North Dakota Self-Employed Part Time Employee Contract

Description

How to fill out Self-Employed Part Time Employee Contract?

If you need to finish, download, or print legal document templates, utilize US Legal Forms, the largest compilation of legal forms available online. Take advantage of the site’s straightforward and convenient search feature to find the documents you require.

Various templates for business and personal purposes are categorized by type and state, or keywords. Use US Legal Forms to acquire the North Dakota Self-Employed Part Time Employee Contract with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the North Dakota Self-Employed Part Time Employee Contract. You can also access forms you previously saved in the My documents section of your account.

Every legal document template you purchase is yours permanently. You have access to every form you saved within your account. Select the My documents section and choose a form to print or download again.

Complete, download, and print the North Dakota Self-Employed Part Time Employee Contract with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your business or personal needs.

- Step 1. Ensure you have selected the form for the correct city/state.

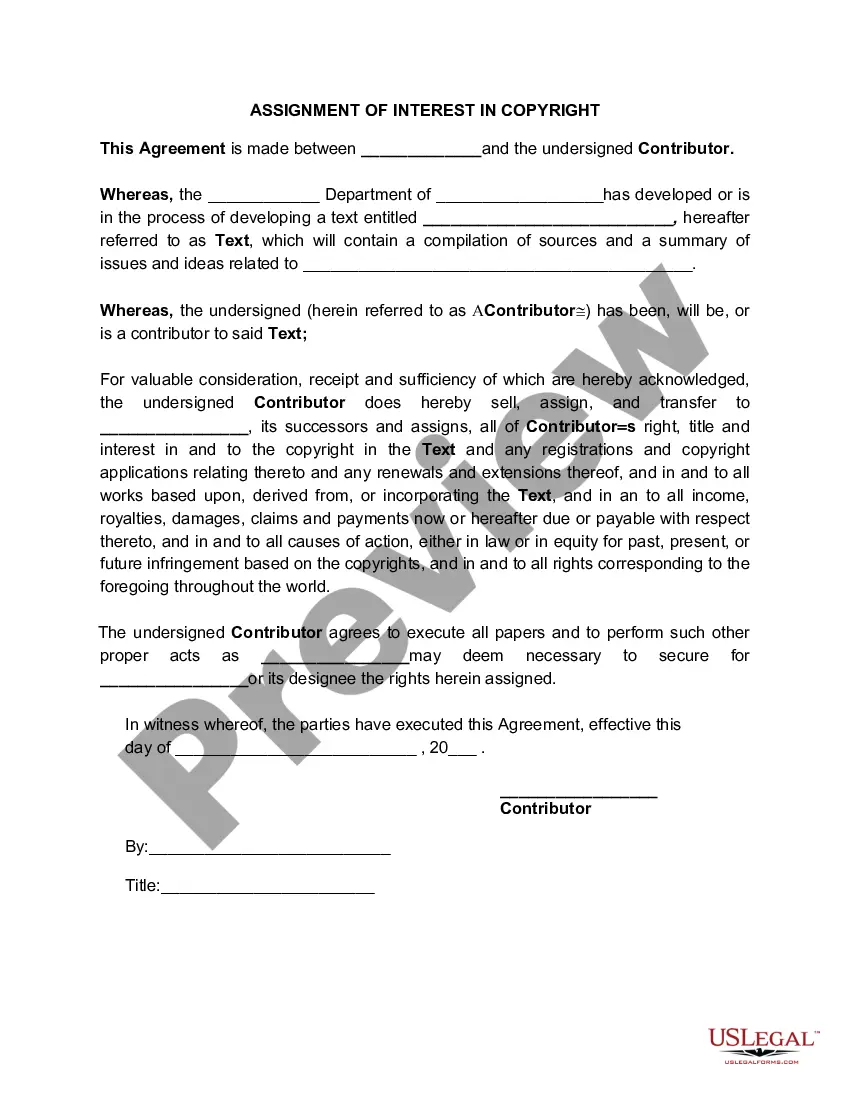

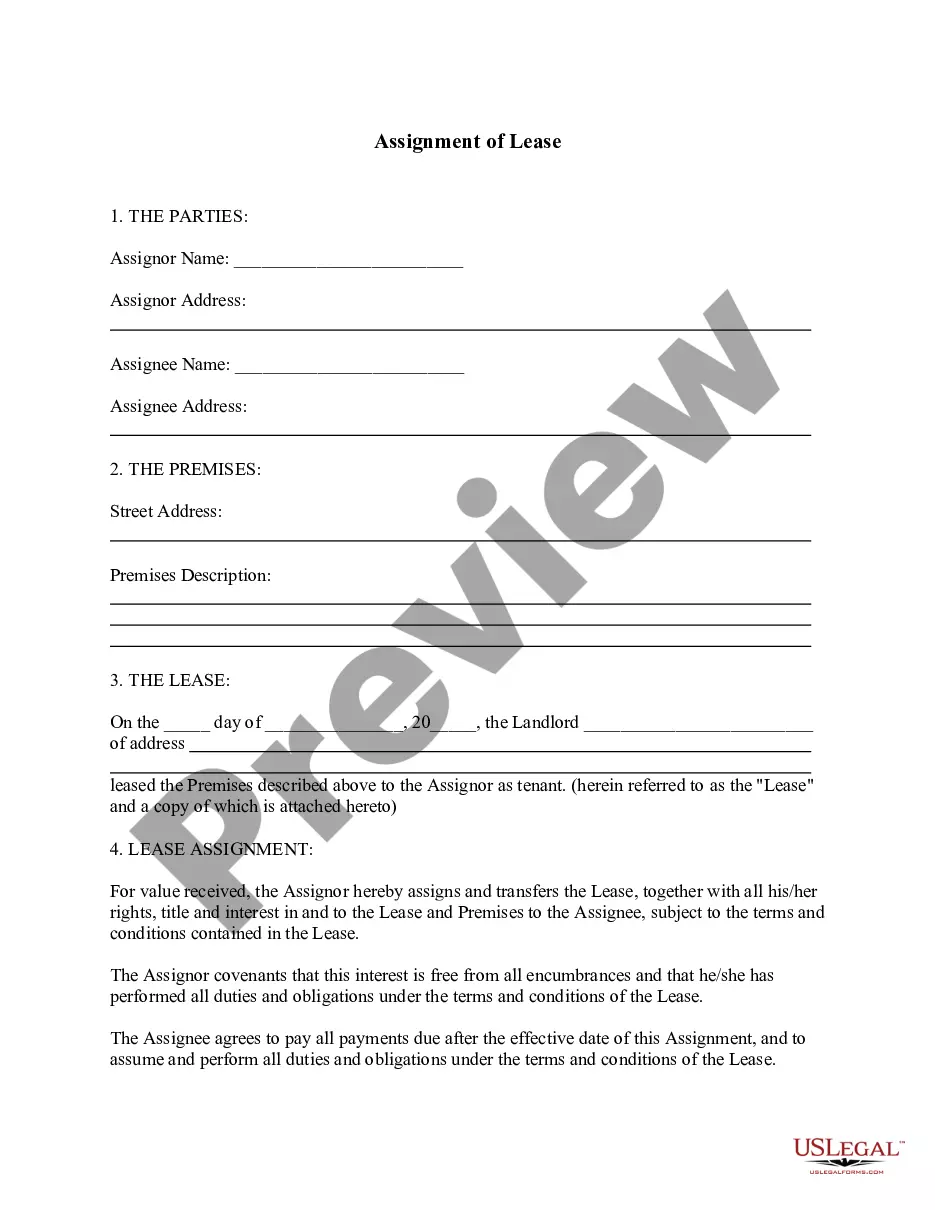

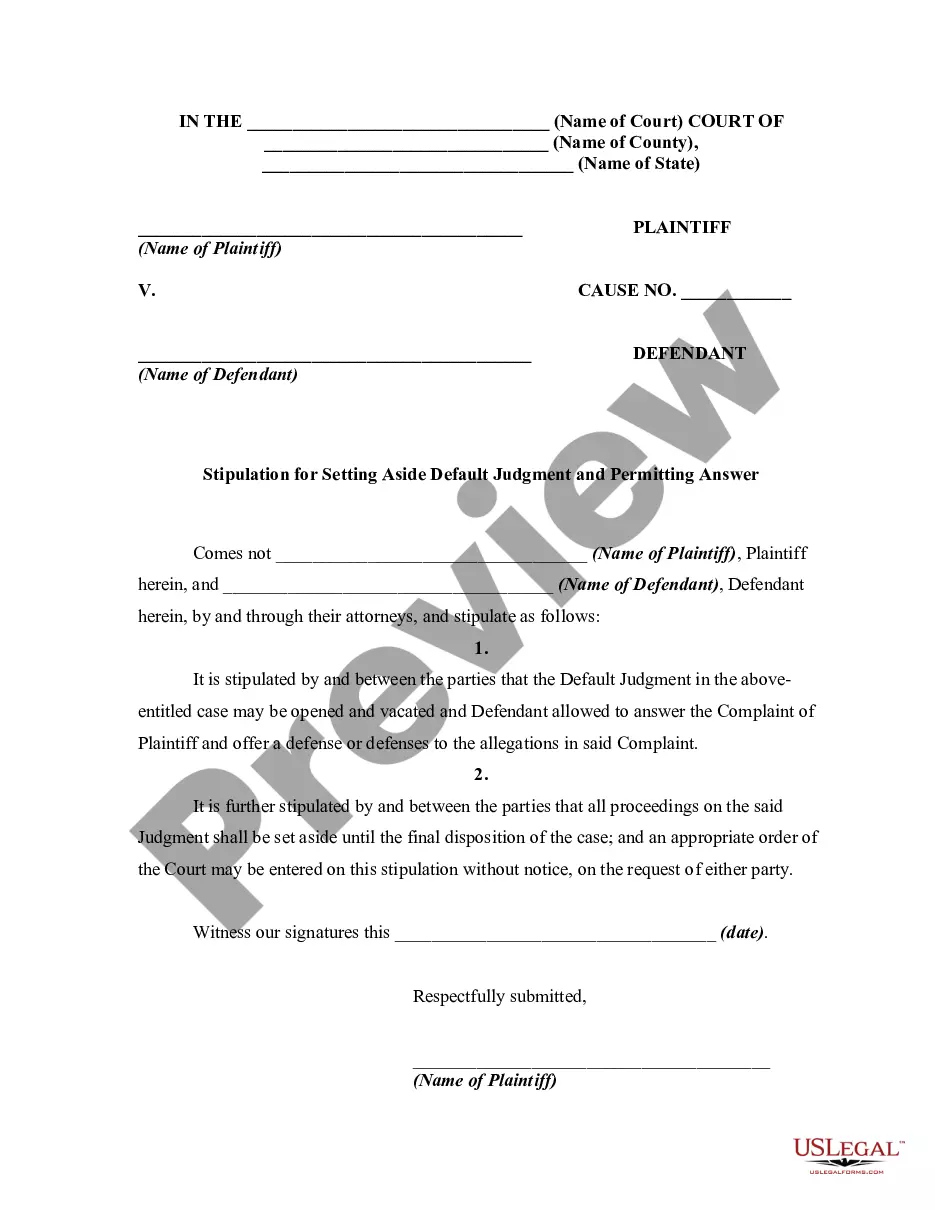

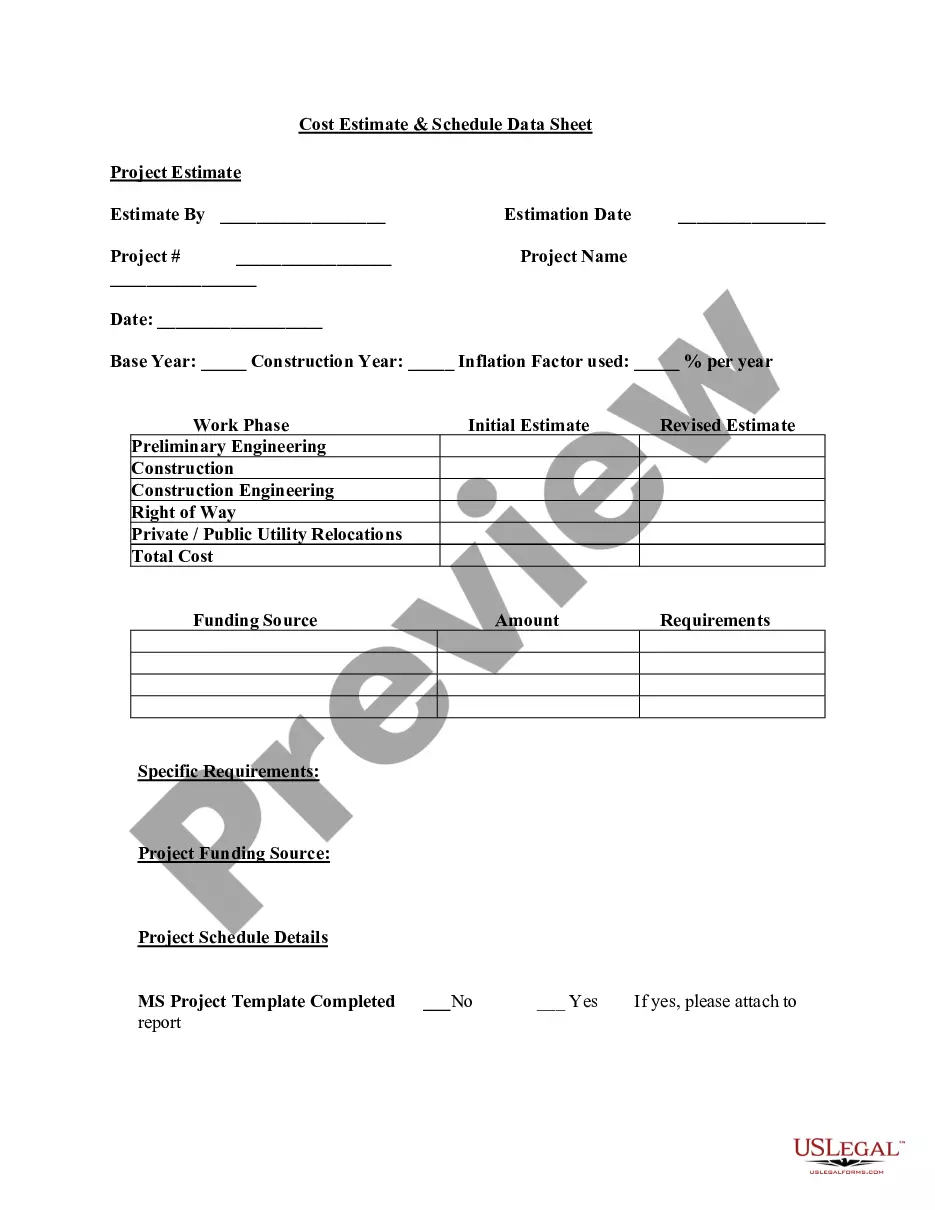

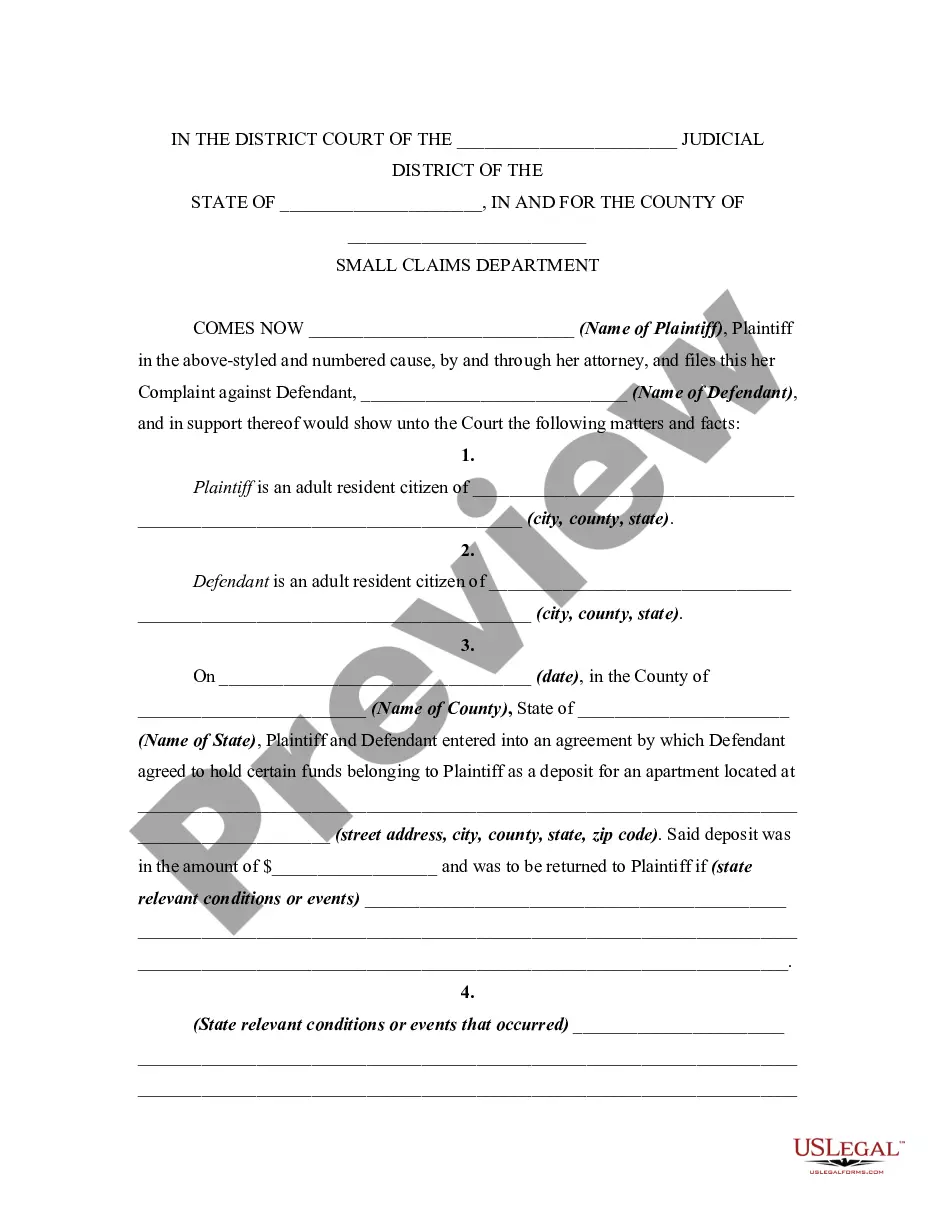

