New Hampshire UCC-1 for Personal Credit

Description

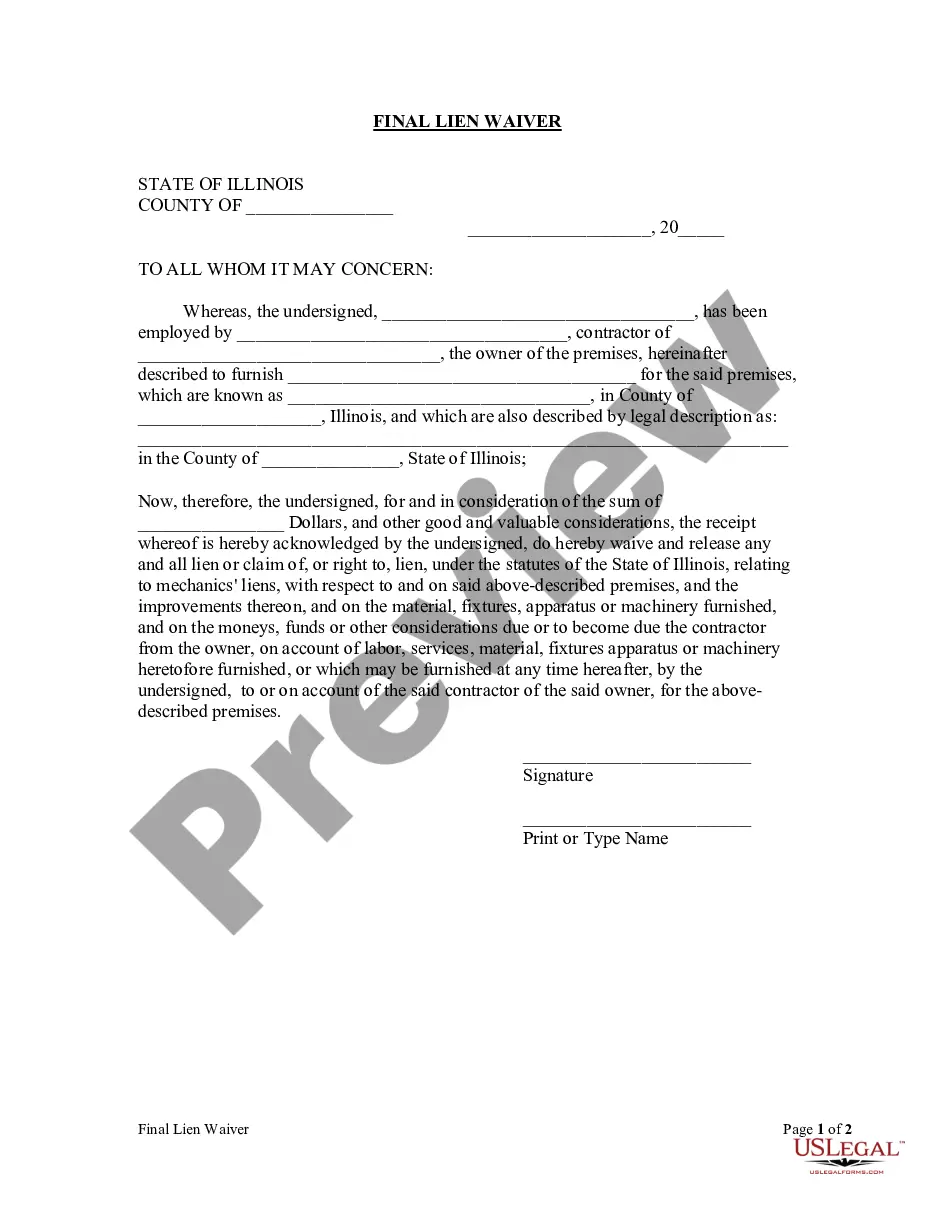

How to fill out UCC-1 For Personal Credit?

You have the capacity to dedicate time online searching for the valid document template that complies with the state and federal requirements you desire.

US Legal Forms offers thousands of valid forms that are evaluated by experts.

You can download or print the New Hampshire UCC-1 for Personal Credit from my service.

If available, utilize the Preview button to review the document template as well.

- If you already own a US Legal Forms account, you can Log In and then click the Download button.

- Afterward, you can complete, modify, print, or sign the New Hampshire UCC-1 for Personal Credit.

- Each valid document template you acquire is yours to keep indefinitely.

- To obtain another copy of any purchased form, go to the My documents tab and click the appropriate button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/region of your preference.

- Read the form description to confirm that you have chosen the right form.

Form popularity

FAQ

The grantee on a UCC financing statement is the lender or creditor receiving the security interest. This party typically retains rights to the collateral in case the borrower defaults on their obligations. By understanding the role of the grantee, you can navigate the process of filing a New Hampshire UCC-1 for Personal Credit with greater clarity.

UCC-1 is a specific type of financing statement used to publicly declare a creditor's interest in a debtor's personal property. Filing a New Hampshire UCC-1 for Personal Credit helps to establish legal priority over the assets involved. This process is crucial for securing loans and can safeguard your financial interests effectively.

No, a UCC financing statement is not a mortgage. Instead, it is a document that secures a lender's interest in personal property, which can be movable assets. While a mortgage is specifically related to real estate, a New Hampshire UCC-1 for Personal Credit addresses personal property and ensures legal rights to that collateral.

1 financing statement is a public record that defines a secured party's interest in collateral. This document is vital for establishing and perfecting a security interest in personal property, helping lenders protect their investment. When you file a New Hampshire UCC1 for Personal Credit, you clarify your claim to the assets involved, which can be essential in transactions like personal loans.

You can file your UCC-1 statement with the New Hampshire Secretary of State's office. This filing is crucial for establishing your personal credit and protecting your interests. Additionally, using uSlegalForms can streamline the process, allowing you to complete your New Hampshire UCC-1 for Personal Credit effectively and efficiently. Make sure to have all necessary information ready to ensure a smooth filing experience.

To fill out a UCC-1 form properly, begin by clearly stating the debtor's name and address at the top. Ensure that you provide a precise description of the collateral to avoid any ambiguity. Finally, verify all information for accuracy before filing with the appropriate authority. Consider using UsLegalForms for guidance to enhance accuracy and speed in your filing.

Filing a UCC-1 on yourself can offer several benefits, especially in terms of establishing credit. By securing your personal credit with a filing, you show potential lenders that you are serious about repaying your debts. Additionally, the New Hampshire UCC-1 for Personal Credit can help protect your interests in the event of business disputes or bankruptcies.

The UCC, or Uniform Commercial Code, is a set of laws that regulates commercial transactions in the United States. For beginners, think of it as a framework that helps ensure clarity and consistency in sales, loans, and other financial deals. Specifically, New Hampshire UCC-1 for Personal Credit allows individuals to secure loans with their personal assets.

UCC filings show secured transactions involving personal property, providing information about creditors' rights to those assets. They indicate which lenders have a claim against your collateral, conveying trustworthiness and financial responsibility to potential creditors. Understanding UCC filings is key when evaluating your options, especially relating to the New Hampshire UCC-1 for Personal Credit. You may find detailed resources on US Legal Forms to navigate this topic confidently.

Yes, a UCC filing can impact your personal credit. When a lender files a UCC-1, it may indicate to future creditors that you have existing obligations. Depending on how this is perceived, it may influence your creditworthiness. Monitoring how the New Hampshire UCC-1 for Personal Credit features in your financial history can help you manage your credit profile effectively.