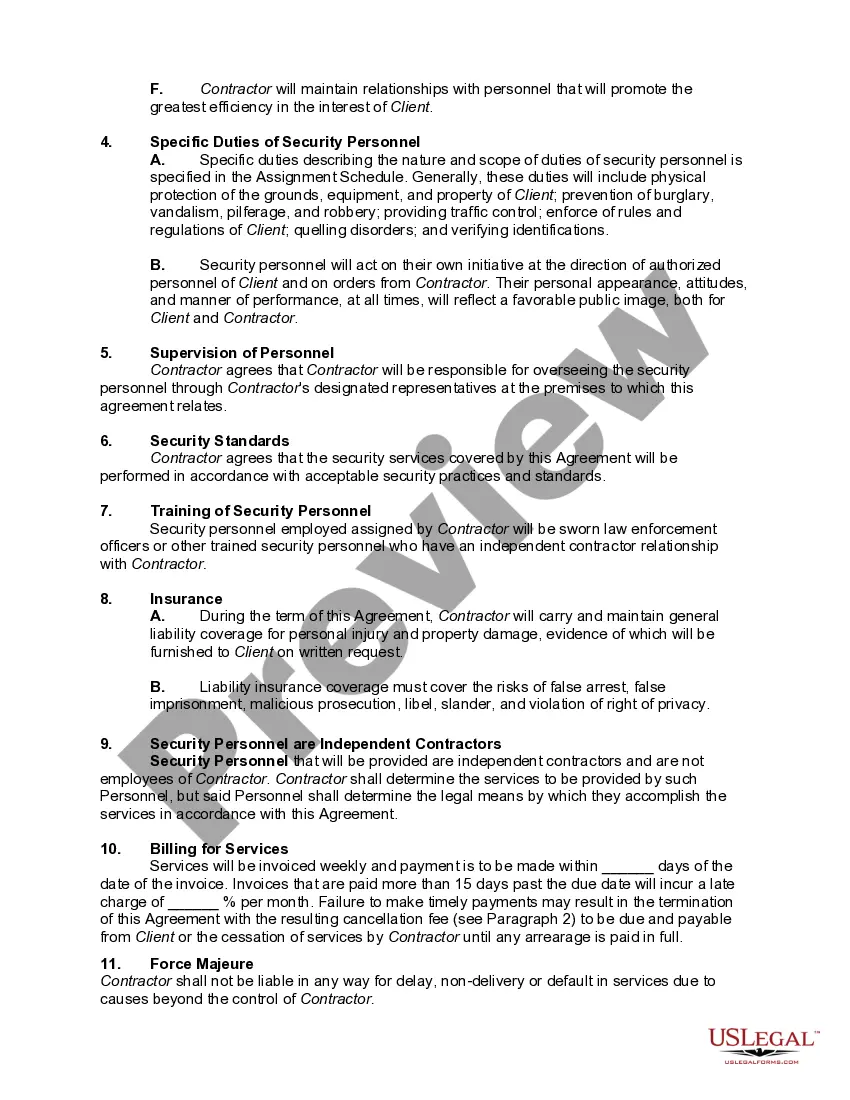

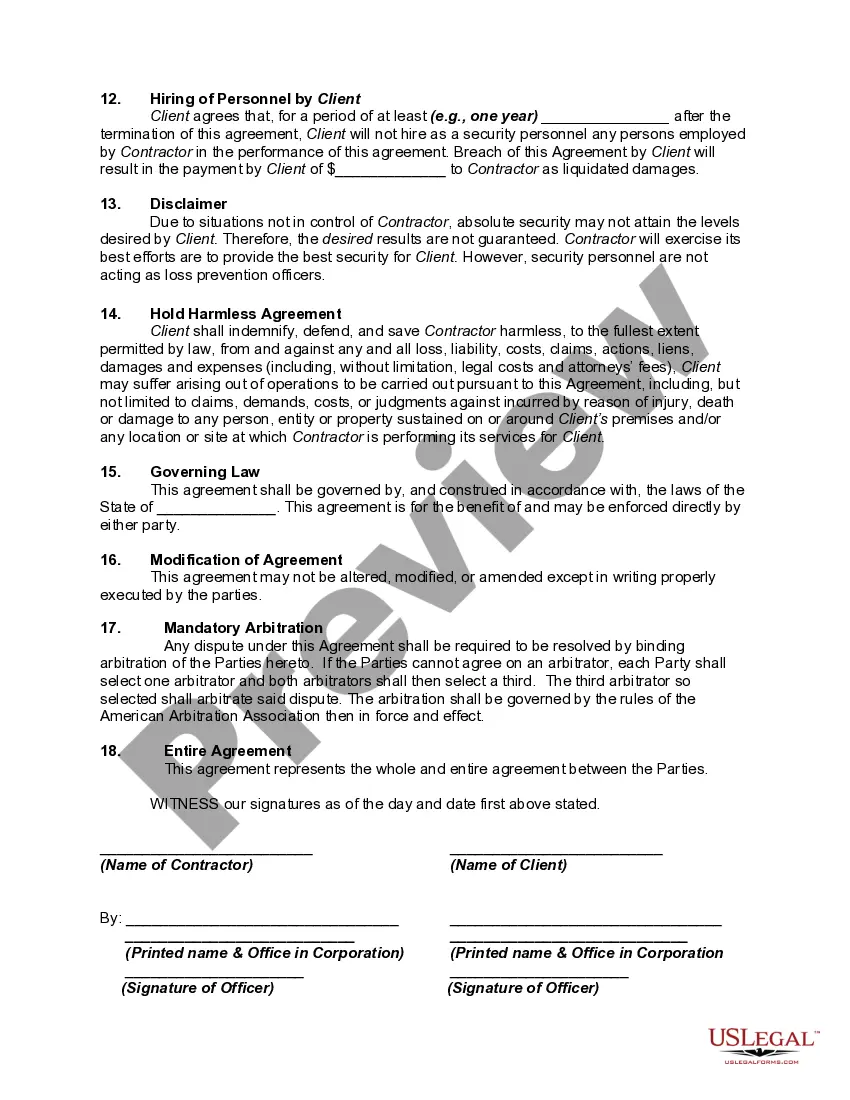

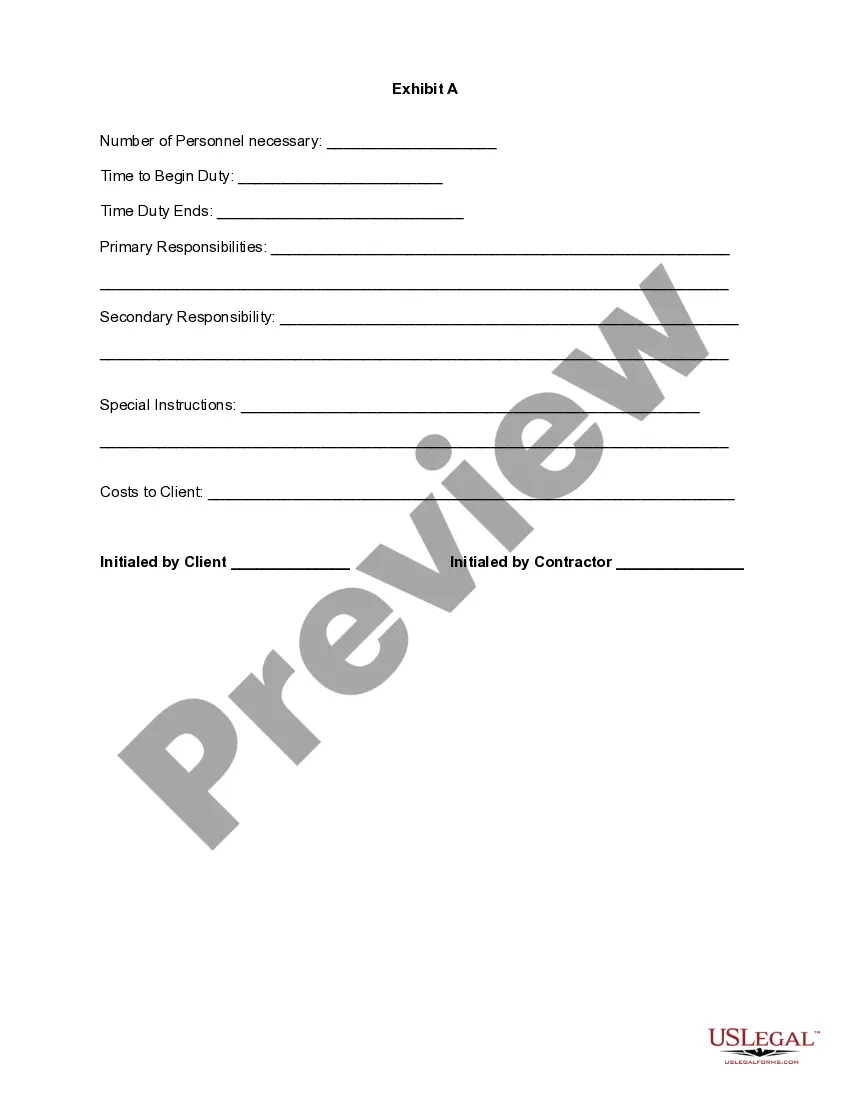

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed

Description

How to fill out Agreement To Provide Security Or Alarm, Surveillance And/or Traffic Control Services - Security Personnel To Be Independent Contractors - Self-Employed?

Are you currently in a situation where you require documents for either corporate or personal purposes almost every day? There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

US Legal Forms provides a wide selection of template options, such as the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, designed to comply with federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. Then, you may download the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed template.

- Locate the template you need and confirm it is for the correct city/state.

- Utilize the Review feature to inspect the document.

- Read the details to ensure you have selected the right template.

- If the template is not what you require, use the Research field to find one that meets your needs.

- Once you find the correct template, click on Purchase now.

- Choose the pricing plan you prefer, complete the required information to create your account, and finalize your order using your PayPal or credit card.

- Select a convenient document format and download your copy.

Form popularity

FAQ

One significant consequence of misclassifying an employee as an independent contractor is the potential for substantial financial penalties. This misclassification can lead to back taxes, unpaid benefits, and fines from regulatory agencies. Moreover, it can also damage your business reputation and employee trust within the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed framework. To avoid such issues, utilizing resources like uslegalforms can provide the necessary guidance in drafting compliant agreements and understanding your obligations.