- Step 2. Use the Preview function to review the form’s content. Don’t forget to check the details.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the page to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal form and download it onto your device.

- Step 7. Complete, modify, and print or sign the North Dakota Self-Employed Part Time Employee Contract.

Form popularity

FAQ

In North Dakota, the self-employment tax is calculated based on your net earnings from self-employment. It is important to keep accurate records, as this tax includes both Social Security and Medicare taxes. Understanding your obligations as a self-employed individual can help you factor these costs into your financial planning, particularly when entering agreements like a North Dakota Self-Employed Part Time Employee Contract.

Generally, Employers define full-time Employees as those who work at least 35-40 hours during a seven-day workweek. Employers may choose to provide benefits, such as paid time off, only to full time Employees.

How Many Hours Is Considered Full-Time? Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.

If you are a business owner or contractor who provides services to other businesses, then you are generally considered self-employed.

Part-time hours can be anywhere from a few hours a week, right up to 35 hours. As with full-time hours, there's no official classification. But no matter how many hours you work, employers must treat you the same as a full-time employee.

A contract worker, also known as an independent contractor or 1099 employee (based on the 1099 tax form they receive), is an individual who enters into a contractual agreement with a business in order to provide a service in exchange for a fee.

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

In addition, 14 and 15 year-old workers are limited to a maximum of 3 hours of work on a school day and 8 hours on a non-school day; and 18 hours in a school week and 40 hours in a non-school week.

Unlike independent contractors, fixed-term contract employees are usually still considered full-time or part-time employees and are entitled to the same benefits. Contractor and client agree on hours to work to complete a task. Usually has the expectation of ongoing work. Usually hired for a specific task.

Short answer: Full-time employment is usually considered between 30-40 hours a week, while part-time employment is usually less than 30 hours a week.