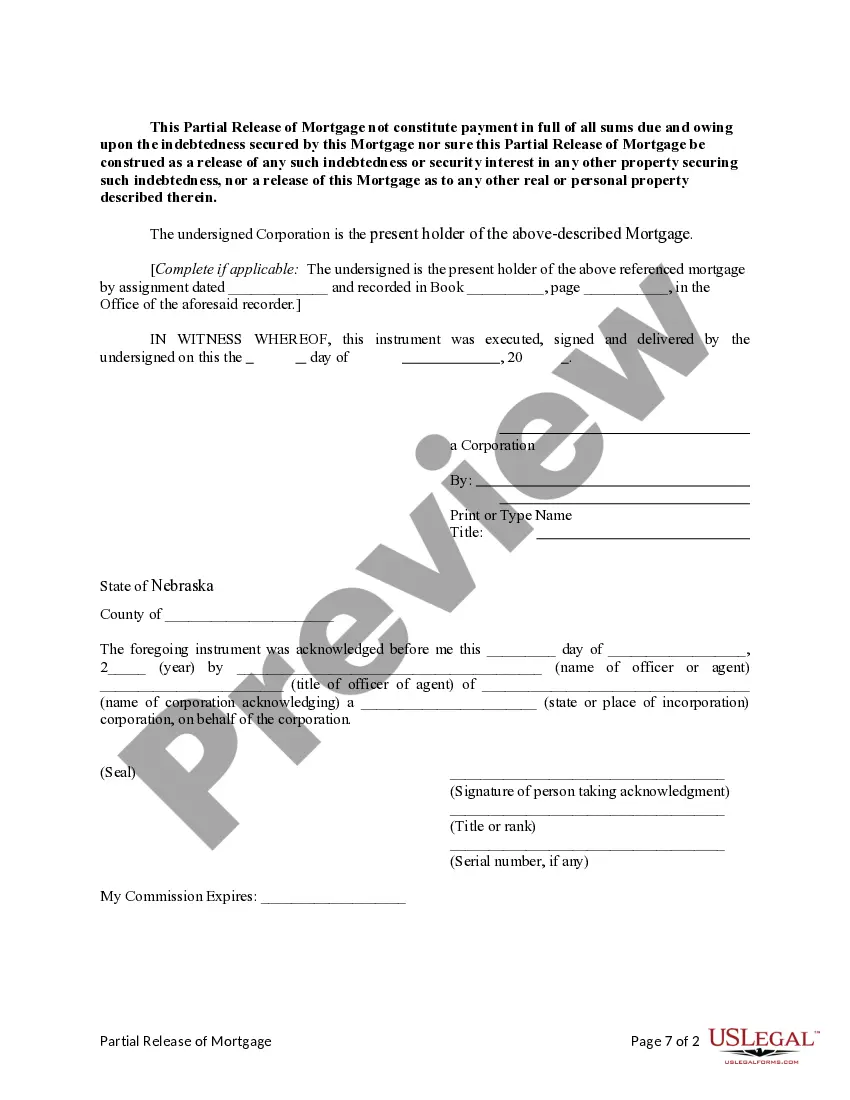

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

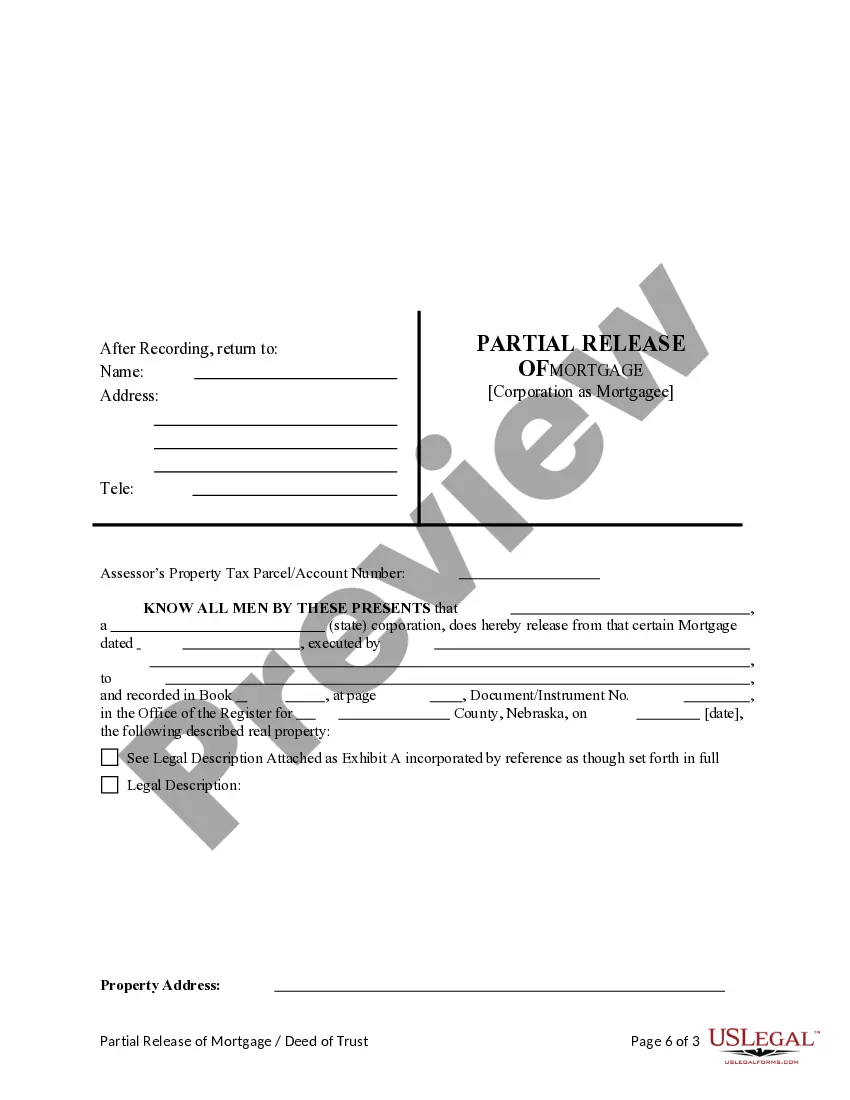

Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation

Description

How to fill out Nebraska Partial Release Of Property From Deed Of Trust Or Mortgage For Corporation?

Avoid pricey lawyers and find the Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation you need at a affordable price on the US Legal Forms site. Use our simple groups function to find and download legal and tax files. Read their descriptions and preview them prior to downloading. Moreover, US Legal Forms provides users with step-by-step tips on how to obtain and fill out every single template.

US Legal Forms subscribers simply must log in and obtain the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet need to follow the guidelines below:

- Make sure the Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation is eligible for use where you live.

- If available, read the description and make use of the Preview option before downloading the sample.

- If you’re confident the document suits you, click on Buy Now.

- If the form is wrong, use the search engine to get the right one.

- Next, create your account and select a subscription plan.

- Pay out by credit card or PayPal.

- Select download the form in PDF or DOCX.

- Click on Download and find your template in the My Forms tab. Feel free to save the template to the gadget or print it out.

After downloading, you are able to fill out the Nebraska Partial Release of Property From Deed of Trust or Mortgage for Corporation manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

