Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets

Description

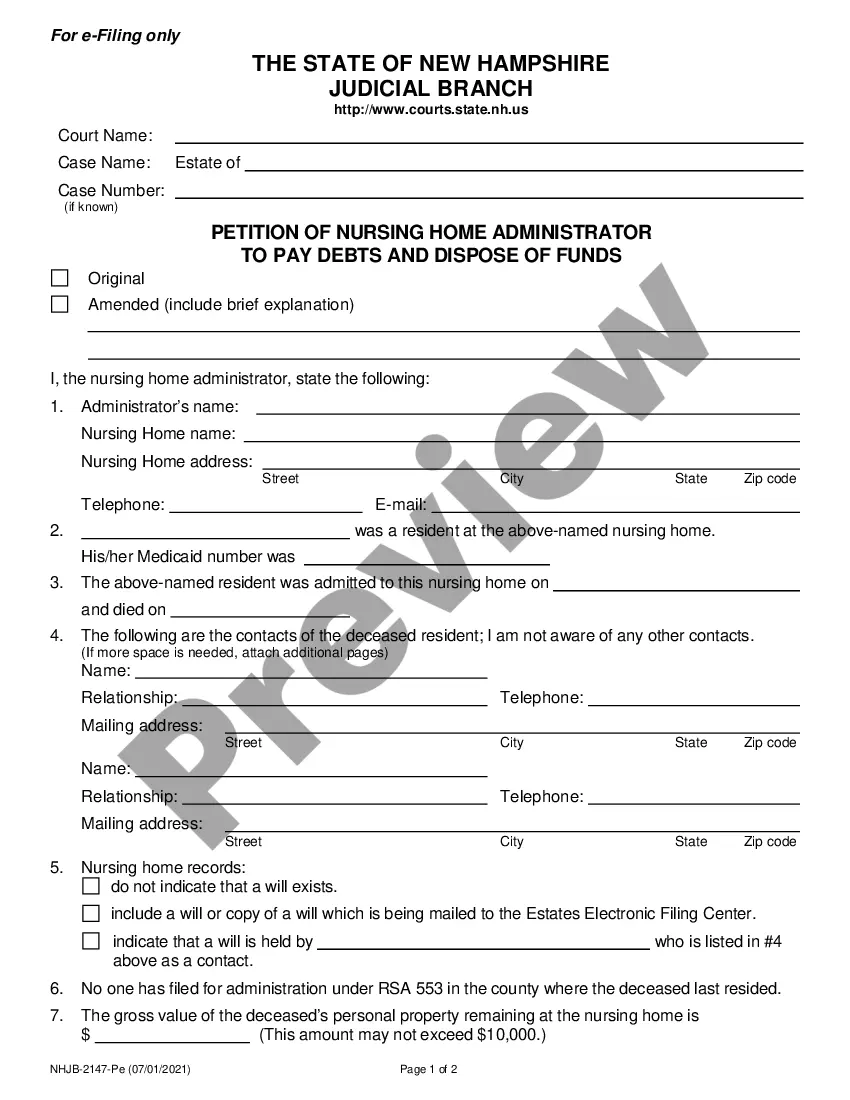

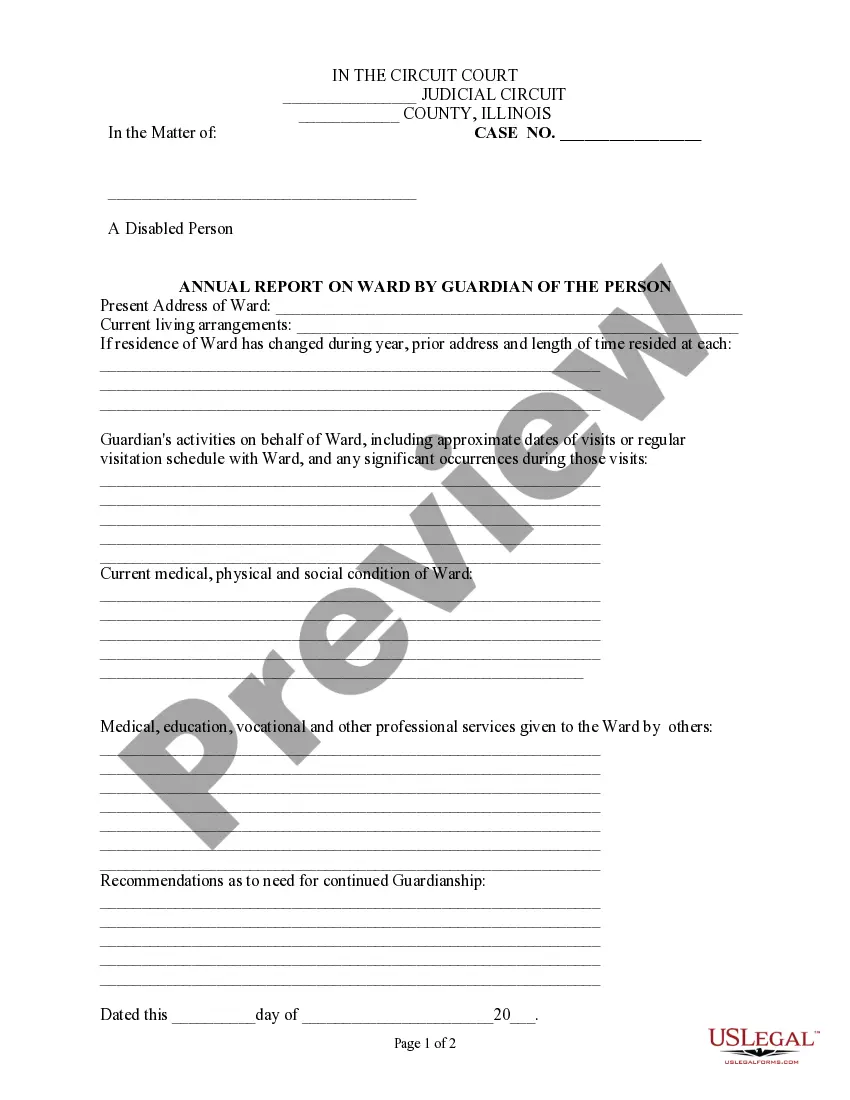

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

If you want to finalize, download, or generate legal document formats, utilize US Legal Forms, the largest collection of legal templates available online.

Make use of the site’s straightforward and user-friendly search to find the documents you require.

A selection of templates for both business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you find the form you need, click the Buy now button. Select your preferred payment method and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase. Step 6. Choose the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Nebraska Bill of Sale by Corporation for all or substantially all of its Assets. Every legal document template you acquire is yours permanently. You have access to every form you purchased in your account. Select the My documents section and choose a form to print or download again. Compete and download, and print the Nebraska Bill of Sale by Corporation for all or substantially all of its Assets with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Nebraska Bill of Sale by Corporation for all or substantially all of its Assets in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to receive the Nebraska Bill of Sale by Corporation for all or substantially all of its Assets.

- You can also access forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Substantially all assets refer to those that, when sold, would materially impact the corporation's operations or survival. This may include key physical assets, such as equipment and inventory, as well as intangible assets like trademarks or customer lists. Utilizing the Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets can help ensure that the definition of substantially all is properly documented, protecting all parties involved in the transaction.

The substantially all requirement generally means that the transaction involves a hefty percentage of a corporation's total asset value or operational capacity. This aim helps establish a clear distinction between a minor asset sale and a more significant transaction that could reshape the corporation. Navigating the nuances of the Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets requires careful documentation to meet this requirement effectively.

A sale of substantially all assets typically constitutes the transfer of assets that significantly define a corporation's operation. This includes tangible and intangible property, intellectual rights, and essential business functions. When considering the Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets, it is vital to specify what is included to avoid disputes and ensure clarity in the transaction.

