Nebraska Software Distribution and Maintenance Agreement

Description

How to fill out Software Distribution And Maintenance Agreement?

Selecting the ideal approved document template can be challenging.

Clearly, there are numerous designs accessible online, but how do you locate the authorized document you require.

Utilize the US Legal Forms website. The service offers a multitude of templates, including the Nebraska Software Distribution and Maintenance Agreement, which you can use for both commercial and personal purposes.

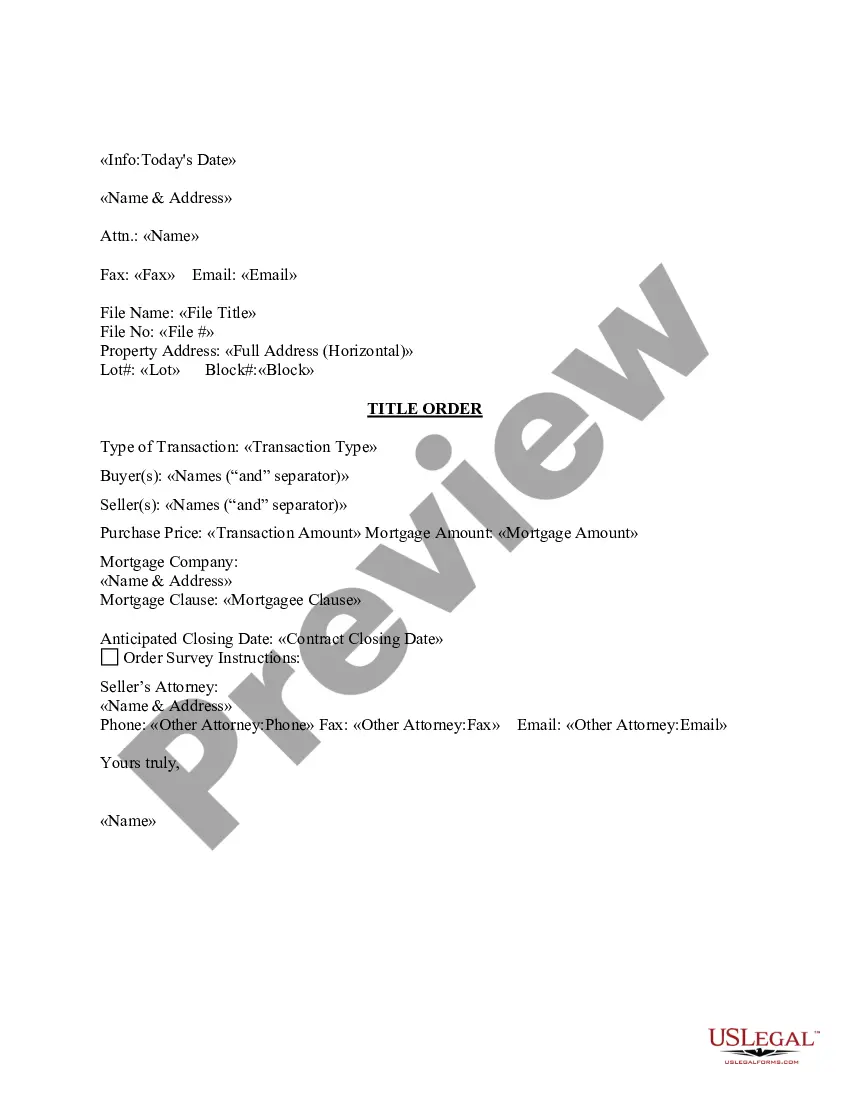

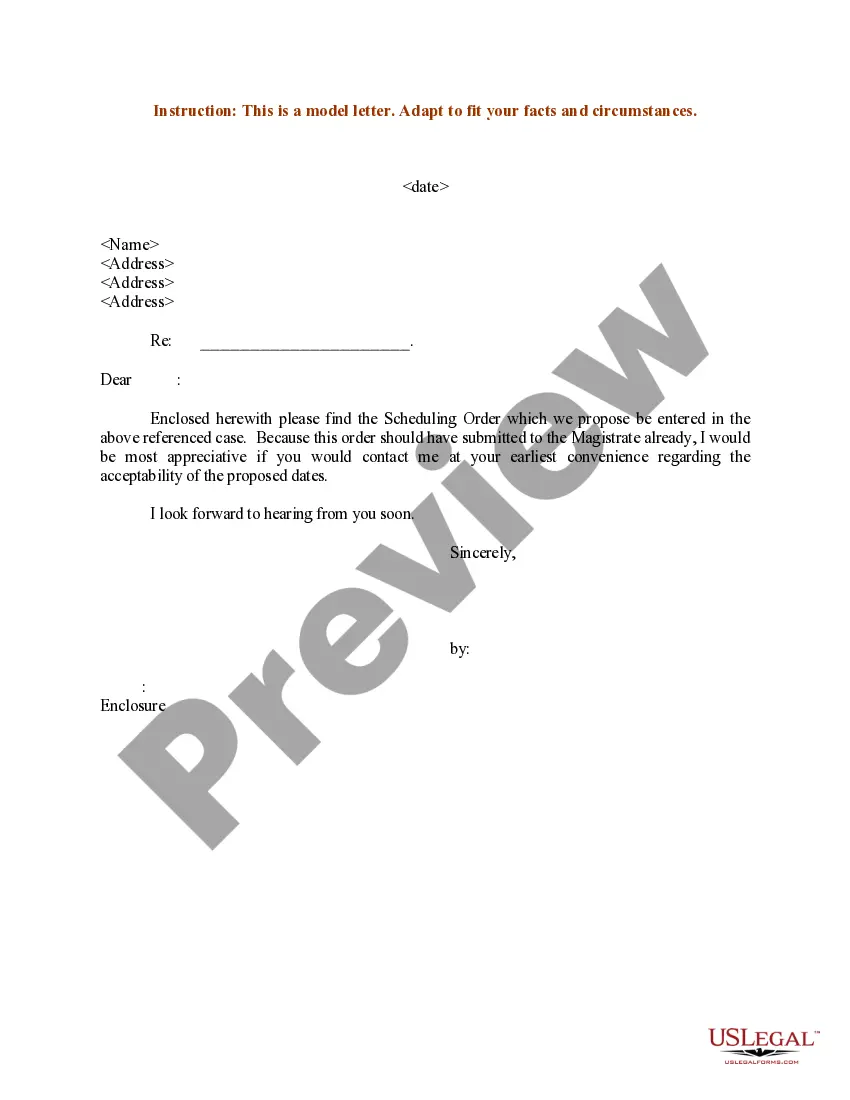

You can review the form using the Preview option and check the form description to confirm it is the appropriate one for you.

- All the forms are evaluated by experts and satisfy state and federal standards.

- If you are already registered, Log In to your account and click on the Obtain button to retrieve the Nebraska Software Distribution and Maintenance Agreement.

- Use your account to browse the legal forms you may have acquired previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines for you to follow.

- First, ensure you have selected the correct form for your city/area.

