Nebraska Statement for Vietnam Era Veterans and / or the Disabled

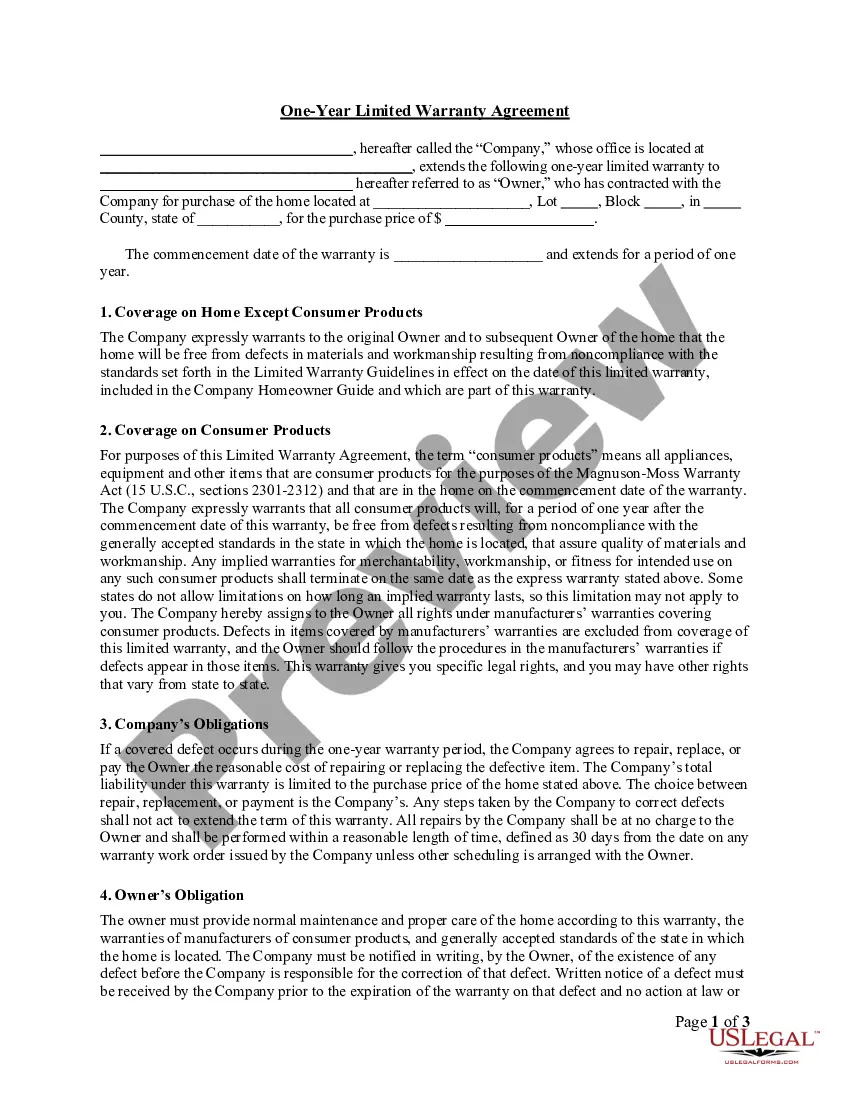

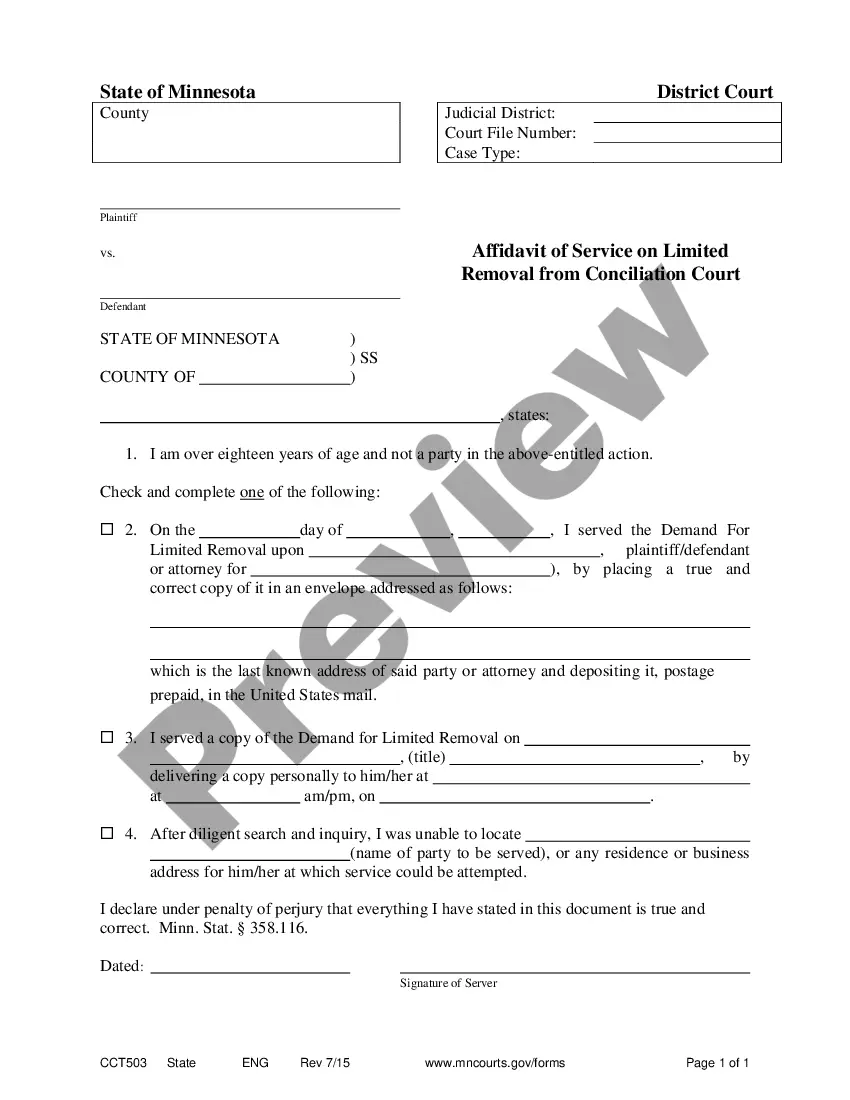

Description

How to fill out Statement For Vietnam Era Veterans And / Or The Disabled?

Have you ever found yourself in a situation where you require documents for various organizational or personal activities almost all the time.

There are numerous legal document templates available online, yet finding ones you can trust is quite challenging.

US Legal Forms provides thousands of form templates, including the Nebraska Statement for Vietnam Era Veterans or the Disabled, which are designed to meet both federal and state regulations.

If you find the correct form, click Purchase now.

Choose the pricing plan you prefer, fill in the necessary information to create your account, and pay for your order using PayPal or Visa or Mastercard.

- If you're already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Nebraska Statement for Vietnam Era Veterans or the Disabled template.

- If you don’t have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need, ensuring it's suitable for your specific city/area.

- Utilize the Review button to examine the form.

- Check the description to ensure you've selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the form that suits your needs and requirements.

Form popularity

FAQ

The following states have no state income tax and, therefore, do not tax military retirement pay: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming.

There are currently 22 states that have an income tax but do not tax military retirement income. There are nine states that have no state income tax. In 2020, LB 153 was enacted allowing retired military in Nebraska to exempt 50 percent of their military retirement pay from state income taxes.

