North Dakota Self-Employed Supplier Services Contract

Description

How to fill out Self-Employed Supplier Services Contract?

If you want to finalize, obtain, or print authentic document templates, utilize US Legal Forms, the premier selection of valid forms, which can be accessed online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your information to create an account.

- Use US Legal Forms to find the North Dakota Self-Employed Supplier Services Agreement with just a few clicks.

- If you are currently a US Legal Forms customer, Log In to your account and click on the Acquire button to obtain the North Dakota Self-Employed Supplier Services Agreement.

- You can also access forms you previously obtained from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

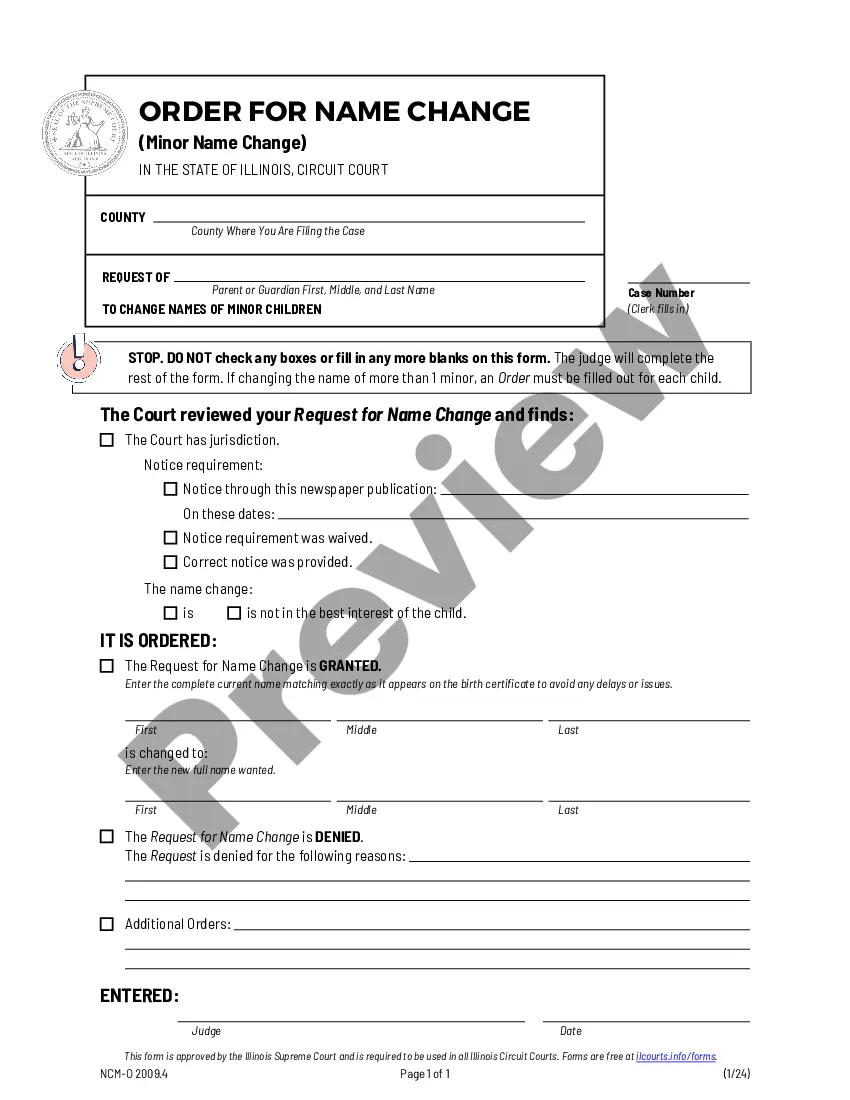

- Step 2. Use the Preview feature to review the form’s details. Don’t forget to read the summary.

Form popularity

FAQ

A contract for deed in North Dakota is a legal agreement between a buyer and a seller, where the buyer agrees to make payments to the seller for a property over time. Unlike traditional mortgages, the seller retains the title until the buyer completes all payments. This arrangement can benefit self-employed individuals seeking flexibility in financing. Utilizing a North Dakota Self-Employed Supplier Services Contract can help clearly outline the terms and protect both parties involved in the transaction.

Choosing between the terms self-employed and independent contractor often depends on context. Both terms indicate that you run your own business. However, using a North Dakota Self-Employed Supplier Services Contract can clarify your role, regardless of the term used. Consider your audience and the nature of your work when deciding which term to use for clarity and professionalism.

Yes, contract workers are generally considered self-employed. They operate under agreements like the North Dakota Self-Employed Supplier Services Contract, which defines their work relationship with clients. This classification allows contract workers to manage their taxes and business expenses independently. Understanding your status can help you make informed decisions about your business operations.

To legally be an independent contractor, you must first establish your business and obtain any necessary licenses. Next, consider using a North Dakota Self-Employed Supplier Services Contract to formalize your working arrangements. This contract should outline your services, payment structure, and other essential terms. By following these steps, you can operate confidently and legally as an independent contractor.

Absolutely, being self-employed and having a contract is common practice. A North Dakota Self-Employed Supplier Services Contract provides a structured way to ensure that your responsibilities and rights are understood by both you and your clients. This clarity can lead to more successful working relationships. Remember, a well-drafted contract can also serve as a helpful legal safeguard if disputes arise.

Yes, you can have a contract if you're self-employed. A North Dakota Self-Employed Supplier Services Contract is a formal agreement that outlines the terms between you and your clients. This contract helps protect both parties by clearly defining the scope of work, payment terms, and deadlines. Having a contract enhances your professionalism and establishes trust with your clients.

In North Dakota, a contractor license is generally required for those who engage in construction or specific trade services. If your business falls under these categories, you must apply for a contractor license to work legally. However, as a self-employed supplier providing services under the North Dakota Self-Employed Supplier Services Contract, you may not need a contractor license unless specified by the services offered. For clarity on your specific needs, consider using USLegalForms to access the necessary guidelines and forms.

Yes, you need a business license to operate legally in North Dakota. This license is essential for compliance with state regulations and helps establish your credibility as a self-employed supplier offering services under the North Dakota Self-Employed Supplier Services Contract. You can obtain a business license through the North Dakota Secretary of State's office and ensure you meet all local requirements as well. Platforms like USLegalForms provide resources to help you navigate this process efficiently.

To become a vendor for government contracts in North Dakota, start by registering your business as a self-employed supplier. You will need to complete the necessary paperwork, including the North Dakota Self-Employed Supplier Services Contract. Additionally, familiarize yourself with the bidding process and maintain compliance with state regulations. Utilizing platforms like USLegalForms can help streamline this process and ensure you have all required documentation.

To write a self-employment contract, define the terms of your engagement, including project details, payment schedule, and confidentiality agreements. It’s crucial to outline expectations clearly to avoid any future misunderstandings. Utilizing a North Dakota Self-Employed Supplier Services Contract template can simplify this task. This way, you can focus on your work while ensuring that your contract is legally sound.