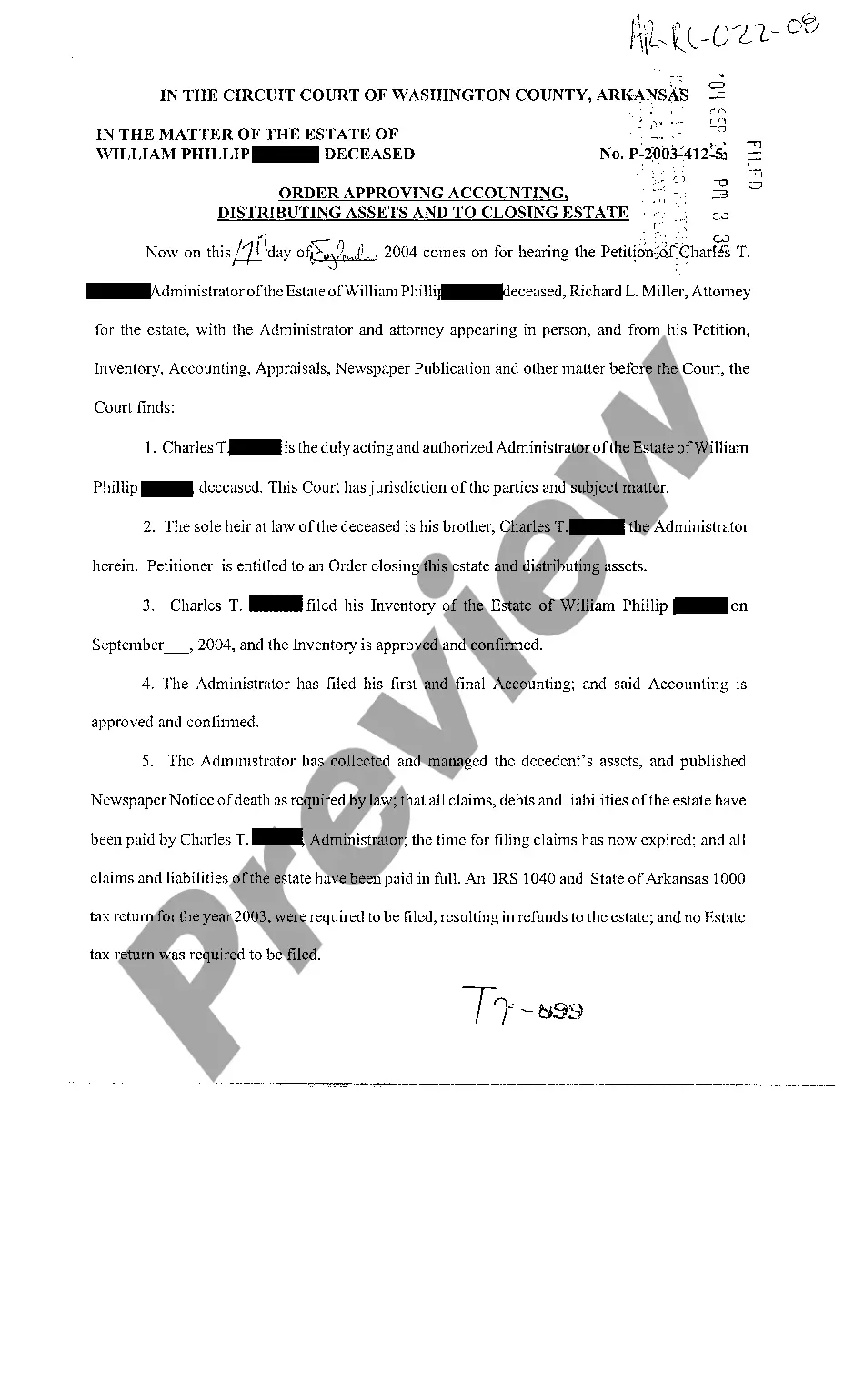

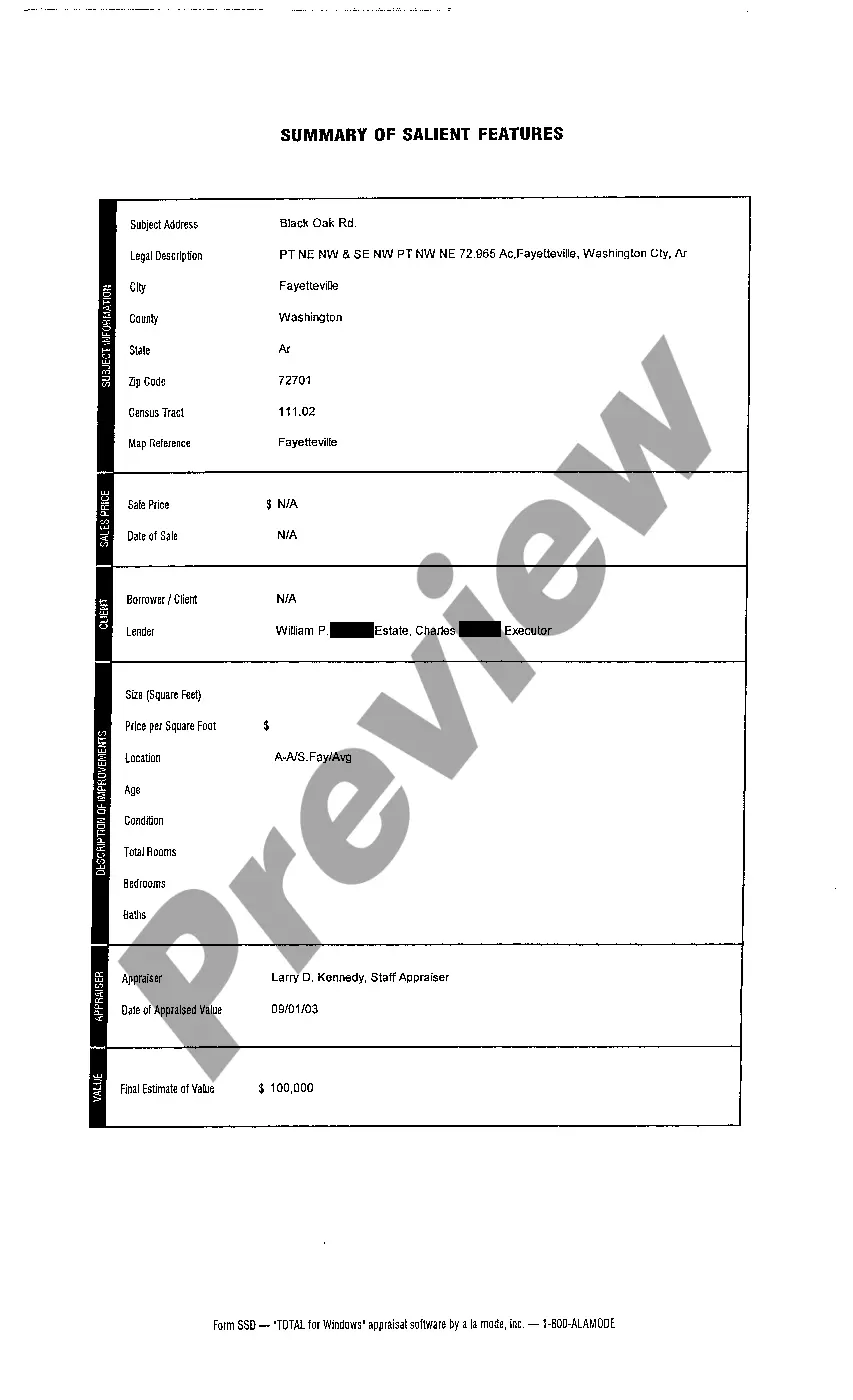

