New Hampshire Summary of Terms of Proposed Private Placement Offering

Description

How to fill out Summary Of Terms Of Proposed Private Placement Offering?

Choosing the best lawful file web template can be quite a battle. Naturally, there are plenty of web templates accessible on the Internet, but how can you obtain the lawful develop you will need? Take advantage of the US Legal Forms site. The assistance delivers a huge number of web templates, for example the New Hampshire Summary of Terms of Proposed Private Placement Offering, that you can use for business and private requirements. All of the varieties are examined by professionals and fulfill federal and state specifications.

In case you are already registered, log in for your profile and click the Down load option to have the New Hampshire Summary of Terms of Proposed Private Placement Offering. Utilize your profile to check from the lawful varieties you might have acquired formerly. Check out the My Forms tab of the profile and have one more backup in the file you will need.

In case you are a fresh consumer of US Legal Forms, listed below are easy instructions that you can follow:

- Initially, be sure you have selected the proper develop for your personal area/state. It is possible to look through the shape making use of the Preview option and look at the shape description to make sure it will be the right one for you.

- In case the develop will not fulfill your needs, take advantage of the Seach field to obtain the proper develop.

- When you are sure that the shape is acceptable, go through the Get now option to have the develop.

- Pick the prices program you want and enter the essential information. Build your profile and buy the order utilizing your PayPal profile or Visa or Mastercard.

- Opt for the file formatting and acquire the lawful file web template for your product.

- Complete, change and produce and signal the received New Hampshire Summary of Terms of Proposed Private Placement Offering.

US Legal Forms is definitely the greatest collection of lawful varieties for which you can see a variety of file web templates. Take advantage of the company to acquire appropriately-made paperwork that follow state specifications.

Form popularity

FAQ

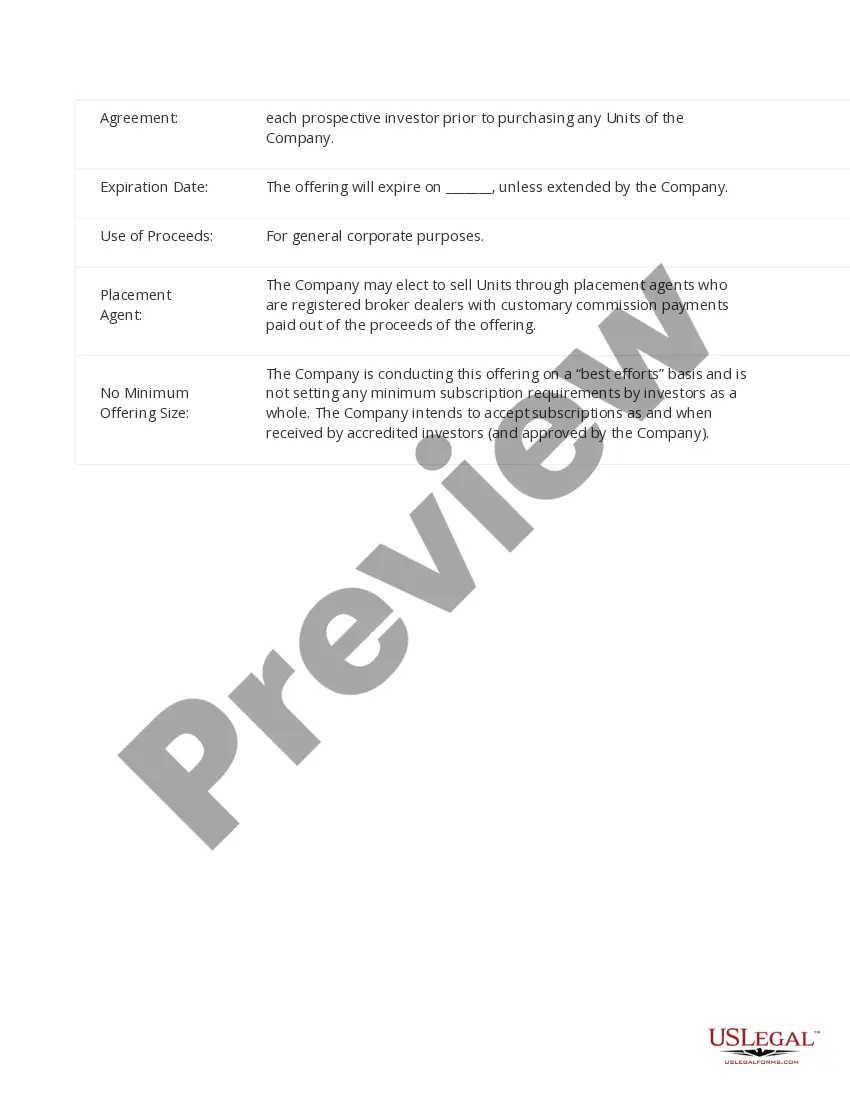

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

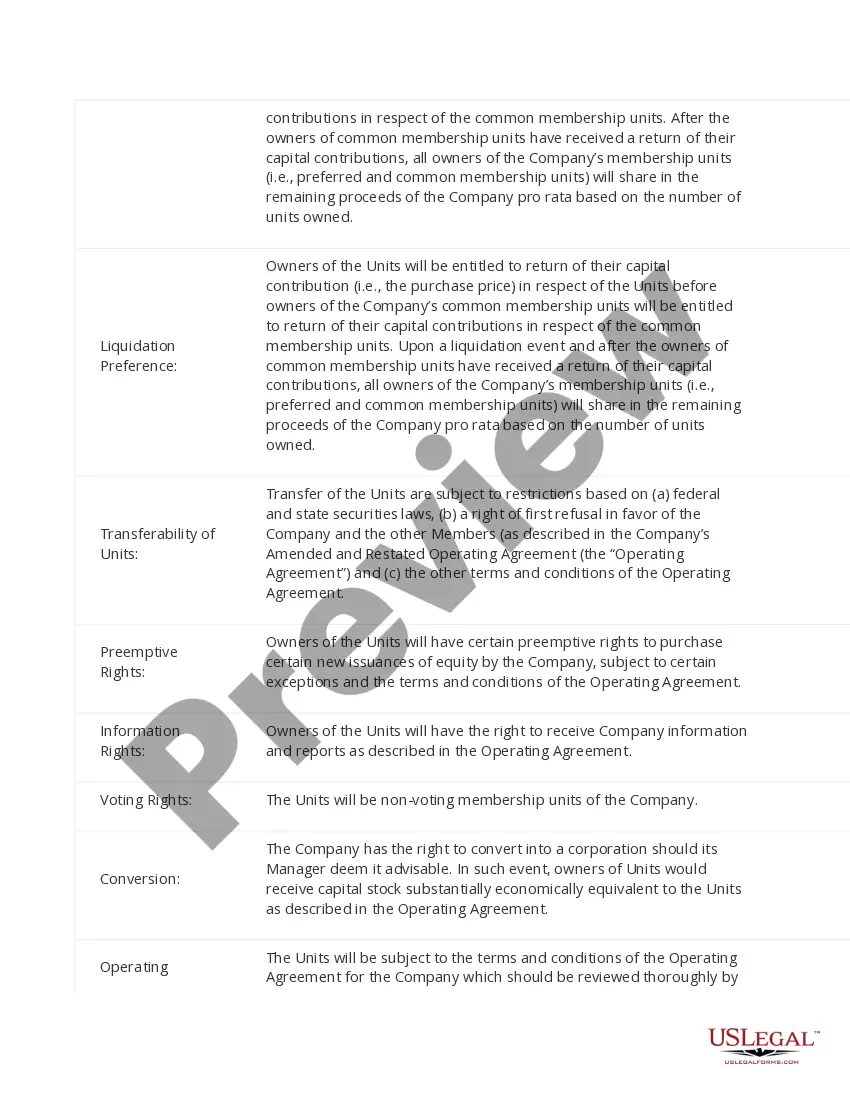

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

A private placement is a sale of stock shares or bonds to pre-selected investors and institutions rather than publicly on the open market. It is an alternative to an initial public offering (IPO) for a company seeking to raise capital for expansion.

??? ????????? ??????? ?? ? ?????? ?? ??? ????????? ???? ?????????? ??? ??? ??? ?????? ??? ????? ???????? ???????. ??? ????????? ??????? ?????? ?? ??????? ?? ?????? ?????????.

Executive Summary An overarching goal in this section of the private placement is to give investors an overview of the transaction, the high level structure of the investment and details on the market and opportunities.

A Private Placement Memorandum (PPM) is a securities disclosure document used by a company (issuer) that is engaged in a private offering of securities. A PPM serves as a single, comprehensive document outlining the material details about the offering.

A private placement is a security that's sold to an investor. Some common examples of private placements include: Real Estate Investment Trusts (REITs) Non-Traded REITs.

Typically PPMs contain: a complete description of the security offered for sale, the terms of the sales, and fees; capital structure and historical financial statements; a description of the business; summary biographies of the management team; and the numerous risk factors associated with the investment.