Nebraska Sample Letter sending Check for Copying Expense

Description

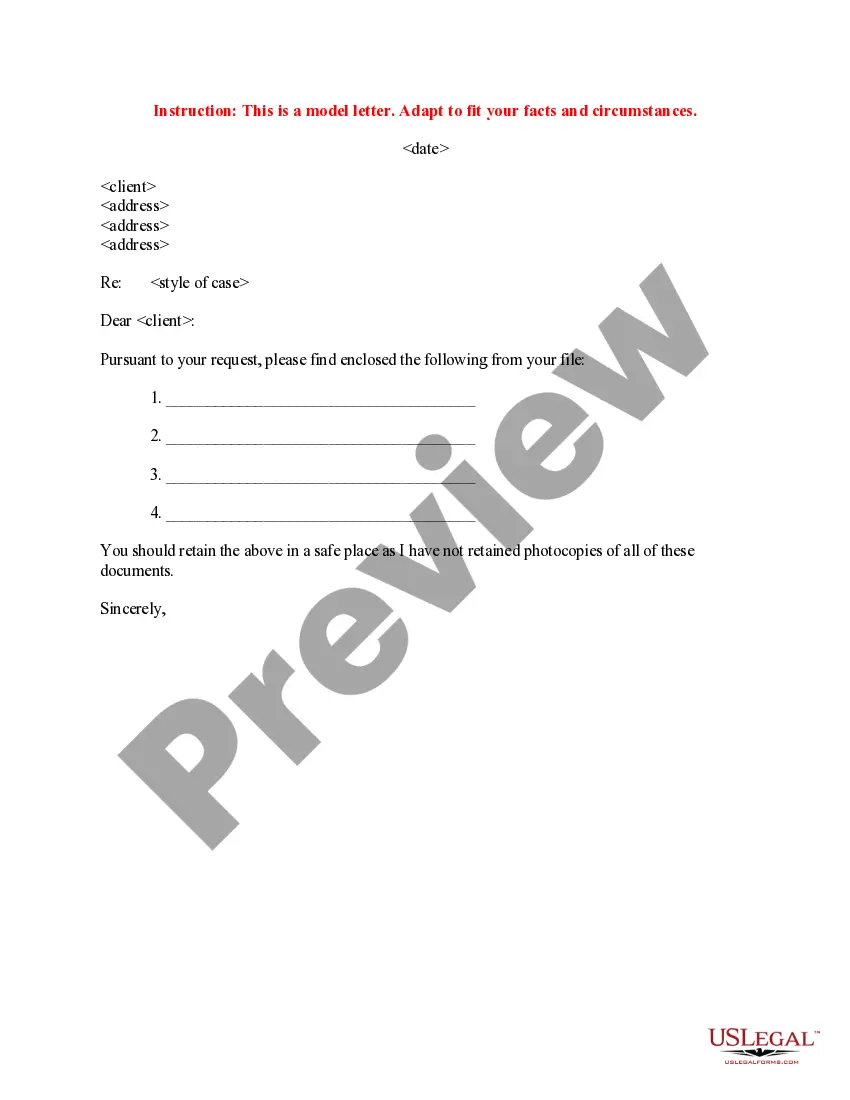

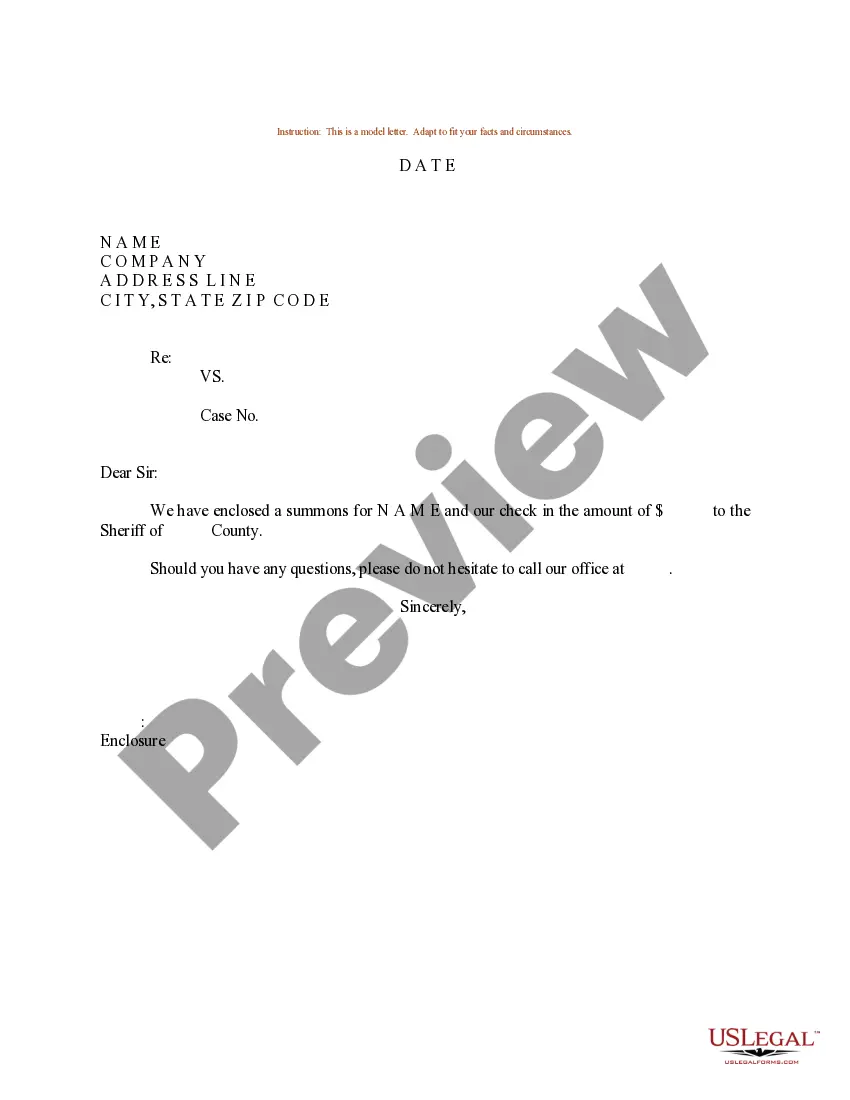

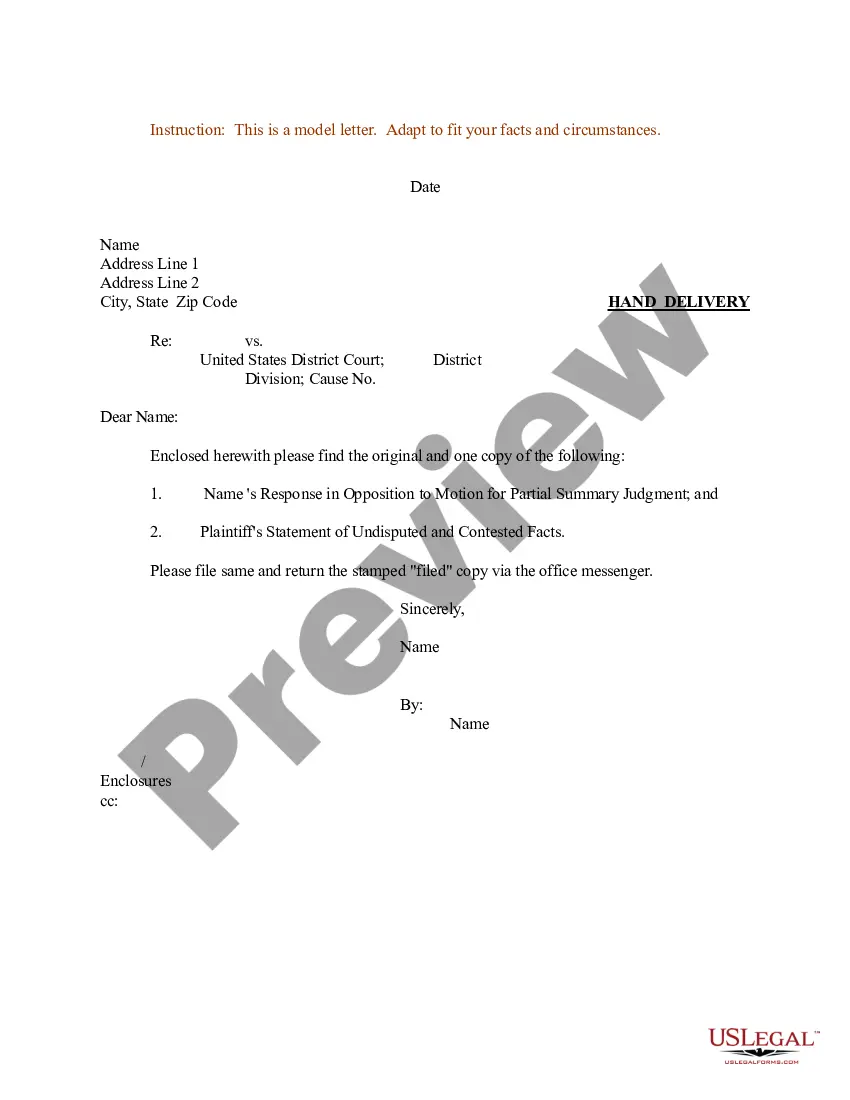

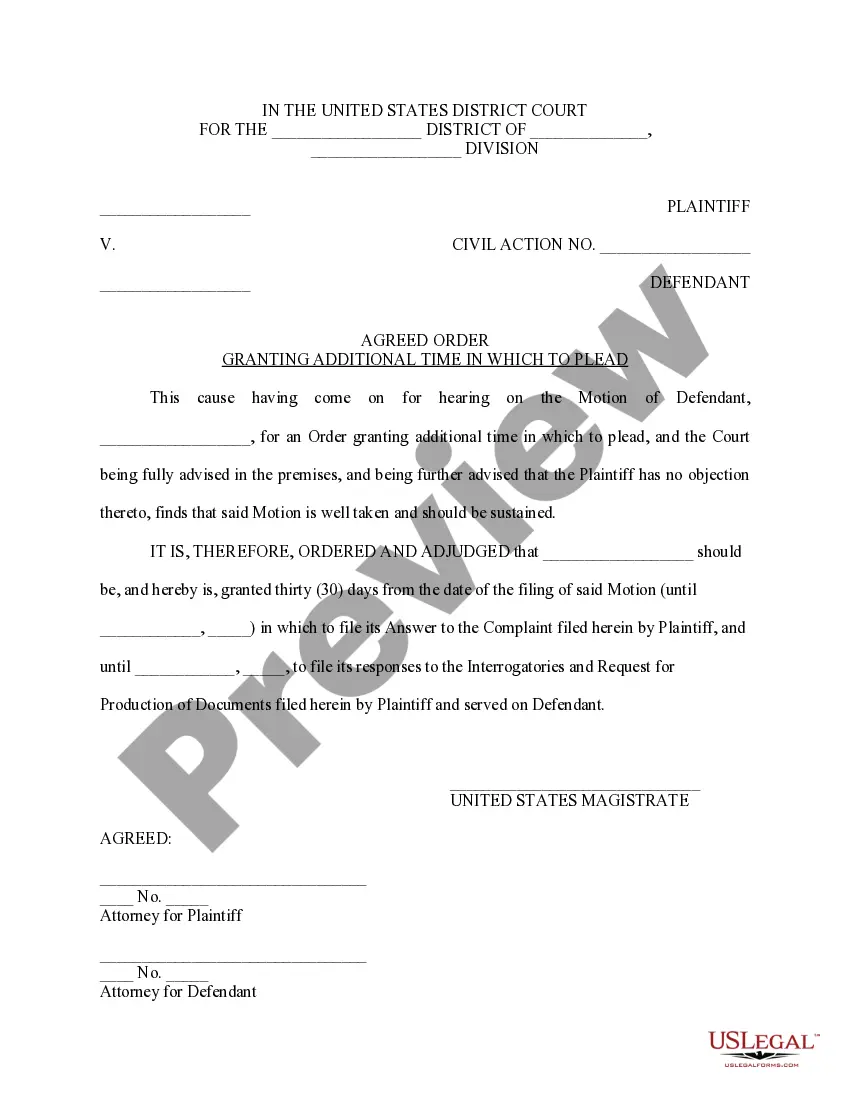

How to fill out Sample Letter Sending Check For Copying Expense?

Have you been in a situation where you need to have paperwork for sometimes organization or person functions just about every time? There are tons of legitimate papers themes available online, but discovering types you can rely on isn`t effortless. US Legal Forms gives a huge number of form themes, like the Nebraska Sample Letter sending Check for Copying Expense, which can be composed to meet state and federal demands.

In case you are previously acquainted with US Legal Forms site and have a merchant account, merely log in. Afterward, it is possible to obtain the Nebraska Sample Letter sending Check for Copying Expense web template.

If you do not come with an profile and would like to begin using US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for your right metropolis/area.

