Nebraska Assignment and Bill of Sale to Corporation

Description

How to fill out Assignment And Bill Of Sale To Corporation?

Are you presently in a situation where you require documents for either business or personal purposes on a daily basis? There is an abundance of legal document templates available online, but finding trusted ones can be challenging. US Legal Forms offers thousands of template options, including the Nebraska Assignment and Bill of Sale to Corporation, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Nebraska Assignment and Bill of Sale to Corporation template.

If you don’t have an account and want to start using US Legal Forms, follow these instructions.

- Locate the form you need and confirm it is for the correct city/region.

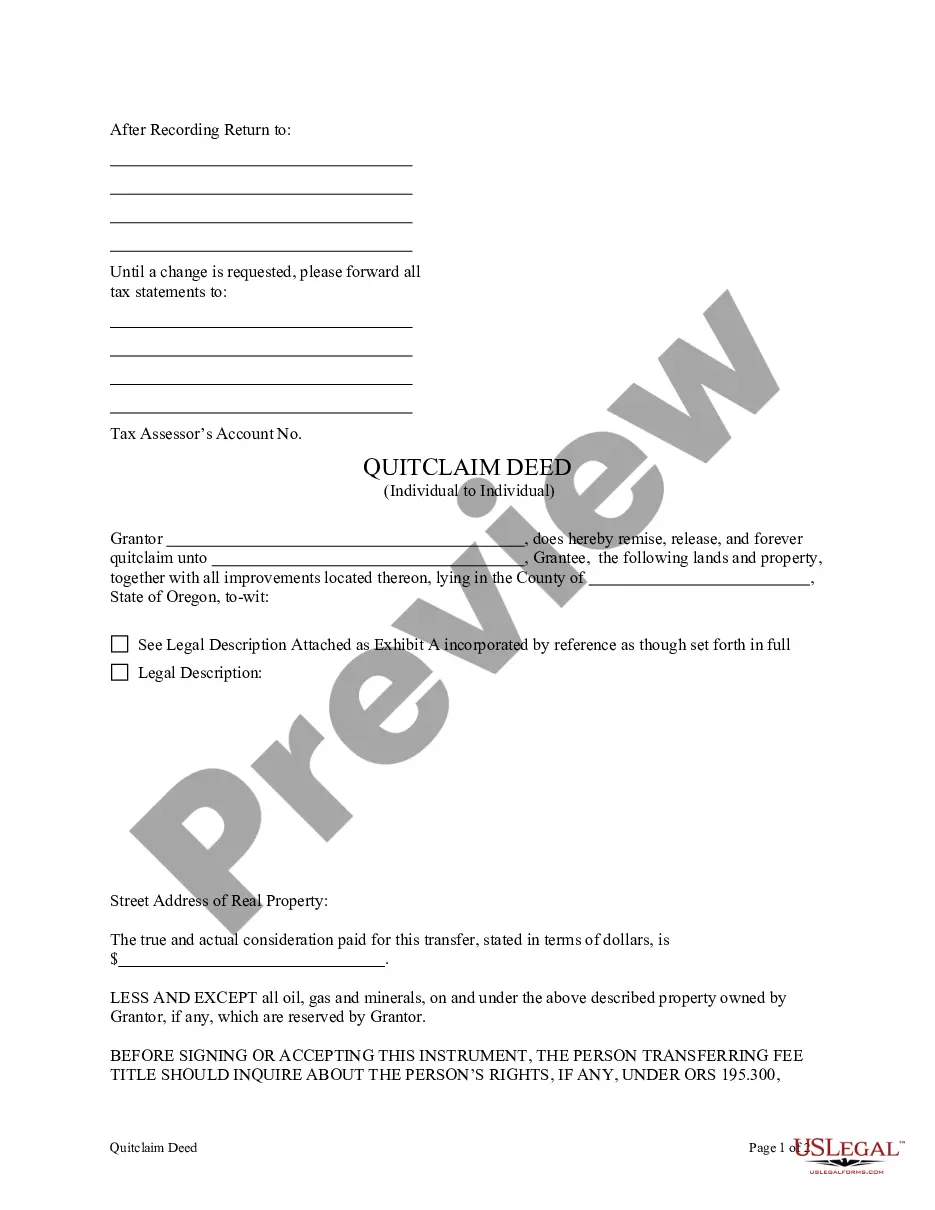

- Utilize the Preview button to inspect the document.

