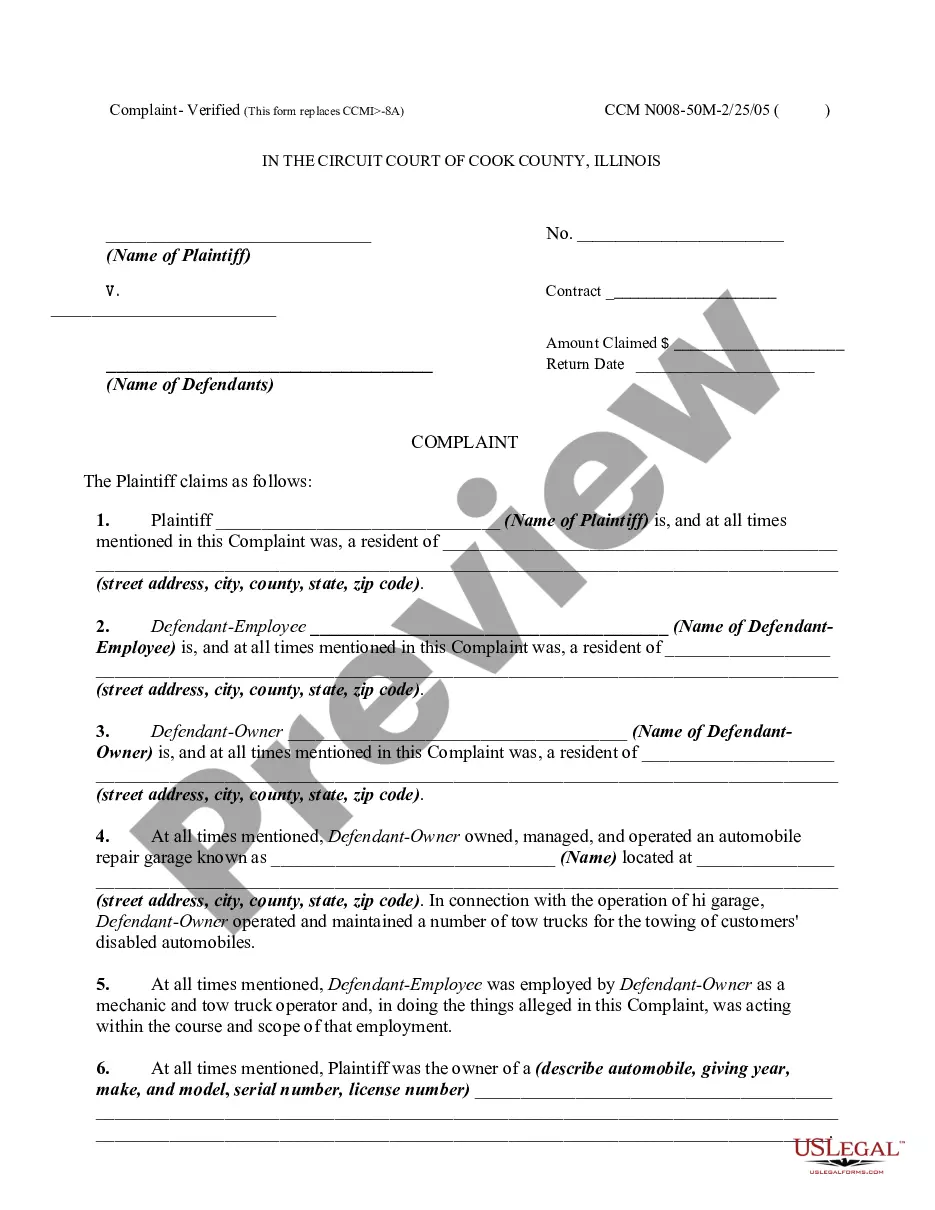

A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

New Hampshire Guaranty of Collection of Promissory Note

Description

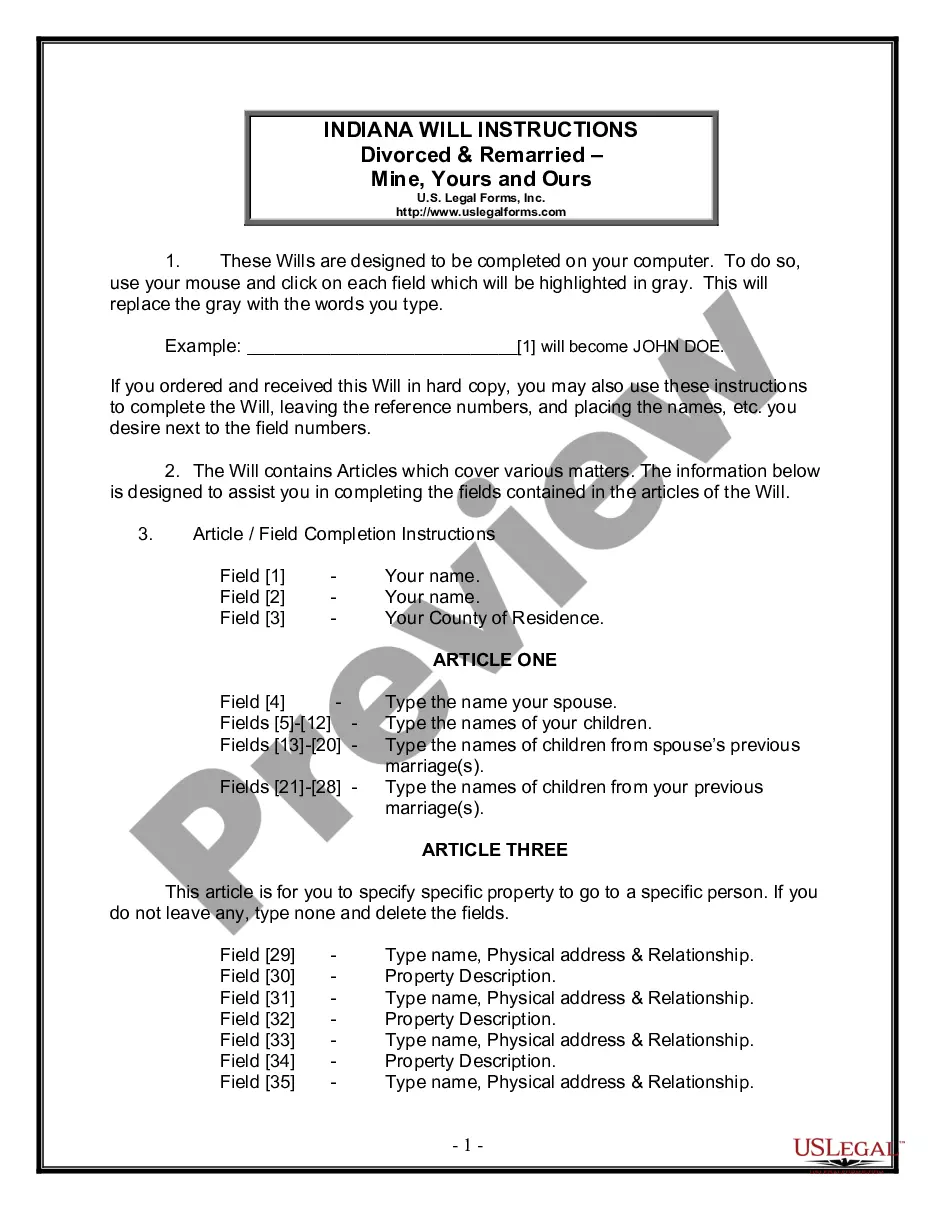

How to fill out Guaranty Of Collection Of Promissory Note?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad range of legal template forms that you can download or print.

Through the site, you can access thousands of forms for business and personal use, organized by categories, states, or keywords.

You can find the latest forms such as the New Hampshire Guaranty of Collection of Promissory Note in just minutes.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

If you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select the payment plan you prefer and enter your details to register for an account.

- If you already have an account, Log In to download the New Hampshire Guaranty of Collection of Promissory Note from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are straightforward steps to help you begin.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

Yes, a promissory note can certainly go to collections if payments are not made as agreed. Once an account goes into delinquency, the lender may turn the debt over to a collection agency. This situation underscores the importance of the New Hampshire Guaranty of Collection of Promissory Note in protecting your interests. Utilizing uslegalforms can help you navigate these situations effectively and avoid pitfalls.

In New Hampshire, the statute of limitations generally makes a debt uncollectible after three years. This timeline applies to most debts, including unsecured debts like small loans or credit card debts. Knowing this helps you understand your rights regarding the New Hampshire Guaranty of Collection of Promissory Note. If you want to maintain your financial health, consider consulting resources like uslegalforms for clearer guidance.

