New Hampshire Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

If you desire to be thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search to locate the documents you need. Various templates for business and personal uses are organized by categories and states, or by keywords. Use US Legal Forms to quickly find the New Hampshire Security Agreement regarding Sale of Collateral by Debtor with just a few clicks.

If you are currently a US Legal Forms user, Log In to your account and click the Download button to access the New Hampshire Security Agreement concerning Sale of Collateral by Debtor. You can also access forms you previously submitted electronically within the My documents section of your account.

If this is your first time using US Legal Forms, refer to the instructions below.

Every legal document format you purchase is yours forever. You have access to every form you downloaded within your account. Click the My documents section and select a form to print or download again.

Compete and download, and print the New Hampshire Security Agreement regarding Sale of Collateral by Debtor with US Legal Forms. There are many professional and state-specific forms you can utilize for your personal business or personal needs.

- Step 1. Ensure you have selected the form for the correct area/region.

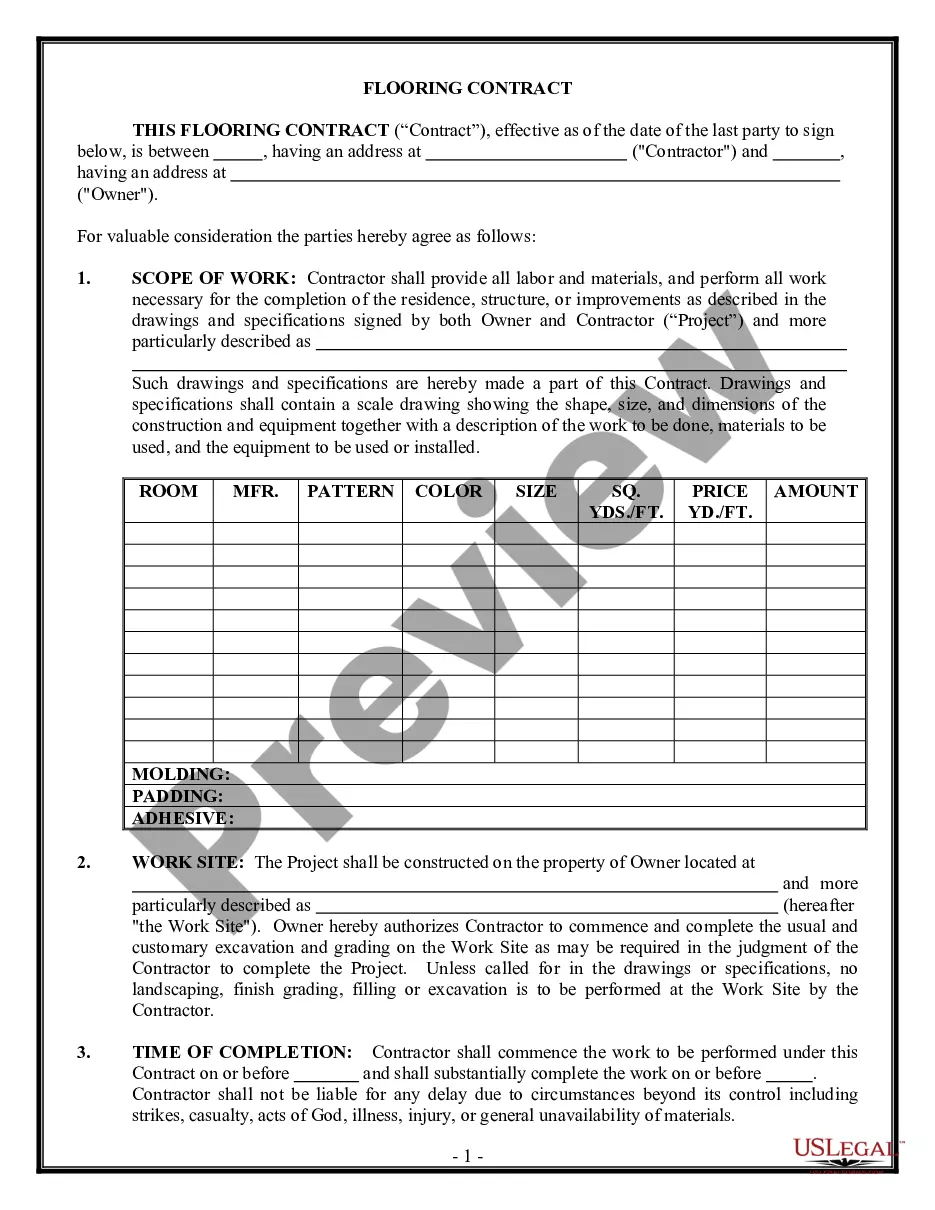

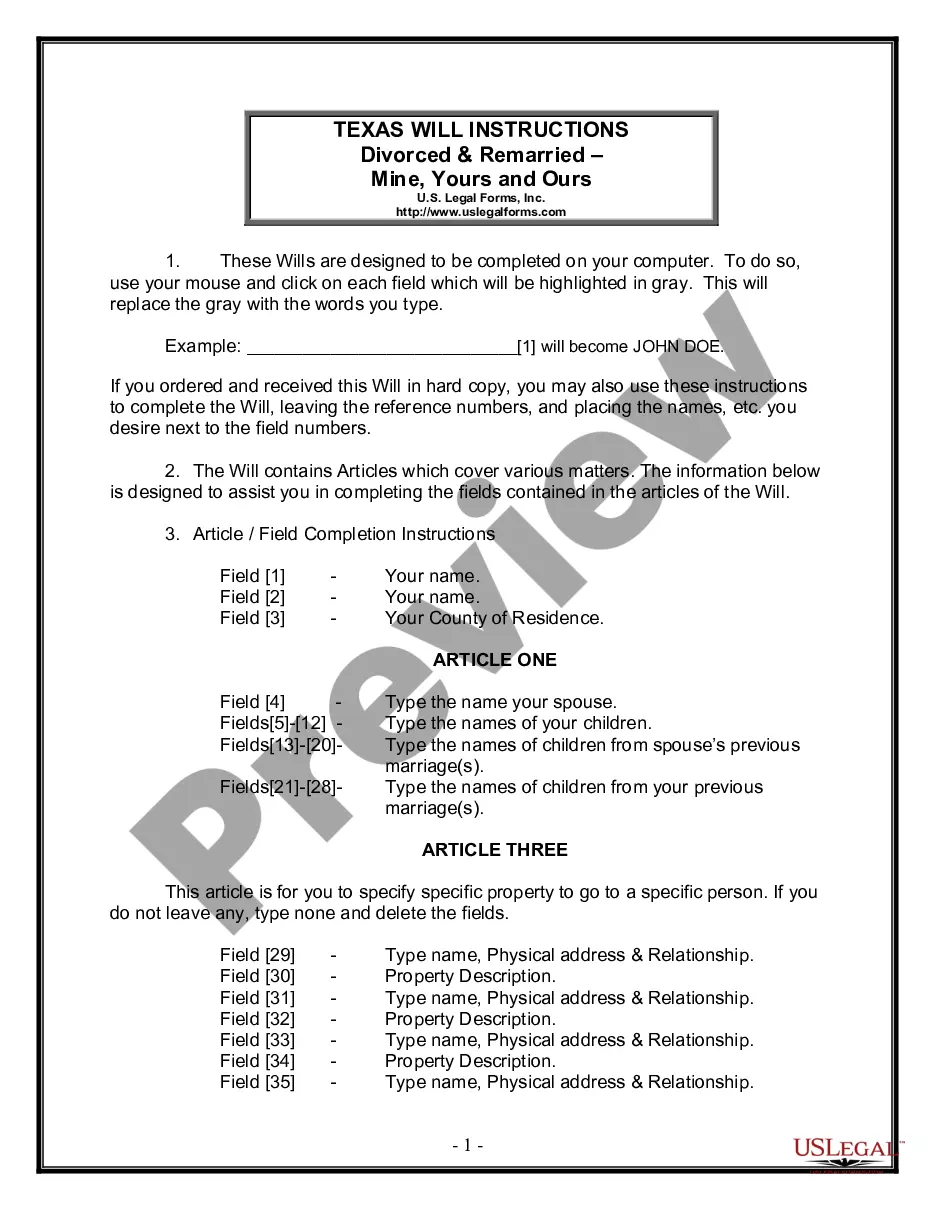

- Step 2. Use the Review feature to examine the form’s details. Don’t forget to check the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form format.