- Review the description to ensure you have chosen the correct form.

- If the form isn't what you're looking for, use the Research field to find the template that suits your needs and requirements.

- Once you identify the right document, click Get now.

- Select the pricing plan you prefer, fill out the necessary information to create your account, and pay for your order using PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

If a business does not have a registered agent in Nebraska, it may face legal challenges, including missing important documents or court notices. This absence can lead to penalties or the dissolution of the LLC. To avoid these pitfalls, consider utilizing US Legal Forms to establish a registered agent, ensuring compliance, and protecting your interests related to the Nebraska Assignment and Bill of Sale to Corporation.

Generally, a Nebraska bill of sale does not require notarization. However, having it notarized can add an extra layer of security and credibility to the transaction. Ensure your documentation aligns with the Nebraska Assignment and Bill of Sale to Corporation regulations to avoid any issues in the future.

Certainly, you can serve as your own registered agent in Nebraska. This gives you the flexibility to handle legal correspondence directly. As you explore your responsibilities, consider how the Nebraska Assignment and Bill of Sale to Corporation aligns with your business activities and compliance needs.

Yes, a registered agent can also be the owner of the LLC in Nebraska. This arrangement can simplify your business operations, as you can control both roles. However, remember that the responsibilities of a registered agent involve managing important documents, especially regarding your Nebraska Assignment and Bill of Sale to Corporation.

Indeed, you can be your own registered agent in Nebraska. This allows you to receive legal documents for your LLC directly. However, make sure you are available during business hours, as the registered agent must be able to accept these documents reliably, especially in matters related to the Nebraska Assignment and Bill of Sale to Corporation.

Yes, you can be your own LLC organizer in Nebraska. This means you can file the necessary documents to establish your LLC without needing a third party. However, ensure you understand the details involved in the Nebraska Assignment and Bill of Sale to Corporation, as this knowledge will help you manage your business effectively.

While Nebraska does not legally mandate a bill of sale for every transaction, it is often beneficial to have one, especially for significant purchases. A bill of sale can serve as verification for ownership transfer and help prevent misunderstandings between parties. Employing our services to create a Nebraska Assignment and Bill of Sale to Corporation offers an easy and efficient way to document your transactions. This documentation can provide peace of mind and ensure that your interests are protected.

The primary difference between an assignment and a bill of sale lies in their purpose. An assignment generally refers to the transfer of rights or obligations under a contract, while a bill of sale specifically conveys ownership of a tangible item or property. In the context of business, a Nebraska Assignment and Bill of Sale to Corporation can serve both purposes, ensuring that you legally transfer both rights and ownership smoothly in one process. Understanding these differences can help you choose the correct document for your needs.

If you find yourself without a bill of sale, you can still proceed with the transaction, but it may involve additional steps. For instance, you may need to gather other forms of documentation, such as receipts or contracts, to establish ownership. Utilizing our platform, you can easily create a Nebraska Assignment and Bill of Sale to Corporation, giving you a solid and legal foundation to support your transaction. This approach not only simplifies the process but also protects your interests.

In Nebraska, a bill of sale is not always required for all sales, but it is highly recommended, especially for high-value items. This document provides both legal protection and a clear record of the transaction. For businesses, having a Nebraska Assignment and Bill of Sale to Corporation can help streamline the process of transferring ownership. It establishes accountability, making it easier to handle disputes if they arise.