Filling out a demand promissory note involves similar steps to a traditional note but focuses on the lender's right to request payment at any time. Clearly mention all parties, the amount borrowed, any interest, and payment terms. Including a note about the New Hampshire Guaranty of Collection of Promissory Note can enhance the document’s legal standing.

Typically, the borrower is primarily liable on a promissory note, meaning they are responsible for repayment. However, if a guarantor is involved, they may also share responsibility according to the terms stated. The New Hampshire Guaranty of Collection of Promissory Note ensures that the lender has avenues to recover funds if necessary.

A standard promissory note format includes the title at the top, followed by the date, borrower's name, lender's name, amount borrowed, interest rate, payment schedule, and maturity date. Additionally, incorporate a statement regarding the New Hampshire Guaranty of Collection of Promissory Note for assurance. This format ensures clarity and legality.

To fill out a promissory demand note, start by clearly stating the amount being borrowed and the date of creation. Then, include the names of both the borrower and lender, along with their addresses. Finally, specify that this note is subject to the New Hampshire Guaranty of Collection of Promissory Note, ensuring legal enforceability.

The first step in enforcing an unsecured promissory note is to file a petition with the courts and get a judgment in your favor. Although this is a powerful legal enforcement of your rights under the promissory note, it does not in and of itself guarantee repayment of the note.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment.

The statute of limitations in California for an action upon any contract, obligation, or liability founded upon an instrument of writing, an example being a promissory note, is four years from the breach.