New Hampshire Checklist - Key Record Keeping

Description

How to fill out Checklist - Key Record Keeping?

Are you currently in a situation where you require documents for either business or personal purposes every day.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

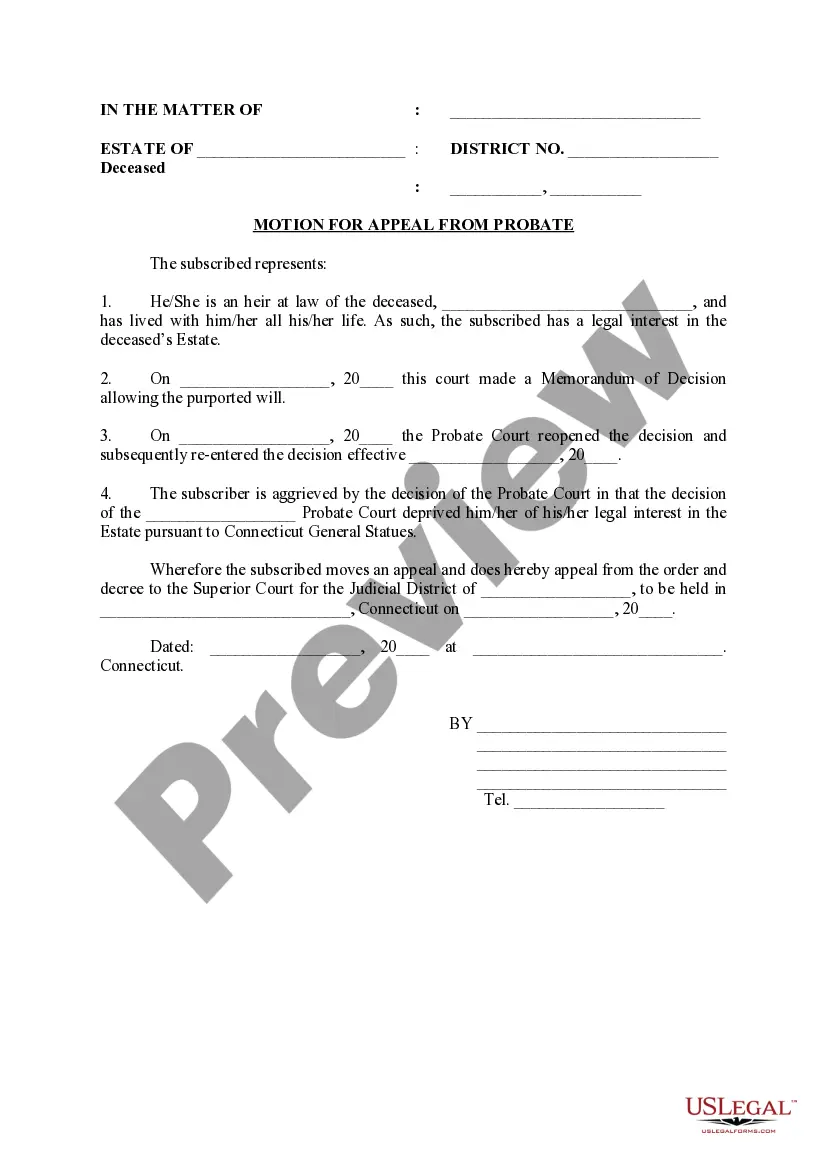

US Legal Forms offers thousands of form templates, including the New Hampshire Checklist - Key Record Keeping, designed to comply with federal and state regulations.

Once you find the appropriate form, click Get now.

Select the pricing plan you want, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Hampshire Checklist - Key Record Keeping template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is suitable for your city/state.

- Utilize the Review button to examine the form.

- Check the description to confirm you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

You can obtain New Hampshire tax forms directly from the New Hampshire Department of Revenue Administration's website. The site offers a user-friendly interface and a complete New Hampshire Checklist - Key Record Keeping for tax-related documents. If you prefer physical copies, you may also find these forms at local tax offices or libraries. Utilizing online resources can save you time and streamline your tax filing process.

Yes, criminal records are generally public in New Hampshire, but access may differ based on the type of record and circumstances. The New Hampshire Checklist - Key Record Keeping helps you understand which records you can access easily. If you need more detailed information, you might consider reaching out to a legal professional or using online services that specialize in record retrieval.

To obtain court records in New Hampshire, you can either visit the courthouse in person or access online resources provided by the state's judicial system. The New Hampshire Checklist - Key Record Keeping highlights the necessary steps for obtaining these records, including any fees or forms required. Ensure you have relevant case details ready to expedite your request.

In New Hampshire, medical records are typically kept for at least seven years from the date of the last treatment. This duration allows for proper New Hampshire Checklist - Key Record Keeping practices. After this period, records may be securely destroyed unless there are specific legal requirements to retain them longer. It's always a good idea to check with your healthcare provider for their specific policies.

To access your court records in New Hampshire, you can visit the New Hampshire Judicial Branch website. Here, you will find a comprehensive New Hampshire Checklist - Key Record Keeping, which guides you through the process. You can also use online portals to view case information or request records directly from the courthouse. Make sure to have the necessary identifying details ready for a smooth experience.

Making a right-to-know request in New Hampshire is uncomplicated. Clearly outline your request in writing, including details such as the documents needed and the agency involved. To avoid delays, consult the New Hampshire Checklist - Key Record Keeping, which will provide you with tips to ensure your request is thorough and well-prepared.

RSA stands for Revised Statutes Annotated in New Hampshire, which includes the state’s laws and legal regulations. These statutes cover a wide range of topics, including civil rights, property laws, and governance. Familiarizing yourself with relevant RSAs is essential for effective record keeping, and the New Hampshire Checklist - Key Record Keeping can be a valuable resource.

Whether you need to file a New Hampshire income tax return depends on your earnings and type of income. NH does not impose a state income tax on wages, but certain other earnings may require filing. To ensure you meet all obligations, consult the New Hampshire Checklist - Key Record Keeping for guidance.

Unfortunately, as of now, you cannot file the NH DP 10 form online. You will need to print the form, fill it out, and then mail it or hand it in to the appropriate office. To streamline this process, refer to the New Hampshire Checklist - Key Record Keeping, which outlines essential steps and provides tips for filing.

The NH Right-to-Know Act is legislation that promotes transparency in government by allowing citizens access to public documents and meetings. This act empowers residents to keep their government accountable. For detailed guidance, consider utilizing the New Hampshire Checklist - Key Record Keeping to navigate these laws effectively.