This form is used by Claimant as notice of ownership and claim of title to additional interest of the mineral estate in lands, by having engaged in, conducted, and exercised the acts of ownership, which entitle Claimant to ownership of the additional mineral interest by limitations, under the laws of the state in which the Lands are located.

Nebraska Notice of Claimed Ownership of Mineral Interest, by Limitations

Description

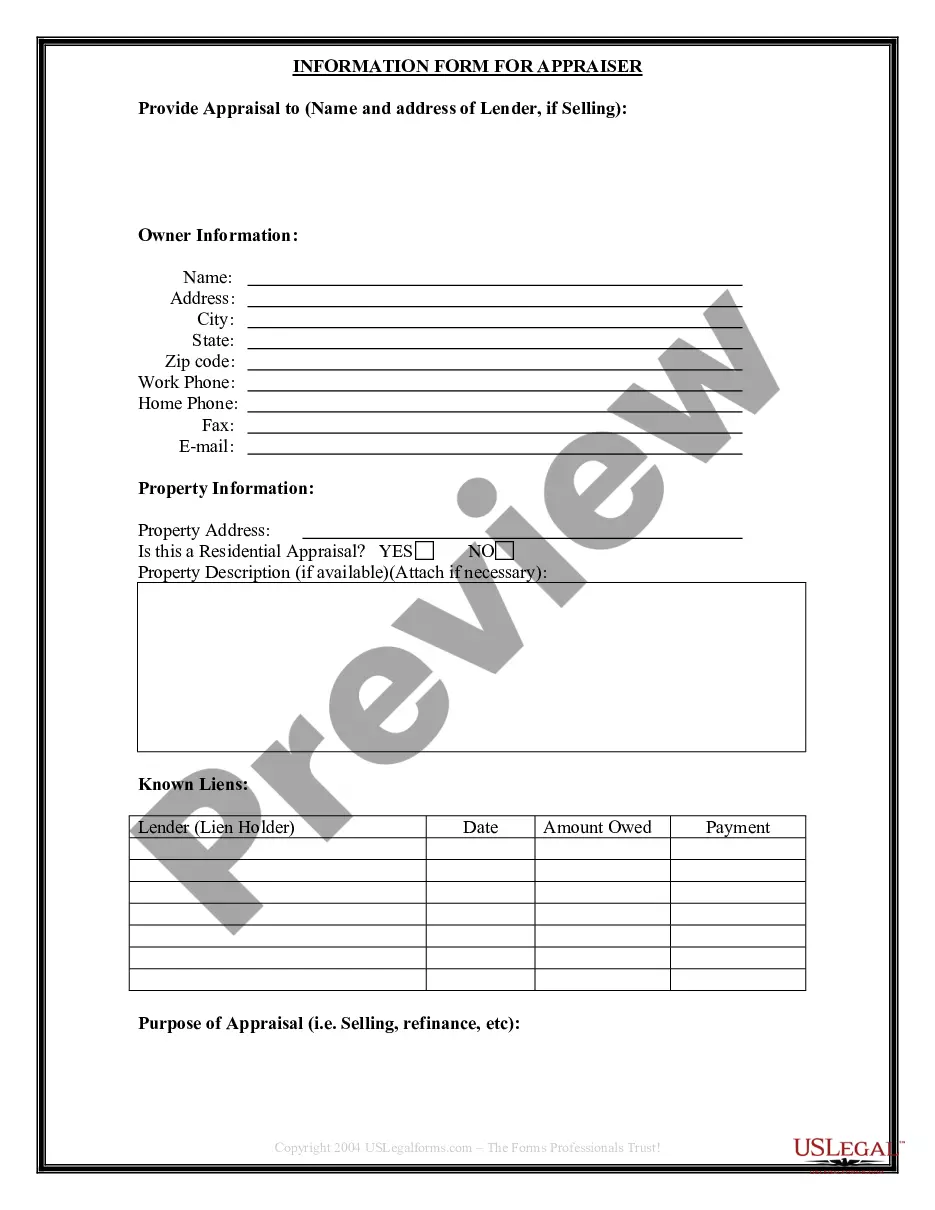

How to fill out Notice Of Claimed Ownership Of Mineral Interest, By Limitations?

Discovering the right lawful record format might be a have a problem. Naturally, there are a variety of themes accessible on the Internet, but how can you discover the lawful form you require? Make use of the US Legal Forms website. The support provides thousands of themes, including the Nebraska Notice of Claimed Ownership of Mineral Interest, by Limitations, that you can use for organization and personal requires. Each of the types are checked out by pros and fulfill federal and state specifications.

In case you are currently registered, log in to your account and click the Down load switch to find the Nebraska Notice of Claimed Ownership of Mineral Interest, by Limitations. Make use of your account to check throughout the lawful types you might have acquired formerly. Visit the My Forms tab of your own account and acquire yet another version of the record you require.

In case you are a fresh user of US Legal Forms, listed below are simple recommendations that you can follow:

- First, make certain you have selected the appropriate form for your metropolis/area. You may look through the form utilizing the Preview switch and study the form description to ensure it will be the right one for you.

- In case the form fails to fulfill your expectations, use the Seach field to discover the proper form.

- When you are certain that the form is proper, go through the Purchase now switch to find the form.

- Choose the pricing strategy you need and enter the essential info. Build your account and buy an order with your PayPal account or credit card.

- Choose the data file format and acquire the lawful record format to your device.

- Complete, change and print out and sign the obtained Nebraska Notice of Claimed Ownership of Mineral Interest, by Limitations.

US Legal Forms is the largest catalogue of lawful types where you can find numerous record themes. Make use of the service to acquire expertly-created documents that follow state specifications.

Form popularity

FAQ

States where minerals (the mineral estate)are often severed from the surface estate include: Texas, Oklahoma, Pennsylvania, Louisiana, Colorado, New Mexico and others where oil and gas has been produced for decades. Surface Rights vs. Mineral Rights in Oil & Gas Leases - MineralWise mineralwise.com ? surface-rights-vs-mineral-right... mineralwise.com ? surface-rights-vs-mineral-right...

Currently, most of the producing mineral rights in Nebraska originate from the production of crude oil. There is very little production of natural gas in Nebraska.

What Are Mineral Rights? Mineral rights are ownership rights that allow the owner the right to exploit minerals from underneath a property. The rights refer to solid and liquid minerals, such as gold and oil. Mineral rights can be separate from surface rights and are not always possessed by the property owner. How To Understand Your Mineral Rights | Rocket Mortgage rocketmortgage.com ? learn ? mineral-rights rocketmortgage.com ? learn ? mineral-rights

The ownership of rights to minerals, including oil and gas, contained in a tract of land. A mineral right is a real property interest and can be conveyed independently of the surface estate. mineral rights | Wex | US Law | LII / Legal Information Institute cornell.edu ? wex ? mineral_rights cornell.edu ? wex ? mineral_rights

Nebraska also produces some natural gas, as well as significant amounts of cement, lime, sand, gravel, crushed stone, and clay. Nebraska - Agriculture, Energy, Tourism | Britannica britannica.com ? place ? Resources-and-power britannica.com ? place ? Resources-and-power

Ing to Nebraska State Law, the assessed value of property is based on 100% of the actual market value of the property during the year in which it is assessed, not the year it was purchased. Questions regarding the valuation of your property should be made to the Douglas County Assessor.

Personal property is all property other than real property and franchises. Recovery Period. The recovery period is the federal Modified Accelerated Cost Recovery System (MACRS) recovery period over which the Nebraska adjusted basis of property will be depreciated for property tax purposes.