New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant

Description

How to fill out Personal Guaranty Of Corporation Agreement To Pay Consultant?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous designs available online, but how can you acquire the legal form you need.

Make use of the US Legal Forms website. The service offers thousands of templates, including the New Hampshire Personal Guaranty of Corporation Agreement to Compensate Consultant, which you can utilize for both business and personal needs.

You can view the form using the Review button and read the form description to confirm it suits your needs.

- All templates are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the New Hampshire Personal Guaranty of Corporation Agreement to Compensate Consultant.

- Use your account to search through the legal forms you have previously purchased.

- Visit the My documents tab in your account and download another copy of the document you desire.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct form for your location/state.

Form popularity

FAQ

An example of a personal guarantee may involve a business owner who signs a document promising to pay a consultant's fees if the corporation fails to do so. This agreement illustrates the New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant, emphasizing the owner's responsibility to cover financial obligations. Such guarantees protect the consultant and establish trust between the parties.

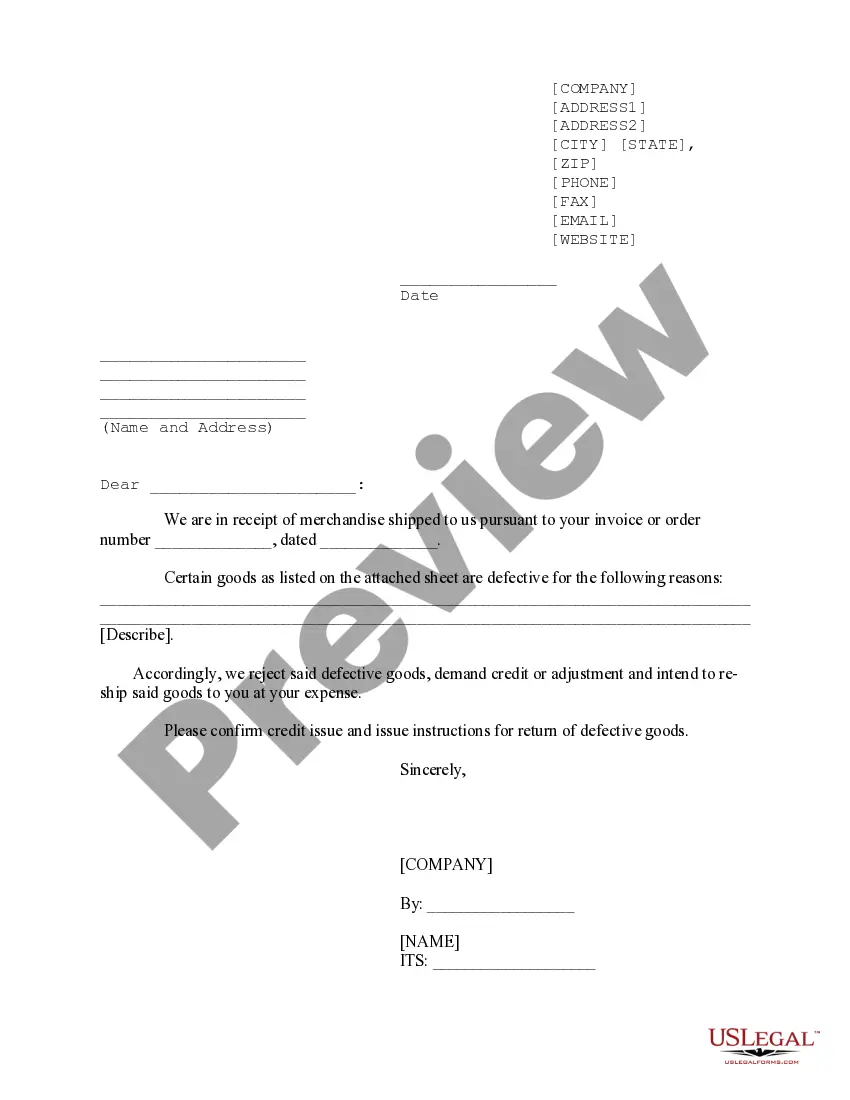

When filling out a personal guaranty, begin by stating your personal information and the corporation you are guaranteeing. Include clear language that represents your commitment to the terms of the New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant. Make sure to consult a legal professional if needed, as ensuring accuracy can prevent future disputes.

Filling out a personal guarantee involves several key steps. First, clearly identify the parties involved, including the corporation and the individual providing the guarantee. Next, detail the specific obligations covered by the New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant. Finally, sign and date the document, ensuring all information is accurate and complete for legal validity.

In most cases, a personal guarantee does not need to be notarized. However, it is wise to check state laws and specific creditor requirements. When dealing with the New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant, having a notarized document can enhance its legal standing. Doing so can provide peace of mind for both parties involved.

Jessica's Law in New Hampshire focuses primarily on protecting children from sexual predators. It enhances penalties for certain sexual offenses and mandates the registration of offenders. While this law does not directly relate to business contracts, understanding state laws is vital for business owners and consultants involved in a New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant, as compliance with legal standards fosters a safe and responsible business environment.

In New Hampshire, verbal contracts can be binding but they are often harder to enforce than written agreements. For significant commitments, such as a New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant, a written document is preferred, as it provides clear evidence of the terms agreed upon. When misunderstandings can arise, having a formal contract reduces complications and protects parties involved. Therefore, it’s wise to formalize important agreements in writing.

A contract must fulfill four key requirements to be legally binding: mutual consent, a lawful object, consideration, and the capacity of the parties. Each party must agree to the terms without coercion, the purpose must be legal, something of value must be exchanged, and all parties must have the legal ability to enter into a contract. These aspects are essential for any agreement, including a New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant. Understanding these requirements helps ensure your agreements stand firm in a court of law.

For inquiries regarding health insurance in New Hampshire, you can reach the NH Health Insurance Marketplace at 1-800-318-2596. This number connects you with knowledgeable representatives who can assist you in finding the best coverage options. While this may not directly relate to a New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant, it's important to ensure your obligations are covered under your health insurance as well.

In New Hampshire, contract law governs the agreements made between parties. A contract must have clear terms, mutual consent, and legal purpose to be enforceable. If you are considering a New Hampshire Personal Guaranty of Corporation Agreement to Pay Consultant, understanding these legal principles is crucial. Having a solid contract can protect your interests and clarify obligations.