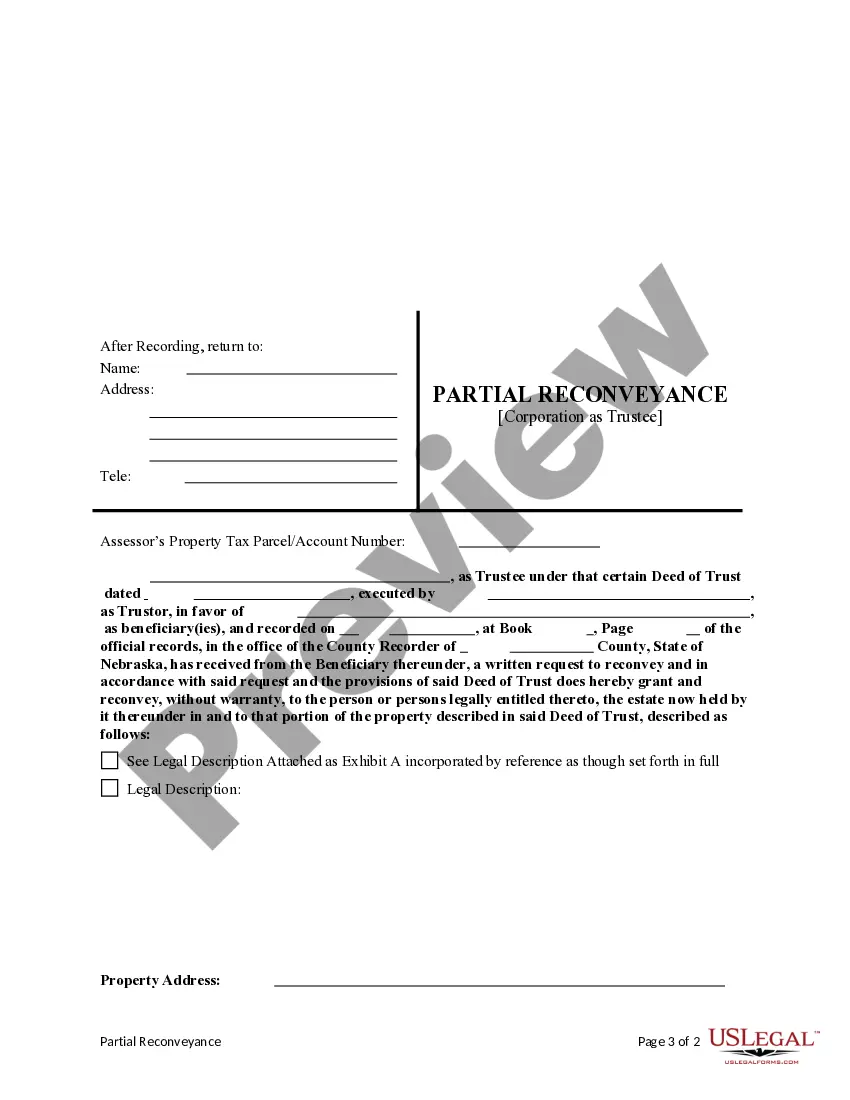

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

If you or another party to the deed of trust already own the property and you enter into a deed of trust to regulate an arrangement there is usually no reason to inform your mortgage lender.Therefore the mortgage company's position is secure and they need not be concerned with a deed of trust.

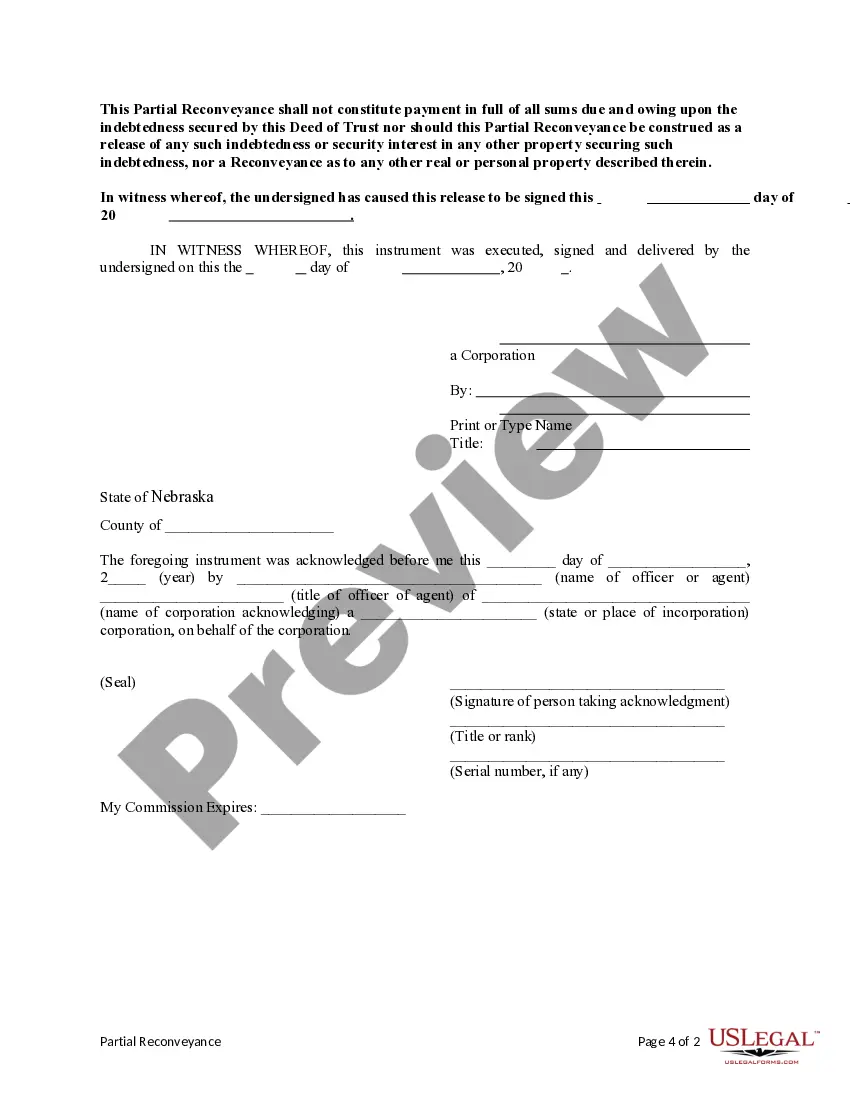

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount.He will have to wait to pay off the full loan before the property is granted back to him.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.