Idaho Installments Fixed Rate Promissory Note Secured by Commercial Real Estate

What is this form?

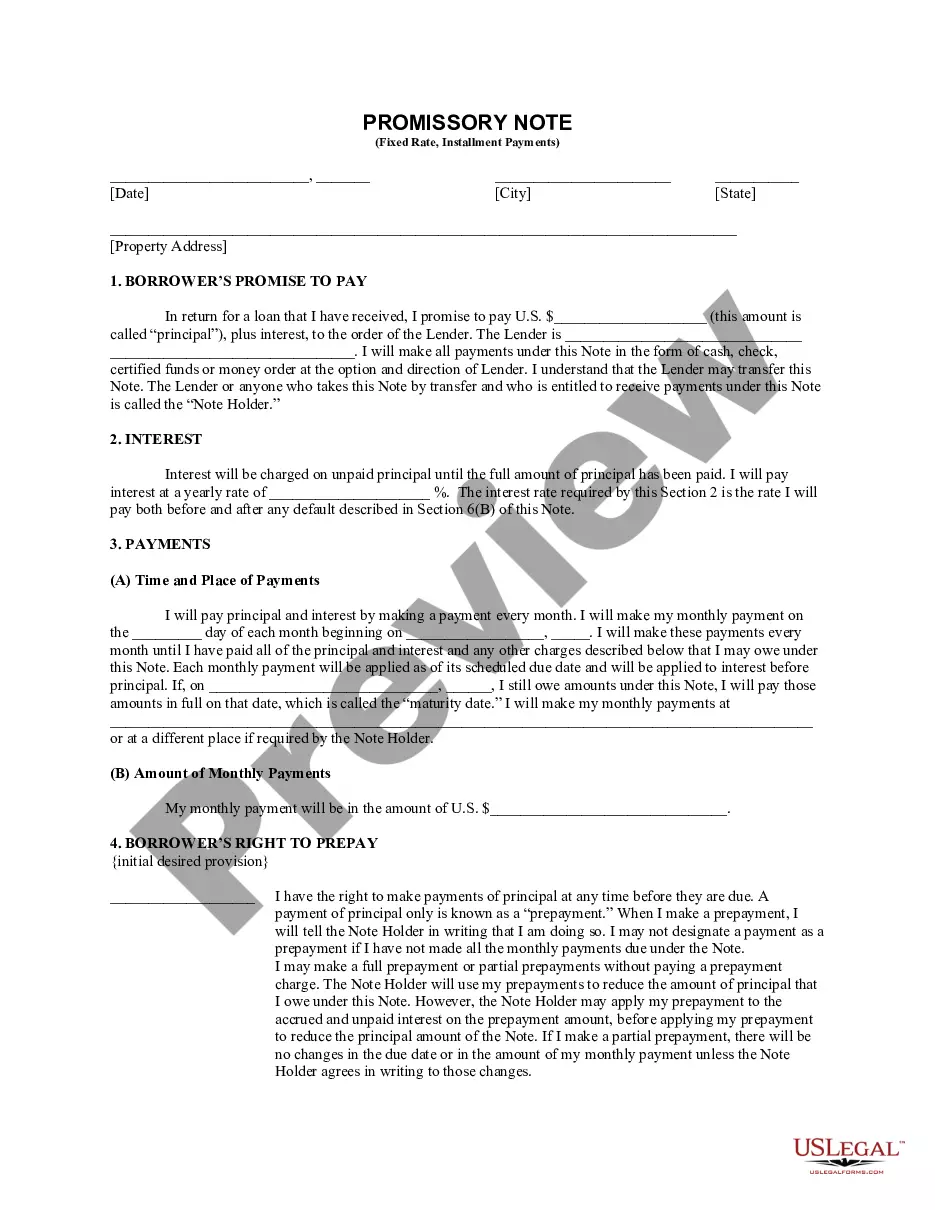

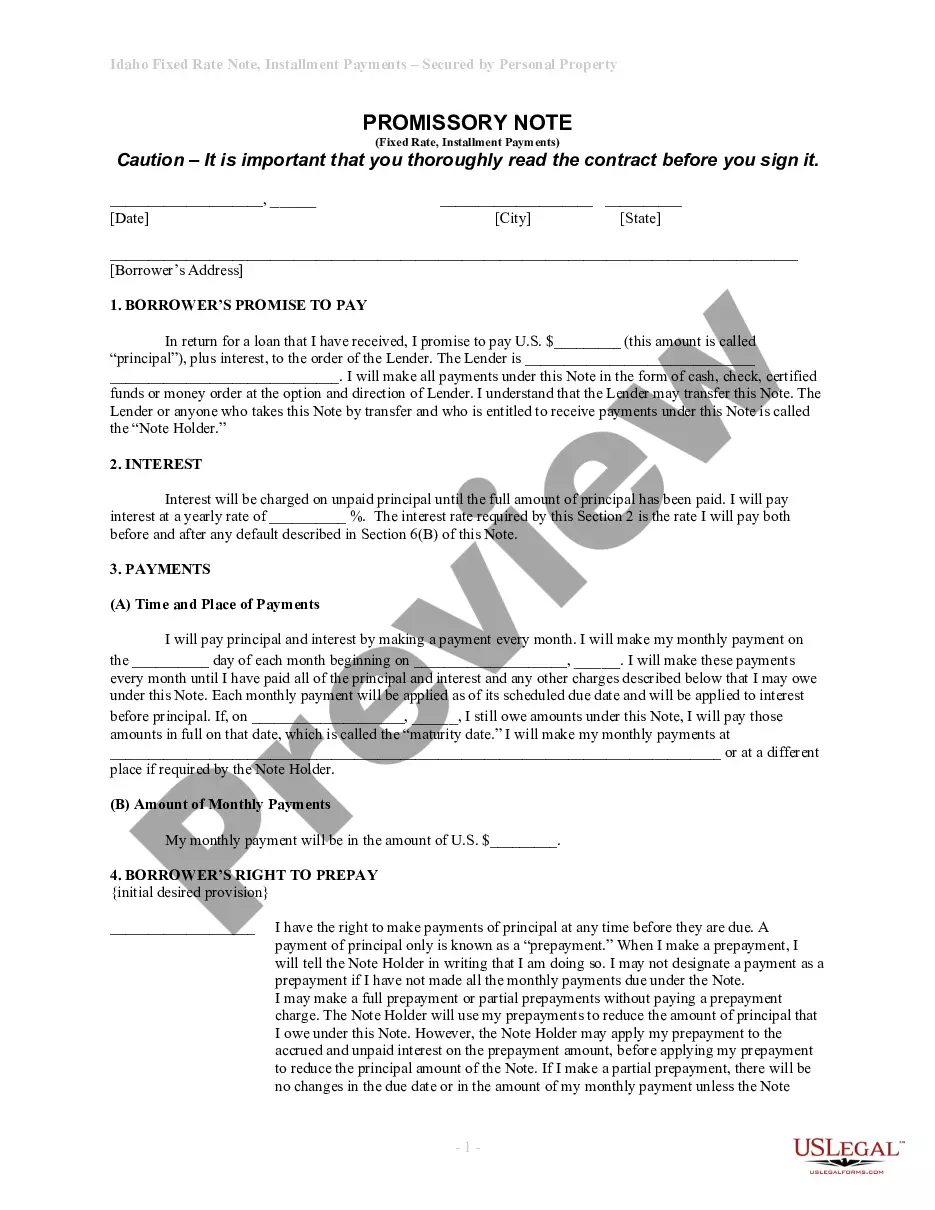

The Installments Fixed Rate Promissory Note Secured by Commercial Real Estate is a legal document used by borrowers when securing a loan with commercial property as collateral. Unlike unsecured promissory notes, this document provides lenders with greater security by linking repayment to a tangible asset, ensuring that they can reclaim the debt through the secured property in case of default. This form outlines the terms of the loan, including payment amounts, interest rates, and the responsibilities of both parties.

Main sections of this form

- Borrower's promise to pay: Specifies the total principal amount borrowed and the lender's identity.

- Interest rate: States the annual interest charge applied to the unpaid principal.

- Payment schedule: Details the frequency and amount of monthly payments, along with the payment due date.

- Right to prepay: Clarifies if the borrower has the option to pay off the loan early without penalty or with specified conditions.

- Default provisions: Explains what constitutes default and the potential consequences for failing to make timely payments.

- Secured note clause: Outlines the protections for the lender and circumstances under which the loan may be accelerated.

When this form is needed

This form should be used when a business seeks to borrow money and is willing to offer commercial real estate as security for the loan. It is applicable in situations where the borrower needs to finance operations, purchasing inventory, or other business expenses and needs a structured repayment plan over time. It is ideal for securing loans to improve cash flow or invest in growth opportunities while ensuring the lender has a claim on the property should repayment not occur as scheduled.

Who needs this form

- Business owners seeking loans for operational expenses or investment.

- Real estate investors wanting to secure funding using commercial properties.

- Lenders who require a formal agreement detailing repayment terms secured by collateral.

- Borrowers who want to structure their loan repayment as fixed installments.

How to prepare this document

- Identify the parties involved, including the borrower and lender's names and addresses.

- Specify the amount of the loan (principal) to be secured by the commercial real estate.

