Nebraska Masonry Services Contract - Self-Employed

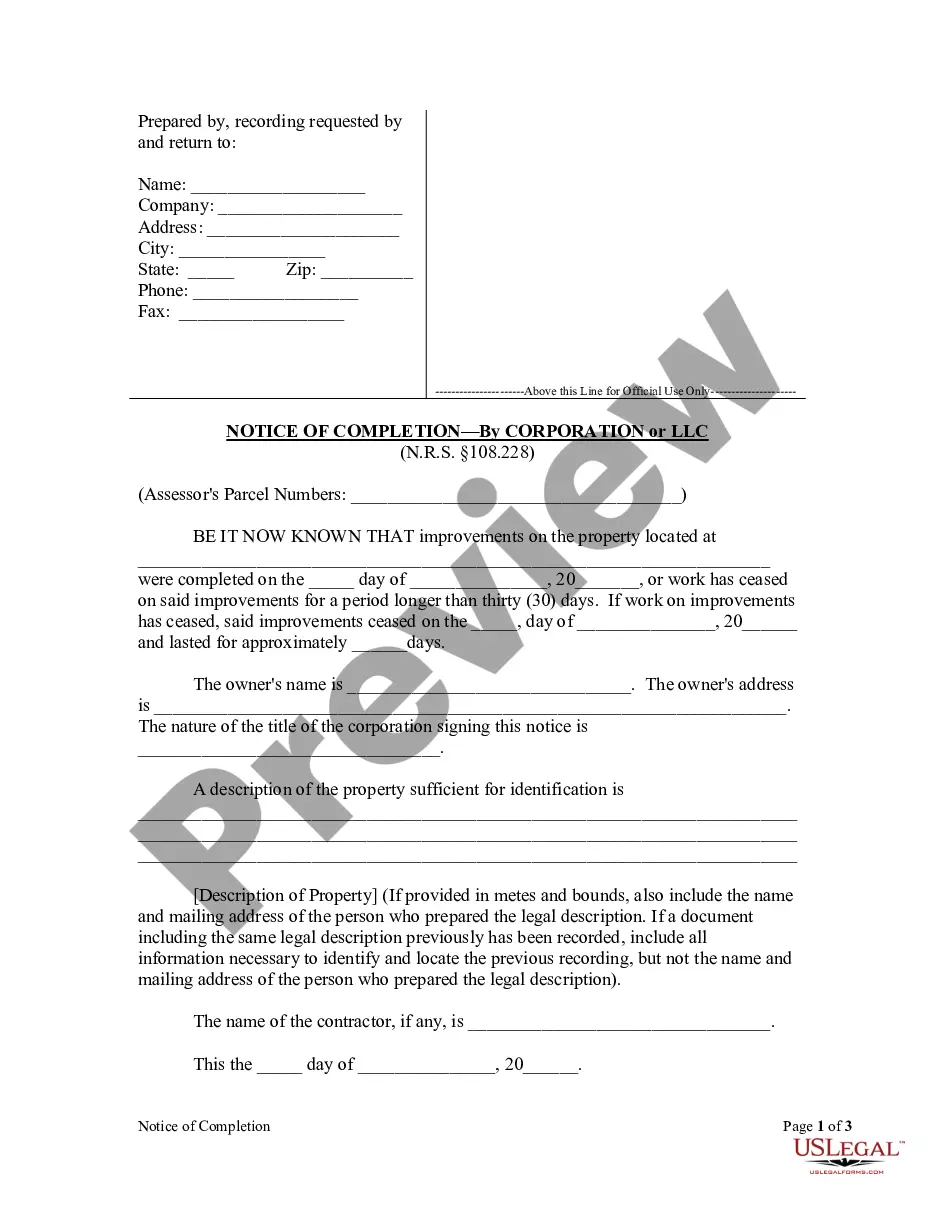

Description

How to fill out Masonry Services Contract - Self-Employed?

You can spend time online searching for the legal document template that conforms to the federal and state requirements you need.

US Legal Forms offers a vast selection of legal documents that have been reviewed by experts.

