Nebraska Dissolution Package to Dissolve Corporation

About this form

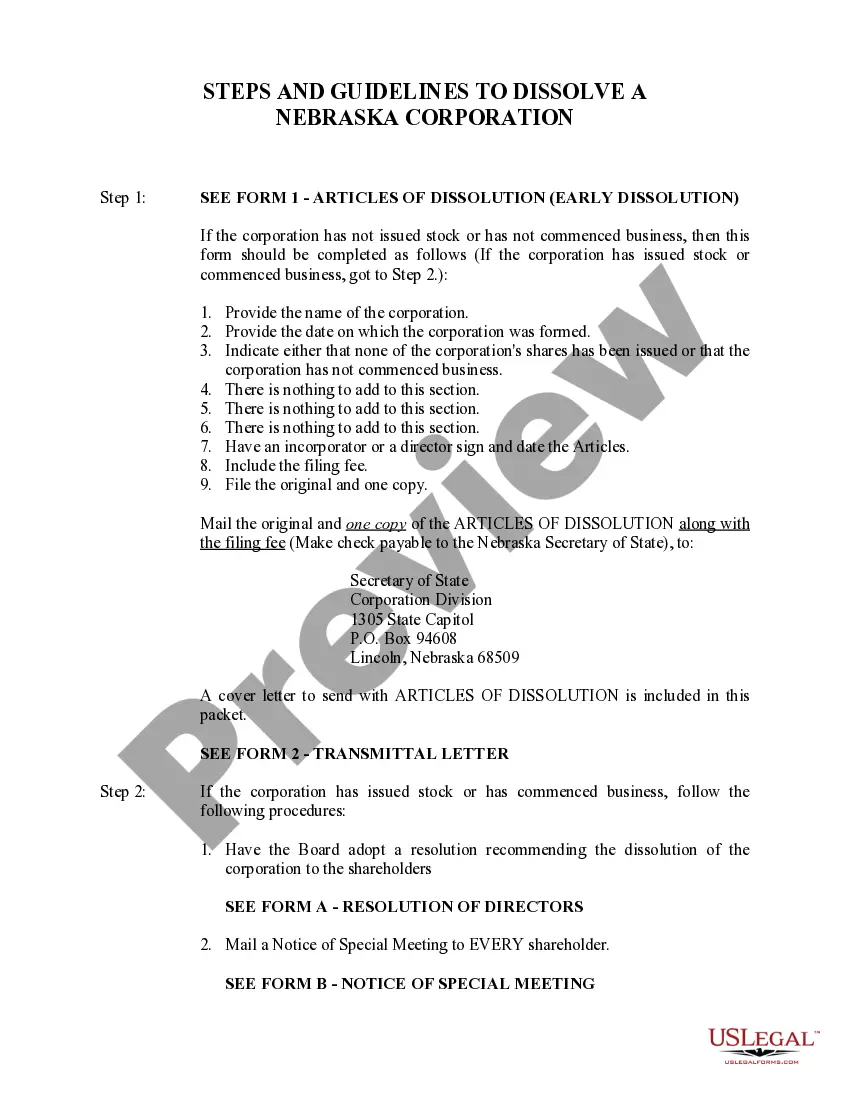

The Nebraska Dissolution Package is a comprehensive set of legal documents designed to facilitate the voluntary dissolution of a corporation in Nebraska. This package includes all necessary forms, step-by-step instructions, and additional information needed to ensure compliance with state laws. Unlike administrative or judicial dissolution forms, this package specifically addresses voluntary dissolution initiated by the corporation's directors or shareholders.

Form components explained

- Articles of Dissolution for both early dissolution and standard process.

- Transmittal letters for filing with the Secretary of State.

