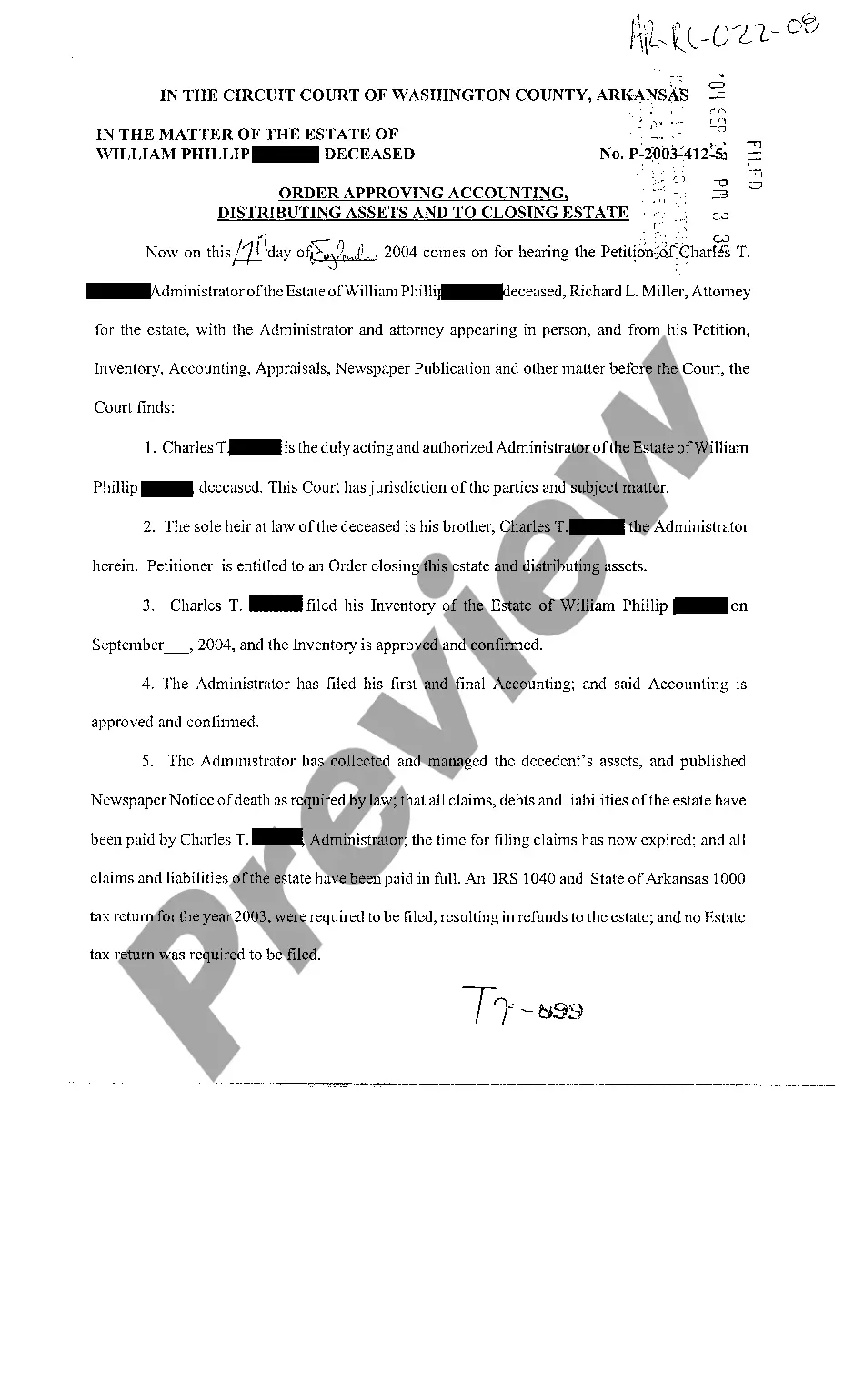

Nebraska Notice of Claim of Mineral Interest for Dormant Mineral Interest

Description

How to fill out Notice Of Claim Of Mineral Interest For Dormant Mineral Interest?

Finding the right legitimate papers web template could be a battle. Needless to say, there are a lot of themes accessible on the Internet, but how can you discover the legitimate type you will need? Make use of the US Legal Forms internet site. The service offers a large number of themes, for example the Nebraska Notice of Claim of Mineral Interest for Dormant Mineral Interest, that you can use for organization and personal needs. Each of the types are inspected by specialists and meet up with federal and state requirements.

If you are currently registered, log in to your profile and then click the Obtain key to find the Nebraska Notice of Claim of Mineral Interest for Dormant Mineral Interest. Make use of your profile to appear from the legitimate types you may have bought previously. Go to the My Forms tab of your own profile and acquire one more duplicate of your papers you will need.

If you are a whole new consumer of US Legal Forms, allow me to share basic directions so that you can stick to:

- First, make certain you have selected the right type for your personal city/county. You are able to look through the shape while using Review key and read the shape description to guarantee this is the right one for you.

- In the event the type does not meet up with your needs, utilize the Seach industry to discover the appropriate type.

- When you are certain that the shape would work, click on the Purchase now key to find the type.

- Select the costs prepare you want and type in the necessary info. Design your profile and pay money for your order with your PayPal profile or Visa or Mastercard.

- Select the submit file format and acquire the legitimate papers web template to your gadget.

- Total, modify and print and signal the acquired Nebraska Notice of Claim of Mineral Interest for Dormant Mineral Interest.

US Legal Forms is the greatest library of legitimate types that you will find numerous papers themes. Make use of the service to acquire professionally-created documents that stick to state requirements.

Form popularity

FAQ

Rarity in minerals may be classed as due to the quality of the specimen being greatly superior to the average, or to the scarcity of the species, variety or form. In each instance rarity adds greatly to the value of a specimen. It is, indeed, one of the most important factors in the scientific valuation of minerals.

The term severed mineral rights refers to a state of title to a given parcel of land in which the mineral estate is owned by a party other than the party that is the owner of the surface estate ? in other words, the mineral estate has been severed from the surface estate.

The IRS views the profits from the sale of mineral rights as a capital gain, not income. To figure out how much you might need to pay as a capital gains tax, you need to figure out your cost basis in the mineral rights. The cost basis is the original price or value of the asset ? in this case, mineral rights.

Currently, most of the producing mineral rights in Nebraska originate from the production of crude oil. There is very little production of natural gas in Nebraska.

As a mineral rights value rule of thumb, the 3X cash flow method is often used. To calculate mineral rights value, multiply the 12-month trailing cash flow by 3. For a property with royalty rights, a 5X multiple provides a more accurate valuation (stout.com).

The cost basis for inherited mineral rights is ?fair value.? It's simply the book value of what you receive on the day you acquire it. If you sell your rights afterward, you'll have to pay capital gains tax on the difference between your cost basis and the sale price.

The important properties are: Color and Intensity. Transparency. Formation of Crystals. Damage and Repairs. Locality. Size. Luster. Anomalies.

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate.