Nebraska Dancer Agreement - Self-Employed Independent Contractor

Description

How to fill out Dancer Agreement - Self-Employed Independent Contractor?

If you want to download, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

A variety of templates for business and personal purposes are categorized by regions and keywords.

Every legal document template you obtain is yours indefinitely. You have access to every form you downloaded in your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the Nebraska Dancer Agreement - Self-Employed Independent Contractor with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to find the Nebraska Dancer Agreement - Self-Employed Independent Contractor in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Nebraska Dancer Agreement - Self-Employed Independent Contractor.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Ensure you have selected the form for the correct city/state.

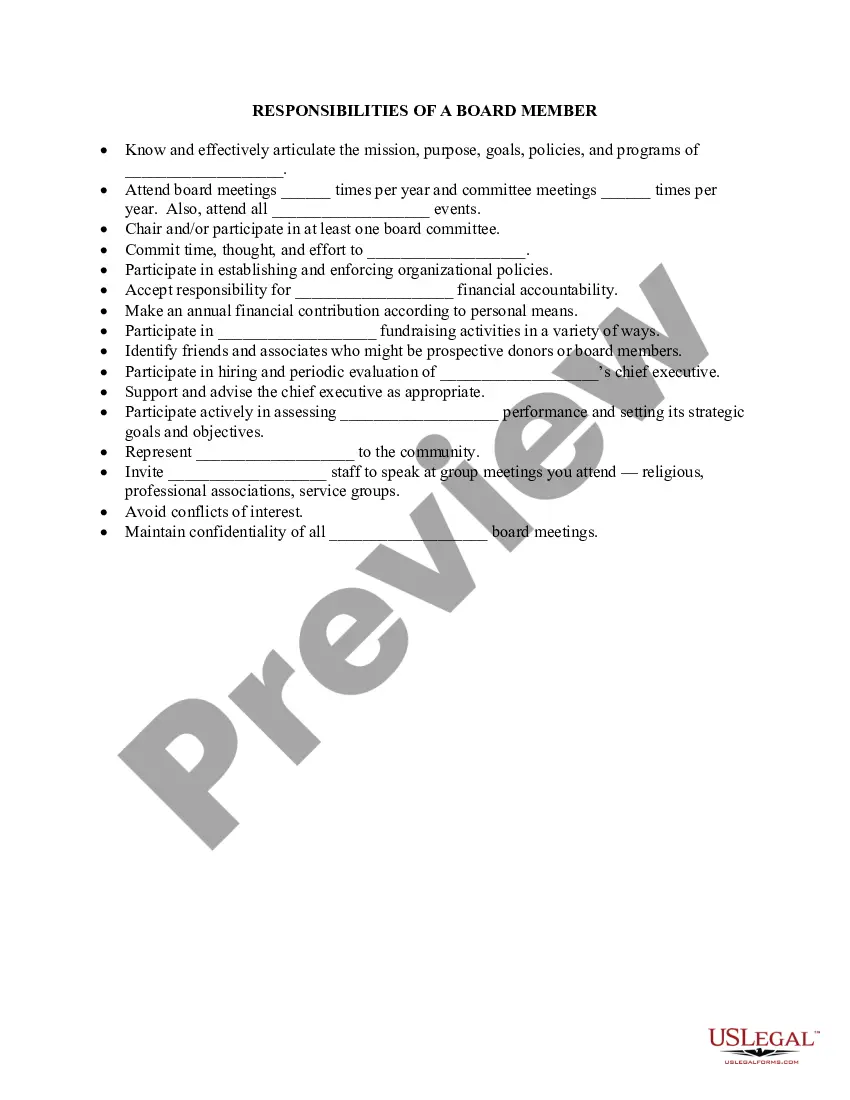

- Utilize the Preview option to review the form's content. Don’t forget to read the explanation.

- If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

- Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

- Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Select the format of the legal form and download it to your device.

- Complete, modify, and print or sign the Nebraska Dancer Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Filling out a declaration of independent contractor status form is straightforward. Start by providing your personal information, including your name, address, and contact details. Next, state the nature of your work under the Nebraska Dancer Agreement - Self-Employed Independent Contractor, ensuring you clarify your relationship with the hiring party. Finally, sign and date the form to confirm its accuracy, and consider using platforms like US Legal Forms for guided templates and additional resources.

Typically, the hiring party or client writes the independent contractor agreement. However, the contractor can also negotiate terms to ensure fairness and clarity in the contract. By employing the Nebraska Dancer Agreement - Self-Employed Independent Contractor, both parties can establish clear expectations. Platforms like uslegalforms provide templates that facilitate collaboration, ensuring both parties have an agreement that meets their needs.

Filling out an independent contractor form involves providing necessary details about both the contractor and the client. Include identification information, payment terms, and information regarding the work's specific nature. For the Nebraska Dancer Agreement - Self-Employed Independent Contractor, clarify what services will be performed and deadlines. Utilizing uslegalforms can streamline this process, as they offer user-friendly templates designed for the independent contractor environment.

When you fill out an independent contractor agreement, begin by entering basic information about the contractor and the hiring party. Then, detail the services to be provided and any payment arrangement. With the Nebraska Dancer Agreement - Self-Employed Independent Contractor, you can specify performance expectations and due dates. Choosing a straightforward guide or template from uslegalforms can make this task more manageable.

Yes, an independent contractor is considered self-employed. This means that they operate their own business and are responsible for paying their taxes. The Nebraska Dancer Agreement - Self-Employed Independent Contractor reinforces this classification, allowing dancers to maintain their independence while enjoying the flexibility of self-employment. It's important to understand these distinctions for tax and legal purposes.

To write an independent contractor agreement, start by clearly defining the roles and responsibilities of both parties. Include key elements such as payment terms, scope of work, and confidentiality clauses. For the Nebraska Dancer Agreement - Self-Employed Independent Contractor, ensure that local laws and regulations are considered. Using a platform like uslegalforms can simplify this process with customizable templates tailored to your needs.

The recent federal rule on independent contractors aims to clarify the criteria for determining worker classification. This rule highlights the importance of the contractor's independence in completing their tasks and emphasizes the flexibility that comes with a Nebraska Dancer Agreement - Self-Employed Independent Contractor. Many workers may now have greater access to benefits and protections under this new guideline. Staying informed about such changes will help you make better business decisions in your independent work.

To qualify as self-employed, you generally need to operate your own business or work independently without a traditional employer-employee relationship. Additionally, you should achieve your income through the services you provide, much like those outlined in a Nebraska Dancer Agreement - Self-Employed Independent Contractor. Remember, self-employed individuals are responsible for managing their own taxes and business expenses. Understanding these qualifications aids in navigating your self-employment journey.

Both terms refer to similar work situations, but the choice mainly depends on your preference. 'Self-employed' is a broader term that can encompass various business structures, while 'independent contractor' is more specific to contractual work like a Nebraska Dancer Agreement - Self-Employed Independent Contractor. Choosing one over the other might affect how clients perceive your professionalism. Therefore, select the term that aligns best with your services and branding.

Yes, receiving a 1099 form typically indicates that you are self-employed. This classification means you are not an employee but rather an independent contractor. For a Nebraska Dancer Agreement - Self-Employed Independent Contractor, this status allows you more control over your work and finances. Just keep in mind that you will need to manage your taxes accordingly.