Nebraska Resolution of Meeting of LLC Members to Dissolve the Company

Description

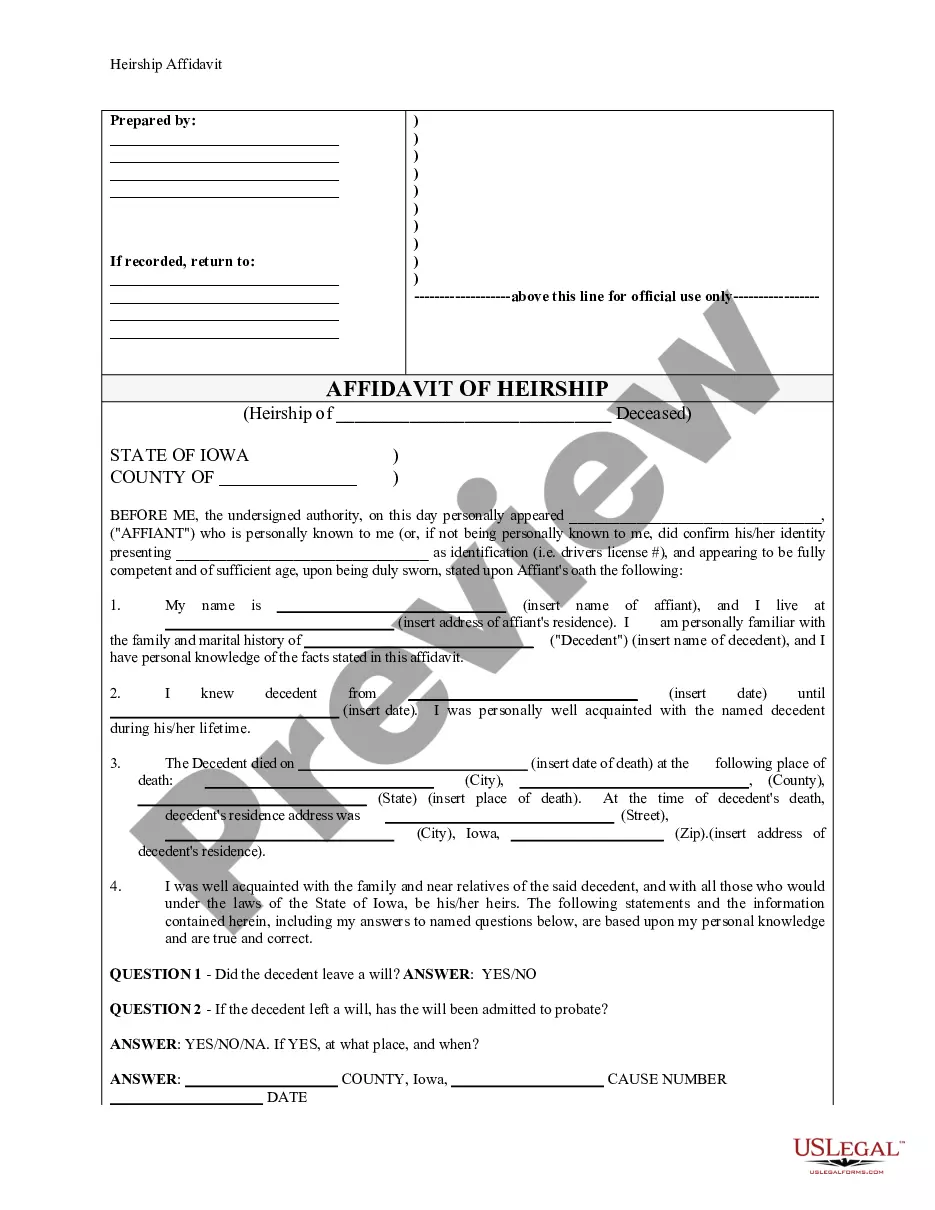

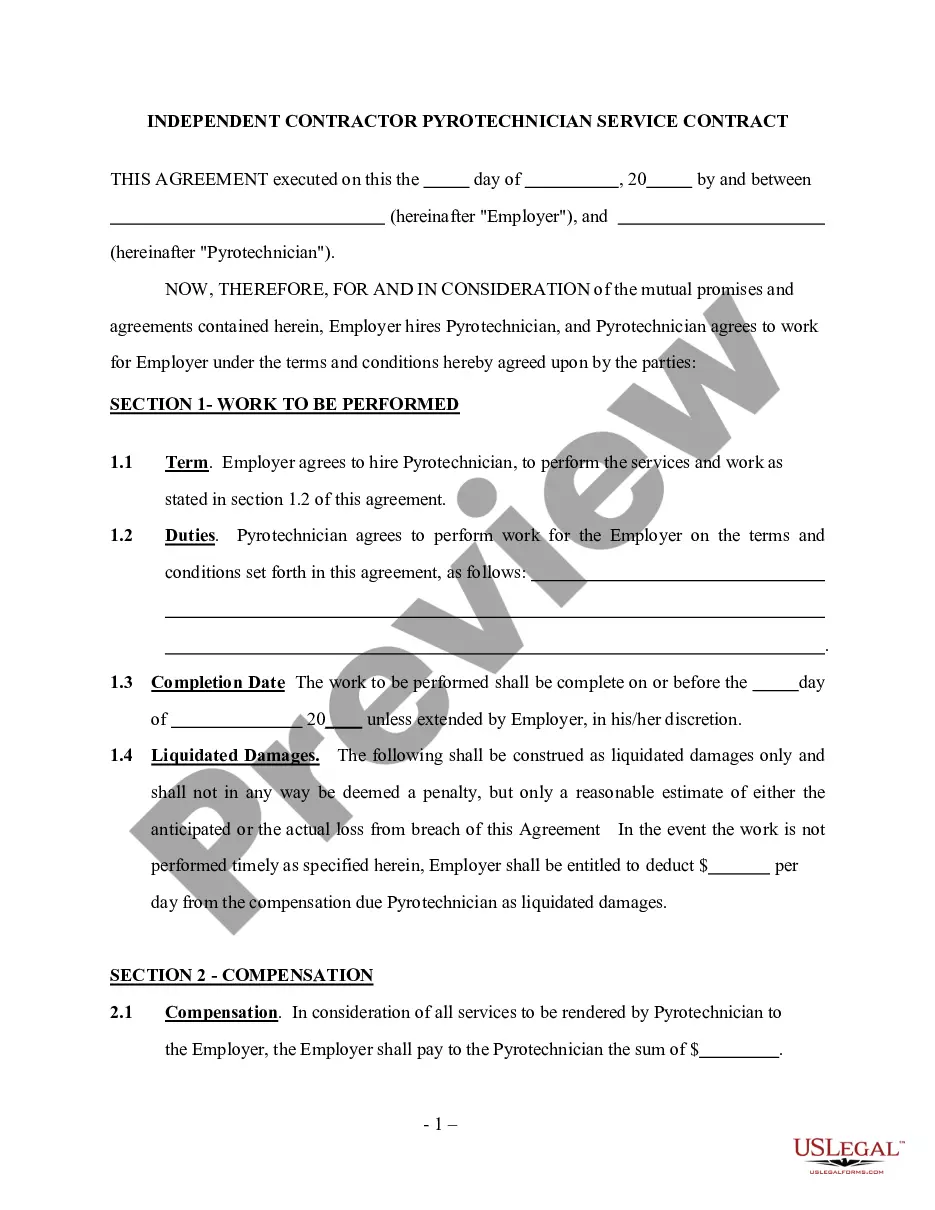

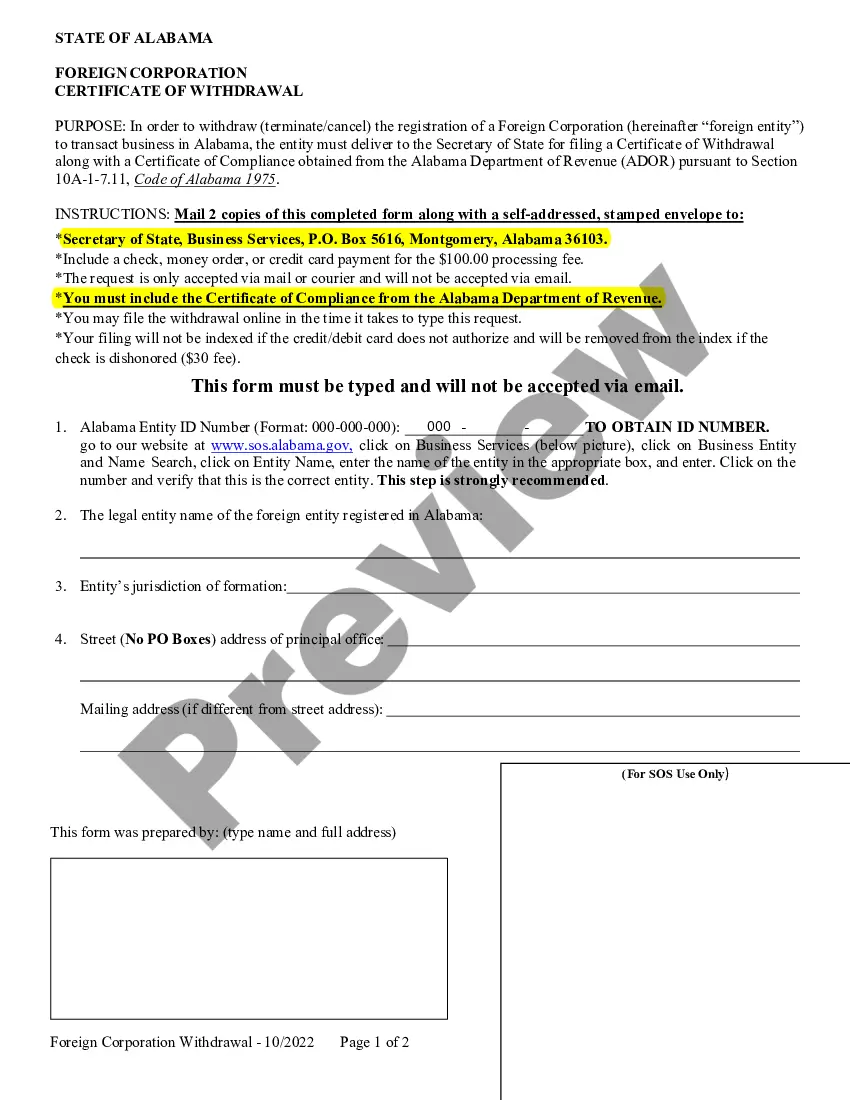

How to fill out Resolution Of Meeting Of LLC Members To Dissolve The Company?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of documents such as the Nebraska Resolution of Meeting of LLC Members to Dissolve the Company in seconds.

- If you already have a membership, Log In to download the Nebraska Resolution of Meeting of LLC Members to Dissolve the Company from your US Legal Forms library.

- The Download option will be available for every form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you want to use US Legal Forms for the first time, here are some simple steps to get started.

