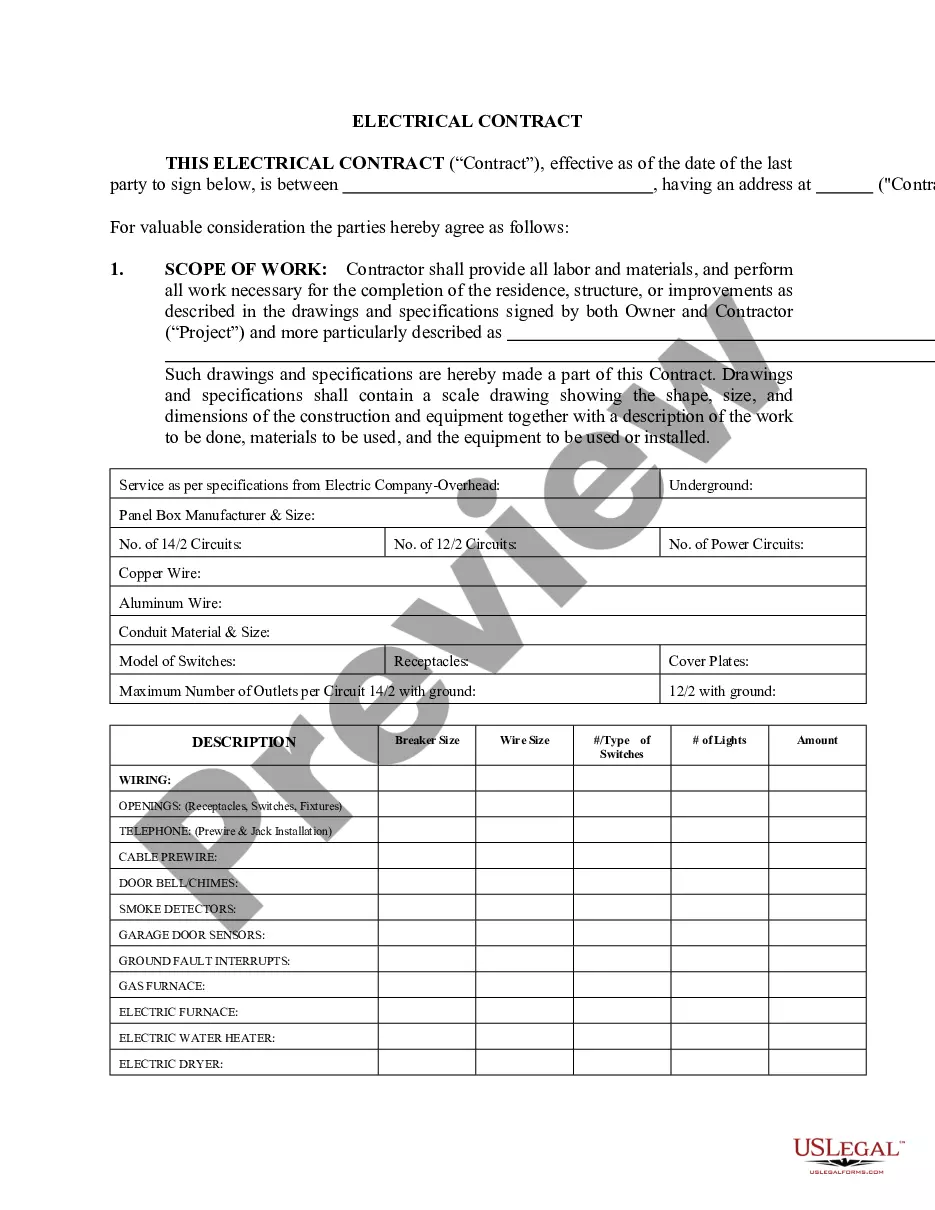

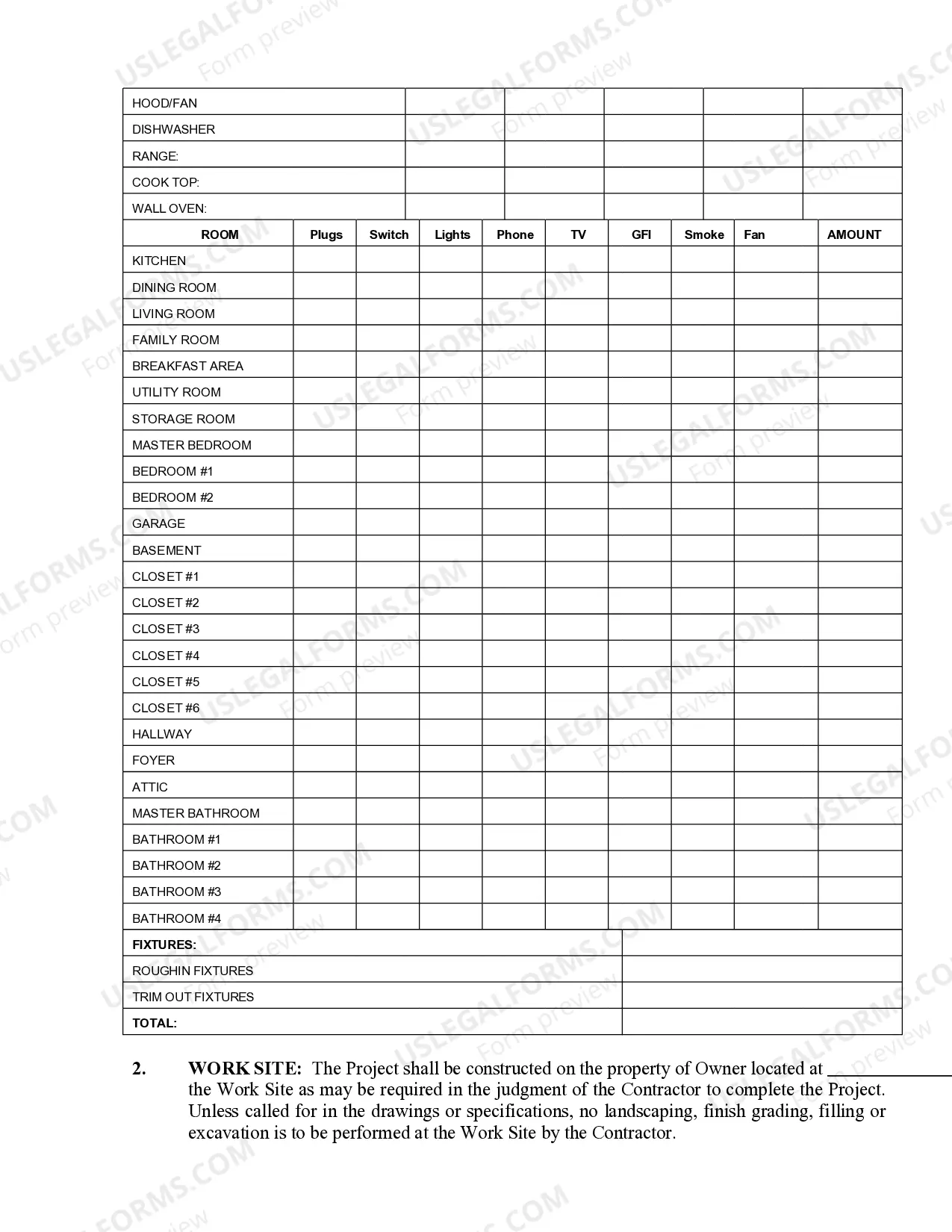

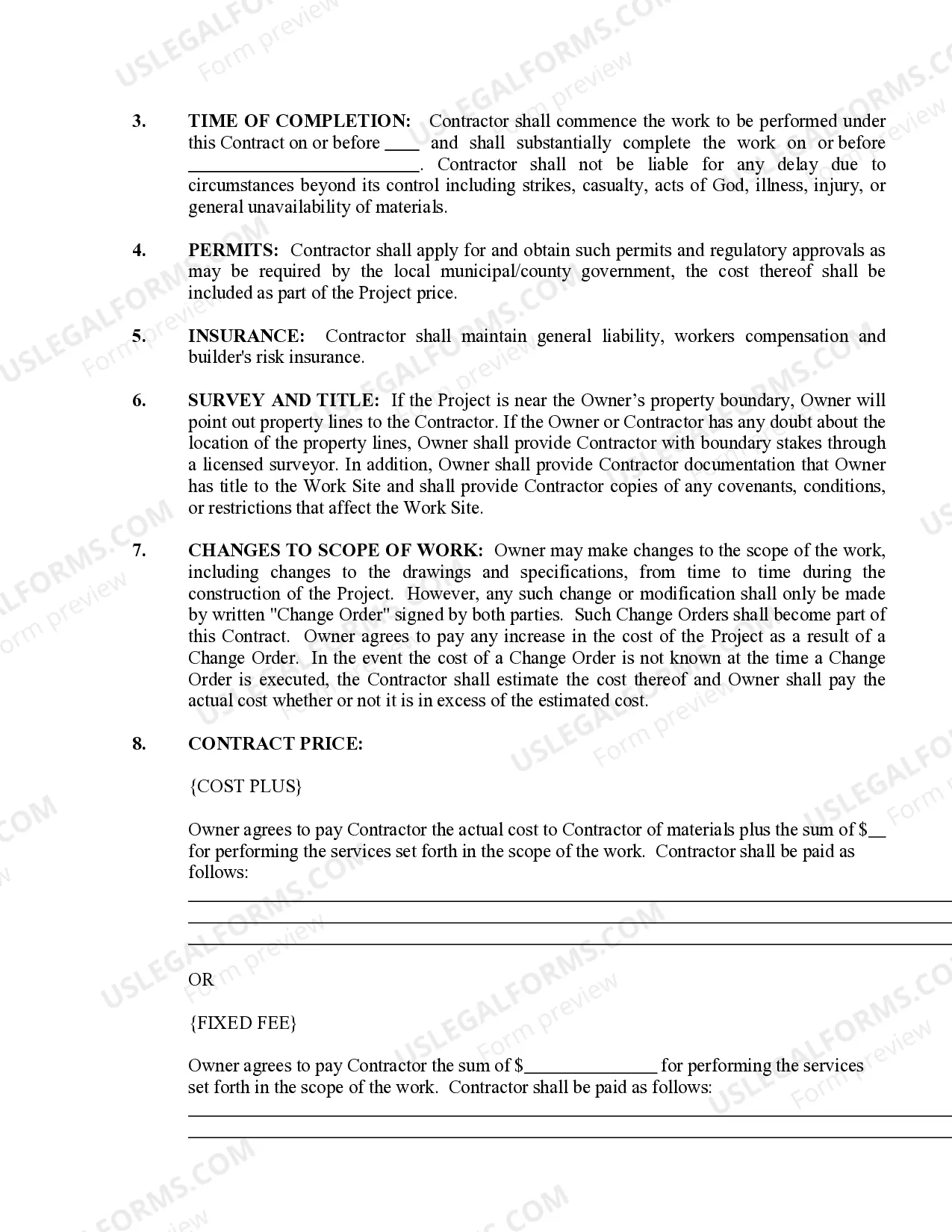

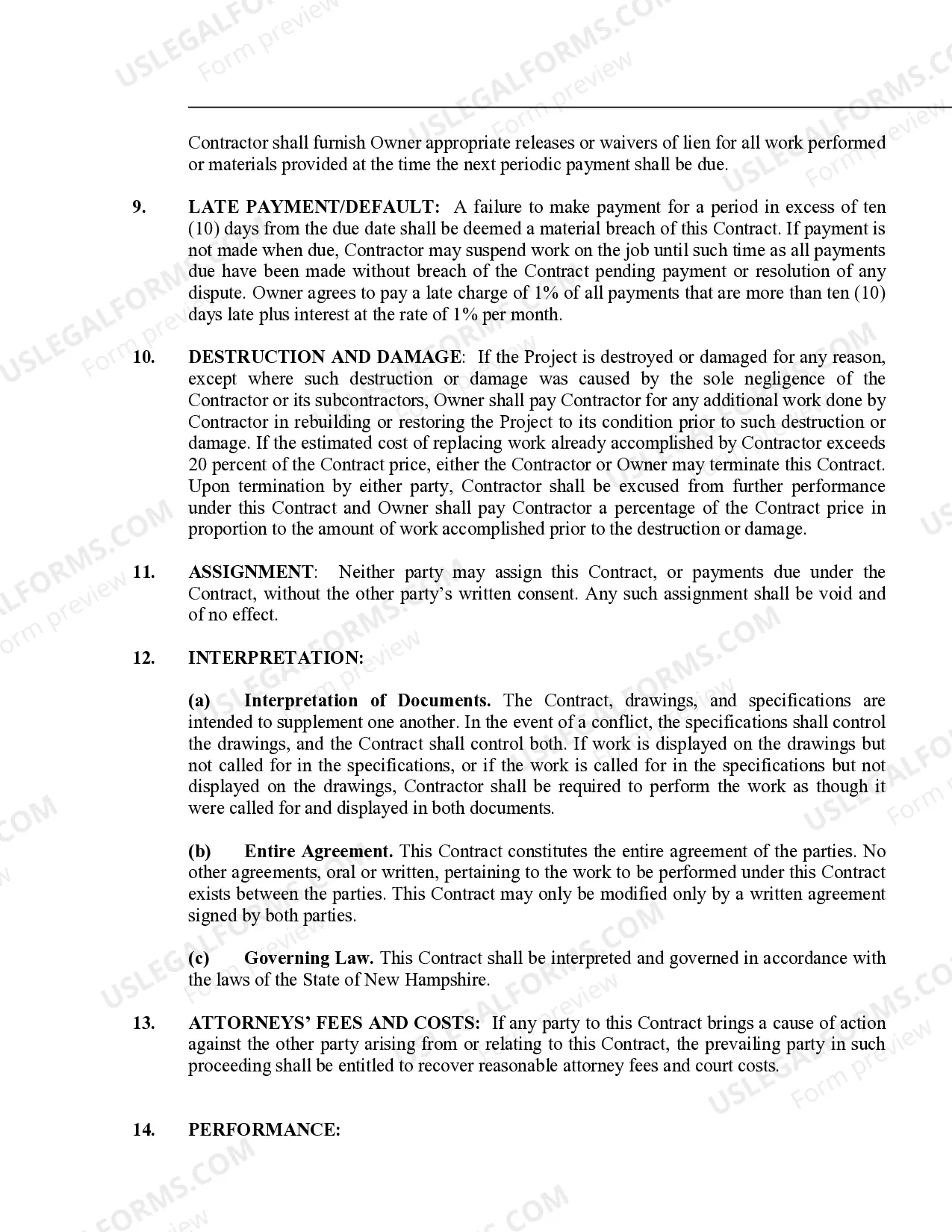

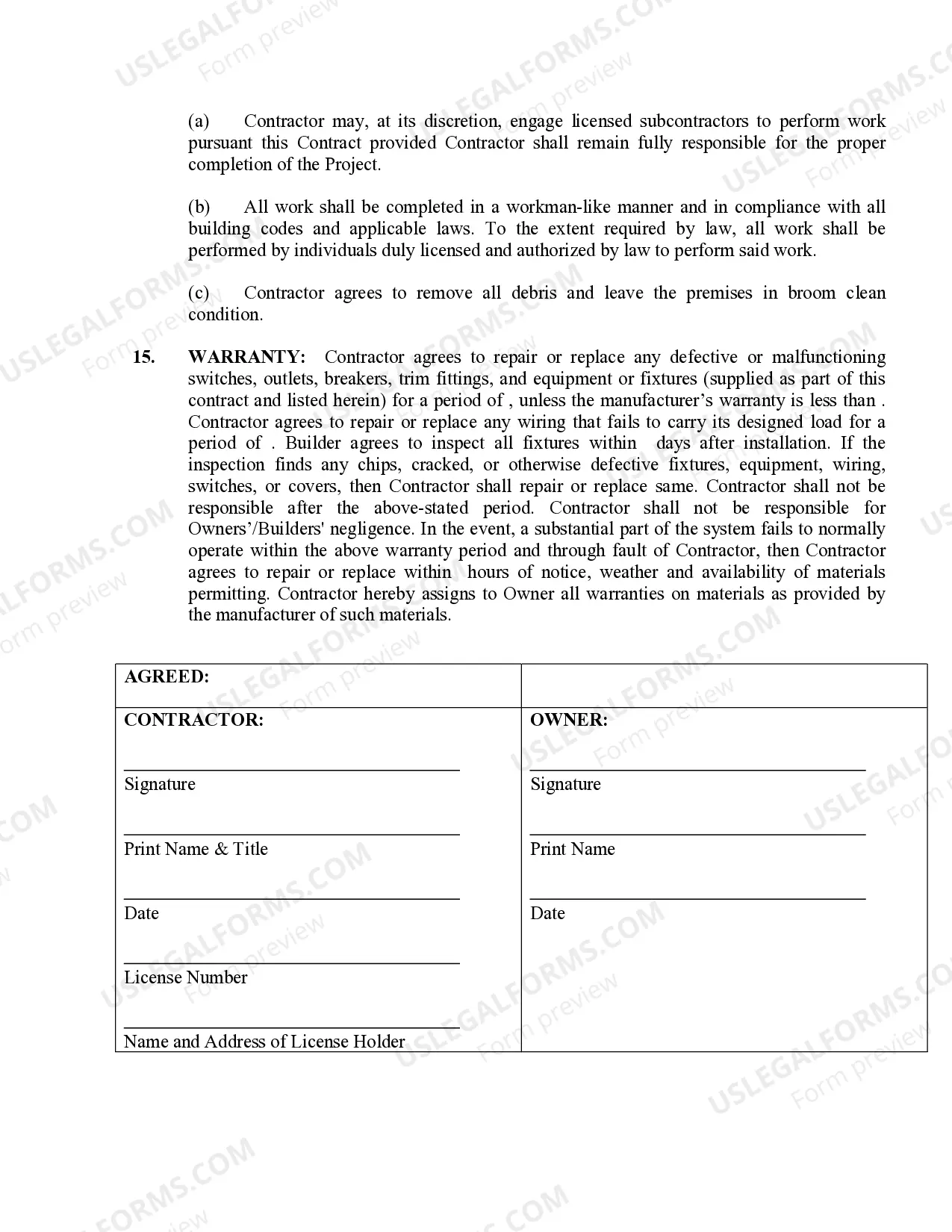

This form is designed for use between Electrical Contractors and Property Owners and may be executed with either a cost plus or fixed fee payment arrangement. This contract addresses such matters as change orders, work site information, warranty and insurance. This form was specifically drafted to comply with the laws of the State of New Hampshire.

New Hampshire Electrical Contract for Contractor

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Hampshire Electrical Contract For Contractor?

Avoid costly attorneys and find the New Hampshire Electrical Contract for Contractor you need at a reasonable price on the US Legal Forms website. Use our simple categories function to find