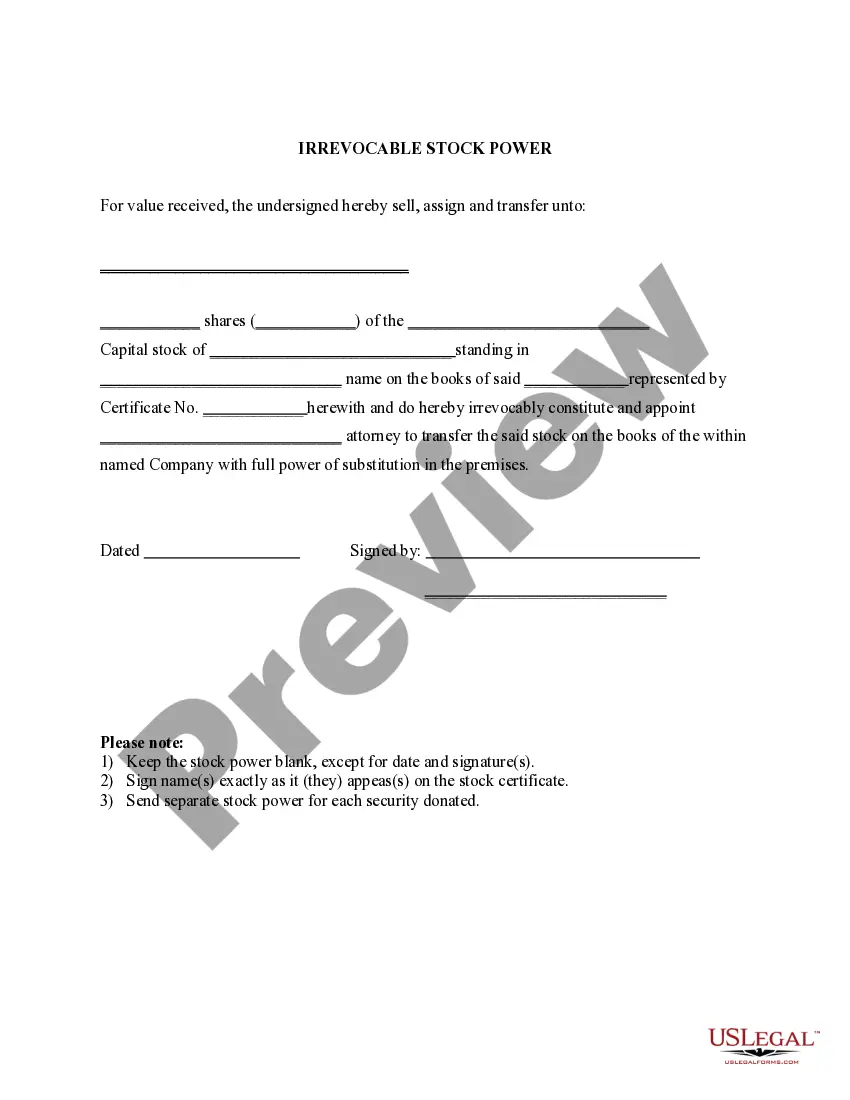

North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor

Description

How to fill out Irrevocable Power Of Attorney For Transfer Of Stock By Executor?

If you need to summarize, obtain, or create legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the site's straightforward and user-friendly search feature to locate the documents you need.

Many templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor in just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor. Each legal document template you purchase is yours permanently. You have access to every form you downloaded in your account. Go to the My documents section and choose a form to print or download again. Compete and acquire, and print the North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor with US Legal Forms. There are many professional and state-specific forms you can use for your personal business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click on the Obtain button to get the North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for your appropriate city/state.

- Step 2. Utilize the Review option to examine the form’s details. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions in the legal form template.

- Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Filling out a power of attorney document, specifically the North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor, requires careful attention to detail. Begin by gathering all necessary information about the principal, the agent, and the specific stock involved. Ensure you clearly outline the powers granted to the agent, as this ensures they can act on your behalf effectively. Using a reliable platform like USLegalForms can simplify this process, providing you with templates and guidance tailored to North Dakota's requirements.

