North Dakota Power of Attorney by Trustee of Trust

Description

How to fill out Power Of Attorney By Trustee Of Trust?

If you require thorough, download, or create authorized document templates, utilize US Legal Forms, the largest collection of legal forms, which can be accessed online.

Take advantage of the site's simple and convenient search to find the documents you need. Various templates for business and personal uses are categorized by classification and jurisdiction, or keywords.

Utilize US Legal Forms to obtain the North Dakota Power of Attorney by Trustee of Trust in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Be proactive and download and print the North Dakota Power of Attorney by Trustee of Trust with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to acquire the North Dakota Power of Attorney by Trustee of Trust.

- You can also access forms you previously saved within the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

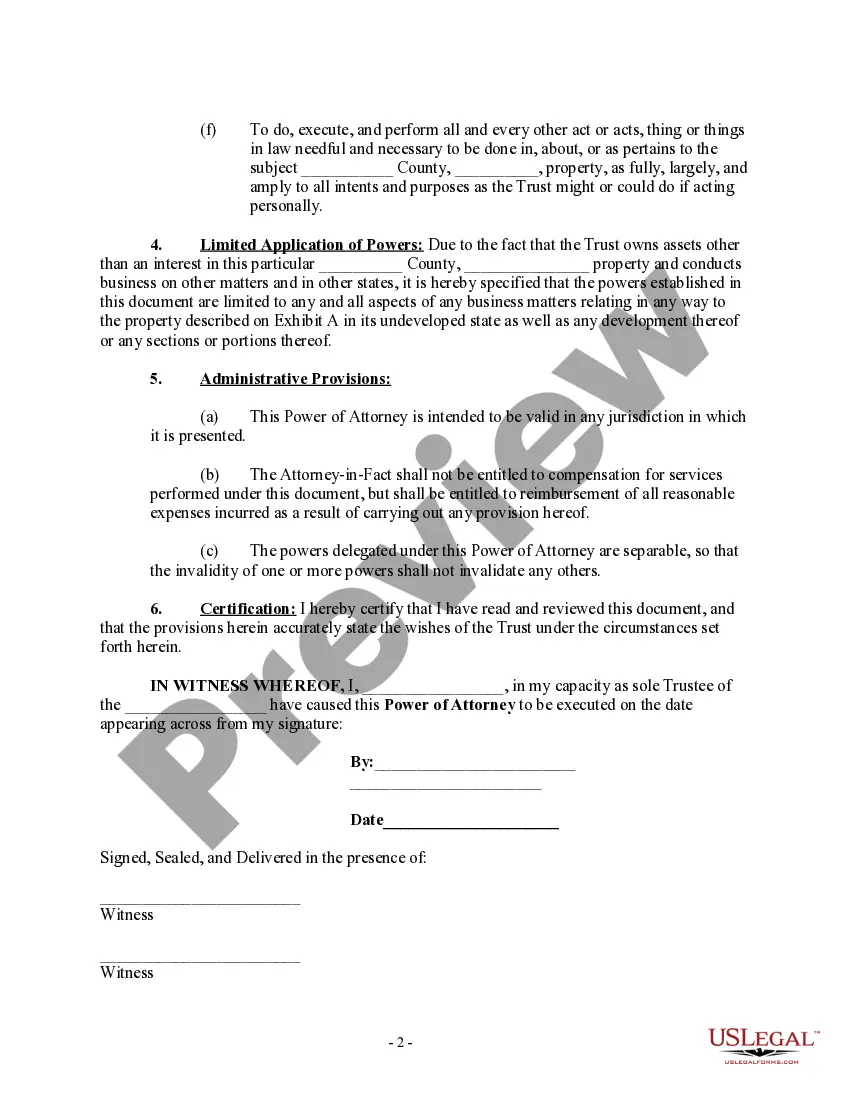

