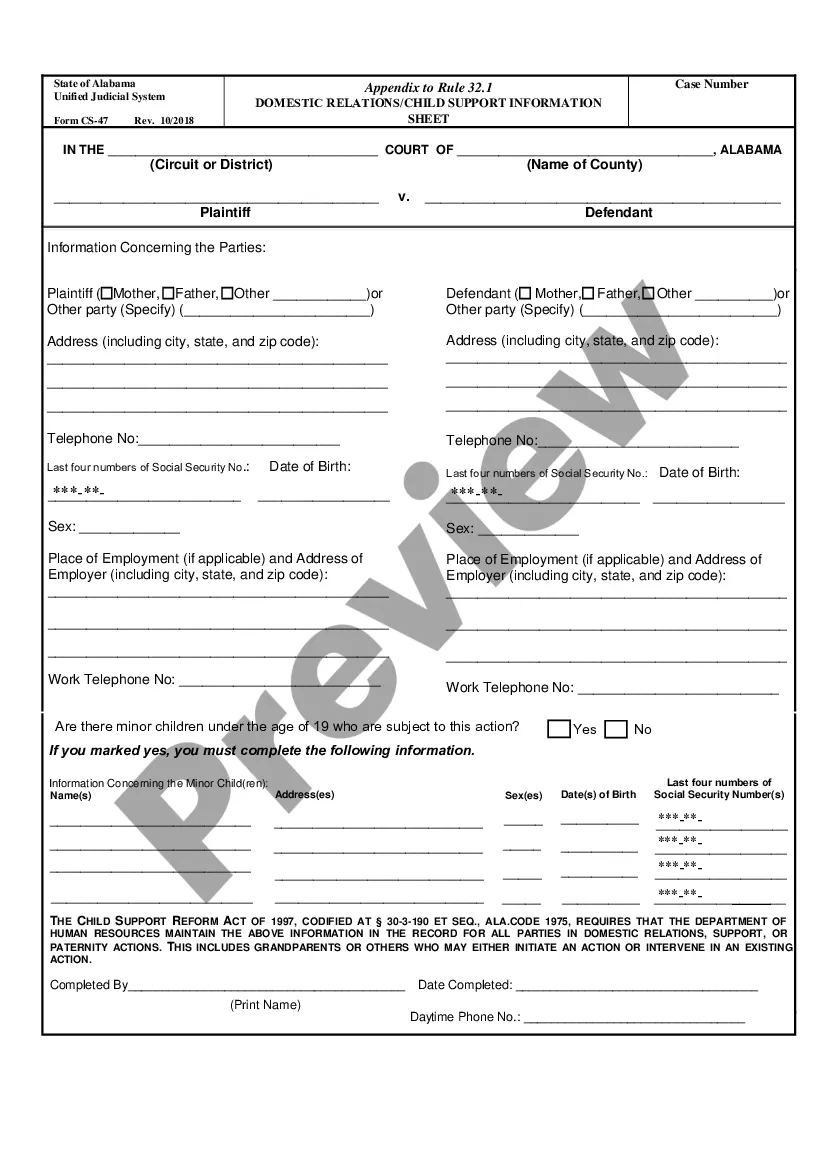

The Alabama Foreign Corporation Certificate of Withdrawal is a legal document that allows a foreign business that is registered in Alabama to complete the process of withdrawing from the state. This document must be filed with the Alabama Secretary of State's Office to formally withdraw the company from the state. The two types of Alabama Foreign Corporation Certificate of Withdrawal are Voluntary Withdrawal, which is filed when the company decides to terminate its business in the state, and Involuntary Withdrawal, which is filed when the company has failed to comply with the requirements of the state or has been dissolved. The Certificate of Withdrawal must include the name of the foreign corporation, the state or country under the laws of which it was incorporated, the date of its incorporation, the date it registered to do business in Alabama, and the type of withdrawal being requested.

Alabama Foreign Corporation Certificate of Withdrawal

Description

How to fill out Alabama Foreign Corporation Certificate Of Withdrawal?

Drafting official documentation can be quite stressful if you lack readily available fillable templates. With the US Legal Forms online repository of formal papers, you can be assured of the blanks you acquire, as all of them align with federal and state regulations and have been reviewed by our specialists.

Obtaining your Alabama Foreign Corporation Certificate of Withdrawal from our service is as simple as one-two-three. Previously authorized users with a valid subscription merely need to Log In and click the Download button once they locate the appropriate template. Later, if they desire, users can select the same blank from the My documents section of their account. However, even if you are a newcomer to our service, registering with a valid subscription will only take a few moments. Here’s a brief guide for you.

