A corporation is owned by its shareholders. An ownership interest in a corporation is represented by a share or stock certificate. A certificate of stock or share certificate evidences the shareholder's ownership of stock. The ownership of shares may be transferred by delivery of the certificate of stock endorsed by its owner in blank or to a specified person. Ownership may also be transferred by the delivery of the certificate along with a separate assignment. This form is a sample of the transfer of ownership of stock by a separate instrument.

Nebraska Bill of Sale and Assignment of Stock by Separate Instrument

Description

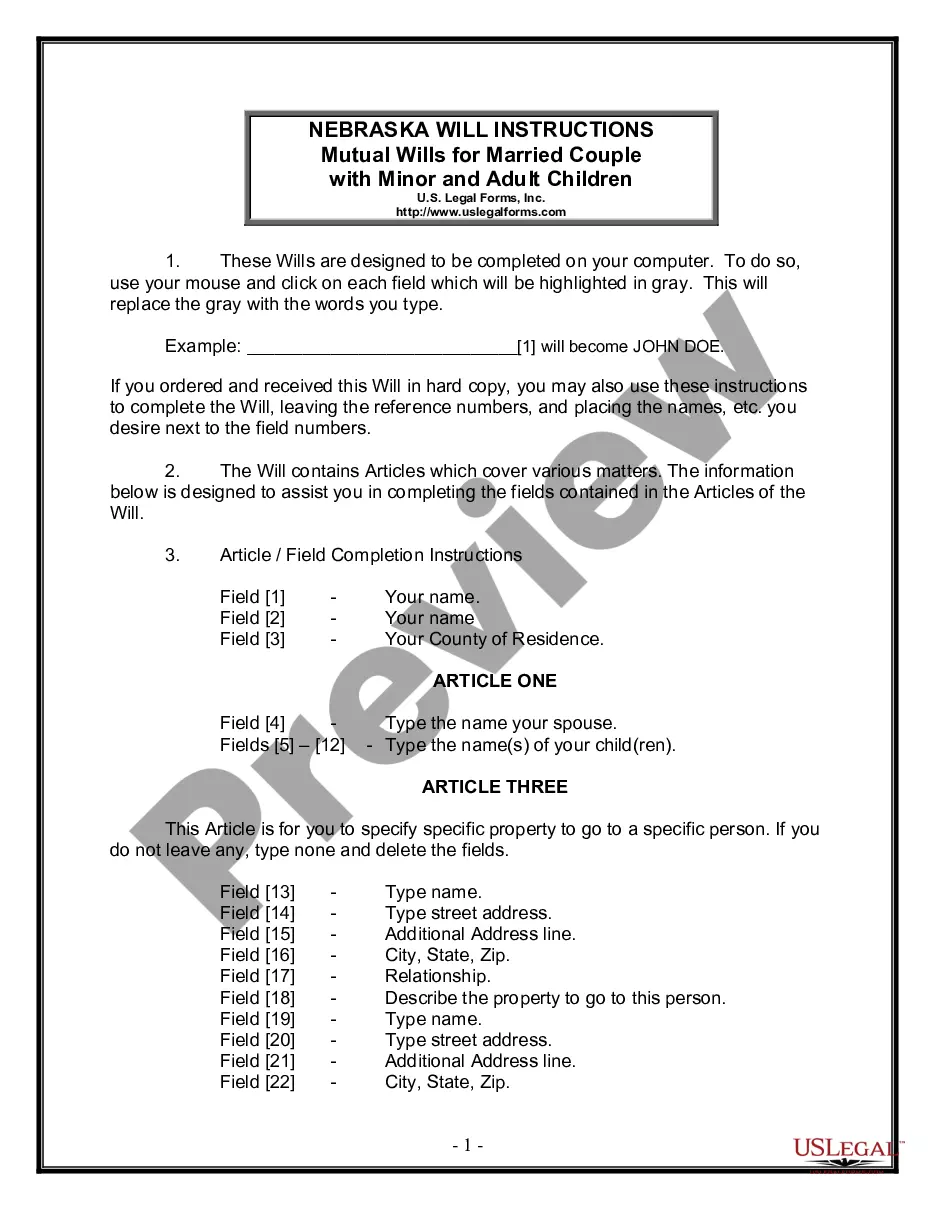

How to fill out Bill Of Sale And Assignment Of Stock By Separate Instrument?

