New Hampshire Guarantee of Performance of Contract

Description

How to fill out Guarantee Of Performance Of Contract?

Have you ever found yourself in a situation where you need documents for either business or personal purposes almost all the time.

There are numerous legal document templates accessible online, but finding templates you can rely on is challenging.

US Legal Forms offers a vast array of form templates, including the New Hampshire Guarantee of Performance of Contract, that are designed to comply with federal and state regulations.

Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors.

The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the New Hampshire Guarantee of Performance of Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

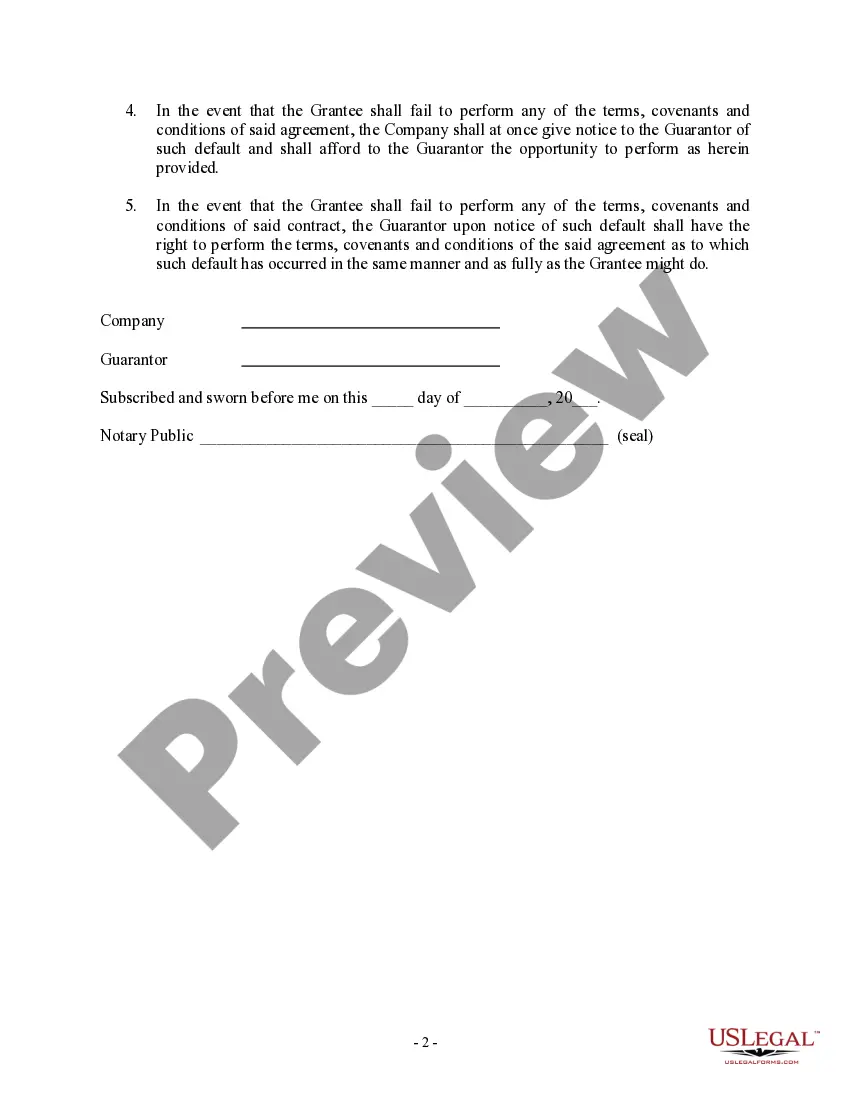

- Use the Preview option to review the form.

- Read the description to ensure that you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click on Buy now.

- Select the pricing plan you want, fill out the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your copy.

- Access all the document templates you have purchased in the My documents section. You can download another copy of the New Hampshire Guarantee of Performance of Contract at any time, if needed. Click on the desired form to download or print the template.

Form popularity

FAQ

Jessica's Law is named after Jessica Lunsford, a victim of a tragic crime that prompted legislative action. It symbolizes the state's commitment to protecting children from sexual predators. Knowing this background can help you appreciate the importance of legal protections, especially when dealing with contracts related to child welfare under the New Hampshire Guarantee of Performance of Contract.

The 72-hour rule in New Hampshire refers to the requirement that certain legal documents must be served within 72 hours of being issued. This rule ensures timely notice and action in legal proceedings. Familiarity with this rule can aid in navigating contracts effectively, supporting the principles of the New Hampshire Guarantee of Performance of Contract.

Jessica's Law in New Hampshire aims to enhance legal protections for children against sexual offenses. It includes provisions for stricter penalties and improved monitoring of offenders. This law is critical for parents and guardians to understand, especially when entering contracts that may impact child safety, reinforcing the New Hampshire Guarantee of Performance of Contract.

One notable contract case in New Hampshire is the Merrimack Valley Railroad case. It dealt with issues of performance and obligations under contract law, emphasizing the importance of fulfilling agreements. Such cases highlight the significance of the New Hampshire Guarantee of Performance of Contract in ensuring that parties meet their commitments.

Jessica's Law in New Hampshire focuses on protecting children from sexual predators by enhancing penalties for certain offenses. It aims to ensure stricter monitoring of offenders and improve the safety of minors. Understanding this law can be crucial, especially when contracts involve the welfare of children, reinforcing the New Hampshire Guarantee of Performance of Contract.

In New Hampshire, harassment involves unwanted behaviors that create a hostile environment for an individual. This can include repeated unwanted contact, threats, or actions that cause fear. It's important to understand your rights under the New Hampshire Guarantee of Performance of Contract, as it can help protect you when entering agreements.

Performance guarantees are typically offered by surety companies, financial institutions, or insurance providers. In the context of the New Hampshire Guarantee of Performance of Contract, these entities assess the risk and provide the necessary coverage. It is essential to choose a reputable provider to ensure the guarantee is reliable. At uslegalforms, we can guide you in finding the right service for your performance guarantee needs, ensuring your contracts are protected.

A performance guarantee is required to protect the interests of the obligee and ensure project completion as agreed. The New Hampshire Guarantee of Performance of Contract provides a financial safety measure that addresses potential breaches of contract. It helps mitigate risks and fosters a reliable working relationship between parties. By requiring this guarantee, parties can confidently proceed with contracts, knowing they are safeguarded against possible failures.

Typically, the obligee requests a performance guarantee to ensure the principal completes their contractual obligations. In scenarios involving the New Hampshire Guarantee of Performance of Contract, project owners or contract issuers often seek this guarantee for added security. This request helps mitigate risks associated with project delays or incomplete work. It is a proactive step that enhances trust between the parties involved.

The three parties involved in a performance guarantee are the principal, the obligee, and the surety. The principal is the party that must perform the obligations, the obligee is the party that requires the guarantee, and the surety is the entity providing the guarantee. In the context of the New Hampshire Guarantee of Performance of Contract, understanding these roles helps ensure clarity in contractual agreements. This structure provides security and confidence for all parties involved.