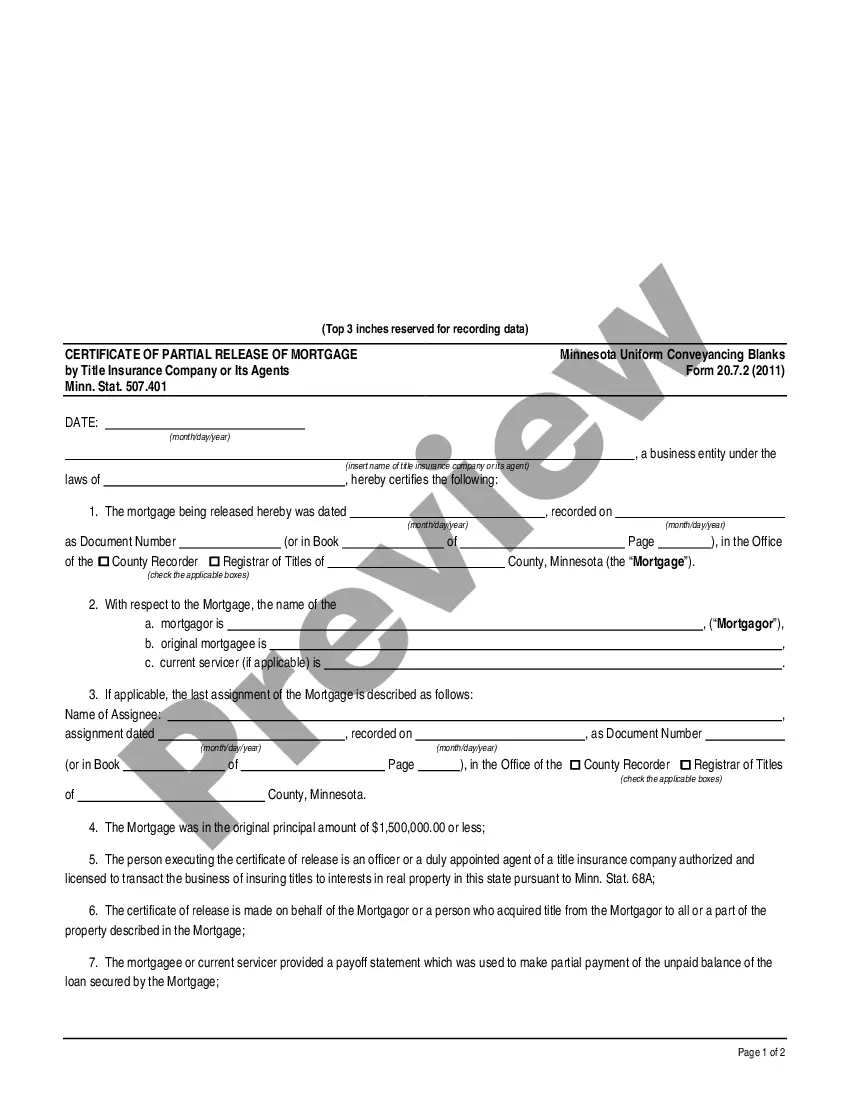

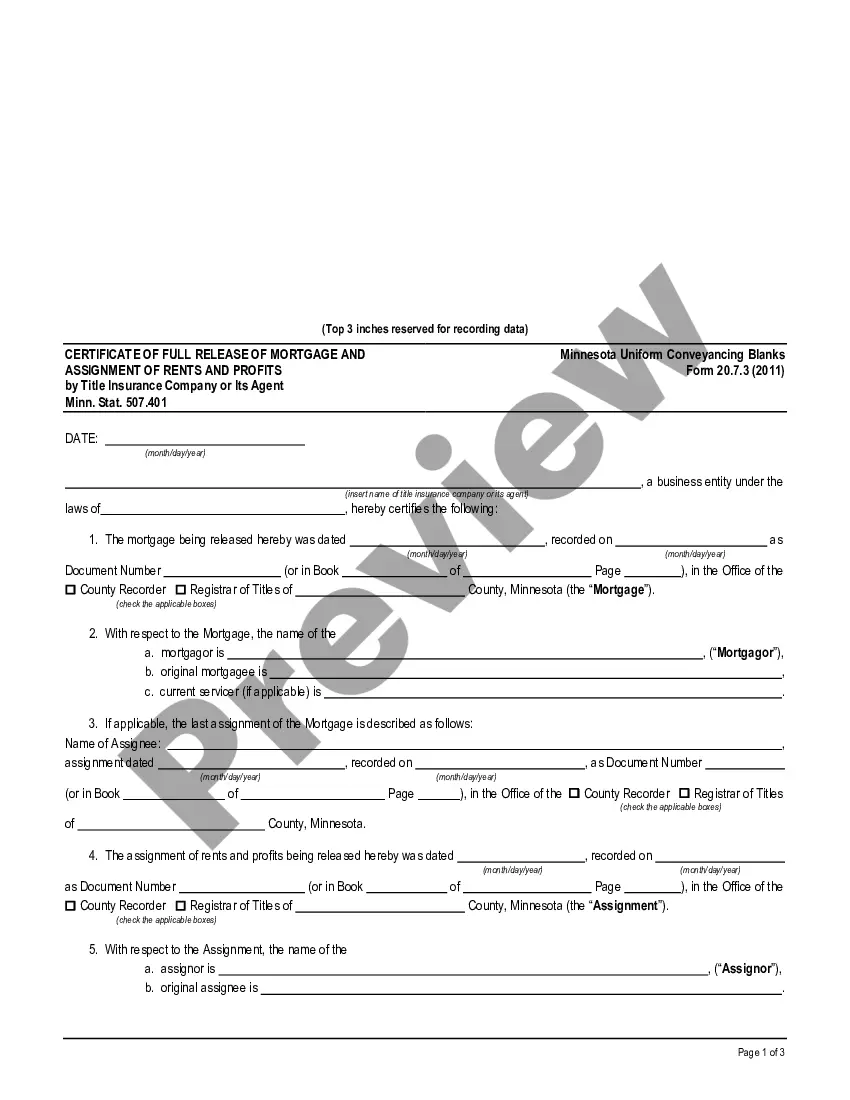

This form is one of the Uniform Conveyancing Blanks developed by Minnesota Uniform Conveyancing Blanks Commission pursuant to Minnesota Code Section 507.09. These forms, which pertain to the transfer of legal title of property from one person to another, or the granting of an encumbrance such as a mortgage or a lien, have been approved by the Commissioner of Commerce.

Minnesota Certificate of Full Release of Mortgage by Title Insurance Company or Its Agent - Minn. Stat. 507.401 - UCBC Form 20.7.1

Description

How to fill out Minnesota Certificate Of Full Release Of Mortgage By Title Insurance Company Or Its Agent - Minn. Stat. 507.401 - UCBC Form 20.7.1?

Obtain any version from 85,000 lawful documents including Minnesota Certificate of Complete Release of Mortgage by Title Insurance Firm or Its Representative - Minn. Stat. 507.401 - UCBC Form 20.7.1 online with US Legal Forms. Each template is crafted and refreshed by state-recognized attorneys.

If you possess a subscription, Log In. Once you are on the form’s page, click the Download button and navigate to My documents to gain access to it.

If you have yet to subscribe, follow the instructions listed below: Check the state-specific criteria for the Minnesota Certificate of Complete Release of Mortgage by Title Insurance Firm or Its Representative - Minn. Stat. 507.401 - UCBC Form 20.7.1 that you wish to use. Review the description and view the sample. When you are assured the sample meets your needs, click on Buy Now. Select a subscription plan that fits your financial plan. Create a personal account. Make the payment in one of two convenient methods: by card or through PayPal. Select a format to download the file in; two options are available (PDF or Word). Download the document to the My documents section. Once your reusable template is downloaded, print it out or save it to your device.

- With US Legal Forms, you will consistently have immediate access to the suitable downloadable sample.

- The service provides access to forms and categorizes them to streamline your search.

- Utilize US Legal Forms to acquire your Minnesota Certificate of Complete Release of Mortgage by Title Insurance Firm or Its Representative - Minn. Stat. 507.401 - UCBC Form 20.7.1 swiftly and efficiently.

Form popularity

FAQ

The official document you are looking for is called the Minnesota Certificate of Full Release of Mortgage by Title Insurance Company or Its Agent - Minn. Stat. 507.401 - UCBC Form 20.7.1. This document serves as proof that the mortgage holder has released the debtor from their mortgage obligations. Once this certificate is filed with the county, it clears the property title, allowing the debtor to enjoy full ownership without any mortgage claims. You can easily obtain this document through platforms like uslegalforms, which streamline the process for you.