Form popularity

FAQ

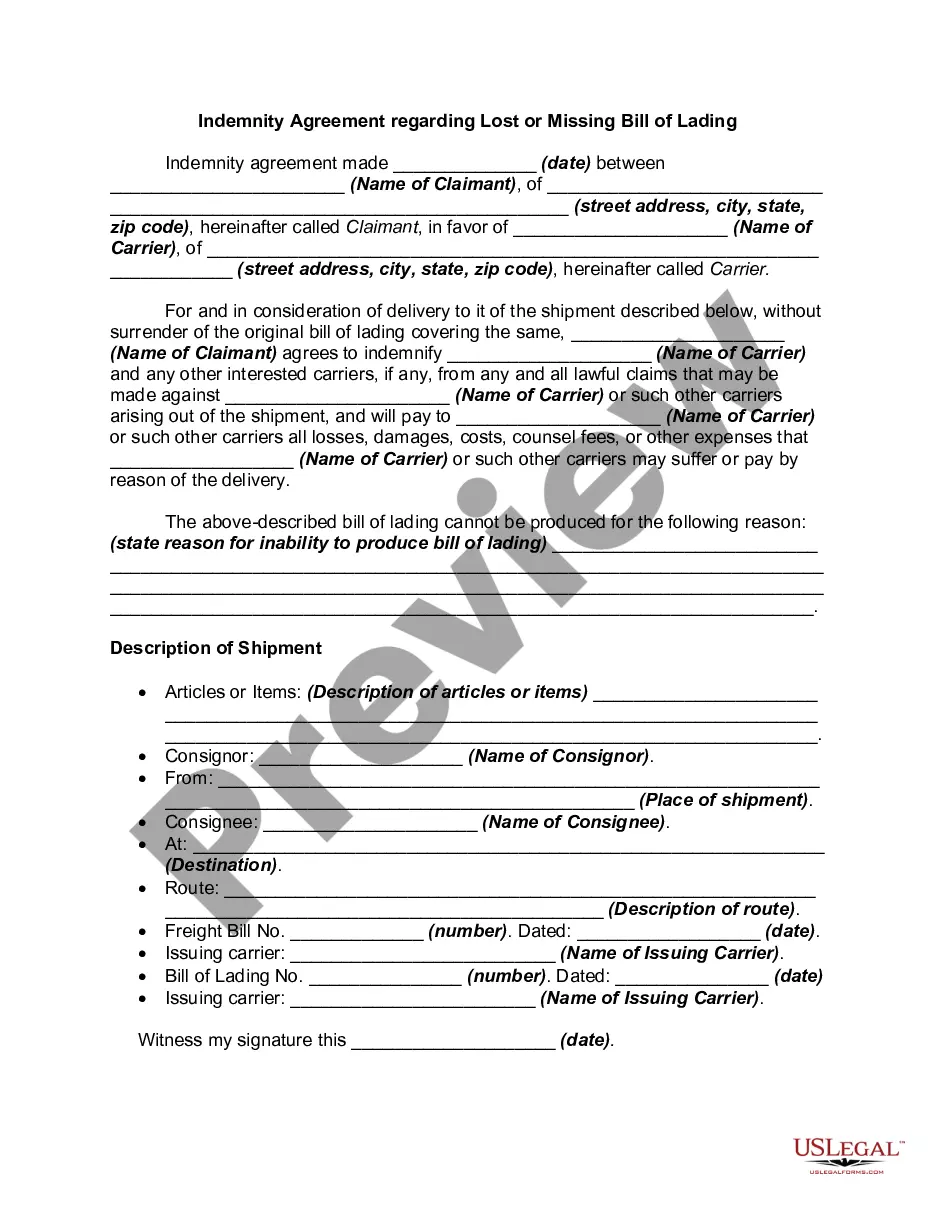

Computer Software Maintenance AgreementsCharges for maintenance agreements to maintain computer software that include free or reduced-price upgrades, enhancements, changes, modifications, or updates are taxable.

Reg-1-088 establishes the following points regarding the taxation of Nebraska software: (1) Software is subject to Nebraska sales and use tax regardless of the manner in which it is conveyed. See Reg-1-088.01. (2) Both canned and custom software are subject to Nebraska sales and use tax.

Traditional Goods or Services Goods that are subject to sales tax in Nebraska include physical property, like furniture, home appliances, and motor vehicles. Medicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax.

Nebraska: Taxable Although SaaS and cloud computing services are not taxable in Nebraska, prewritten software that's electronically delivered to the purchaser is subject to sales and use tax in the state.

Traditional Goods or ServicesMedicine, groceries, and gasoline are all tax-exempt. Some services in Nebraska are subject to sales tax. For a detailed list of taxable services view Sales Tax Frequently Asked Questions through the Nebraska Department of Revenue.

An individual or business that has been issued a common or contract carrier certificate of exemption may only use it to purchase those items described above prior to the expiration date on the certificate. The certificate of exemption expires every 5 years. (See Nebraska Common or Contract Carrier Information Guide).

Services in Nebraska are generally not taxable.

Canned software is considered taxable tangible personal property because it is actually stored on a computer and takes up space on the hard drive. Software licenses are considered licenses to use canned software and constitute tangible personal property, regardless of the method of delivery.

But, in most, it's a mixed bag. California exempts most software sales but taxes one type: canned software delivered on tangible personal property an actual object you can touch or hold, such as a disc. Nebraska taxes most software sales with the exception of one type: SaaS.

Deliveries into another state are not subject to Nebraska sales tax. Services are generally taxed at the location where the service is provided to the customer.