Nebraska Stone Contractor Agreement - Self-Employed

Description

How to fill out Stone Contractor Agreement - Self-Employed?

Are you in a situation where you require documents for occasional organization or specific objectives almost all the time.

There are numerous authentic document templates accessible online, but obtaining ones you can rely on isn’t straightforward.

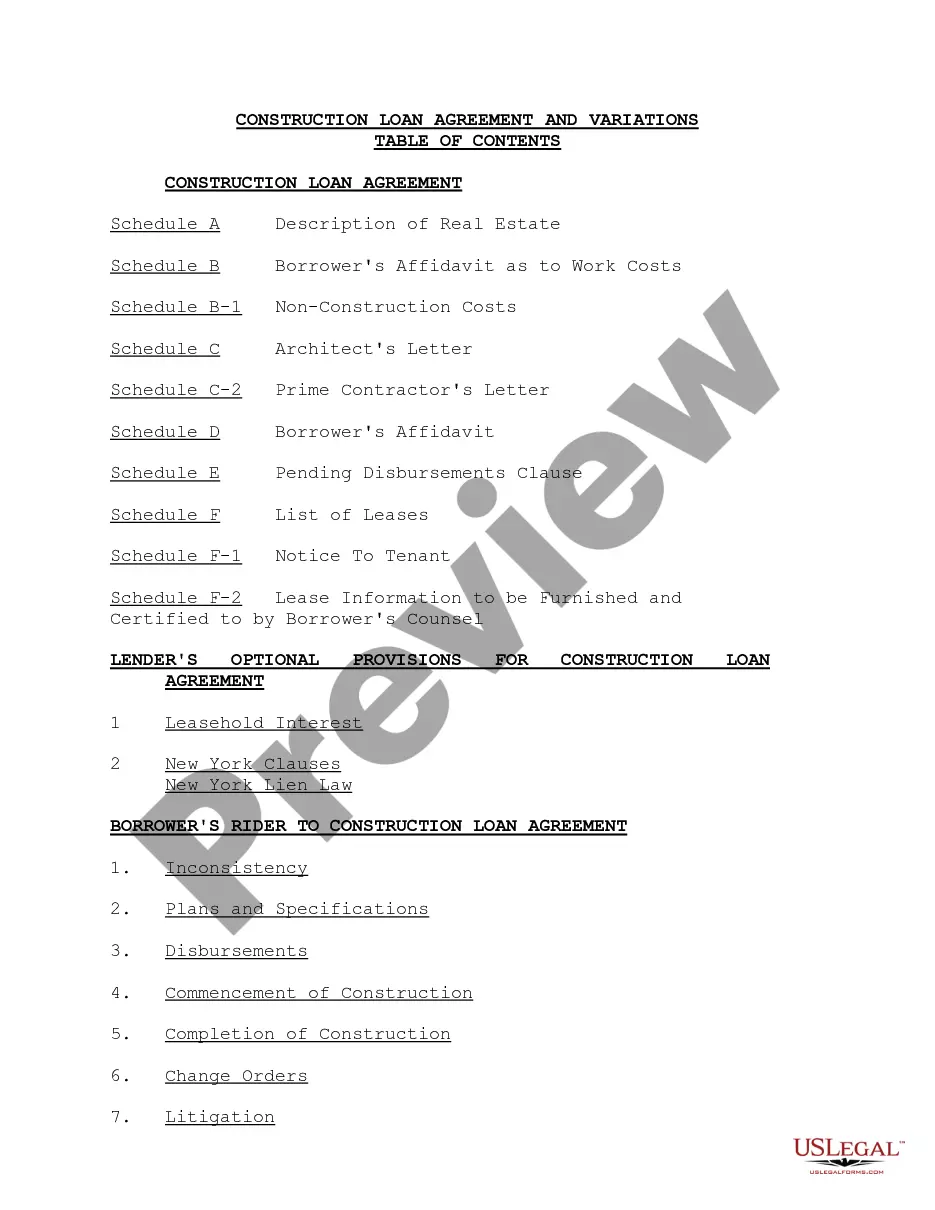

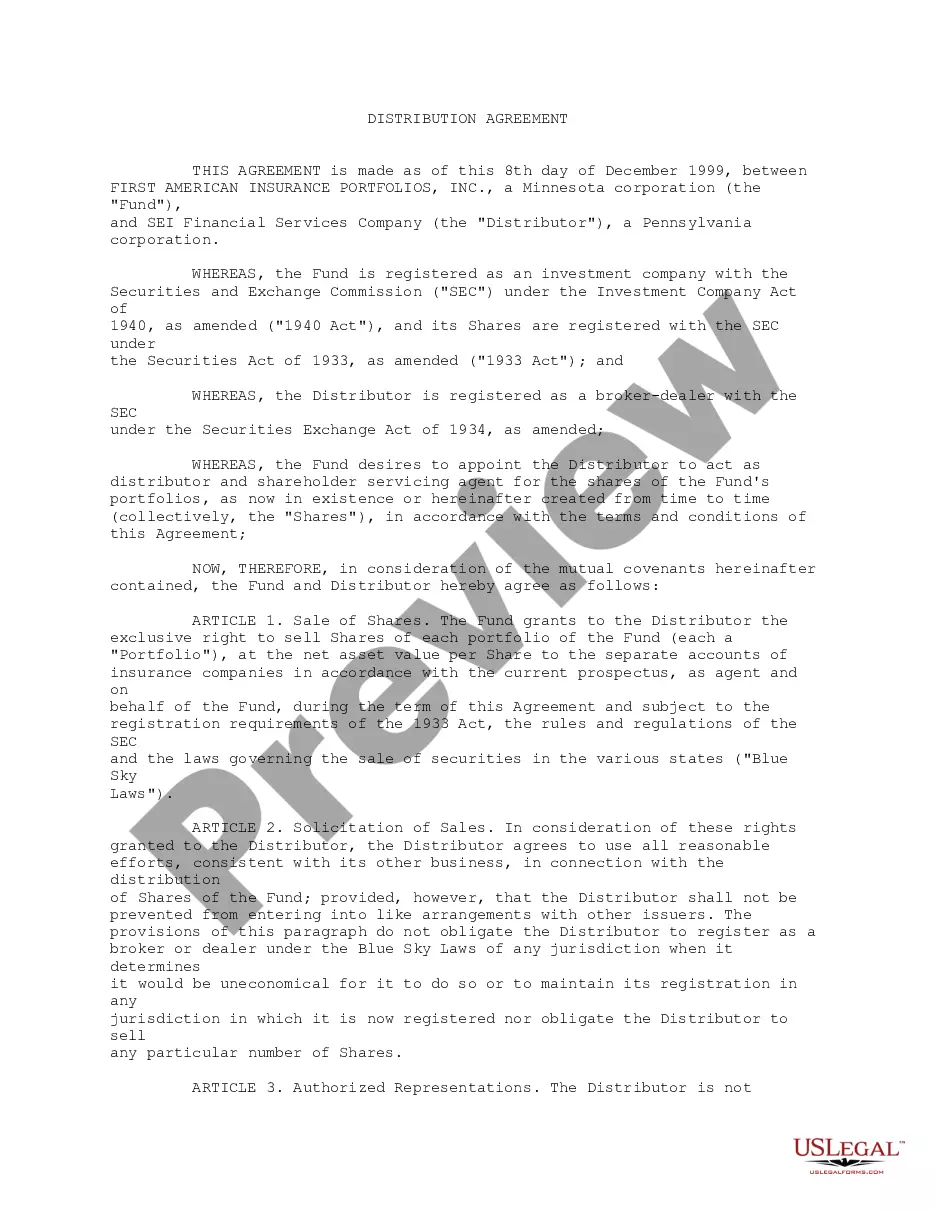

US Legal Forms offers thousands of template documents, such as the Nebraska Stone Contractor Agreement - Self-Employed, that are crafted to meet state and federal requirements.

