Nebraska Equity Incentive Plan

Description

How to fill out Equity Incentive Plan?

Are you currently within a placement the place you will need papers for both company or individual purposes nearly every day time? There are a variety of lawful file templates accessible on the Internet, but getting types you can rely on isn`t simple. US Legal Forms gives 1000s of form templates, such as the Nebraska Equity Incentive Plan, that are written in order to meet federal and state specifications.

Should you be presently acquainted with US Legal Forms website and get an account, simply log in. After that, you can obtain the Nebraska Equity Incentive Plan web template.

Should you not have an accounts and want to begin to use US Legal Forms, follow these steps:

- Get the form you need and ensure it is for your appropriate town/state.

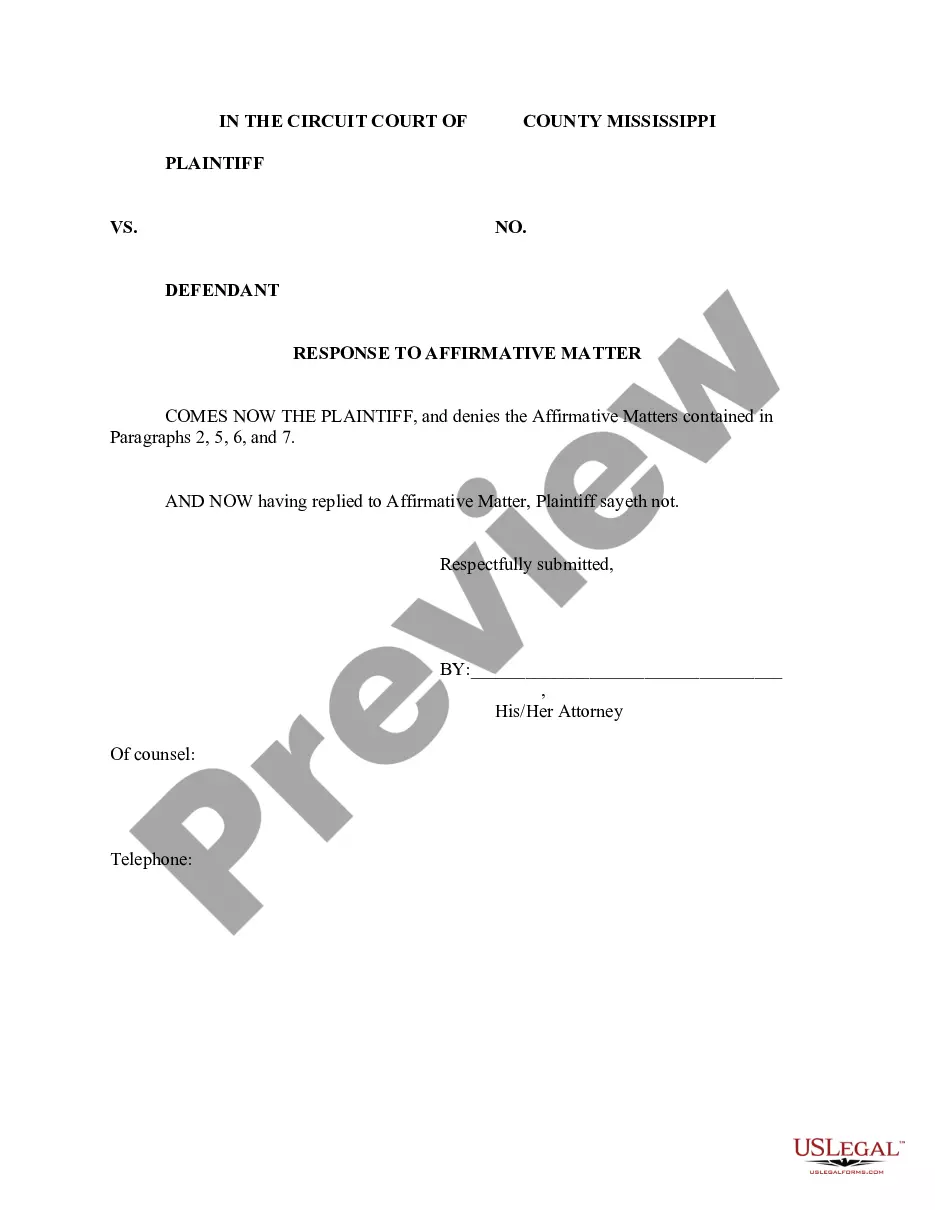

- Take advantage of the Review switch to check the form.

- Read the explanation to ensure that you have selected the correct form.

- In the event the form isn`t what you`re looking for, take advantage of the Look for area to obtain the form that suits you and specifications.

- Once you discover the appropriate form, just click Acquire now.

- Choose the pricing prepare you would like, fill in the necessary information and facts to make your money, and purchase the order using your PayPal or credit card.

- Pick a convenient file file format and obtain your backup.

Get every one of the file templates you might have purchased in the My Forms menus. You can obtain a additional backup of Nebraska Equity Incentive Plan whenever, if necessary. Just select the necessary form to obtain or print the file web template.

Use US Legal Forms, the most comprehensive assortment of lawful kinds, to save time and avoid blunders. The assistance gives skillfully produced lawful file templates which you can use for a selection of purposes. Make an account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

This long-term saving plan freezes your assessed property evaluation (at the prehab value) for 8 years after you've rehabilitated your building. Your property taxes increase by 25-percent each year for 4 years after the initial 8 years.

The Property Tax Credit Act (Act) was created in 2007 and the purpose of the Act is to provide property tax relief for property taxes levied against real property. The operative statutes are found in Neb. Rev. Stat.

The Nebraska Department of Revenue announced Tuesday that the real property tax credit for tax year 2023 will amount to $220.76 for the owner of a $200,000 home, and $264.90 for the owner of $200,000 worth of farmland.

In 2023, the Nebraska Legislature passed a bill that will increase the minimum amount of relief granted under the Property Tax Credit Act from the current $275 million to $475 million by tax year 2028.

SEPTEMBER 22, 2023 (LINCOLN, NEB.) - The State of Nebraska is providing property owners tax relief of a portion of real property taxes levied in 2023.

No matter your income tax situation ? if you pay property taxes, you are eligible for the income tax credit. For tax year 2022, the credit equals 30% of property taxes paid to schools and community colleges.

The credit is available for both school district and community college property taxes paid. An individual or entity may claim the credit by filing the appropriate Nebraska tax return together with a Nebraska Property Tax Credit, Form PTC (Form PTC). Credit for Property Taxes paid in 2021.