Nebraska Certificate of Formation for Limited Liability Company LLC

Description

How to fill out Certificate Of Formation For Limited Liability Company LLC?

Are you currently in a placement where you need files for either business or person reasons nearly every time? There are a lot of legitimate papers templates available on the Internet, but discovering types you can trust isn`t simple. US Legal Forms provides 1000s of type templates, just like the Nebraska Certificate of Formation for Limited Liability Company LLC, that happen to be composed to satisfy state and federal specifications.

If you are presently acquainted with US Legal Forms website and possess a free account, just log in. After that, you are able to down load the Nebraska Certificate of Formation for Limited Liability Company LLC web template.

Should you not offer an profile and would like to start using US Legal Forms, abide by these steps:

- Get the type you require and make sure it is for that correct town/state.

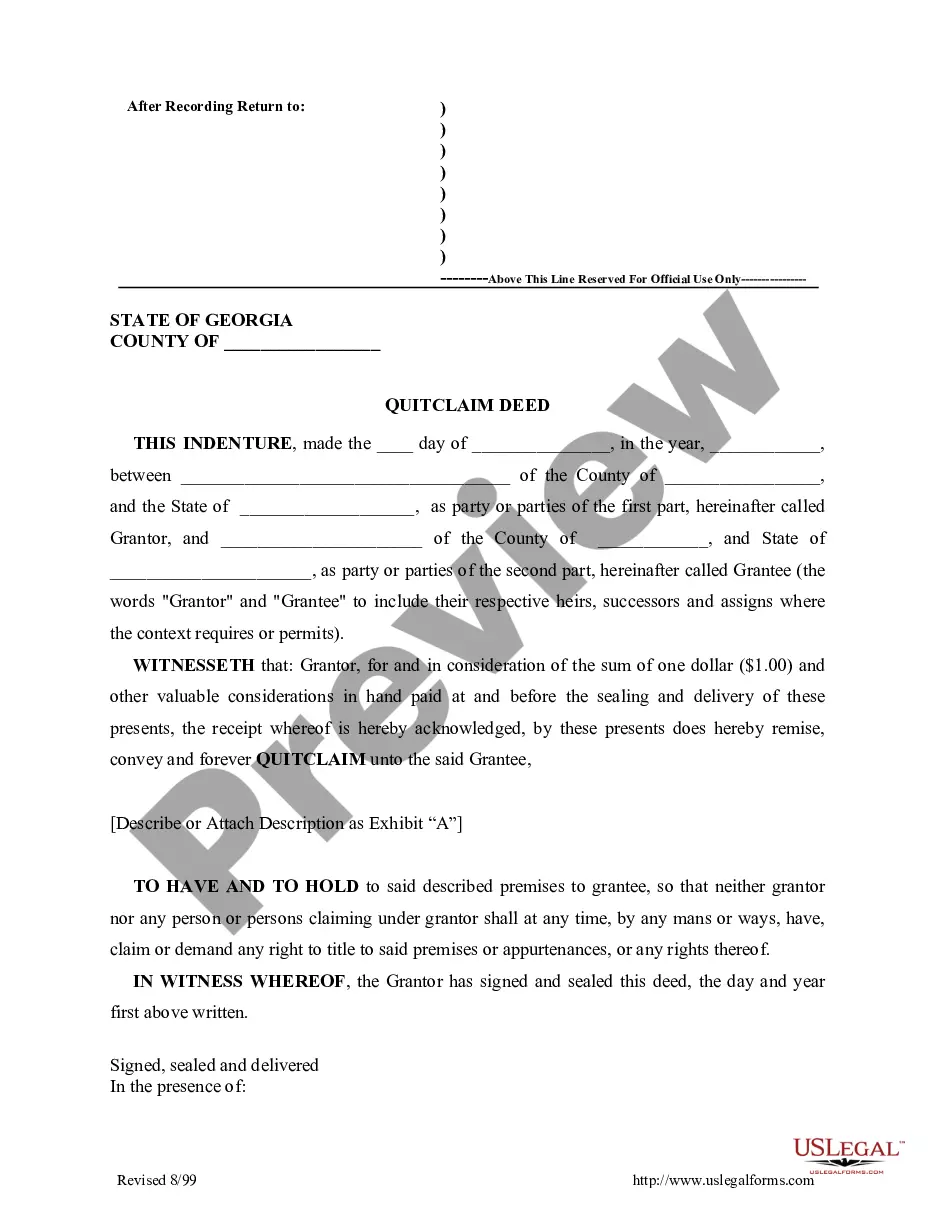

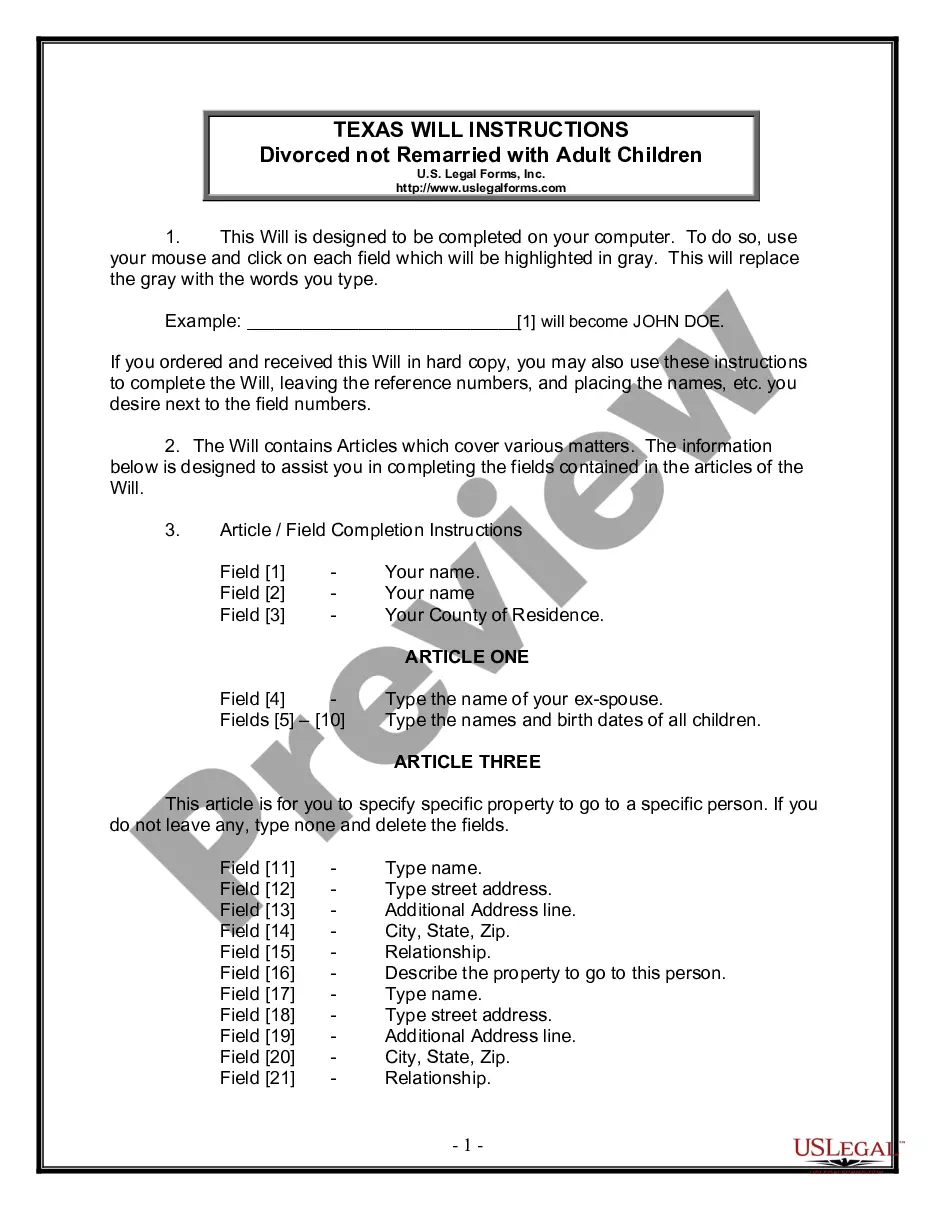

- Use the Review button to check the form.

- See the outline to ensure that you have selected the correct type.

- If the type isn`t what you`re searching for, use the Lookup discipline to discover the type that meets your requirements and specifications.

- If you find the correct type, just click Buy now.

- Pick the prices prepare you want, fill out the required information to make your bank account, and buy your order making use of your PayPal or Visa or Mastercard.

- Decide on a convenient file formatting and down load your copy.

Get all of the papers templates you may have purchased in the My Forms food selection. You can get a extra copy of Nebraska Certificate of Formation for Limited Liability Company LLC any time, if needed. Just click the required type to down load or printing the papers web template.

Use US Legal Forms, the most considerable collection of legitimate forms, in order to save efforts and avoid mistakes. The support provides expertly manufactured legitimate papers templates which you can use for a variety of reasons. Create a free account on US Legal Forms and start making your life easier.