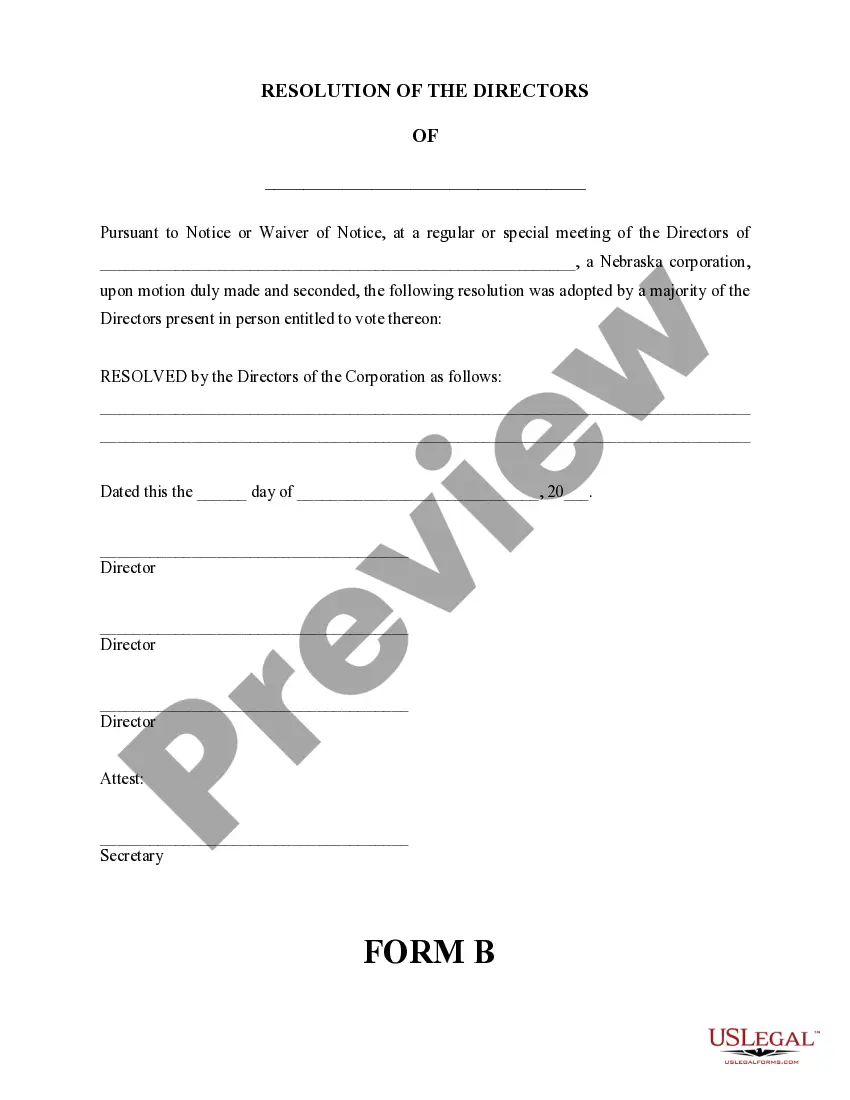

- Resolution of Directors for recommending dissolution.

- Notice of Special Meeting to inform shareholders of the proposed dissolution.

- Forms for notifying claimants and publishing notices for claims.

- Guidelines for distributing remaining assets and addressing liabilities.

When to use this form

This form package should be used when the board of directors of a Nebraska corporation decides to voluntarily dissolve the organization. Common scenarios include when the corporation has completed its business operations, when it has no outstanding debts or liabilities, or when shareholders agree to end the corporate entity. This package is necessary to effectively and legally wind up a corporation's affairs and ensures compliance with Nebraska law.

Who this form is for

- Corporate directors or officers seeking to dissolve their corporation.

- Shareholders looking for a structured way to wind up a business entity.

- Individuals responsible for the legal compliance of a corporation in Nebraska.

- Business owners who have decided not to continue operations.

Instructions for completing this form

- Review all sections of the dissolution package to understand the requirements for dissolution.

- If applicable, have the board of directors adopt a resolution to recommend dissolution.