You can download or print the Nebraska Masonry Services Contract - Self-Employed from our platform.

If you wish to obtain another version of the form, utilize the Search field to find the template that fits your needs and specifications.

- If you have a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Nebraska Masonry Services Contract - Self-Employed.

- Every legal document template you receive is yours indefinitely.

- To access another copy of any purchased form, navigate to the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the region/area you desire.

- Review the form details to confirm you have chosen the right document. If available, use the Review button to check the document template as well.

Form popularity

FAQ

When invoicing for service contracts in Nebraska, you generally should include sales tax if applicable. For a Nebraska Masonry Services Contract - Self-Employed, it's necessary to confirm whether your service is taxable. Always ensure your invoices reflect the correct charges to maintain compliance. UsLegalForms offers invoicing templates that can help streamline this process for your masonry services.

Generally, construction labor is taxable in Nebraska unless it falls under specific exemptions. When working under a Nebraska Masonry Services Contract - Self-Employed, it is crucial to determine if your services align with taxable categories. Consulting with a tax professional can also clarify your obligations. Tools and templates from UsLegalForms can provide essential guidance in navigating tax-related issues for your construction services.

An Option 3 contractor in Nebraska refers to a classification under the contractor registration law. This classification is intended for contractors who are self-employed and manage their own work without an employer. If you engage in a Nebraska Masonry Services Contract - Self-Employed, knowing your classification can help in fulfilling regulatory requirements. UsLegalForms can assist you in understanding the implications of being classified as an Option 3 contractor.

In Nebraska, professional services are typically not subject to sales tax. However, it's important to check specific scenarios as some services may have tax implications. If you are engaging in a Nebraska Masonry Services Contract - Self-Employed, understand how these rules apply. Utilizing resources such as UsLegalForms can provide clarity on tax liabilities for your contract.

To become an independent contractor, you need a clear understanding of your services and the necessary business licenses. Additionally, maintaining an organized financial system is crucial for managing invoices and taxes. Communication skills are also vital, as you’ll need to negotiate contracts and keep clients informed. If you're considering the Nebraska Masonry Services Contract - Self-Employed, uslegalforms can assist in laying the groundwork for your new venture.

Deciding whether to form an LLC or remain an independent contractor depends significantly on your business needs. An LLC can provide personal liability protection and potential tax benefits, while being an independent contractor typically entails fewer administrative requirements. However, if you plan to grow your business, an LLC may be advantageous long-term. Evaluate your specific situation, and remember that resources like the Nebraska Masonry Services Contract - Self-Employed on uslegalforms can clarify your choices.

To qualify as an independent contractor, you must demonstrate that you control your work environment and the methods you use to complete projects. This includes setting your own hours and deciding which clients to take on. It's essential to keep detailed records of your activities, as these can help clarify your role as a self-employed individual. For further information about maintaining your status, consider reviewing the Nebraska Masonry Services Contract - Self-Employed through uslegalforms.

Yes, Nebraska does require certain contractors to obtain a license before they begin work. Regulations may vary by city and the specific type of contracting work, such as masonry. Having the proper license not only complies with state laws but also instills confidence in your clients. For details on licensing requirements, you might find the Nebraska Masonry Services Contract - Self-Employed useful, and uslegalforms can guide you in obtaining the right documents.

Being a contractor often means you are self-employed, but the two terms aren’t exactly synonymous. As a self-employed individual, you may operate as a sole proprietor or an independent contractor. In many cases, contractors have more flexibility, but they also manage more aspects of their business, including client contracts and financial responsibilities. To better understand your status, consider exploring the Nebraska Masonry Services Contract - Self-Employed options available on platforms like uslegalforms.

To become an independent contractor in Nebraska, begin by determining your area of specialization and the necessary qualifications. Register your business, obtain any relevant licenses, and familiarize yourself with local regulations. Utilize a Nebraska Masonry Services Contract - Self-Employed to detail your services and responsibilities clearly. This contract will serve as a valuable tool in establishing trust and professionalism with your clients.