If you intend to finalize, obtain, or print official document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site’s user-friendly and convenient search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and suggestions, or keywords.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the purchase.

Step 6. Retrieve the format of your legal form and download it to your device. Step 7. Fill out, review, and print or sign the Nebraska Bill of Sale and Assignment of Stock by Separate Instrument. Every legal document format you acquire is yours indefinitely. You will have access to every form you saved in your account. Click the My documents section and choose a form to print or download again. Be proactive and obtain, and print the Nebraska Bill of Sale and Assignment of Stock by Separate Instrument with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- Utilize US Legal Forms to acquire the Nebraska Bill of Sale and Assignment of Stock by Separate Instrument in just a few clicks.

- If you are already a US Legal Forms subscriber, Log In to your account and then click the Obtain button to find the Nebraska Bill of Sale and Assignment of Stock by Separate Instrument.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the steps below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Download now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Form popularity

FAQ

To privately sell a car in Nebraska, start by gathering all necessary documents, including the title and a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument. Advertise your car on reputable platforms, and communicate honestly with potential buyers. Once you find a buyer, meet in a public place to complete the sale. Remember to provide the buyer with the signed title and bill of sale for a secure and legal transfer of ownership.

In Nebraska, you can sell up to five cars per calendar year without needing a dealer's license. This limit applies to individuals who are not regularly in the business of selling vehicles. To stay compliant, ensure that you provide a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument for each sale. This helps maintain proper records and protects your rights as a seller.

The most secure way to sell a car privately involves using a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument. This document legally transfers ownership and protects both the buyer and seller. Always meet in a safe, public location for the exchange, and consider accepting payment methods that offer additional security, such as a bank transfer. Properly documenting the sale is essential to prevent any future disputes.

While Nebraska does not impose a sales tax on the sale of real estate, other taxes may apply, such as property tax. When selling a house, sellers should ensure all local taxes are accounted for. Understanding these financial aspects can be beneficial when dealing with a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument during property transfers.

In Nebraska, a bill of sale for livestock serves as proof of ownership transfer and is crucial for transactions involving livestock. This document should include specific details about the animals, along with the buyer's and seller's information. Utilizing resources such as uslegalforms can facilitate creating a proper Nebraska Bill of Sale and Assignment of Stock by Separate Instrument tailored for livestock transactions.

Yes, rentals are typically taxable in Nebraska. This includes short-term and long-term rentals unless exceptions apply. It is important to account for these taxes when preparing a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument to ensure compliance with state laws.

In Nebraska, the sales tax on rental property can vary based on the type of rental agreement. Generally, rental charges are subject to sales tax, unless specifically exempt. Understanding these tax obligations is crucial when drafting a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument for property transactions.

The Nebraska sales tax rate is currently 5.5% on most goods and services. However, some cities and counties may impose additional local taxes. This total can impact transactions, including those involving a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument.

A handwritten bill of sale is indeed legal in Nebraska, provided it meets required specifications. It must contain essential details, including the transaction date, buyer and seller information, and item description. To make this process easier, consider using a Nebraska Bill of Sale and Assignment of Stock by Separate Instrument, which helps you follow local legal standards.

Yes, Nebraska is a paper title state, meaning that physical titles are necessary for vehicle ownership transfers. Owners must possess the actual title to complete and submit necessary documentation at the county treasurer's office. To facilitate this, a well-prepared Nebraska Bill of Sale and Assignment of Stock by Separate Instrument is crucial.