- Step 4. Once you have found the form you need, click on the Acquire now button. Choose the pricing plan you prefer and enter your information to sign up for an account.

- Step 5. Complete the transaction. You may use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, revise, and print or sign the New Hampshire Security Agreement concerning Sale of Collateral by Debtor.

Form popularity

FAQ

In secured transactions, the debtor is the party that borrows funds and pledges specific assets as collateral to secure repayment. This definition is essential in the context of a New Hampshire Security Agreement involving Sale of Collateral by Debtor. Recognizing the debtor's role helps ensure a clear understanding of the transaction, providing security and clarity for both the debtor and the secured party.

No, in a New Hampshire Security Agreement involving Sale of Collateral by Debtor, the secured party is not the debtor. The secured party is the lender or entity that holds an interest in the collateral until the debtor fulfills their obligations. Understanding this distinction is crucial for both parties as it shapes their rights and responsibilities within the agreement.

Creating a security contract is similar to drafting a security agreement, as it requires clear terms and definitions. Ensure you describe the obligations of the debtor and outline the collateral involved. Using an established platform like USLegalForms can simplify this process and help you create a solid New Hampshire Security Agreement involving Sale of Collateral by Debtor.

Creating a security agreement involves several straightforward steps. Begin by clearly defining the obligations of the debtor and securing the appropriate collateral. You can leverage platforms like USLegalForms to facilitate the drafting process, ensuring you meet all necessary legal requirements for a New Hampshire Security Agreement involving Sale of Collateral by Debtor.

In New Hampshire, a security agreement does not need to be notarized to be enforceable. However, having it notarized can add an extra layer of protection and credibility. It ensures that the identities of the parties are verified, which can be beneficial in resolving disputes regarding the New Hampshire Security Agreement involving Sale of Collateral by Debtor in the future.

Creating a security agreement in New Hampshire involves drafting a document outlining the terms of the agreement. You should include details such as the parties involved, description of the collateral, and the obligations undertaken by the debtor. Utilizing resources like USLegalForms can help you generate a comprehensive New Hampshire Security Agreement involving Sale of Collateral by Debtor with essential legal clauses.

To establish an enforceable security interest in a New Hampshire Security Agreement involving Sale of Collateral by Debtor, a creditor must meet three key requirements. First, there must be a written security agreement that clearly describes the collateral. Second, the creditor must have possession of the collateral or the debtor must have rights in the collateral. Lastly, the debtor’s obligations must be secured by the collateral to ensure protection for the creditor.

No, a security agreement and a lien are not the same, although they are related concepts. A security agreement is a contract between the debtor and lender outlining the collateral, while a lien is a legal claim the lender has on the debtor's property until the debt is satisfied. Understanding the distinction helps clarify legal protections for both parties involved in the New Hampshire Security Agreement involving Sale of Collateral by Debtor.

The process by which a security interest in the collateral becomes enforceable typically involves properly drafting and signing a security agreement, followed by filing the necessary documents with the appropriate authorities. In the context of the New Hampshire Security Agreement involving Sale of Collateral by Debtor, this may also include specific steps required by New Hampshire law. Ensuring this process is followed correctly is vital for protecting the lender's rights.

A security agreement is a contract that outlines the terms under which a debtor offers collateral to secure a debt, while a lien is a legal right or interest that a lender has over the debtor's property until the debt obligation is fulfilled. The New Hampshire Security Agreement involving Sale of Collateral by Debtor focuses on securing the agreement, while a lien gives the lender specific legal rights over the collateral. It is crucial to distinguish between the two for effective financial planning.