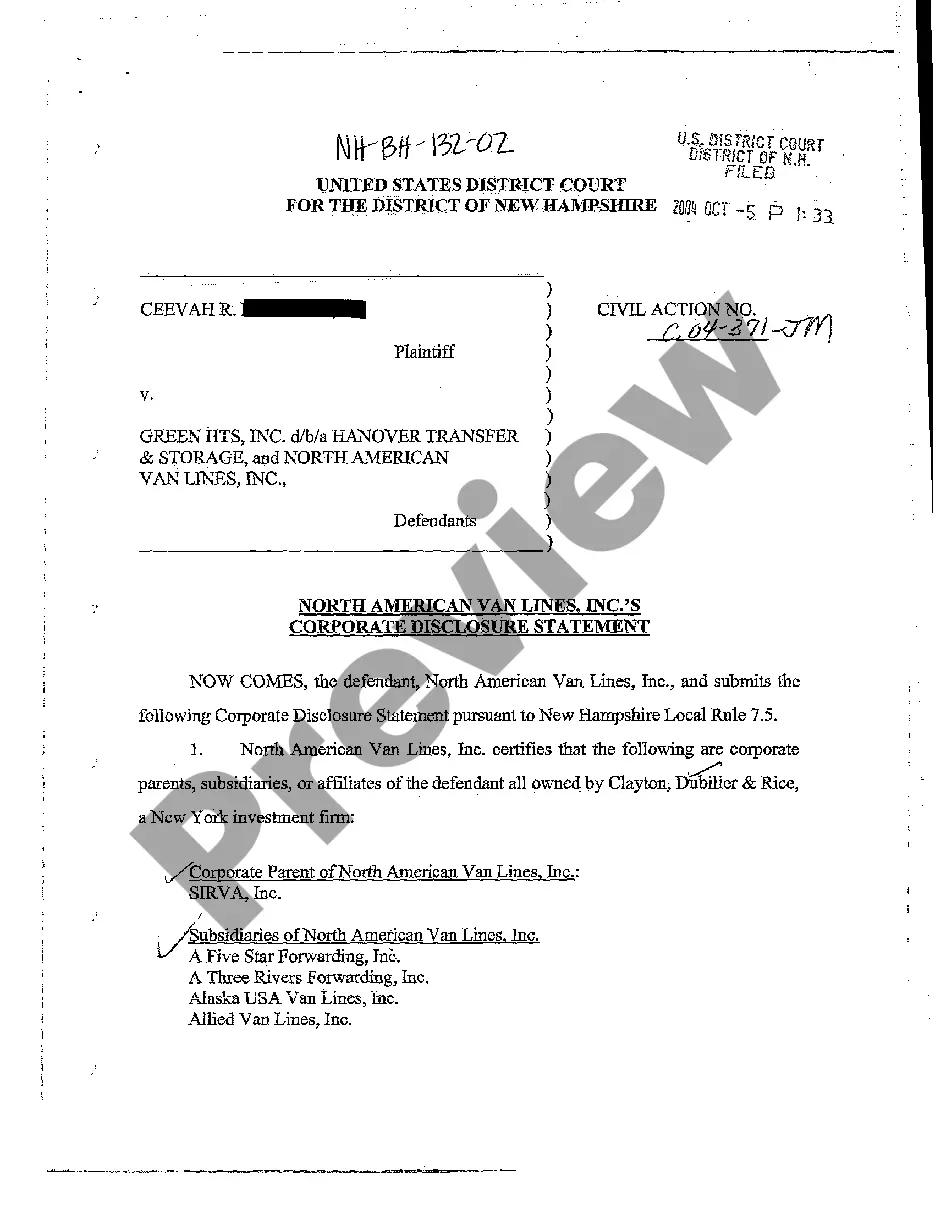

New Hampshire Defendant's Corporate Disclosure Statement

Description

How to fill out New Hampshire Defendant's Corporate Disclosure Statement?

Avoid pricey lawyers and find the New Hampshire Defendant's Corporate Disclosure Statement you need at a reasonable price on the US Legal Forms website. Use our simple categories function to search for and obtain legal and tax documents. Read their descriptions and preview them before downloading. Additionally, US Legal Forms provides customers with step-by-step tips on how to obtain and complete every form.

US Legal Forms clients basically must log in and get the specific form they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the guidelines below:

- Ensure the New Hampshire Defendant's Corporate Disclosure Statement is eligible for use where you live.

- If available, read the description and use the Preview option before downloading the templates.

- If you’re confident the template suits you, click on Buy Now.

- If the form is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Click on Download and find your form in the My Forms tab. Feel free to save the template to your gadget or print it out.

Right after downloading, you can complete the New Hampshire Defendant's Corporate Disclosure Statement manually or an editing software program. Print it out and reuse the template multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Does a verification have to be served with discovery responses in Federal Court?In California court you have to include a verification with discovery responses.

Rule 7.1 therefore does not require any disclosures with respect to it. Lex Claims, LLC is a limited liability company. It is not a corporation, and is therefore not a nongovernmental corporate party for purposes of Rule 7.1. Rule 7.1 therefore does not require any disclosures with respect to it.

The disclosure statement must provide adequate information about your financial affairs to allow your creditors to make an informed decision about whether to accept or reject your plan. Once you file your disclosure statement, the court will hold a hearing to approve or reject it.

Initial disclosures are a requirement under the federal legislation and must include: (1) the names, addresses, and phone numbers of individuals who contributed to the discovery, (2) a duplicate description of all related paperwork, compilation of all information pertaining to the invention, and publicly owned tangible

Rule 7.1 therefore does not require any disclosures with respect to it. Lex Claims, LLC is a limited liability company. It is not a corporation, and is therefore not a nongovernmental corporate party for purposes of Rule 7.1. Rule 7.1 therefore does not require any disclosures with respect to it.

(a) WHO MUST FILE; CONTENTS. A nongovernmental corporate party must file 2 copies of a disclosure statement that: identifies any parent corporation and any publicly held corporation owning 10% or more of its stock; or. states that there is no such corporation.

Subdivision (a). Rule 26.1(a) requires nongovernmental corporate parties to file a corporate disclosure statement. In that statement, a nongovernmental corporate party is required to identify all of its parent corporations and all publicly held corporations that own 10% or more of its stock.

A disclosure statement is a financial document given to a participant in a transaction explaining key information in plain language. Disclosure statements for retirement plans must clearly spell out who contributes to the plan, contribution limits, penalties, and tax status.