- Make use of the Preview option to check the shape.

- Browse the description to ensure that you have chosen the right form.

- In the event the form isn`t what you`re trying to find, use the Research field to obtain the form that suits you and demands.

- Once you obtain the right form, click on Acquire now.

- Pick the prices plan you desire, submit the necessary information and facts to make your account, and buy your order with your PayPal or credit card.

- Pick a practical data file format and obtain your duplicate.

Find all of the papers themes you may have purchased in the My Forms menu. You can get a further duplicate of Nebraska Sample Letter sending Check for Copying Expense any time, if required. Just click the required form to obtain or produce the papers web template.

Use US Legal Forms, probably the most extensive selection of legitimate types, in order to save efforts and steer clear of faults. The service gives appropriately produced legitimate papers themes that can be used for an array of functions. Create a merchant account on US Legal Forms and start producing your daily life a little easier.

Form popularity

FAQ

This Form 20 is filed to apply for permits, licenses, and registrations required to conduct business in Nebraska. Also, when owners of an existing business change, a Form 20 needs to be filed.

You have three options for filing and paying your Nebraska sales tax: File online ? File Form 10 online at the Nebraska Department of Revenue. You can also remit your payment through Nebraska E-Pay. File by mail ? You can use Form 10 and file and pay through the mail. AutoFile ? Let TaxJar file your sales tax for you.

Every retailer must file a Form 10. Retailers include remote sellers and Multivendor Marketplace Platforms (MMPs) with more than $100,000 of gross sales or 200 or more transactions in Nebraska. All retailers must hold a Nebraska Sales Tax Permit.

1. Account statement from a bank or other financial institution issued within the last 90 days. 2. Pay stub or earnings statement issued within the last 90 days with the name and address of the employer.

For an exempt sale certificate to be fully completed, it must include: (1) identification of purchaser and seller; (2) a statement that the certificate is for a single purchase or is a blanket certificate covering future sales; (3) a statement of the basis for exemption, including the type of activity engaged in by the ...

A Form 6 is the Nebraska Sales Tax and Use Form. If you purchase something from a Licensed Nebraska Dealer they are required by the State to provide you with this form so that you can register your vehicle in whatever county you reside.

Residents must report all income to Nebraska, and will receive a credit for taxes paid to other states by completing Form 1040N and Nebraska Schedule I. Nonresidents and partial-year residents must file a Form 1040N and a Nebraska Schedule I to compute the Nebraska tax due.

Nebraska Sales Tax Exemptions SaleDocumentation Required (in addition to the normal books and records of the retailer)Medicines & medical equipmentPrescription from health care professional (except insulin)NewspapersNonePolitical Campaign FundraisersNoneRepair laborNone9 more rows