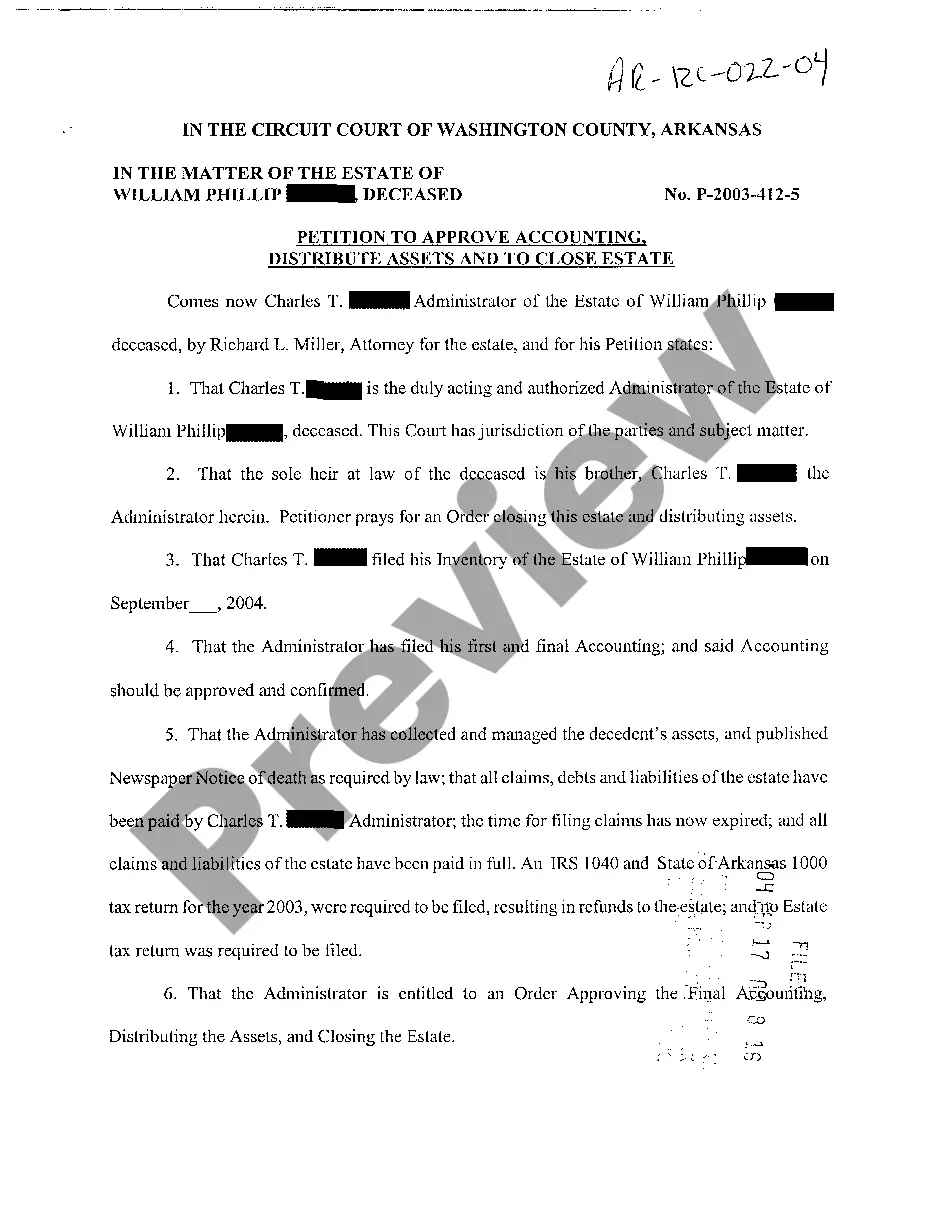

Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arkansas Order Approving Accounting, Distributing Assets And To Closing Estate?

