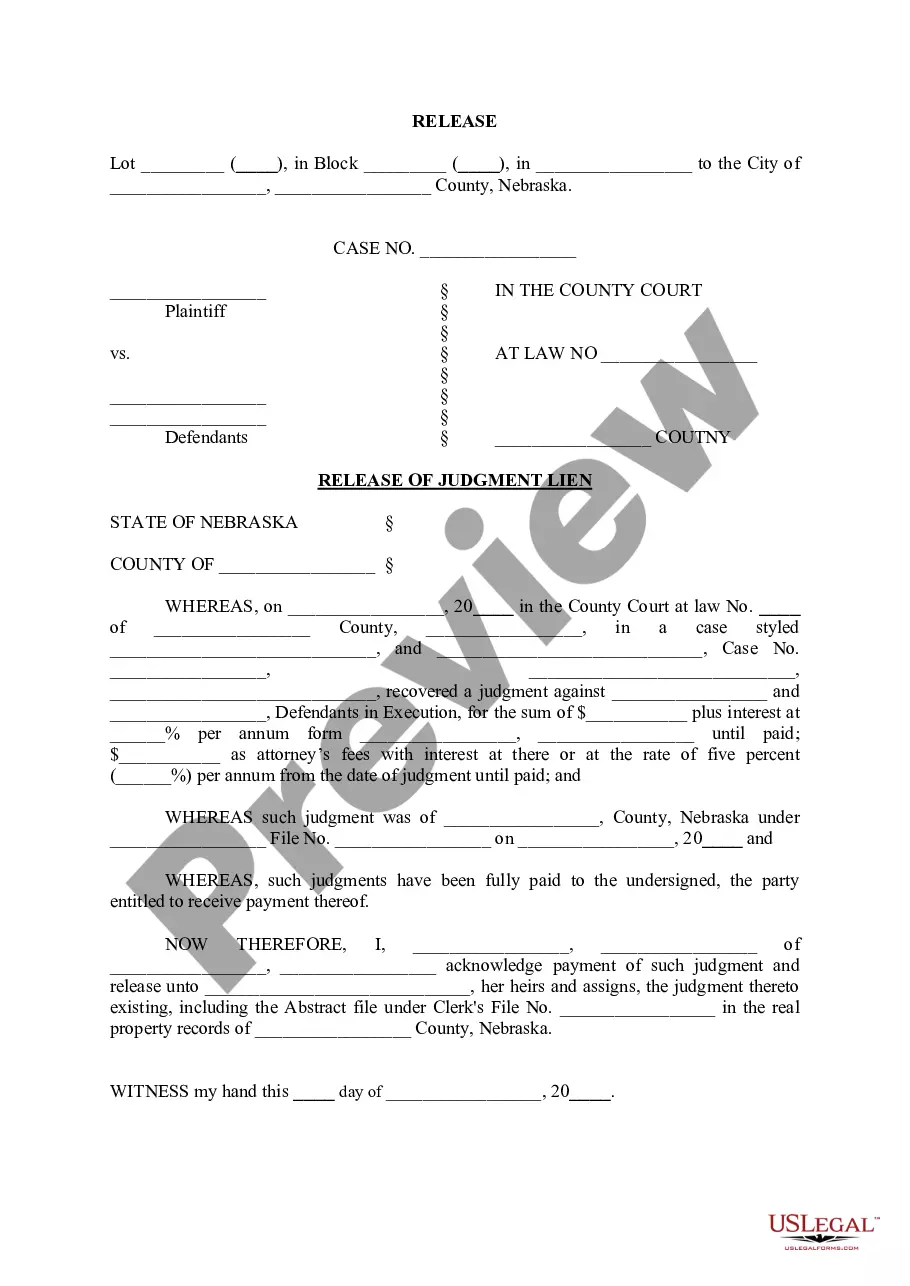

Nebraska Release of Judgment Lien

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

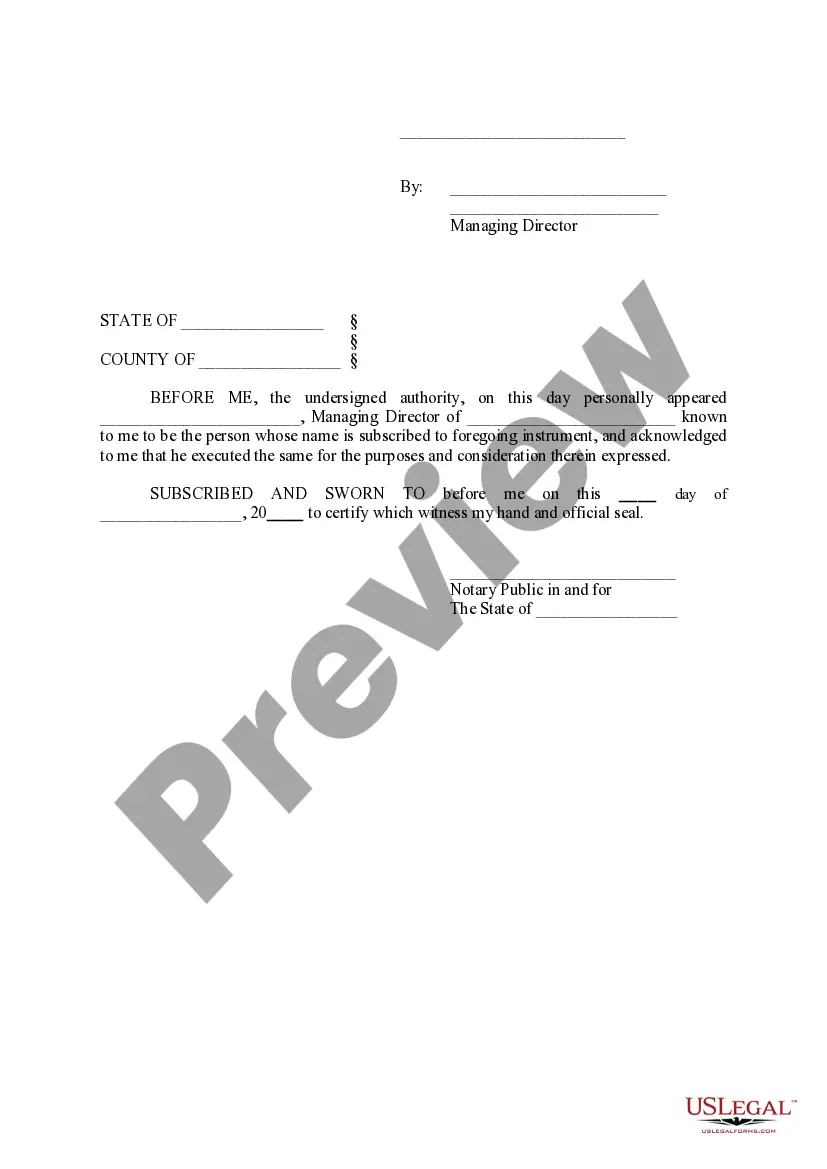

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Nebraska Release Of Judgment Lien?

Avoid pricey lawyers and find the Nebraska Release of Judgment Lien you need at a affordable price on the US Legal Forms site. Use our simple groups functionality to look for and download legal and tax files. Go through their descriptions and preview them before downloading. Additionally, US Legal Forms provides customers with step-by-step instructions on how to download and fill out every form.

US Legal Forms clients just need to log in and download the specific document they need to their My Forms tab. Those, who have not obtained a subscription yet must follow the guidelines below:

- Ensure the Nebraska Release of Judgment Lien is eligible for use where you live.

- If available, read the description and make use of the Preview option before downloading the sample.

- If you are sure the template suits you, click on Buy Now.

- In case the form is wrong, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay by card or PayPal.

- Select obtain the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the form to the device or print it out.

Right after downloading, you can complete the Nebraska Release of Judgment Lien by hand or by using an editing software program. Print it out and reuse the form many times. Do more for less with US Legal Forms!

Form popularity

FAQ

In civil law, enforcement of the judgment is left to the parties of the lawsuit.Although most people comply with a judgment issued by a court, some people simply ignore the judgment and do not pay. When a person does not pay, enforcement is required to make them give the plaintiff the money owed.

