New Hampshire Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner

Description

How to fill out Agreement To Dissolve And Wind Up Partnership Between Surviving Partners And Estate Of Deceased Partner?

Are you currently in a situation where you require documents for either business or personal matters almost every day.

There are numerous legal document templates accessible online, yet finding reliable versions is challenging.

US Legal Forms offers a wide range of form templates, such as the New Hampshire Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner, which are designed to comply with state and federal regulations.

Once you locate the correct form, click on Purchase now.

Select the payment plan you want, fill in the necessary information to create your account, and complete the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the New Hampshire Agreement to Dissolve and Wind up Partnership between Surviving Partners and Estate of Deceased Partner template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it's for the correct city/region.

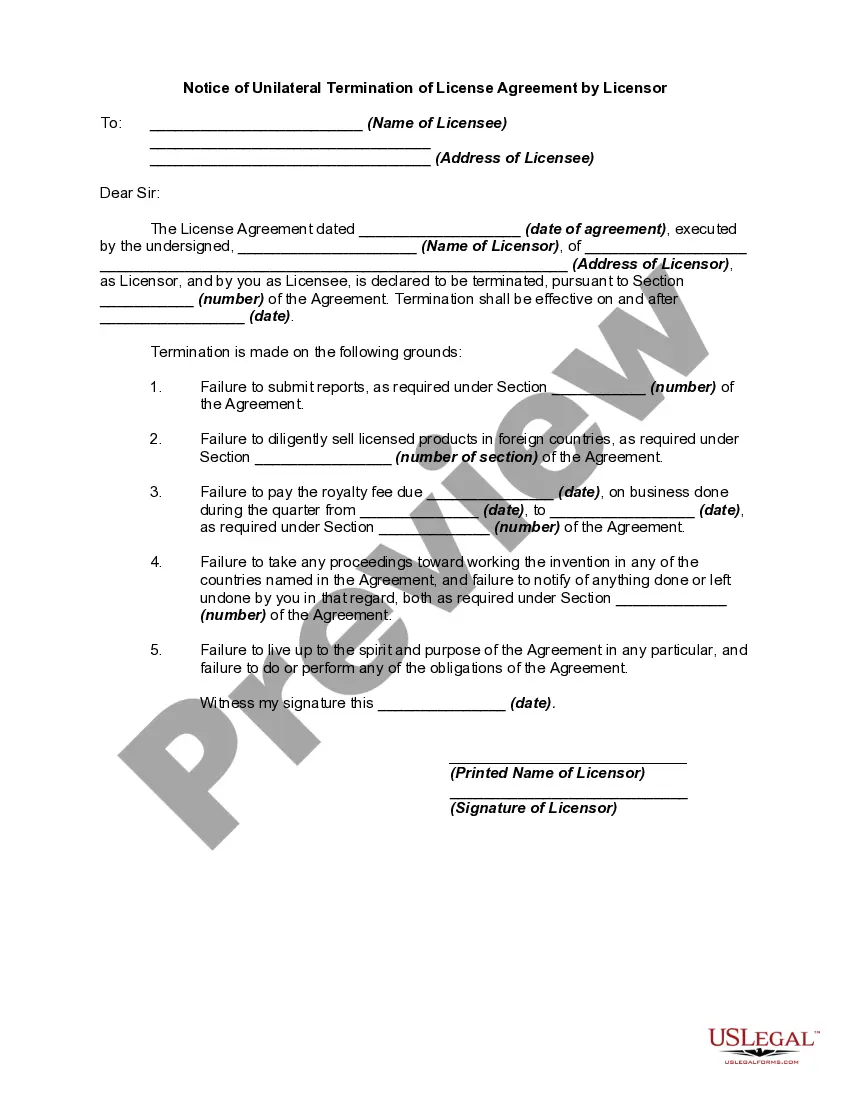

- Utilize the Review button to examine the form.

- Read the summary to confirm that you have selected the right document.

- If the form isn't what you require, use the Search field to find the document that meets your needs.

Form popularity

FAQ

When a partner in a partnership dies, the basic position under the Partnership Act 1890 is that the partnership is dissolved: 'Subject to any agreement between the partners, every partnership is dissolved as regards all the partners by the death2026 of any partner.

A general partnership is one in which all of the partners have the ability to actively manage or control the business. This means that every owner has authority to make decisions about how the business is run as well as the authority to make legally binding decisions.

A partnership liquidation happens where the partners have decided that the partnership has no viable future or purpose, and a decision may be made to cease trading and wind up the business.

Winding up a partnership business is a procedure that distributes, or liquidates, any remaining property of the partnership and any assets that remain after the dissolution of the partnership business. Only those partners that remain with the partnership have the right to partnership assets in the wind up process.

Death of the partner If there are only two partners, and one of the partner dies, the partnership firm will automatically dissolve. If there are more than two partners, other partners may continue to run the firm.

Section 37 of the UPA provides that unless otherwise agreed, the partners who have not wrongfully dissolved the partnership or the legal representative of the last surviving solvent partner have the right to wind up the partnership affairs, provided, however, that any partner, his legal representative, or his assignee

If it was death that had caused the end of the partnership, then the monies are paid out in equal shares to the surviving ex-partners and the deceased's estate. When all the partners are living there may be room to negotiate, but when one of them dies, the options disappear, especially if the beneficiaries are minors.

A liquidating partner is a partner who is appointed to settle the accounts, collect the assets, adjust the claims and pay the debts of a dissolving or insolvent firm. A liquidating partner will be responsible for selling and distributing assets and settling debts in a partnership that is in the process of liquidation.

Upon the winding up of a limited partnership, the assets shall be distributed as follows: (1) To creditors, including partners who are creditors, to the extent permitted by law, in satisfaction of liabilities of the limited partnership other than liabilities for distributions to partners under section 34-20d or 34-27d;

Most legislation states that the partnership will end upon the death or bankruptcy of any partner. If your partner dies, you will then owe your partner's estate their share of the partnership that accrues at the date of their death.