Utilize US Legal Forms, one of the most comprehensive collections of authentic templates, to save time and avoid mistakes.

The service provides properly crafted legal document templates that can be used for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Nebraska Stone Contractor Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the template you need and ensure it is for your correct state/region.

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the correct template.

- If the template isn’t what you’re looking for, utilize the Search field to find the template that meets your needs and requirements.

- Once you find the appropriate template, click Purchase now.

- Select the pricing plan you want, fill in the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- Choose a convenient file format and download your version.

- Find all the document templates you have purchased in the My documents menu.

- You can obtain an additional copy of the Nebraska Stone Contractor Agreement - Self-Employed at any time, if necessary.

- Click the desired template to download or print the document template.

Form popularity

FAQ

In Nebraska, a contractor license is not required for all types of contractors, but it depends on the scope and nature of your work. However, having a Nebraska Stone Contractor Agreement - Self-Employed can help clarify requirements in your contract, which is beneficial if you work in regulated areas. Always check local regulations to ensure compliance before starting any projects. For additional guidance, uslegalforms offers resources that outline licensing requirements for contractors.

Creating an independent contractor agreement involves outlining the scope of work, payment terms, and project deadlines. It's essential to include key details that define the working relationship to avoid misunderstandings. Utilizing the Nebraska Stone Contractor Agreement - Self-Employed ensures you have a solid framework to build upon. You can find templates and guidance on uslegalforms to streamline the process of drafting your agreement.

To set up as a self-employed contractor, you should first choose a business structure, such as a sole proprietorship or LLC. Next, register your business name with the appropriate state authorities in Nebraska. Additionally, consider obtaining the Nebraska Stone Contractor Agreement - Self-Employed to outline your terms and conditions clearly. This agreement will help protect your rights and responsibilities as a self-employed contractor.

Independent contractors do file as self-employed on their tax returns. They report their income and deduct business expenses, which highlights the benefits of their independent status. Using the Nebraska Stone Contractor Agreement - Self-Employed can guide you through the paperwork involved in maintaining your self-employed status. Proper documentation and filing can maximize your potential deductions and benefits.

Yes, an independent contractor is considered self-employed. They run their own business, offering services under their terms. The distinction lies in the fact that they are not employees of another company, but rather operate as sole proprietors or through a formal business structure. The Nebraska Stone Contractor Agreement - Self-Employed specifically addresses the rights and responsibilities of independent contractors in this context.

Being self-employed means you operate your own business and work for yourself rather than a company. According to the Nebraska Stone Contractor Agreement - Self-Employed, this includes independent contractors who offer services directly to clients. Key indicators include controlling your business decisions, setting your hours, and assuming the financial risks of your work. This setup allows you greater flexibility and control over your professional life.

To prove you are an independent contractor, gather documents that demonstrate your work history, contracts, and tax filings. Additionally, the Nebraska Stone Contractor Agreement - Self-Employed can serve as a solid reference for your independent status. Show that you set your own hours and work independently to further establish your standing. These documents can help clarify your role to clients and tax authorities.

Contract work is technically not the same as traditional employment. Instead, it is a mutually agreed-upon arrangement where services are provided in exchange for payment. Having a Nebraska Stone Contractor Agreement - Self-Employed makes this distinction clear, providing a formal structure to the contractor-client relationship.

The choice between saying self-employed or independent contractor often depends on context. Both terms indicate a lack of traditional employment, but independent contractor specifically refers to someone working on a contract basis for clients. Regardless of the term used, a Nebraska Stone Contractor Agreement - Self-Employed will clarify your status.

To write an independent contractor agreement, start by clearly defining the scope of work and payment terms. Include details such as deadlines, expectations, and confidentiality. Using a template for a Nebraska Stone Contractor Agreement - Self-Employed can simplify this process, ensuring you cover all necessary points.