Haven’t you experienced US Legal Forms yet? Sign up for our service now to secure any formal document swiftly and effortlessly each time you need to, and maintain your paperwork organized!

- Document compliance verification. You should thoroughly examine the content of the form you wish to use and ensure it fulfills your requirements and adheres to your state legislation. Previewing your document and checking its general summary will assist you in doing just that.

- Alternative search (optional). If there are any discrepancies, explore the library using the Search tab at the top until you discover a fitting blank, and click Buy Now when you find the one you require.

- Account setup and form acquisition. Register for an account with US Legal Forms. After confirming your account, Log In and select the subscription plan that best meets your needs. Proceed with payment (PayPal and credit card options are available).

- Template retrieval and further utilization. Select the file format for your Alabama Foreign Corporation Certificate of Withdrawal and click Download to store it on your device. Print it to manually fill out your forms, or utilize a comprehensive online editor to prepare an electronic version quickly and more efficiently.

Form popularity

FAQ

To dissolve a foreign entity in Alabama, you must first obtain your Alabama Foreign Corporation Certificate of Withdrawal. This certificate confirms that your company has completed all necessary steps to legally cease its operations in the state. You will need to file the appropriate forms with the Secretary of State and ensure that you have settled all financial obligations. Using the US Legal Forms platform simplifies this process, guiding you through the paperwork and ensuring you meet all requirements.

To obtain a certificate of authority in Alabama, you must first ensure that your foreign corporation meets all state requirements. You will need to file an application and provide necessary documents with the Alabama Secretary of State. One of the important steps is to have a registered agent in Alabama. Additionally, consider utilizing the uslegalforms platform, which simplifies the process of obtaining the Alabama Foreign Corporation Certificate of Withdrawal and helps you navigate necessary legal requirements efficiently.

A foreign corporation is a business incorporated in one state or country but conducting business in another. For instance, if your corporation is established outside Alabama and operates there, it is classified as a foreign corporation. Understanding this distinction is crucial for complying with local laws, such as filing an Alabama Foreign Corporation Certificate of Withdrawal when you close operations in Alabama.

To dissolve a foreign corporation in Massachusetts, you must file a Certificate of Withdrawal with the Secretary of the Commonwealth. This procedure involves completing necessary forms and addressing any outstanding obligations. While this might seem daunting, utilizing resources like US Legal Forms can simplify your experience. They provide guidance and templates for the Alabama Foreign Corporation Certificate of Withdrawal process as well.

A certificate of surrender is a formal document filed to indicate the intention to dissolve a foreign corporation. By submitting this document, you declare that your corporation will no longer conduct business in the state, such as Alabama. It is essential for ensuring that you adhere to state laws and prevent potential complications. Achieving compliance is straightforward through the Alabama Foreign Corporation Certificate of Withdrawal process.

A certificate of surrender is a legal document that allows a foreign corporation to voluntarily give up its authority to operate in Alabama. This certificate signifies that the corporation has fulfilled its obligations and wishes to cease all business activities in the state. If your foreign corporation needs to dissolve its operations in Alabama, acquiring an Alabama Foreign Corporation Certificate of Withdrawal will be essential.

A foreign entity refers to a corporation or LLC registered in one state but doing business in another, like Alabama. On the other hand, an LLC is a specific business structure offering limited liability protection to its owners. Understanding this distinction is key when considering options for obtaining an Alabama Foreign Corporation Certificate of Withdrawal in the future.

To dissolve a foreign corporation in Alabama, you must file a certificate of withdrawal with the Secretary of State. This document affirms your intent to cease business operations and must include information about your corporation. Ensuring you complete this step properly is essential to obtaining your Alabama Foreign Corporation Certificate of Withdrawal.

A certificate of withdrawal is an official document allowing a foreign corporation to formally cease business operations in Alabama. This certificate signifies that the corporation has met all state obligations and is withdrawing its authority to operate. To initiate this process, you will often need the Alabama Foreign Corporation Certificate of Withdrawal, to ensure compliance with state regulations.

Filing a foreign entity in Alabama involves submitting the necessary paperwork to the Secretary of State. You will need to provide details such as the entity's name, business address, and certificate of existence from your home state. Completing this filing accurately will streamline the process of obtaining your Alabama Foreign Corporation Certificate of Withdrawal down the line.