and download legal and tax documents. Read their descriptions and preview them well before downloading. In addition, US Legal Forms enables customers with step-by-step tips on how to obtain and fill out each form.

US Legal Forms customers merely have to log in and get the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet must follow the guidelines below:

- Make sure the New Hampshire Electrical Contract for Contractor is eligible for use where you live.

- If available, look through the description and make use of the Preview option just before downloading the templates.

- If you are confident the template is right for you, click on Buy Now.

- If the template is wrong, use the search field to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select obtain the form in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the form to the device or print it out.

After downloading, you are able to fill out the New Hampshire Electrical Contract for Contractor by hand or by using an editing software. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Enter your information in the 'payer' section. Fill in your tax ID number. As a business owner, enter the contractor's tax ID number which is found on their form W-9. Fill out the account number you have assigned to the independent contractor. Enter the total amount you paid the independent contractor in box 7.

When it comes time to report all payments you make to the independent contractor on a 1099 form, you will need the information on the W-9. It's only necessary to issue a 1099 if you pay the independent contractor $600 or more during the tax year.

Start with procurement standards. Execute all subcontracts prior to starting your projects. Help those who help you. Award the job to the lowest fully qualified bidder. Use contract scope checklists. Make sure you have tight clauses. Meet to review the proposed subcontract.