Yes, you can sue for being misclassified as an independent contractor under the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed. If you believe your rights were violated due to misclassification, you may seek legal recourse. It is crucial to gather evidence regarding your employment status and consult a legal professional who specializes in labor law. They can guide you through your options and help protect your rights.

The IRS evaluates several criteria to classify a worker as an independent contractor. These include the level of control the worker has over their work, whether they provide their own tools, and the extent to which their services are integrated into the business. Focusing on these criteria helps clarify relationships under the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, ensuring proper compliance and tax treatment.

An independent contractor agreement in Missouri outlines the terms and conditions between a business and an independent contractor. This agreement specifies the scope of work, compensation, and the relationship's nature, ensuring compliance with applicable laws. Understanding this agreement is essential for both parties, particularly when dealing with the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed.

When managing independent contractors, it is crucial to establish three primary controls: contractual obligations, deliverables, and communication protocols. By setting clear contractual obligations, you ensure accountability regarding the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed. Establishing deliverables defines expectations, while robust communication protocols facilitate effective collaboration.

Determining independent contractor status involves four key factors: the degree of control exercised by the employer, the worker's opportunity for profit or loss, the worker's investment in facilities or equipment, and the permanency of the working relationship. These factors help you understand whether the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed aligns with specific workforce classifications.

Courts commonly assess three main tests: the control test, the economic reality test, and the relative nature of the work test. The control test examines how much control a business has over the worker's work. The economic reality test considers the worker's independence in financial terms, while the relative nature of the work test evaluates the worker's relationship to the business's core activities.

Yes, an independent contractor is usually classified as self-employed. This means that they operate their own business and offer services to clients, often under agreements like the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed. While both terms indicate a level of independence, a self-employed individual may also encompass a wider range of business scenarios beyond contracting.

Receiving a 1099 form typically indicates you earned income as a contractor rather than as an employee. If you receive this form, it generally means you are considered self-employed for tax purposes. This classification aligns with the structure of the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, which emphasizes the independence of the workers.

The IRS defines a self-employed individual as someone who carries on a trade or business as a sole proprietor or an independent contractor. This definition broadly applies to anyone who receives income from sources other than being an employee. For many people working under the Missouri Agreement to Provide Security or Alarm, Surveillance and/or Traffic Control Services - Security Personnel to be Independent Contractors - Self-Employed, this means they control their work and have flexibility in how they provide services.