VA Benefits Vietnam Veterans may be eligible for a wide-variety of benefits available to all U.S. military Veterans. VA benefits include disability compensation, pension, education and training, health care, home loans, insurance, vocational rehabilitation and employment, and burial.

Vietnam era veterans are those who served during the time of the Vietnam war but didn't set foot in the country of Vietnam. The Vietnam vet is one who was assigned within the combat zone of the country and it's surrounding waters.

Nebraska Income Taxes on Military Pay: All Nebraska residents that are required to file a federal income tax return must also file a Nebraska Individual Income Tax Return. For tax years prior to January 1, 2022, retired Service members must make a one-time election to exclude a portion of their military retired pay.

To be 100 percent disabled by VA standards means that you are totally disabled. Veterans awarded disability at this level receive the maximum in schedular monthly compensation.

The State of Nebraska offers both income and property tax benefits to qualifying veterans.

Most other retirement income, including public and private pensions, IRA withdrawals and 401(k) funds are taxed, too. Plus, the top income tax rate kicks in pretty quickly. Nebraska's median property tax rate is also the ninth-highest in the country.

(b) PostVietnamera veteran means an eligible veteran who first became a member of the Armed Forces or first entered on active duty as a member of the Armed Forces after . (c) Vietnam era means the period be ginning August 5, 1964 and ending .

The State of Nebraska offers both income and property tax benefits to qualifying veterans.