Keep in mind that if you do NOT pay the judgment: The amount you owe will increase daily, since the judgment accumulates interest at the rate of 10% per year. The creditor can get an order telling you to reimburse him or her for any reasonable and necessary costs of collection.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

A simple way to collect a judgment is by deducting money out of the debtor's paycheck using a wage garnishment. The debtor must have a decent income because both the federal government and states cap the amount you can take, and certain types of income, like Social Security, are off-limits.

A Satisfaction of Judgment or Release and Satisfaction is a legal document that shows that the plaintiff has been paid all that he or she is owed, based upon the original judgment against the defendant.

How long does a judgment lien last in Nebraska? A judgment lien in Nebraska will remain attached to the debtor's property (even if the property changes hands) for five years.

Renew the judgment Money judgments automatically expire (run out) after 10 years.If the judgment is not renewed, it will not be enforceable any longer and you will not have to pay any remaining amount of the debt. Once a judgment has been renewed, it cannot be renewed again until 5 years later.

A civil judgment is a ruling against a defendant in a court of law. It refers to a non-criminal legal matter and often requires the defendant to pay damages. Damages are generally money amounts.

Understanding Judgment Liens If you owe money to a creditor and don't pay, that party may sue you for the balance. If the court rules against you, the creditor can file a judgment lien against you.Once a judgment lien is filed with the appropriate authority, it becomes attached to any personal or real property.