The sale of all or substantially all of the assets refers to transferring the majority of a corporation's assets to another entity, affecting its overall viability. This process often requires specific legal documentation, including a Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets, to safeguard both parties involved. By having comprehensive legal support, you can streamline this critical transaction while ensuring compliance with relevant laws.

A substantial sale of assets refers to when a corporation sells a significant portion of its assets, which can impact its operations and financial status. In the context of the Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets, this type of sale typically occurs when moving to a new business strategy or divesting from certain operations. Understanding the nuances of this process ensures that your legal documents reflect the intention and specifics of the sale.

In Nebraska, sales tax must be filed either monthly, quarterly, or annually, depending on the business's total sales volume. Businesses with higher sales generally need to file more frequently. Keeping track of your sales and maintaining accurate records is essential, especially for those handling transactions like the Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets. Regular filings help you stay compliant and avoid potential fines.

An Option 2 contractor in Nebraska refers to a specific classification for contractors pursuant to the Nebraska Department of Labor’s regulations. This typically includes those who meet certain qualifications and offer services like construction or renovation. If you plan to sell a significant asset, understanding contractor classifications is vital, especially when a Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets is involved.

The sales and use tax in Nebraska is 5.5% on most goods and services. However, certain jurisdictions may impose additional local taxes, which can raise the total to over 7%. Understanding the tax implications is essential for transactions involving a Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets. Proper tax computation ensures compliance and proper financial planning.

To file Nebraska sales tax, start by gathering your sales records. Use the Nebraska Department of Revenue's online portal or complete a paper tax return. Make sure to report any applicable sales from transactions involving a Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets. Submitting your return on time helps avoid penalties.

Sales and use tax regulation 1 022.02 in Nebraska specifies the rules surrounding tax on sales of tangible personal property and services. This regulation defines which transactions are taxable and outlines exemptions. When engaging in transactions documented by a Nebraska Bill of Sale by Corporation of all or Substantially all of its Assets, awareness of this regulation helps ensure compliance and accuracy.