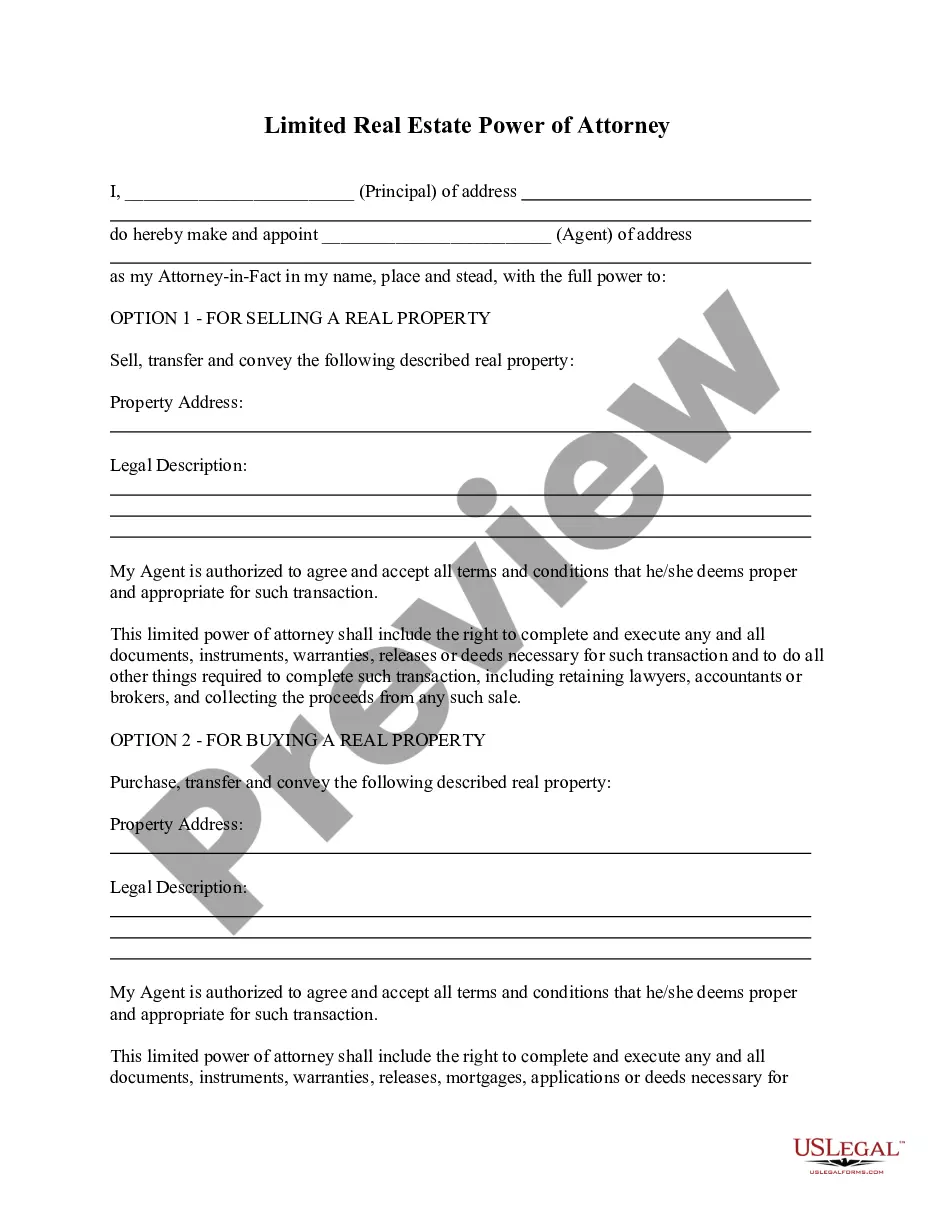

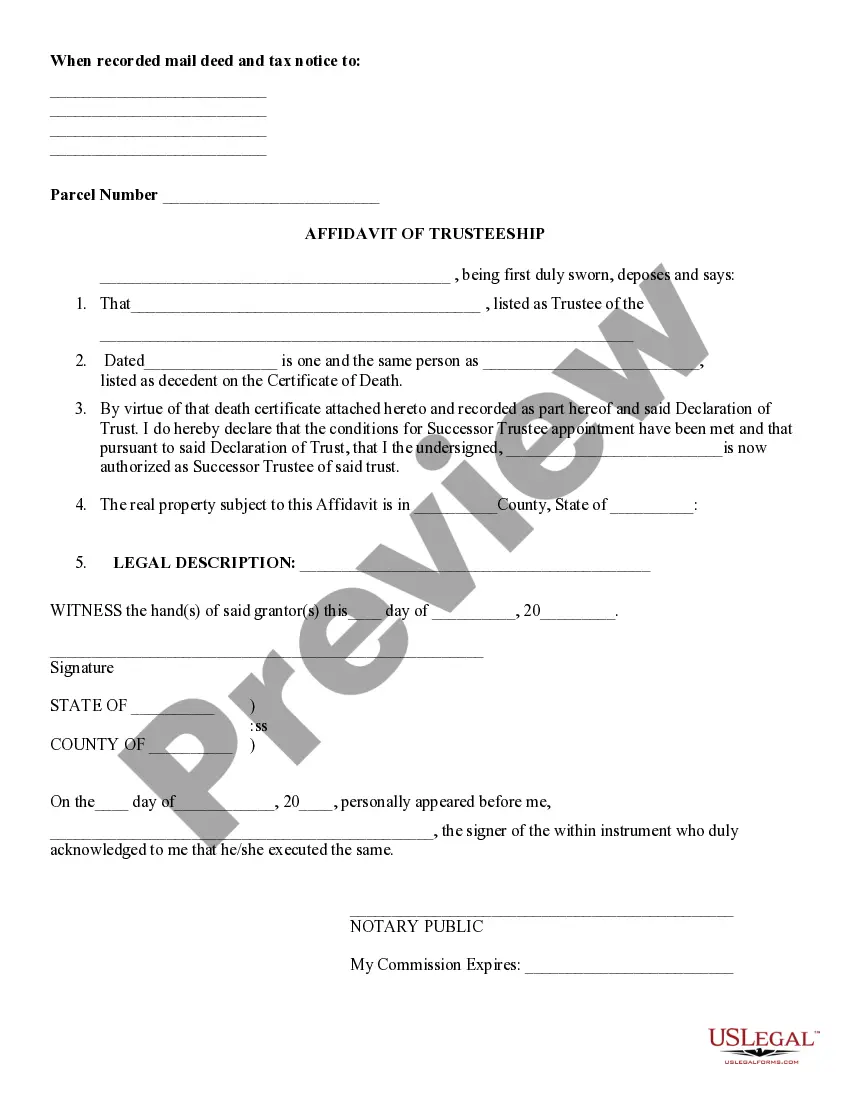

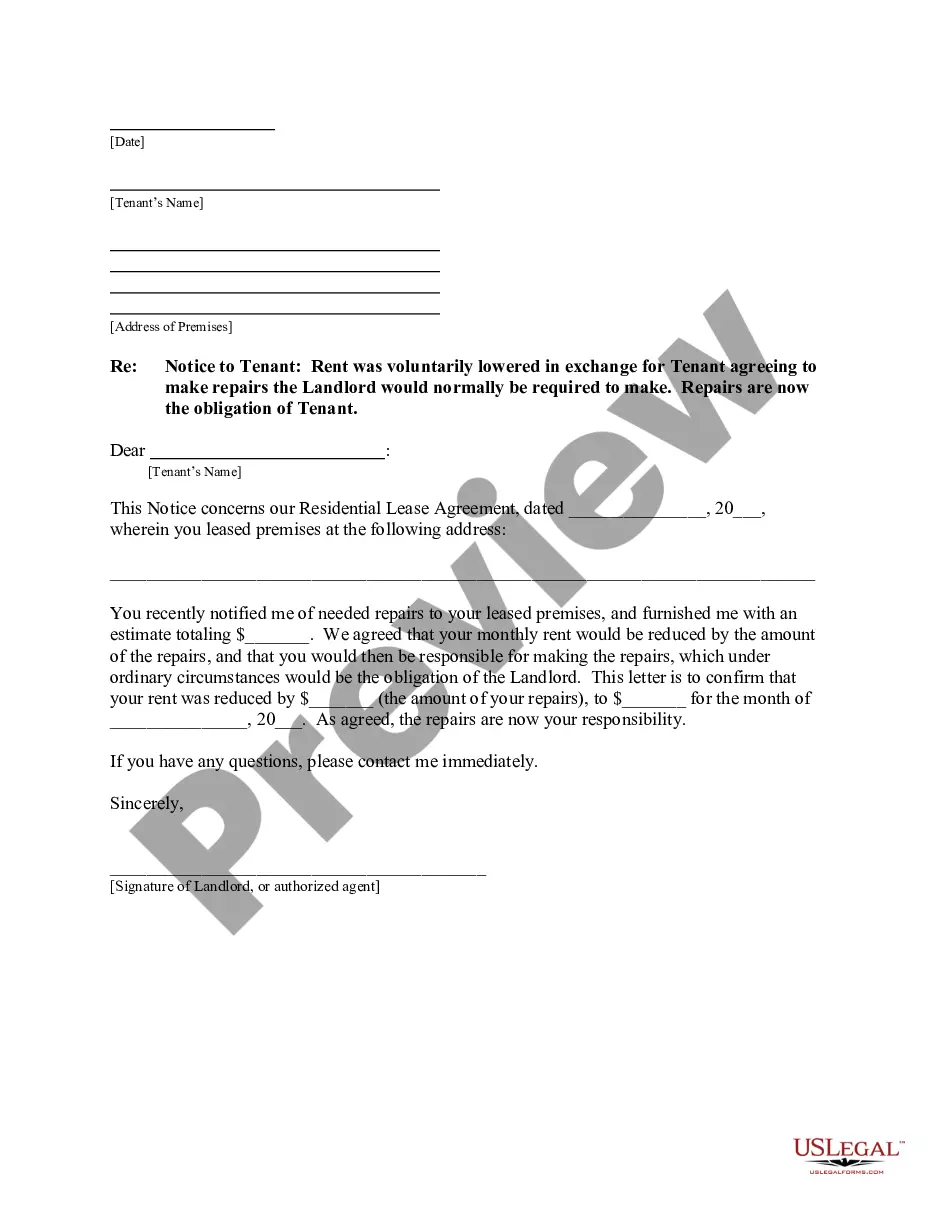

- Step 2. Utilize the Preview option to review the form's content. Remember to read the instructions.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to sign up for an account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the North Dakota Power of Attorney by Trustee of Trust.

Form popularity

FAQ

A power of attorney is a legal document that gives another person legal power to make personal decisions on your behalf. A trustee, on the other hand, is a person or company appointed in a trust document to manage and disburse trust property.

To exercise reasonable care and ensure the correct distribution of assets. To provide an income for the beneficiaries and to preserve the value of the capital. The precise powers that a trustee has will be defined by the trust deed and by law.

