Nebraska Storage Lease

Description

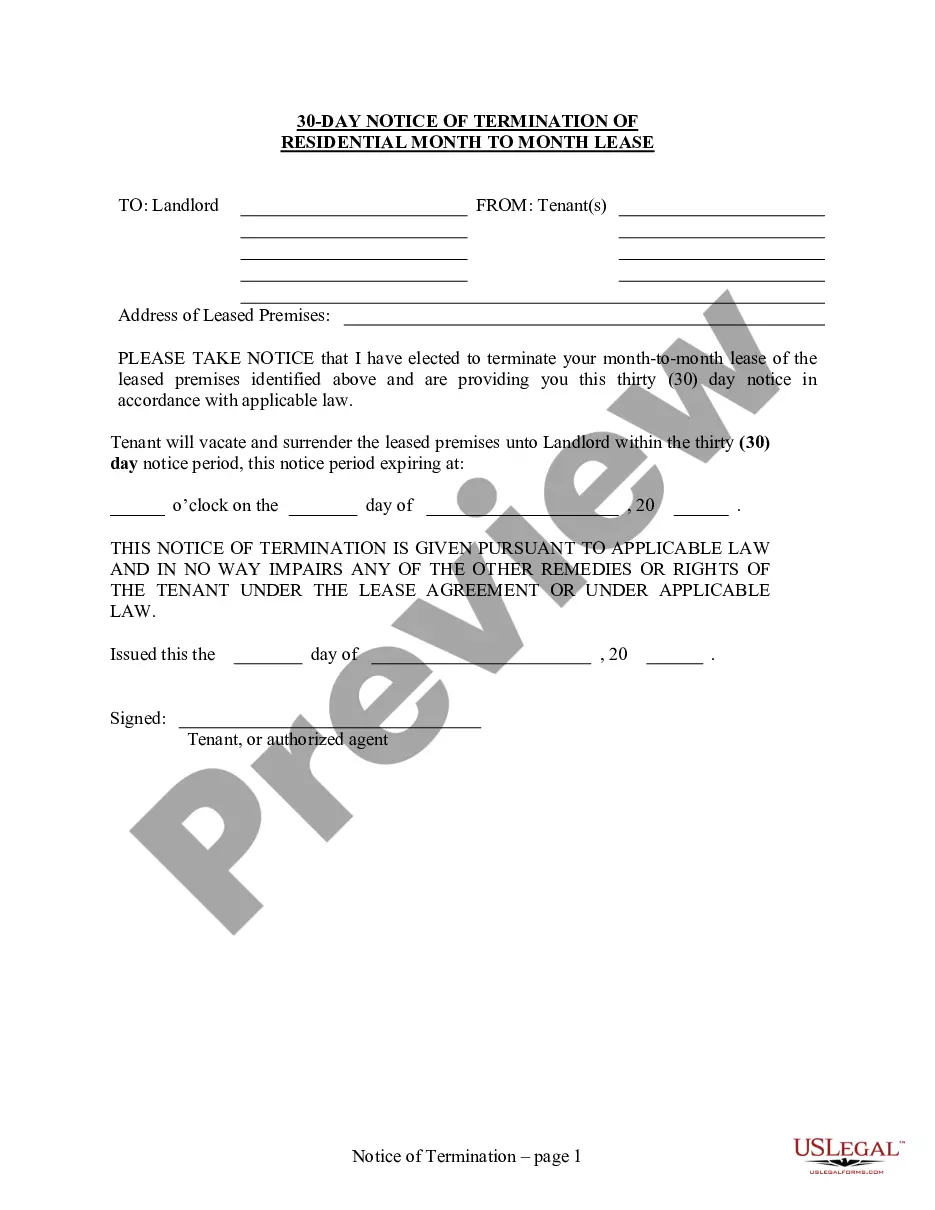

How to fill out Storage Lease?

It is possible to commit several hours on the web searching for the legitimate papers web template which fits the state and federal requirements you want. US Legal Forms offers thousands of legitimate types that are evaluated by specialists. You can easily acquire or printing the Nebraska Storage Lease from your services.

If you have a US Legal Forms account, it is possible to log in and click the Obtain button. Next, it is possible to complete, change, printing, or indication the Nebraska Storage Lease. Every single legitimate papers web template you acquire is your own property for a long time. To have yet another backup of the obtained kind, go to the My Forms tab and click the corresponding button.

If you are using the US Legal Forms site for the first time, follow the easy guidelines beneath:

- Initial, be sure that you have chosen the correct papers web template for your area/area of your choosing. Look at the kind information to ensure you have picked the proper kind. If readily available, take advantage of the Preview button to search from the papers web template too.

- If you would like discover yet another model of the kind, take advantage of the Lookup field to get the web template that fits your needs and requirements.

- Once you have discovered the web template you desire, click Get now to proceed.

- Pick the pricing prepare you desire, enter your accreditations, and sign up for your account on US Legal Forms.

- Complete the transaction. You can utilize your Visa or Mastercard or PayPal account to purchase the legitimate kind.

- Pick the formatting of the papers and acquire it to the system.

- Make modifications to the papers if necessary. It is possible to complete, change and indication and printing Nebraska Storage Lease.

Obtain and printing thousands of papers themes using the US Legal Forms website, which offers the greatest variety of legitimate types. Use skilled and state-certain themes to tackle your company or person requires.

Form popularity

FAQ

Lessors of motor vehicle leases or rentals are required to collect sales tax on the total amount of the lease or rental. The total amount includes any deposits, down payments, initial payments, services, and any other taxable charges related to the lease or rental (for example, charges for refueling and insurance).

Residents must report all income to Nebraska, and will receive a credit for taxes paid to other states by completing Form 1040N and Nebraska Schedule I. Nonresidents and partial-year residents must file a Form 1040N and a Nebraska Schedule I to compute the Nebraska tax due.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the ...

To apply for a Nebraska Identification Number, you can either register online, or complete the Nebraska Tax Application, Form 20. If you indicate that you will be collecting sales tax, you will be issued a Sales Tax Permit. The permit must be displayed at each retail location.

Every retailer must file a Form 10. Retailers include remote sellers and Multivendor Marketplace Platforms (MMPs) with more than $100,000 of gross sales or 200 or more transactions in Nebraska. All retailers must hold a Nebraska Sales Tax Permit.

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Aircraft owned by an out-of-state resident or businessNoneLabor for items to be shipped out-of-stateNoneProperty purchased in other states to be used in another stateNoneProperty shipped out-of-stateNone3 more rows

Sales Tax¹ Nebraska sales tax is imposed upon the gross receipts from: all sales, leases, rentals, installation, application, and repair of tangible personal property; ? every person providing or installing utility services; retailers of intellectual or entertainment property; the sale of admissions, bundled ...

A Form 6 is the Nebraska Sales Tax and Use Form. If you purchase something from a Licensed Nebraska Dealer they are required by the State to provide you with this form so that you can register your vehicle in whatever county you reside.