A subcontractor agreement is a contract between contractors or project managers and subcontractors. This solidifies any agreement between the two parties and assures work. Subcontractors should read the subcontractor agreement and assure specifics to protect themselves from unfair risk.

New Hampshire does not require general contractors to be licensed with the state. You should however check with your local city or county to ensure there are no additional requirements. Licensure at the state level is required for some specialty trades, including electrical and plumbing.

You are required to complete and retain a Form I-9 for every employee you hire for employment in the United States, except for:Independent contractors or individuals providing labor to you if they are employed by a contractor providing contract services (for example, employee leasing or temporary agencies).

Each subcontractor should complete Form W-9 before they begin any work. On the form, the subcontractor identifies their business structure type (sole proprietorship, corporation, etc.). Form W-9 also asks for the subcontractor's name and Taxpayer Identification Number (TIN).

IRS Form 1099-MISCForm 1099-MISC is an information return, providing both the contractor or subcontractor and the IRS with taxable income information. Complete Form 1099-MISC with the name, address and tax identification number copied from the IRS Form W-9 for accuracy.

Scope of the Project. Timing for Completion: Duration of Work Clause. Payment and Billing Clause. Independent Contractor Notice. Non-Disclosure Agreement. Non-Complete Clause. Work for Hire Inclusion. Responsibilities for Insurance for Accidental Damages.