Section 25 of the Trustee Act 1925 allows a trustee to grant a power of attorney delegating their functions as a trustee to the attorney. Section 25 provides a short form of power by which a single donor can delegate trustee functions under a single trust to a single donee. Trustees can use other forms.

The trustee cannot fail to carry out the wishes and intent of the settlor and cannot act in bad faith, fail to represent the best interests of the beneficiaries at all times during the existence of the trust and fail to follow the terms of the trust. A trustee cannot fail to carry out their duties.

The trustee cannot do whatever they want. They must follow the trust document, and follow the California Probate Code. More than that, Trustees don't get the benefits of the Trust. The Trust assets will pass to the Trust beneficiaries eventually.

All trustees have the power to manage trust assets. This may include the sale and purchase of trust property and making investments. The trustee must decide whether to use its power to manage assets on a case-by-case basis and must only consider relevant factors when deciding to exercise any power.

A trust is a legal arrangement through which one person, called a "settlor" or "grantor," gives assets to another person (or an institution, such as a bank or law firm), called a "trustee." The trustee holds legal title to the assets for another person, called a "beneficiary." The rights of a trust beneficiary depend

If the terms of the trust regarding the trust investments no longer seem reasonable, the trustee can obtain a court order to deviate from the terms of the trust.

Generally speaking, a Trustee (who is not also the Grantor) cannot appoint a Power of Attorney to take over the Trustee's duties or responsibilities, unless this is something that is directly permitted by the Trust Deed or a court order.

1) Duty to Inform Beneficiaries (Section 16060). 2) Duty to Provide Terms of Trust at Beneficiary's Request (Section 16060.7). 3) Duty to Report at Beneficiary's Request (Section 16061).