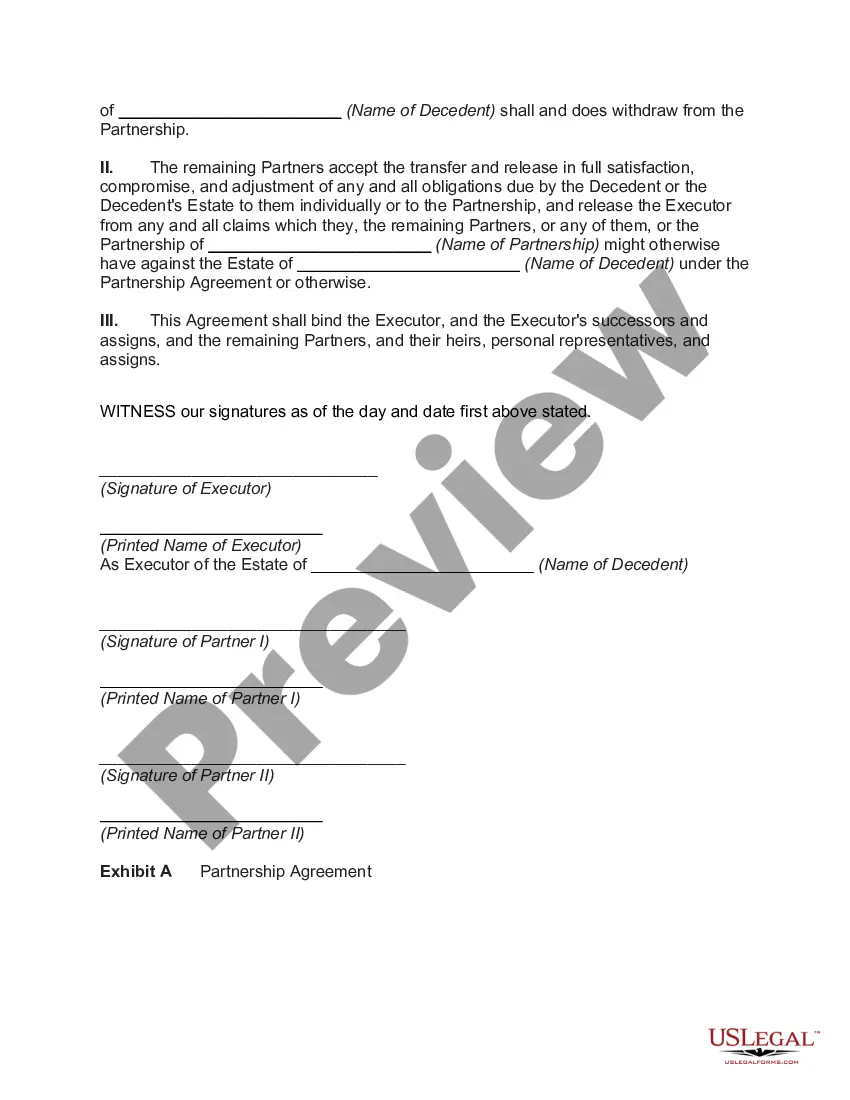

New Hampshire Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners

Description

the remaining partners of a business partnership.

How to fill out Settlement Agreement Between The Estate Of A Deceased Partner And The Surviving Partners?

You can devote time on-line searching for the lawful papers web template that meets the state and federal specifications you want. US Legal Forms gives 1000s of lawful varieties which are reviewed by specialists. It is simple to down load or printing the New Hampshire Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners from the service.

If you already have a US Legal Forms account, you may log in and click on the Acquire switch. Afterward, you may full, modify, printing, or indication the New Hampshire Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners. Every single lawful papers web template you purchase is your own eternally. To have an additional duplicate for any bought develop, visit the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms site initially, stick to the easy instructions under:

- Very first, ensure that you have selected the best papers web template for your county/area of your choosing. Browse the develop information to make sure you have selected the proper develop. If available, make use of the Preview switch to appear throughout the papers web template too.

- In order to get an additional edition from the develop, make use of the Research area to get the web template that meets your requirements and specifications.

- Upon having identified the web template you need, simply click Acquire now to carry on.

- Pick the costs strategy you need, key in your references, and register for your account on US Legal Forms.

- Comprehensive the transaction. You can utilize your bank card or PayPal account to cover the lawful develop.

- Pick the structure from the papers and down load it to the system.

- Make modifications to the papers if required. You can full, modify and indication and printing New Hampshire Settlement Agreement between the Estate of a Deceased Partner and the Surviving Partners.

Acquire and printing 1000s of papers web templates utilizing the US Legal Forms Internet site, which provides the greatest variety of lawful varieties. Use specialist and status-particular web templates to take on your organization or personal requires.

Form popularity

FAQ

Probate law doesn't stipulate how personal items should be divided among beneficiaries unless they've been specifically named in the Will. Such things are called specific legacies. A mother, for example, might wish her eldest daughter to receive her wedding and engagement rings.

Like other Trusts, a Deceased Estate is not a legal entity in its own right, involving a relationship between the trustee (the Executor of the Estate) and the Beneficiaries.

Checklist for Settling an Estate in 9 Easy StepsOrganize important information.Determine need for probate or attorney help.File the Will and notify necessary persons.Take inventory and appraise all assets.Set up a bank account.Pay taxes.Pay off any debts.Distribute assets according to deceased person's Will.More items...

Under New Hampshire law, if you are named as executor in a will, you have thirty (30) days after the decedent's death to file the will with the Circuit Court in addition to one of the forms listed below.

If an executor breaches this duty, then they can be held personally financially liable for their mistakes, and the financial claim that is made against them can be substantial. In an extreme example of this, one personal representative failed to settle the inheritance tax bill before distributing the estate.

Once contracts have been exchanged, there is a binding contract between the buyer and the seller. The death of one of the parties does not change this but ultimately, it will be the personal representatives or administrators of the deceased person's estate who have to fulfil the obligations of the person who has died.

As an Executor, you should ideally wait 10 months from the date of the Grant of Probate before distributing the estate.

How does the executor's year work? The executors have a number of duties to both creditors and beneficiaries during the administration of the deceased's estate. Starting from the date of death, the executors have 12 months before they have to start distributing the estate.

Probate can take anywhere from around nine months to about a year for an average estate to be settled through New Hampshire probate.