Section 806 of the Fair Debt Collection Practices Act says a debt collector may not harass, oppress, or abuse any person in connection with the collection of a debt. This includes placing telephone calls without meaningful disclosure of the caller's identity.

North Dakota Notice to Debt Collector - Not Disclosing the Caller's Identity

Description

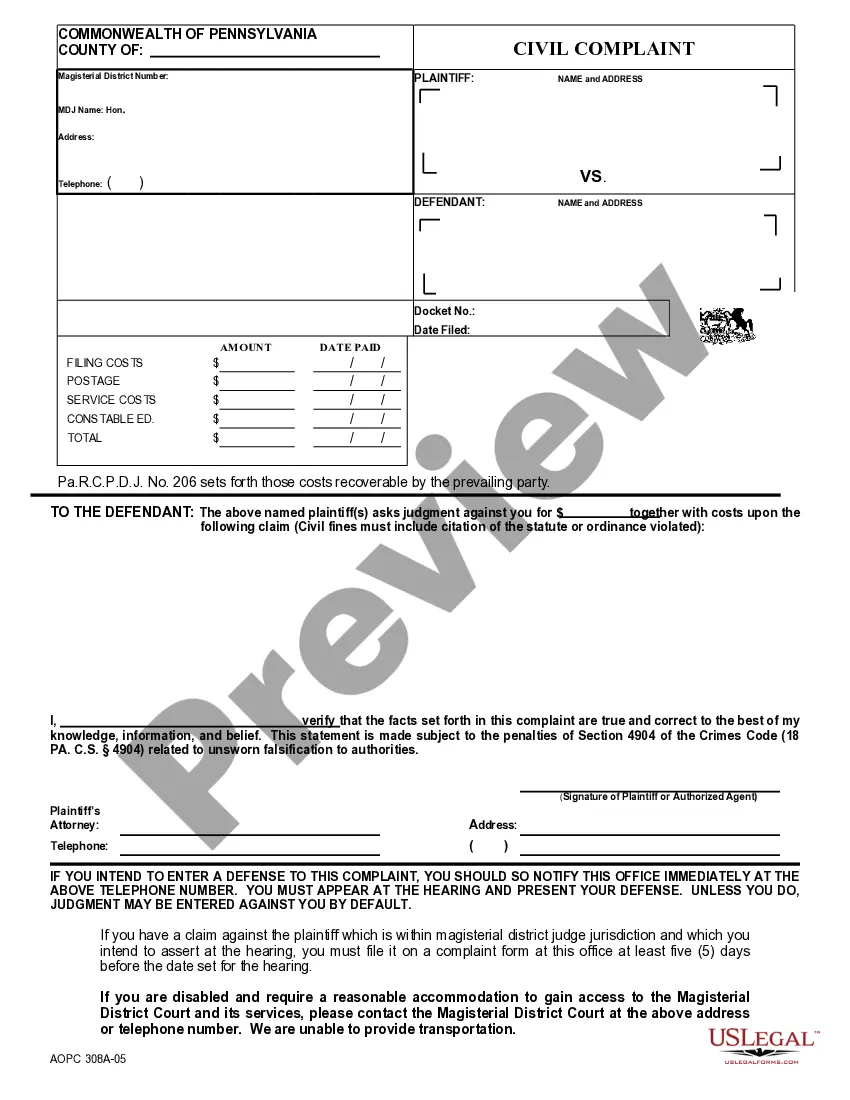

How to fill out Notice To Debt Collector - Not Disclosing The Caller's Identity?

You can dedicate time online looking for the legal document template that fulfills the federal and state requirements you desire.

US Legal Forms provides thousands of legal documents that can be reviewed by professionals.

It is easy to obtain or create the North Dakota Notice to Debt Collector - Not Revealing the Caller’s Identity from my services.

If you wish to acquire another version of the form, use the Search field to locate the template that suits your needs and criteria.

- If you already possess a US Legal Forms account, you can Log In and click on the Get button.

- After that, you can complete, modify, generate, or sign the North Dakota Notice to Debt Collector - Not Revealing the Caller’s Identity.

- Every legal document template you obtain is your own property indefinitely.

- To have an additional copy of an acquired form, navigate to the My documents section and click on the respective button.

- If you are visiting the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure that you have selected the correct document template for the area/town of your choice.

- Review the form description to confirm you have picked the right template.

- If available, utilize the Preview button to view the document template at the same time.

Form popularity

FAQ

A debt collector must tell you the name of the creditor, the amount owed, and that you can dispute the debt or seek verification of the debt. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

Debt collectors often ask for Social Security numbers, birth dates or other personal information to ensure they have reached the correct debtor.

Legally, debt collectors can spoof their phone numbers, but the FDCPA doesn't allow them to hide their identitysuch as when you ask what agency they are calling from. They also can't spoof a number that would indicate they are from a law firm or any type of official government agency.

If you have asked a debt collector not to call you because they are calling the wrong number, they may be in violation of the Telephone Consumer Protection Act. The Fair Debt Collection Practices Act also protects people from harassment by debt collectors, notes The Balance.

Generally, a debt collector can't discuss your debt with anyone other than: You. Your spouse. Your parents (if you are a minor)

For a debt collector to have the legal right to pull your credit report without your consent, you must owe the company a legitimate debt and it must stem from a voluntary credit transaction.

It often happens because that is the number on that person's credit card application, credit report, or other records.Send a Cease-and-Desist Letter to Stop Collection Calls.Get Important Info From the Collection Agent.Cease-and-Desist Letter for Wrong Number.Tips for the Future.

Do not give the caller personal financial or other sensitive information. Never give out or confirm personal financial or other sensitive information like your bank account, credit card, or Social Security number unless you know the company or person you are talking with is a real debt collector.

While these procedures may vary by company and whether the call is inbound or outbound, there is a common thread: generally debt collectors ask the consumer to verify some piece of personal information, such as the last four digits of the consumer's social security number or the consumer's birth date, to ensure they

Be aware that collection agencies are forbidden from trying to collect a without first notifying you in writing or making a reasonable attempt to do so. Do not share financial and personal information if you are not certain you are dealing with a real collection agency.