Nebraska Amended and Restated Stock Option Plan of L. Luria and Son, Inc.

Description

How to fill out Amended And Restated Stock Option Plan Of L. Luria And Son, Inc.?

US Legal Forms - one of several most significant libraries of authorized kinds in the USA - offers a wide array of authorized record web templates you can acquire or print. Making use of the site, you can get a large number of kinds for company and individual purposes, sorted by types, suggests, or key phrases.You will find the latest versions of kinds just like the Nebraska Amended and Restated Stock Option Plan of L. Luria and Son, Inc. within minutes.

If you already possess a monthly subscription, log in and acquire Nebraska Amended and Restated Stock Option Plan of L. Luria and Son, Inc. from your US Legal Forms collection. The Obtain button will show up on each and every develop you view. You have access to all in the past delivered electronically kinds from the My Forms tab of your respective account.

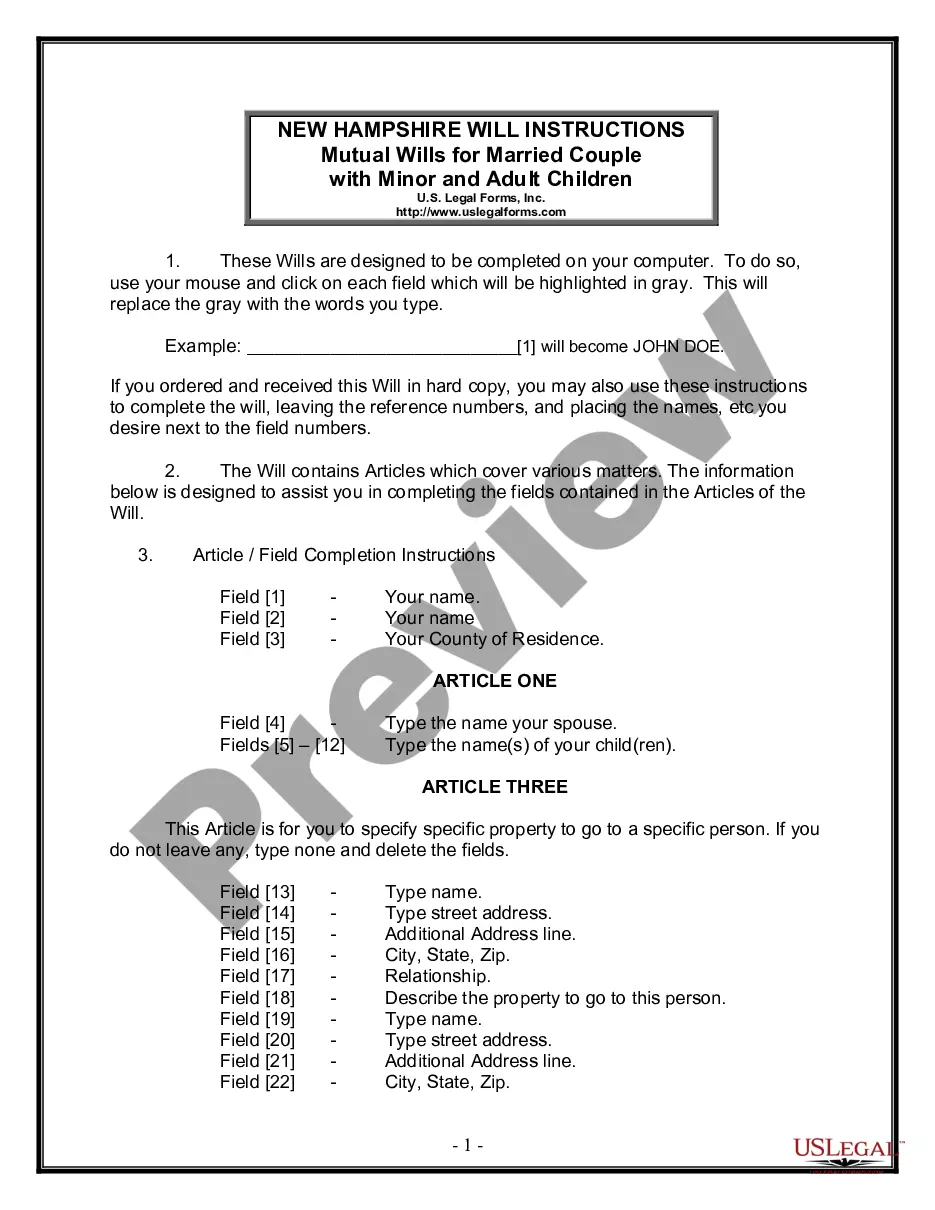

If you would like use US Legal Forms initially, here are basic guidelines to get you started off:

- Make sure you have picked the best develop for your personal city/county. Select the Review button to check the form`s content. See the develop explanation to actually have chosen the proper develop.

- If the develop does not fit your specifications, take advantage of the Search area near the top of the display screen to discover the one who does.

- In case you are happy with the shape, affirm your selection by visiting the Get now button. Then, pick the pricing plan you want and offer your credentials to register for an account.

- Process the purchase. Make use of your bank card or PayPal account to finish the purchase.

- Choose the formatting and acquire the shape on the gadget.

- Make modifications. Fill up, revise and print and signal the delivered electronically Nebraska Amended and Restated Stock Option Plan of L. Luria and Son, Inc..

Each and every design you added to your account does not have an expiry particular date and it is your own eternally. So, in order to acquire or print an additional version, just check out the My Forms portion and click in the develop you require.

Obtain access to the Nebraska Amended and Restated Stock Option Plan of L. Luria and Son, Inc. with US Legal Forms, one of the most considerable collection of authorized record web templates. Use a large number of professional and status-specific web templates that meet up with your company or individual needs and specifications.