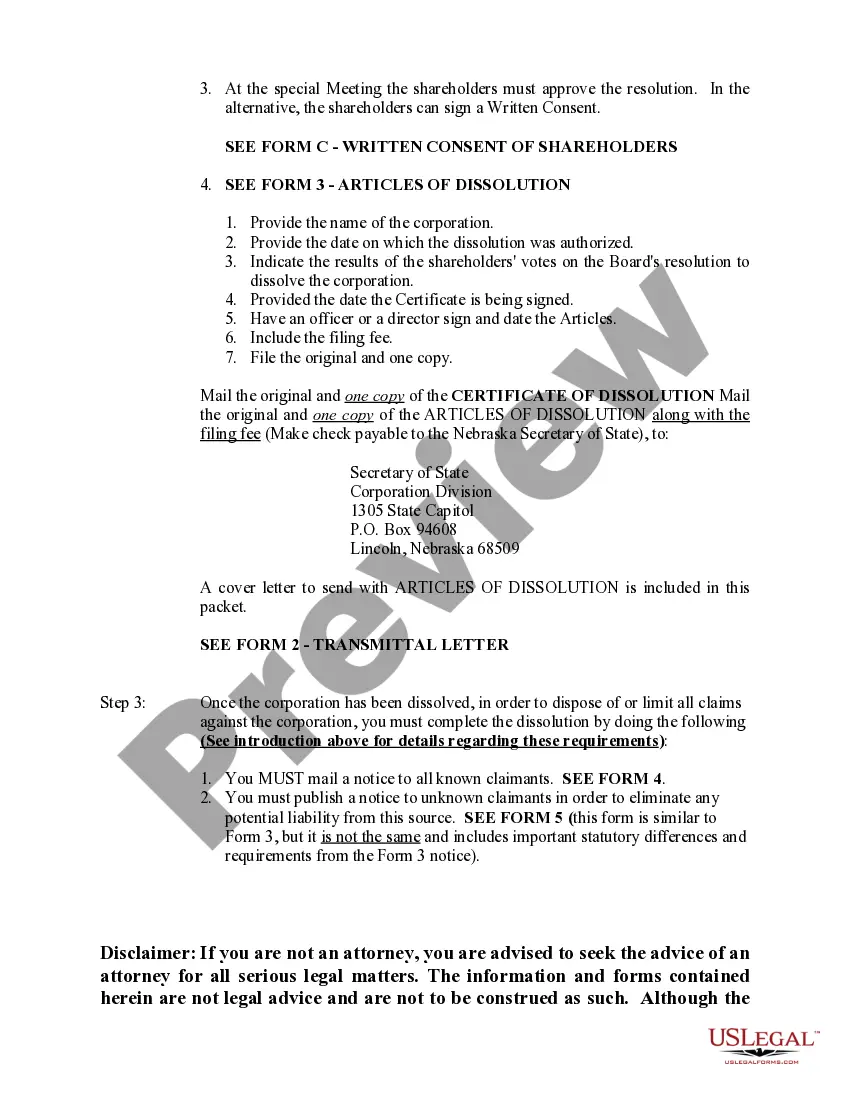

- Complete the appropriate Articles of Dissolution, ensuring all necessary information is included.

- Submit the completed forms along with any required fees to the Secretary of State.

- Notify all known claimants of the dissolution and publish a notice for unknown claimants.

Notarization requirements for this form

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Failing to obtain shareholder approval for the dissolution proposal.

- Not submitting the complete set of required forms or necessary fees.

- Overlooking the requirement to notify claimants properly.

- Failing to properly distribute assets before dissolution.

Benefits of completing this form online

- Easy access to professionally drafted legal forms.

- Step-by-step instructions guide you through the process seamlessly.

- Ability to download and customize forms to suit your specific needs.

- Ensures compliance with state laws, reducing the risk of errors.

Looking for another form?

Form popularity

FAQ

If the company has ceased trading and is closed owing money and your debt is with that company then your liability ends with that company.

Hold a Directors meeting and record a resolution to Dissolve the Nebraska Corporation. Hold a Shareholder meeting to approve Dissolution of the Nebraska Corporation. File all required Biennial Reports with the Nebraska Secretary of State.

In legal terms, when a company is dissolved, it ceases to exist. It cannot still be trading - although a person may trade (misleadingly) using its name.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

Definition. The ending of a corporation, either voluntarily by filing a notice of dissolution with the Secretary of State or as ordered by a court after a vote of the shareholders, or involuntarily through government action as a result of failure to pay taxes.

After dissolution, you cannot use the funds remaining in your business bank account for new business. LLC members no longer have the authority to conduct business or do anything that would indicate that the LLC is still active. Your bank account can cover only essential winding up affairs.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.