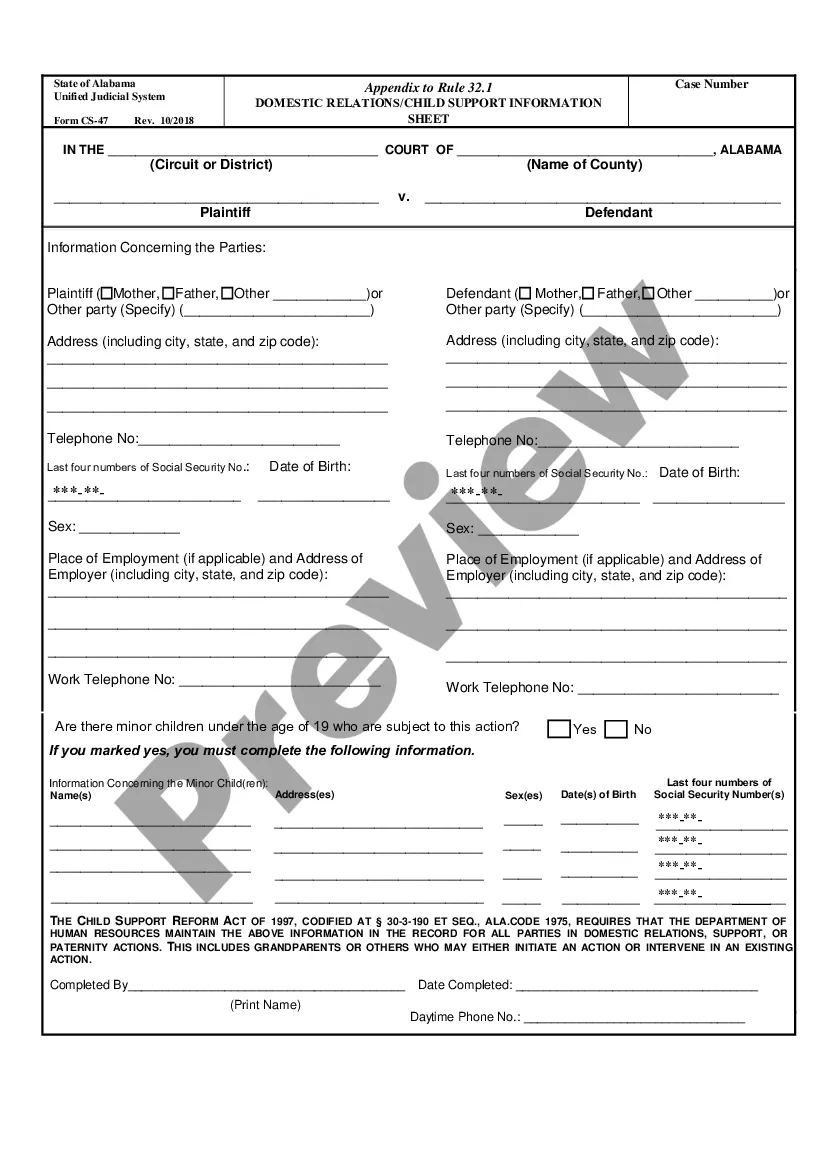

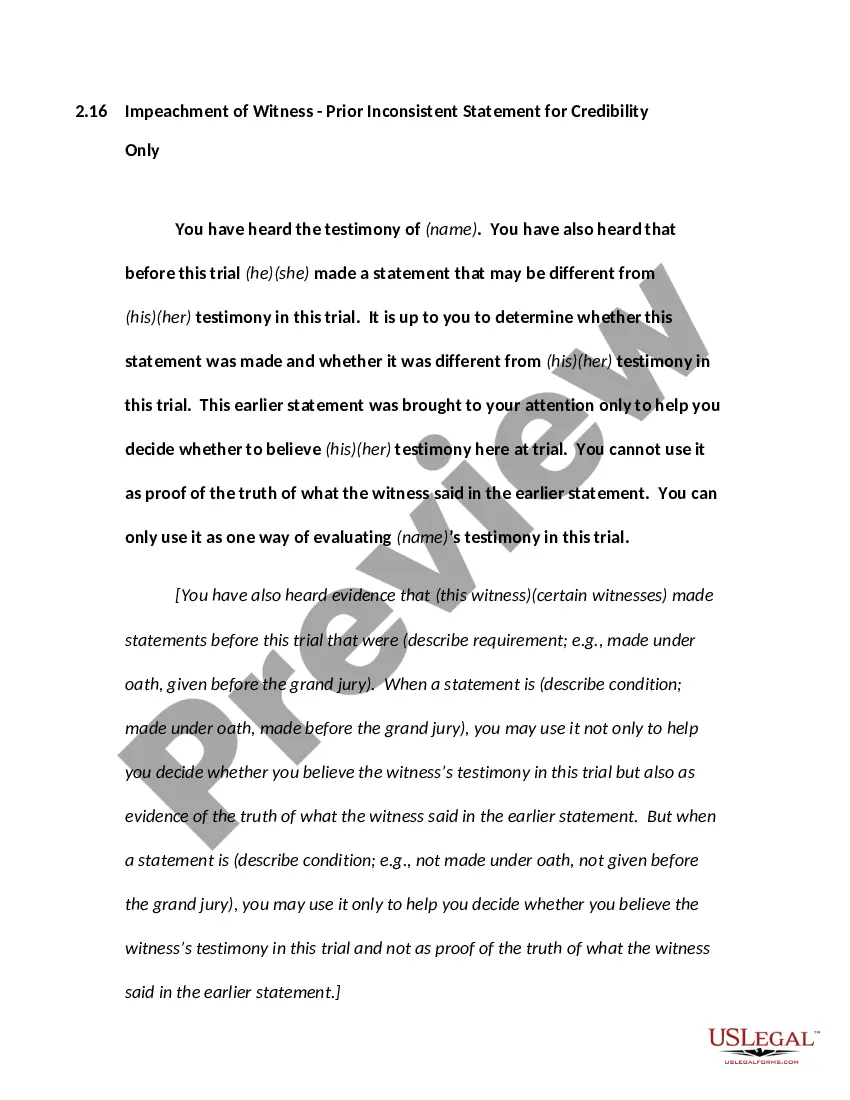

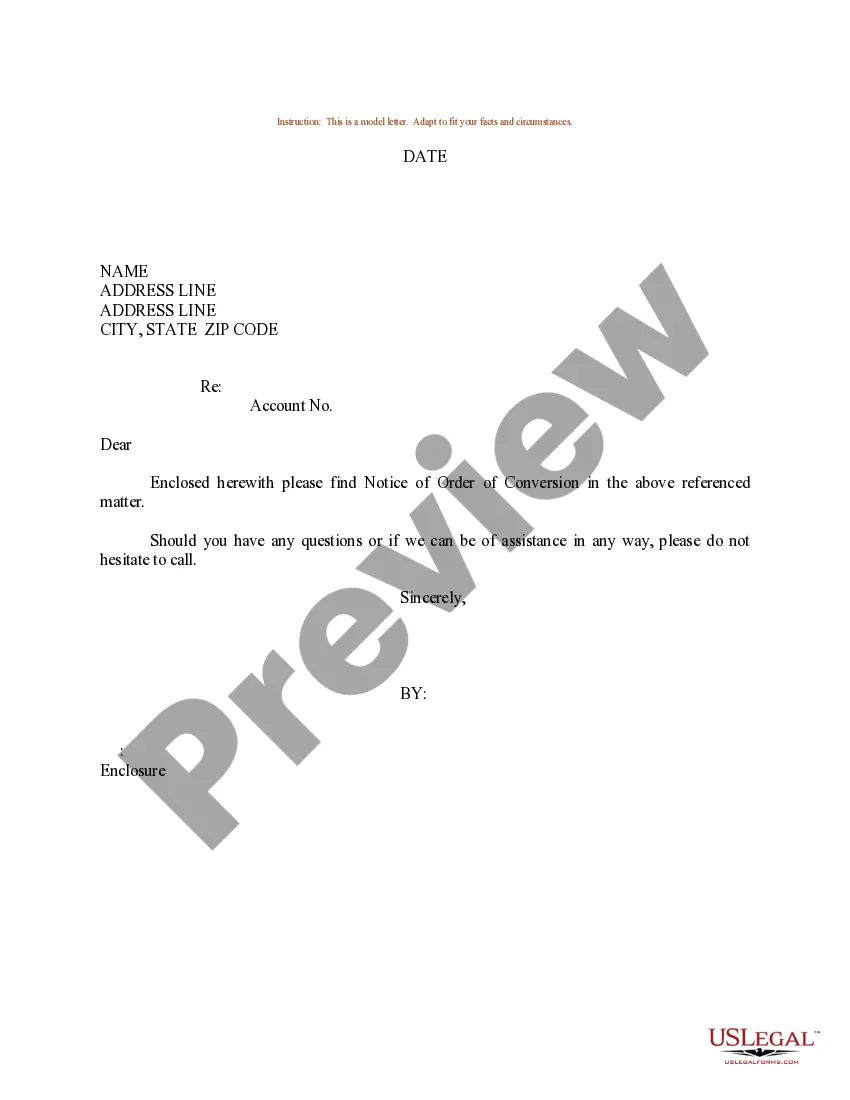

- Ensure you have selected the appropriate form for your city/county.

- Click the Preview option to review the contents of the form.

Form popularity

FAQ

To close an LLC completely, you need to file a final tax return with the state and the IRS. Make sure you check the box to show this is the final return for the LLC. Fill out Schedule K-1 and give a copy to each member so that they know what to report on their own personal taxes in terms of losses and gains.

The dissolution is initiated by a resolution by the board of directors who submit it at a meeting of the shareholders. The shareholders each vote and if the resolution is approved, the directors have the authorization to proceed with the dissolution process.

Less...Hold a Board of Directors meeting and record a resolution to Dissolve the Nebraska Corporation.Hold a Shareholder meeting to approve Dissolution of the Nebraska Corporation.File all required Biennial Reports with the Nebraska Secretary of State.Clear up any business debts.More items...

To dissolve an LLC in Nebraska, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Nebraska LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

To file a Nebraska LLC amendment, submit the proper form, in duplicate. Domestic LLCs organized before January 1, 2011: File the Amended Certificate of Organization. The certificate must be amended when there is a change in the name, purpose, capital, or duration of the LLC.

By dissolving an LLC properly, it means that the LLC is no longer a legal business entity so you won't be expected to pay any fees or taxes, or file any more documents. Despite no longer operating, it is possible for members to create a new LLC and run it in the same way as the dissolved company.

How to Dissolve an LLCVote to Dissolve the LLC. Members who decide to dissolve the company are taking part in something called a voluntary dissolution.File Your Final Tax Return.File an Article of Dissolution.Settle Outstanding Debts.Distribute Assets.Conduct Other Wind Down Processes.

These terms are often used interchangeably, but have distinct legal meanings. Dissolution is the winding up of the affairs of the entity in advance of the termination of the entity. Termination of the entity occurs when the entity ceases to legally exist.