Nebraska Nonqualified Stock Option Plan of the Banker's Note, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of The Banker's Note, Inc.?

If you have to comprehensive, acquire, or print out legal papers themes, use US Legal Forms, the largest collection of legal varieties, that can be found on the Internet. Utilize the site`s easy and practical research to obtain the documents you will need. Various themes for enterprise and personal purposes are categorized by types and claims, or search phrases. Use US Legal Forms to obtain the Nebraska Nonqualified Stock Option Plan of the Banker's Note, Inc. in a number of click throughs.

In case you are previously a US Legal Forms customer, log in to your bank account and click on the Down load option to get the Nebraska Nonqualified Stock Option Plan of the Banker's Note, Inc.. You can even accessibility varieties you earlier saved from the My Forms tab of the bank account.

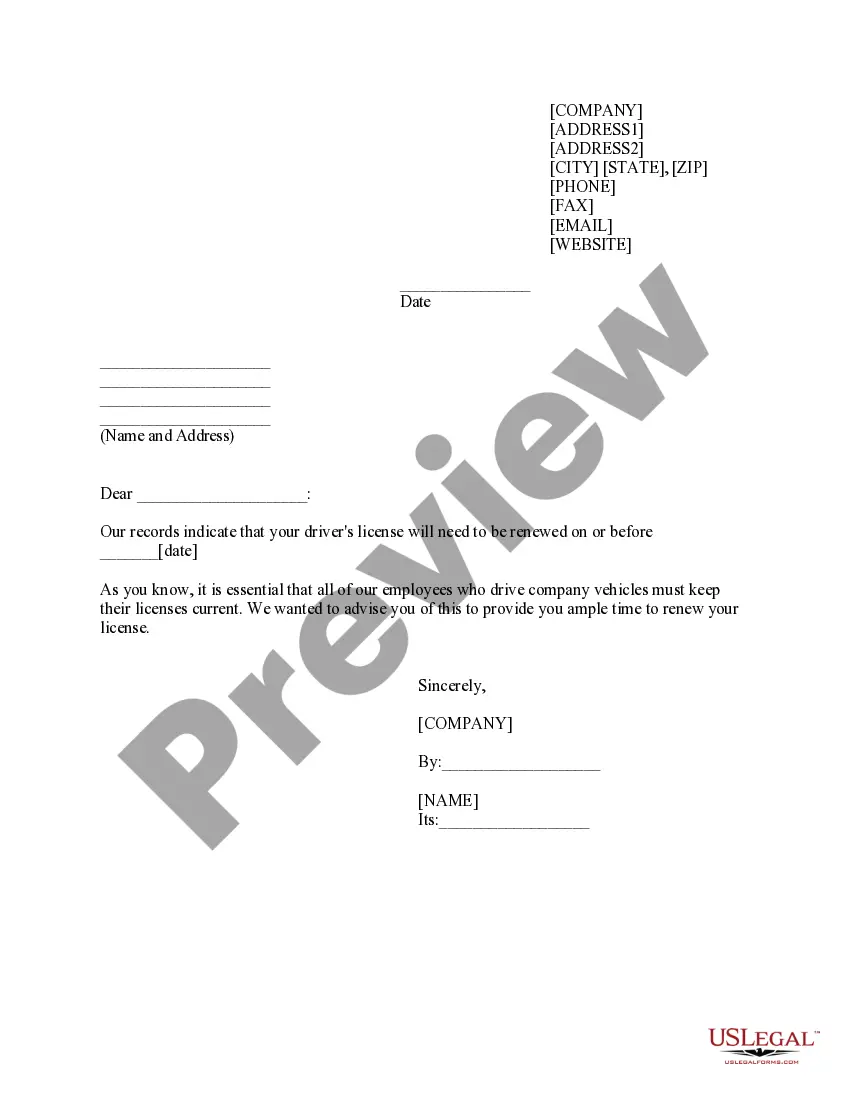

If you work with US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the form for that proper town/nation.

- Step 2. Use the Preview choice to look over the form`s content. Never neglect to see the explanation.

- Step 3. In case you are unhappy with all the kind, make use of the Research discipline at the top of the screen to get other types of your legal kind template.

- Step 4. When you have discovered the form you will need, click on the Acquire now option. Select the costs plan you prefer and add your references to register on an bank account.

- Step 5. Approach the financial transaction. You should use your Мisa or Ьastercard or PayPal bank account to complete the financial transaction.

- Step 6. Choose the formatting of your legal kind and acquire it on your gadget.

- Step 7. Total, revise and print out or sign the Nebraska Nonqualified Stock Option Plan of the Banker's Note, Inc..

Every single legal papers template you get is your own property for a long time. You may have acces to every single kind you saved within your acccount. Select the My Forms section and decide on a kind to print out or acquire once more.

Compete and acquire, and print out the Nebraska Nonqualified Stock Option Plan of the Banker's Note, Inc. with US Legal Forms. There are thousands of expert and status-particular varieties you can use for your personal enterprise or personal requirements.

Form popularity

FAQ

Taxation on nonqualified stock options As mentioned above, NSOs are generally subject to higher taxes than ISOs because they are taxed on two separate occasions ? upon option exercise and when company shares are sold ? and also because income tax rates are generally higher than long-term capital gains tax rates.

Non-qualified stock options give employees the right, within a designated timeframe, to buy a set number of shares of their company's shares at a preset price. It may be offered as an alternative form of compensation to workers and also as a means to encourage their loyalty with the company. 1?

Prior to shares meeting the vesting requirements, the employee has no ability to act on the options. Shares are also issued with an expiration date. This is a date when the shares expire if the employee does not take any action to exercise them.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

As with other types of stock options, when you're granted NSOs, you're getting the right to buy a set number of shares at a fixed price, also called the strike price, grant price, or exercise price. A company's 409A valuation or fair market value (FMV) determines the strike price of an option.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

A stock option may be worth exercising if the current stock price (also known as the fair market value or FMV*) is more than the exercise price.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.