Among numerous complimentary and paid templates available online, you cannot guarantee their dependability.

For instance, who created them or if they possess the necessary expertise to address your needs.

Always remain composed and utilize US Legal Forms!

Ensure that the document you view is applicable in your region.

- Explore Arkansas Order Approving Accounting, Distributing Assets and Closing Estate templates crafted by proficient legal experts.

- Avoid the expensive and labor-intensive task of seeking an attorney.

- Save money on having them draft a document for you that you can do yourself.

- If you maintain a subscription, Log In to your account and locate the Download button adjacent to the form you need.

- You will also have access to your previously downloaded templates under the My documents section.

- If you are using our website for the first time, follow these instructions to easily obtain your Arkansas Order Approving Accounting, Distributing Assets and Closing Estate.

Form popularity

FAQ

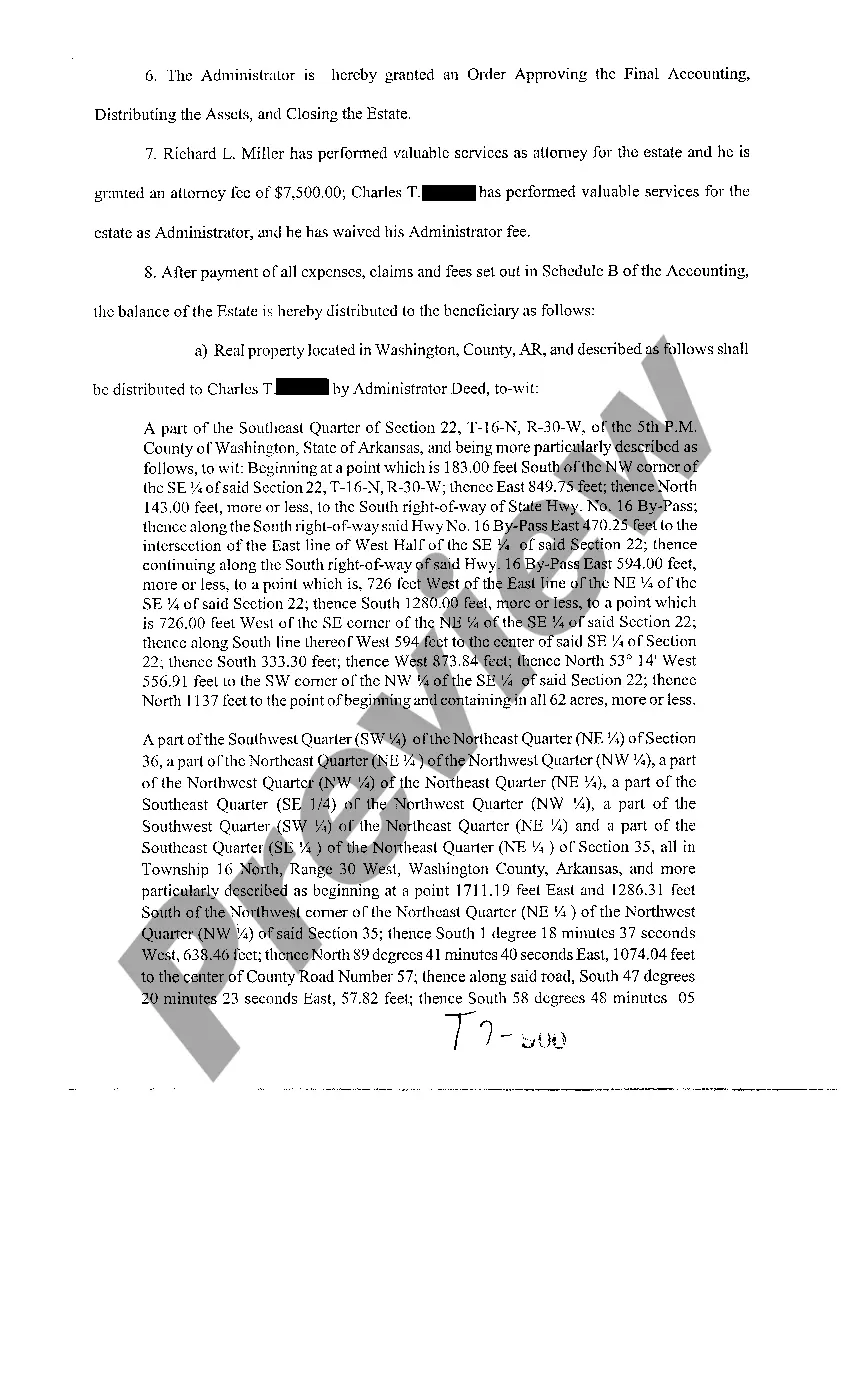

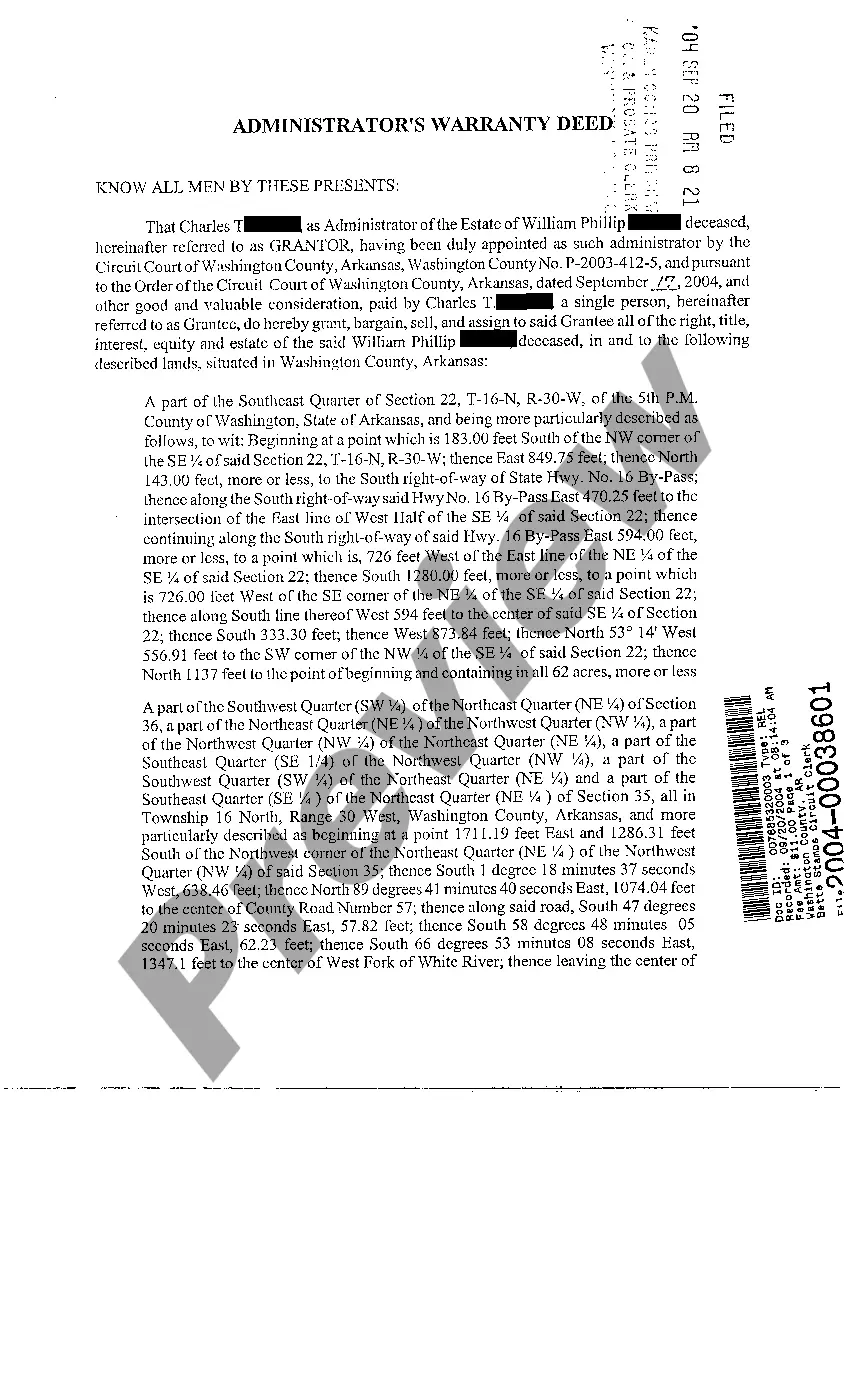

To distribute stock from an estate, the executor must have the Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate in hand. This order grants the executor authority to proceed with the stock distribution. The executor will need to contact the financial institution or stock transfer agent to initiate the stock transfer, ensuring that all required forms are completed accurately. It’s important to keep records and inform the beneficiaries about the process for transparency.

Distributing stock from an estate involves several steps, starting with the appointment of the executor to handle the estate. After obtaining the Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate, the executor can transfer stock holdings to the beneficiaries. This process typically requires submitting necessary documentation to the stock transfer agent and may involve liquidating stocks if the will specifies so. Always ensure compliance with legal requirements to facilitate a smooth distribution.

