Nebraska Shareholders Agreement

Description

How to fill out Shareholders Agreement?

You may devote hrs on the Internet trying to find the lawful record format that fits the state and federal demands you will need. US Legal Forms provides 1000s of lawful varieties which are analyzed by experts. You can actually download or printing the Nebraska Shareholders Agreement from your service.

If you currently have a US Legal Forms accounts, you may log in and click on the Download switch. After that, you may full, edit, printing, or indicator the Nebraska Shareholders Agreement. Every single lawful record format you get is your own for a long time. To have another copy for any purchased develop, proceed to the My Forms tab and click on the related switch.

Should you use the US Legal Forms site the first time, stick to the straightforward guidelines under:

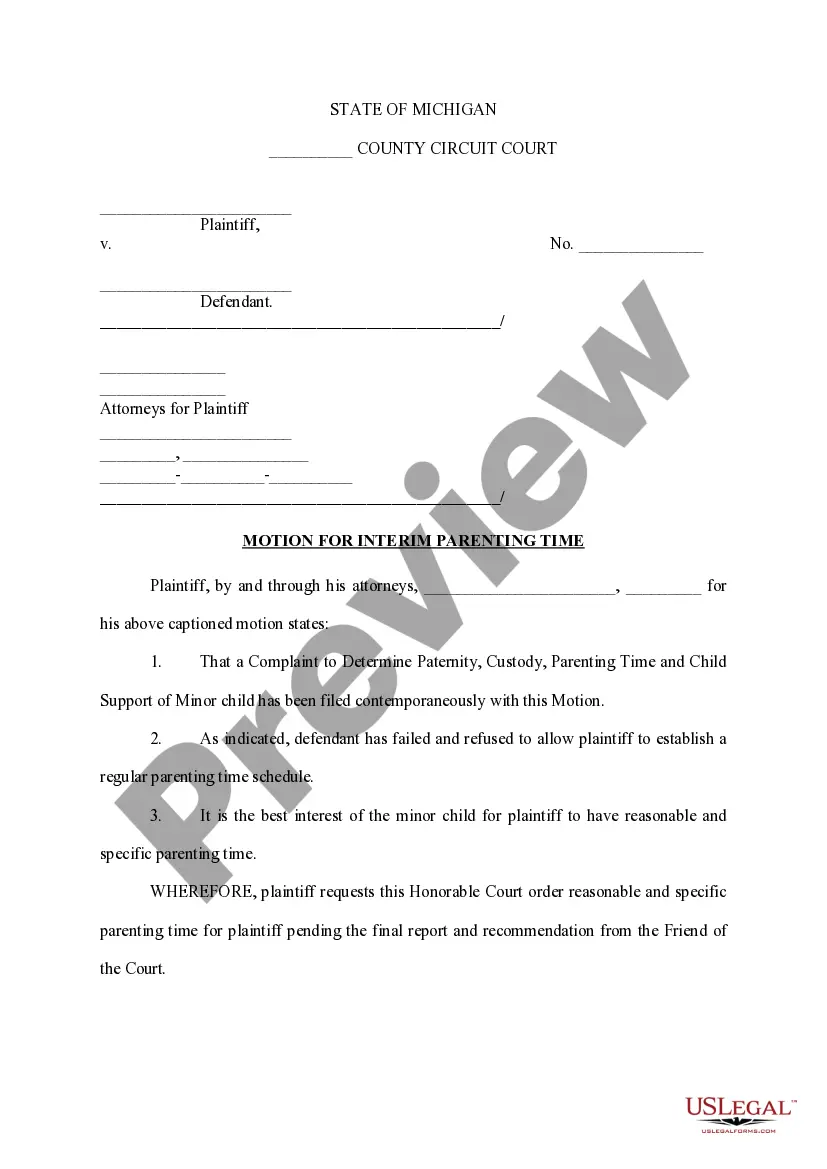

- First, ensure that you have chosen the best record format to the region/area of your liking. See the develop explanation to make sure you have picked out the right develop. If readily available, use the Review switch to search through the record format too.

- In order to find another model from the develop, use the Lookup discipline to get the format that meets your needs and demands.

- When you have located the format you want, just click Purchase now to move forward.

- Pick the prices strategy you want, type in your references, and register for an account on US Legal Forms.

- Full the transaction. You should use your Visa or Mastercard or PayPal accounts to pay for the lawful develop.

- Pick the format from the record and download it to the system.

- Make alterations to the record if possible. You may full, edit and indicator and printing Nebraska Shareholders Agreement.

Download and printing 1000s of record templates making use of the US Legal Forms Internet site, which offers the most important selection of lawful varieties. Use expert and express-particular templates to deal with your business or specific requirements.

Form popularity

FAQ

Can I set up an S corp myself? While it is possible to file articles of incorporation and go through the S corporation election process alone, S corp requirements are both strict and complex. To ensure you're following the rules, we recommend consulting an attorney or tax professional.

Hear this out loud PauseNebraska Tax Rates, Collections, and Burdens Nebraska also has a 5.58 percent to 7.25 percent corporate income tax rate. Nebraska has a 5.50 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 6.95 percent.

To qualify for S corporation status, the corporation must meet the following requirements: Be a domestic corporation. Have only allowable shareholders. ... Have no more than 100 shareholders. Have only one class of stock.

Hear this out loud PauseEvery business needs a set of governing legal documents. For a corporation, these include a certificate of incorporation, bylaws and often a shareholders' agreement.

All California S corporations and LLCs companies treated as S corporations for federal, should file Form 100S (California S Corporation Franchise or Income Tax Return).

Follow these six steps to start a Nebraska LLC and elect Nebraska S corp designation: Name Your Business. Choose a Registered Agent. File the Nebraska Certificate of Organization. Complete Publication Requirements. Create an Operating Agreement. File Form 2553 to Elect Nebraska S Corp Tax Designation.

How much does it cost to start an S-Corp? Registering an S-corp requires paying state filing fees which can range from $40 to $500, depending on the state. States also typically require annual fees to maintain a corporation's status.