- Enter the annual interest rate that will apply to the unpaid principal.

- State the repayment schedule, including the due date for monthly payments and the maturity date of the note.

- Include any special provisions, such as the right to prepay the loan or any penalties associated with defaults.

Notarization guidance

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to properly identify all parties involved.

- Not clearly specifying the interest rate and payment terms.

- Overlooking additional clauses related to default or prepayment conditions.

- Ignoring state-specific regulations that may impact the note.

Why use this form online

- Convenient access allows you to complete and customize the promissory note at your own pace.

- Instant downloads ensure you have the form readily available whenever needed.

- Legal reliability, as the forms are drafted by licensed attorneys familiar with current laws.

- Easy to edit and adapt according to specific requirements, ensuring all relevant details are included before printing.

Looking for another form?

Form popularity

FAQ

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Write the date of the writing of the promissory note at the top of the page. Write the amount of the note. Describe the note terms. Write the interest rate. State if the note is secured or unsecured. Include the names of both the lender and the borrower on the note, indicating which person is which.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

No. California promissory notes do not need to be notarized or witnessed for validity.

Amount of repayment. Repayment terms. Interest rate. Default penalties.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Borrower and Lender Details. A promissory note outlines information about both parties including the names, streets addresses, city, state and zip code of each party. Loan Information. Legal Language. Signatures. Warnings.

Although a promissory note is usually written on a computer and printed out or a pre-made form is filled out, a handwritten promissory note signed by both parties is legal and will stand up in court.

However, it is still smart to contact a lawyer to help you prepare a personal promissory note, even if you already used an online template. A lawyer can prepare and/or review the note to ensure that all state law requirements are included. This will help with enforceability if there are any issues down the road.