New Hampshire Personal Guaranty - General

Description

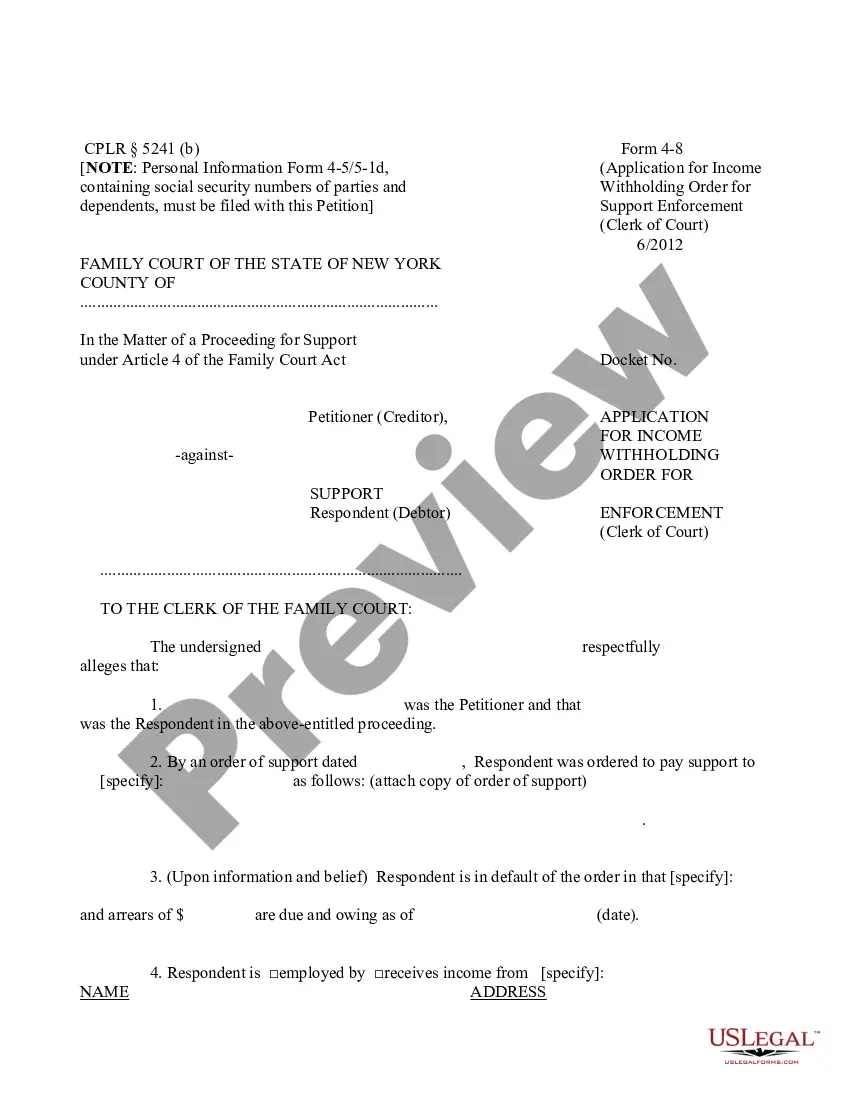

How to fill out Personal Guaranty - General?

You might spend hours online searching for the approved document template that meets the federal and state requirements you need.

US Legal Forms offers a multitude of legal documents that are vetted by experts.

It's easy to download or print the New Hampshire Personal Guaranty - General from their platform.

- If you already possess a US Legal Forms account, you can sign in and click on the Download button.

- After that, you can complete, modify, print, or sign the New Hampshire Personal Guaranty - General.

- Each legal document template you purchase is yours permanently.

- To get an additional copy of the purchased document, navigate to the My documents section and click the corresponding button.

- If you're visiting the US Legal Forms website for the first time, follow these simple instructions.

- First, ensure that you have selected the correct document template for your chosen state/city.

Form popularity

FAQ

Financial responsibility in New Hampshire pertains to the legal obligation to secure a certain level of insurance or financial coverage for damages or losses. This is particularly relevant when considering the implications of a personal guaranty. Understanding your responsibilities can aid in protecting personal assets and complying with legal standards. If you need legal forms or templates regarding financial responsibility, uSlegalforms can provide the resources you need to navigate this area confidently.

The New Hampshire Department of Safety is dedicated to protecting citizens by regulating various safety measures across the state. They handle emergency management and oversee transportation safety, ensuring public welfare. For anyone dealing with personal guarantees, understanding state safety regulations can be crucial to ensuring compliance with the New Hampshire Personal Guaranty - General. uSlegalforms offers comprehensive solutions to assist with necessary documentation.

The New Hampshire Secretary of State oversees a wide range of functions, including business registrations and maintaining public records. This role ensures that individuals and businesses operate within the legal framework of the state. For those interested in matters concerning personal guarantees, the Secretary of State’s office provides important information on financial accountability. Utilizing platforms like uSlegalforms can help simplify any necessary legal paperwork.

The Department of Safety operates under the state’s mission to enhance the quality of life by providing essential services related to public safety. They manage various sectors, including motor vehicle services and public health preparedness. When navigating legal requirements like the New Hampshire Personal Guaranty - General, awareness of safety regulations is vital. You can find helpful documents and guidance on uSlegalforms to navigate these concerns.

The New Hampshire Department of Safety focuses on maintaining public safety and managing emergency services across the state. This includes overseeing law enforcement agencies, fire safety, and emergency response systems. Understanding safety regulations is essential for individuals dealing with personal guarantees in New Hampshire, making sure they adhere to legal responsibilities. For more information on legal forms related to these matters, uSlegalforms can be a valuable resource.

The current Attorney General of New Hampshire is John M. Formella. He plays a crucial role in overseeing legal matters for state government and representing the interests of New Hampshire residents. As an advocate for justice, the Attorney General ensures laws are enforced, including regulations related to financial responsibility, which are important for understanding the New Hampshire Personal Guaranty - General. If you require legal assistance regarding debts or guarantees, exploring resources on uSlegalforms can be beneficial.

Yes, if you earn income in New Hampshire, you typically need to file state taxes. There are specific rules regarding filing thresholds and types of income involved. Understanding your tax obligations, including those related to a New Hampshire Personal Guaranty - General, is crucial for compliance.

In New Hampshire, you are required to carry liability insurance at a minimum but can choose to waive it under certain conditions. Familiarizing yourself with these rules, including policy limits and optional coverages, helps protect you legally and financially. This knowledge is vital when considering a New Hampshire Personal Guaranty - General.

Yes, you can file the NH DP 10 form online through various platforms, including those dedicated to legal documents. This makes the process convenient and efficient for fulfilling your obligations. It's advisable to check the requirements related to the New Hampshire Personal Guaranty - General to ensure you are compliant.

Yes, in most cases, someone can drive your car even if they are not listed on your insurance. However, your insurance policy will likely cover any accidents they cause. It’s essential to understand how this plays into your coverage and any New Hampshire Personal Guaranty - General requirements you may face.