Form popularity

FAQ

Nebraska requires LLCs to publish notice of the incorporation for three consecutive weeks in a publication (i.e. newspaper) in the county of the principal business location. If the LLC does not have a principal business location in Nebraska, the notice may be published in the county of the registered agent's location.

Nebraska LLC Formation Filing Fee: $100 To file your Nebraska Certificate of Organization with the Secretary of State, you'll pay $100 to file online, or, for $110, you can file in-office.

Benefits of Starting a Nebraska LLC Protects your personal assets from your business liability and debts. Easy tax filing and potential advantages for tax treatment. Quick and simple filing, management, compliance, regulation and administration. Low LLC filing fee ($109)

How much does it cost to open an LLC in Nebraska? It costs $100 to start a Nebraska LLC. This is a one-time filing fee for the LLC Certificate of Organization when filed online. If you file the Certificate of Organization by mail instead, it costs a little more: $110.

Nebraska LLC Approval Times Mail filings: In total, mail filing approvals for Nebraska LLCs take 1-2 weeks. This accounts for the 2-3 business days processing time, plus the time your documents are in the mail. Online filings: In total, online filing approvals for Nebraska LLCs take 2-3 business days.

Single member LLCs are treated the same as sole proprietorships. Profits are reported on Schedule C as part of your individual 1040 tax return. Self-employment taxes on Nebraska LLC net income must be paid just as you would with any self-employment business.

You can get an LLC in Nebraska in 2-3 business days if you file online (or about a week if you file by mail).

Choose a Name for Your LLC. Under Nebraska law, an LLC name must contain the words "Limited Liability Company" or the abbreviations "LLC" or "L.L.C." ... Appoint a Registered Agent. ... File a Certificate of Organization. ... Prepare an Operating Agreement. ... Publication Requirements. ... Obtain an EIN. ... File Biennial Reports.