To distribute items from an estate, the executor should first gather an inventory of all assets and their estimated values. Next, the executor must obtain an Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate, which legitimizes the distribution process. Once the order is in place, the executor can allocate the items to the respective beneficiaries as specified in the will or outlined by state law. Clear communication with beneficiaries throughout this process helps to minimize confusion and potential conflicts.

Distributions from an estate occur once the executor has obtained an Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate. This order allows the executor to manage the financial obligations and ensure proper distribution of assets. Generally, the executor distributes assets in accordance with the deceased's will or according to state law if there is no will. It's essential to follow these guidelines carefully to avoid disputes among beneficiaries.

The best way to distribute estate assets involves clear communication with beneficiaries and following legal requirements set forth in the estate plan. Ideally, all assets should be distributed according to the will or state law if there's no will. Implementing the Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate can provide a structured approach, ensuring transparency and fairness during the distribution process.

In Arkansas, an executor typically has a reasonable timeframe, usually up to one year, to settle an estate, but this period can extend depending on the complexity of the estate. Effective planning and execution are crucial for timely resolution. Using resources like the Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate can help expedite this process, ensuring all matters are handled efficiently.

While Ontario's regulations differ from Arkansas, estate debts generally follow a similar structure. The priority usually starts with secured debts, then funeral costs, followed by taxes and unsecured debts. When handling estate issues, having a reliable document platform, such as uslegalforms, can assist in drafting the necessary Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate to ensure everything is managed smoothly.

When managing an estate, the correct order of payment typically begins with funeral expenses, followed by secure debts, such as taxes, and finally, general debts. Adhering to this order helps ensure compliance with legal requirements and protects the rights of heirs and beneficiaries. If you require guidance, consider utilizing the Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate as it streamlines processes efficiently.

Estate accounting involves documenting all financial transactions related to the estate, including income, expenses, and distributions. This process ensures transparency and provides a record for the beneficiaries. Proper estate accounting is essential for the executor's fiduciary duty. The Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate emphasizes the importance of accurate estate accounting in the settlement process.

Assets that are generally exempt from probate in Arkansas include certain bank accounts, life insurance proceeds, and property held in joint tenancy. These assets can pass to heirs without going through the lengthy probate process. Being aware of these exemptions can help beneficiaries receive their inheritance faster. The Arkansas Order Approving Accounting, Distributing Assets and To Closing Estate will guide you in managing these exempt assets appropriately.