To obtain a mortgage release certificate, you typically need to contact your lender or title insurance company. They will guide you through the process of completing the necessary documentation, including the Certificate of Full Release of Mortgage by Title Insurance Company or Its Agent - Minn. Stat. 507.401 - UCBC Form 20.7.1. Using platforms like uslegalforms can simplify this process, providing you with the forms and guidance needed to secure your release efficiently.

The release of mortgage deed is similar to the release of mortgage document, but it specifically refers to the formal deed that transfers ownership back to the borrower. This deed confirms that the mortgage has been satisfied and that the lender no longer has a financial interest in the property. In Minnesota, you may need the Certificate of Full Release of Mortgage by Title Insurance Company or Its Agent - Minn. Stat. 507.401 - UCBC Form 20.7.1 for proper documentation.

In general a discharge fee costs between $275 and $325, but may be higher or lower. Some states impose a "release of mortgage" fee.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

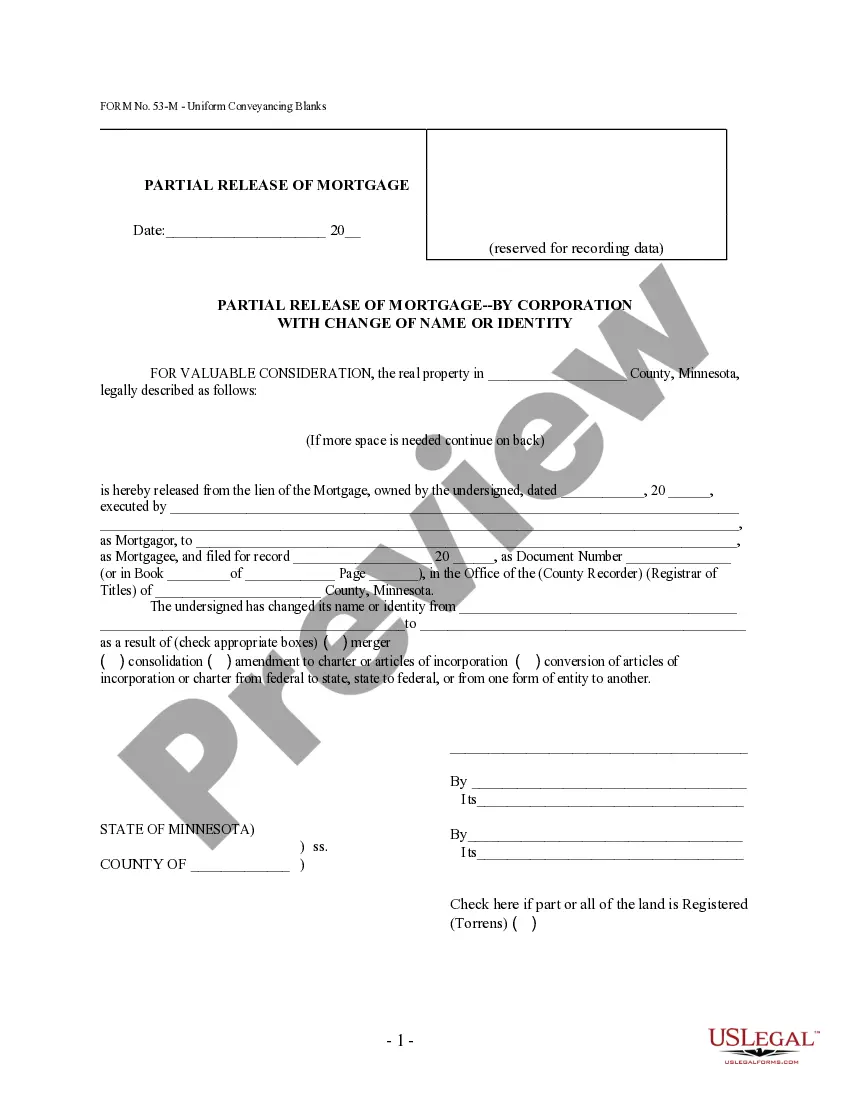

Key Takeaways. A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

Lending institutions are responsible for preparing and filing the satisfaction of mortgage with the appropriate county recorder, land registry office, city registrar, or recorder of deeds. Some borrowers prepay their mortgages by making extra mortgage payments in an effort to pay off their mortgages faster.