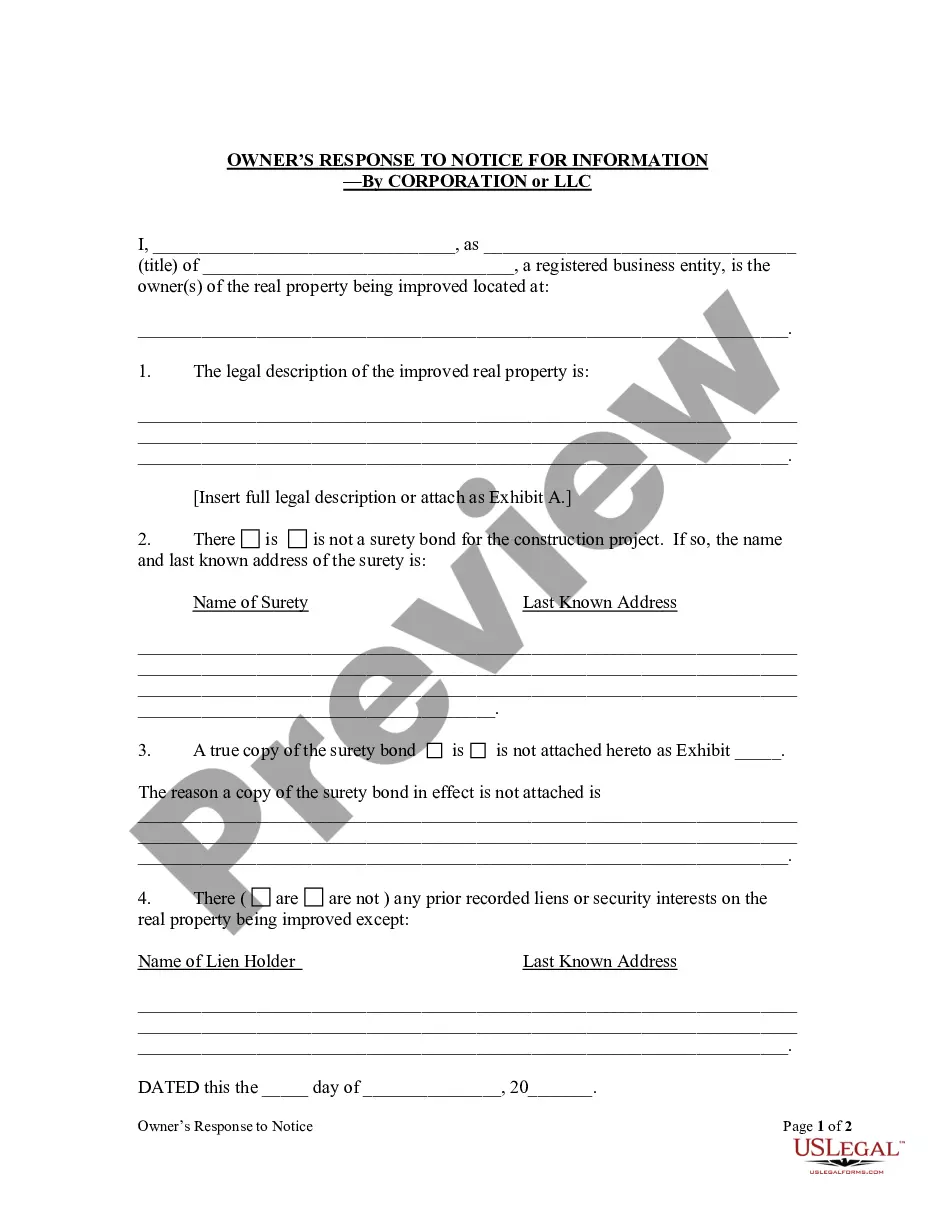

How to fill out Personal Shopper Services Contract - Self-Employed Independent Contractor?

It is feasible to spend hours online looking for the legal document template that meets the state and federal specifications you need.

US Legal Forms offers a wide array of legal documents that can be examined by professionals.

You can conveniently obtain or create the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor from the service.

If available, use the Review button to view the document template at the same time. If you wish to find another version of the form, use the Lookup field to search for the template that meets your needs and requirements. Once you have located the template you want, click Acquire now to proceed. Select the pricing plan you prefer, enter your credentials, and register for your account on US Legal Forms. Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make changes to the document if necessary. You can complete, modify, and sign and print the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor. Download and print numerous document templates using the US Legal Forms website, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, create, or sign the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor.

- Each legal document template you receive is yours indefinitely.

- To get another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for your county/area of choice.

- Check the form details to make sure you have selected the right document.

Form popularity

FAQ

Yes, you can work as an independent contractor without forming an LLC. Many self-employed individuals choose to operate under their personal names. However, a New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor can protect your interests and clarify your business relationship with clients. Using uslegalforms can simplify the process by providing customizable contract templates that address your specific needs, ensuring a smooth and professional engagement.

Receiving a 1099 form generally indicates that you are considered self-employed. A 1099 form is issued to independent contractors and freelancers who earn income outside of traditional employment. If your work aligns with the parameters of a New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor, this is a clear signal that you operate as an independent business, and thus, you have self-employment status.

Yes, an independent contractor is indeed considered self-employed. This designation comes from the fact that independent contractors work for themselves and provide services to clients without being under direct control from an employer. For services outlined in the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor, understanding your status as self-employed can help you navigate tax obligations and legal protections effectively.

The terms self-employed and independent contractor are often used interchangeably, yet there are nuances that might affect your choice of words. Self-employed typically refers to anyone running their own business, while independent contractor specifically describes a type of self-employment defined by specific contractual obligations. When discussing the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor, using the term independent contractor can clarify your role in the context of your contract and the services you provide.

To be considered self-employed, you must operate your own business rather than working as an employee for someone else. This involves taking on risks, generating your own income, and managing your own work schedule. In the realm of the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor, you will likely need to show that you provide services independently and are responsible for your own expenses. This distinction is crucial for tax and legal purposes.

The 72 hour rule in New Hampshire refers to the timeframe that determines how long a contract remains valid after an agreement has been reached. In the context of New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor, this rule ensures that both parties have a clear understanding of the contract's terms before they become effective. It is essential to comply with this rule to avoid misunderstandings and ensure smooth operations. Therefore, be sure to review your contract thoroughly within this period.

Independent contractors typically need to fill out several essential forms, including the W-9 form for tax purposes and any agreement relevant to their services, such as the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor. Additional forms may be required based on state regulations and specific client needs. It's wise to check local guidelines to ensure compliance.

When filling out an independent contractor form, ensure that you provide personal identification details, such as your name, address, and Social Security number. You should also specify the services you offer, particularly those related to the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor. Make sure to review all sections for accuracy before submitting the form.

Filling out an independent contractor agreement involves entering the information in all required sections. Begin with the contractor's information, followed by the client's details, and outline the scope of work specific to the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor. Don't forget to include payment schedules and signatures to finalize the document.

To write an independent contractor agreement, start by clearly stating the names and addresses of both parties. Include a detailed description of the services to be provided under the New Hampshire Personal Shopper Services Contract - Self-Employed Independent Contractor. Specify payment terms, deadlines, and any relevant conditions. Finally, ensure both parties sign the agreement to make it legally binding.