Nebraska Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees

Description

How to fill out Nonqualified Stock Option Plan Of Medicore, Inc., For Officers, Directors, Consultants, Key Employees?

US Legal Forms - one of several greatest libraries of authorized forms in the United States - provides a wide array of authorized record web templates you can download or produce. Using the internet site, you can find a huge number of forms for business and personal uses, sorted by groups, suggests, or key phrases.You will discover the latest variations of forms like the Nebraska Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees within minutes.

If you already possess a membership, log in and download Nebraska Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees from the US Legal Forms collection. The Down load switch will show up on every single type you view. You gain access to all previously acquired forms within the My Forms tab of the accounts.

In order to use US Legal Forms the very first time, here are simple directions to get you started off:

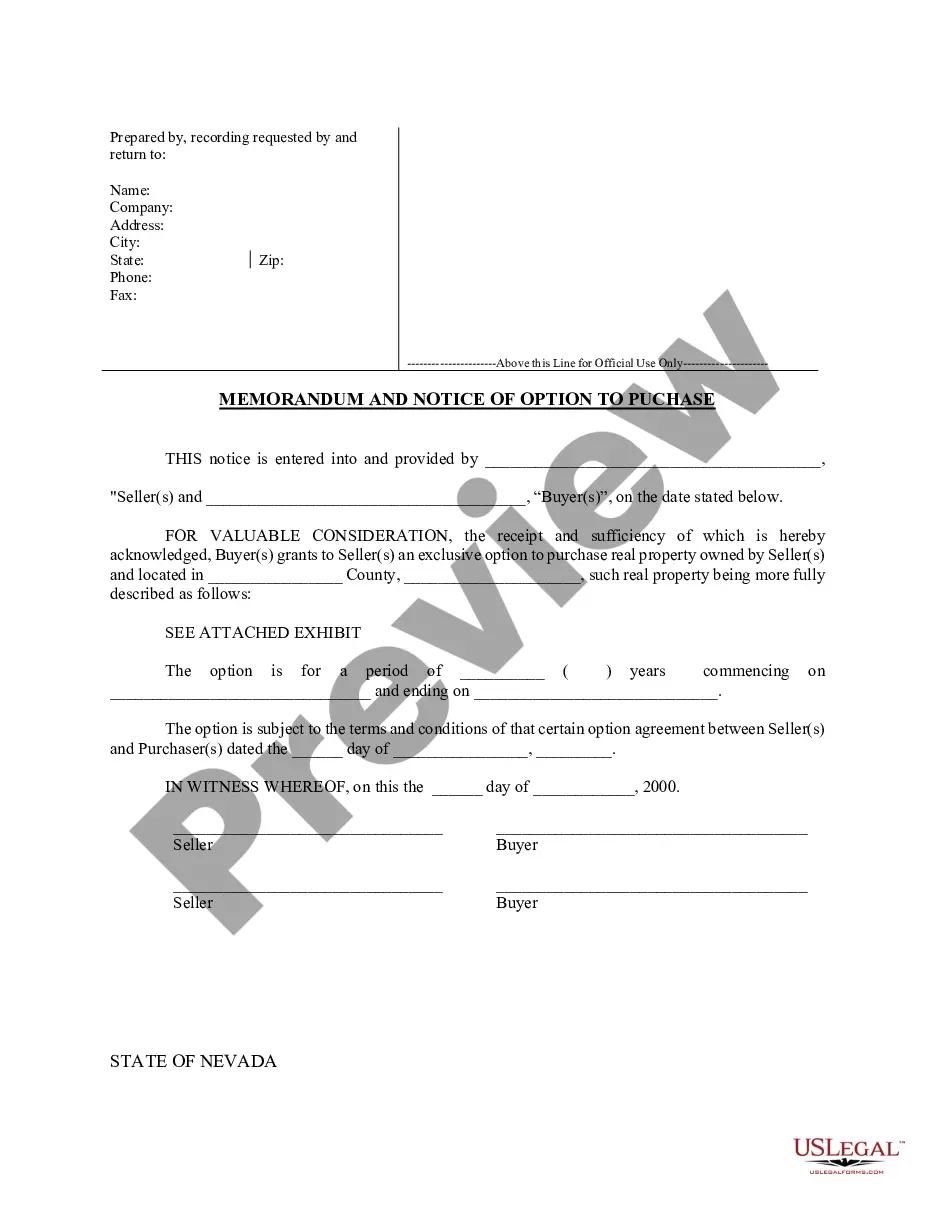

- Make sure you have selected the correct type to your town/area. Select the Preview switch to check the form`s information. Browse the type outline to ensure that you have chosen the correct type.

- In case the type doesn`t fit your specifications, take advantage of the Lookup area towards the top of the display screen to obtain the one which does.

- Should you be happy with the form, affirm your choice by visiting the Acquire now switch. Then, opt for the costs prepare you favor and offer your references to sign up for an accounts.

- Method the financial transaction. Use your credit card or PayPal accounts to finish the financial transaction.

- Choose the formatting and download the form in your device.

- Make changes. Fill up, revise and produce and indicator the acquired Nebraska Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees.

Every template you put into your account lacks an expiration day and is also your own eternally. So, if you would like download or produce yet another version, just proceed to the My Forms segment and click on around the type you require.

Gain access to the Nebraska Nonqualified Stock Option Plan of Medicore, Inc., for officers, directors, consultants, key employees with US Legal Forms, the most substantial collection of authorized record web templates. Use a huge number of skilled and express-certain web templates that meet up with your company or personal needs and specifications.

Form popularity

FAQ

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

All transactions or qualified plans involving ESOPs are simply variations on one of these three types. Nonleveraged ESOP. This first type of ESOP (Diagram 1) does not involve borrowed funds to acquire the sponsoring employer's stock. ... Leveraged Buyout ESOP. ... Issuance ESOP.

An employee stock purchase plan (or ESPP) can be a very valuable benefit. In general, if your employer offers an ESPP, we think you should participate at the level you can comfortably afford and then sell the shares as soon as you can.

What are non-qualified stock options? Non-qualified stock options (NSOs or NQSOs) are a type of stock option that does not qualify for tax-advantaged treatment for the employee like ISOs do. NSOs can also be issued to other non-employee service providers like consultants, advisors, and independent board members.

Weighing your options Ultimately, it's best to remember that stock options are just that: Options. They don't compel anyone to do anything, but they can, in some cases, prove extremely valuable and help significantly increase an employee's wealth. If they're fortunate enough to be at a strong, growing company, that is.

ISOs have more favorable tax treatment than non-qualified stock options (NSOs) in part because they require the holder to hold the stock for a longer time period. This is true of regular stock shares as well.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Incentive stock options (ISOs), also known as statutory or qualified options, are generally only offered to key employees and top management. They receive preferential tax treatment in many cases, as the IRS treats gains on such options as long-term capital gains.