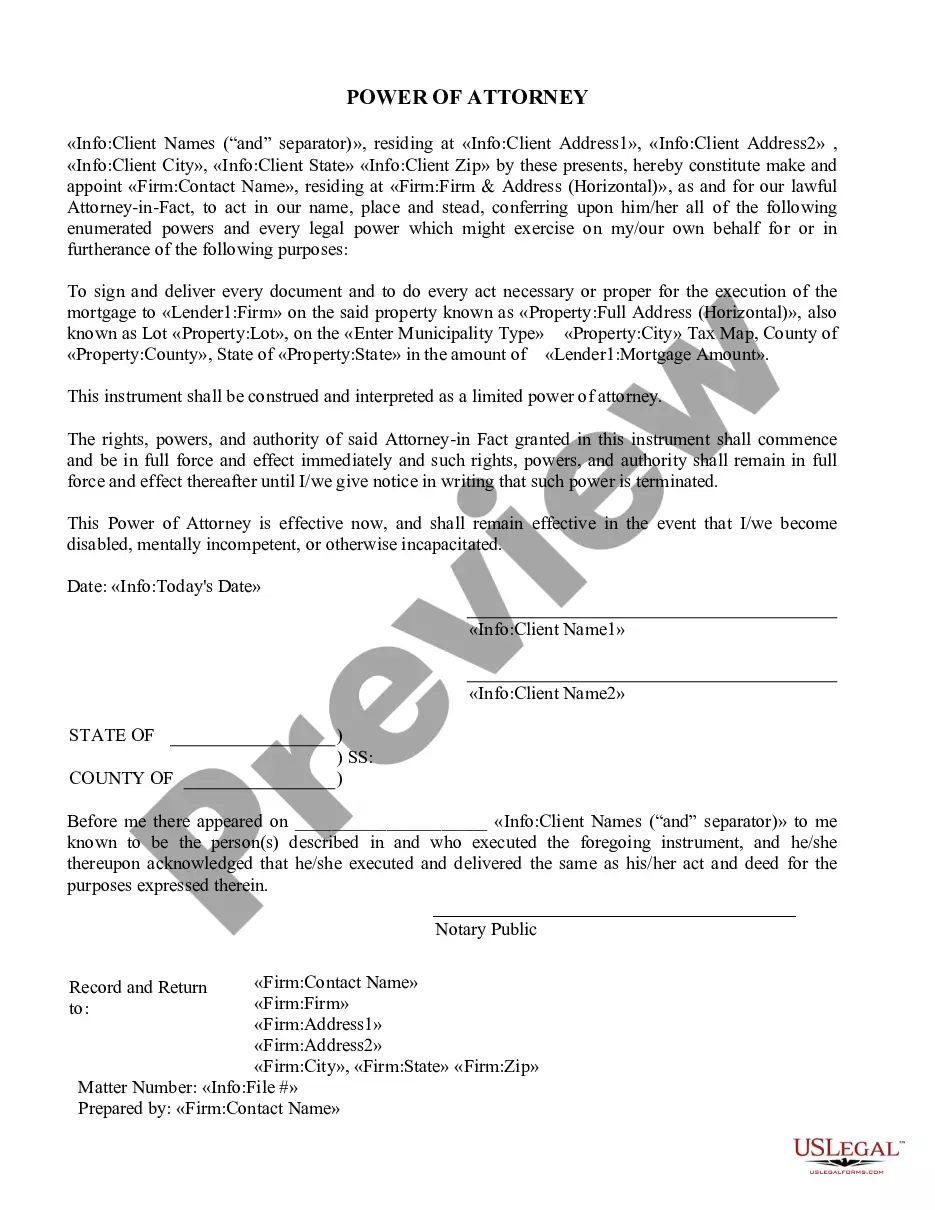

Durable power of attorney allows an agent to act on your behalf even after you become incapacitated, ensuring that your financial affairs continue to be managed effectively. In contrast, a non-durable power of attorney is limited to situations where you are still able to make decisions. When considering stock transfers, a North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor is a durable option that protects your interests and provides peace of mind for your estate management.

The primary difference between a durable and non-durable power of attorney lies in their effectiveness during incapacitation. A durable POA remains valid even if you are unable to make decisions, while a non-durable POA becomes void under such circumstances. For those managing estates or stock transfers, a North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor offers the durability needed to ensure continued management of assets.

A power of attorney on a brokerage account allows someone to manage your investment decisions and transactions on your behalf. This arrangement can be particularly useful if you wish to delegate authority while ensuring your financial interests are protected. Utilizing a North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor can provide the necessary framework for executing stock transactions effectively, ensuring compliance with legal requirements.

Power of attorney grants specific authority to a designated person, but it does come with limitations. For instance, your agent cannot make decisions that violate your stated wishes, nor can they act beyond the scope of authority defined in the document. In situations involving stock transfers, a North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor provides clear guidelines and limitations, ensuring actions taken align with your intent.

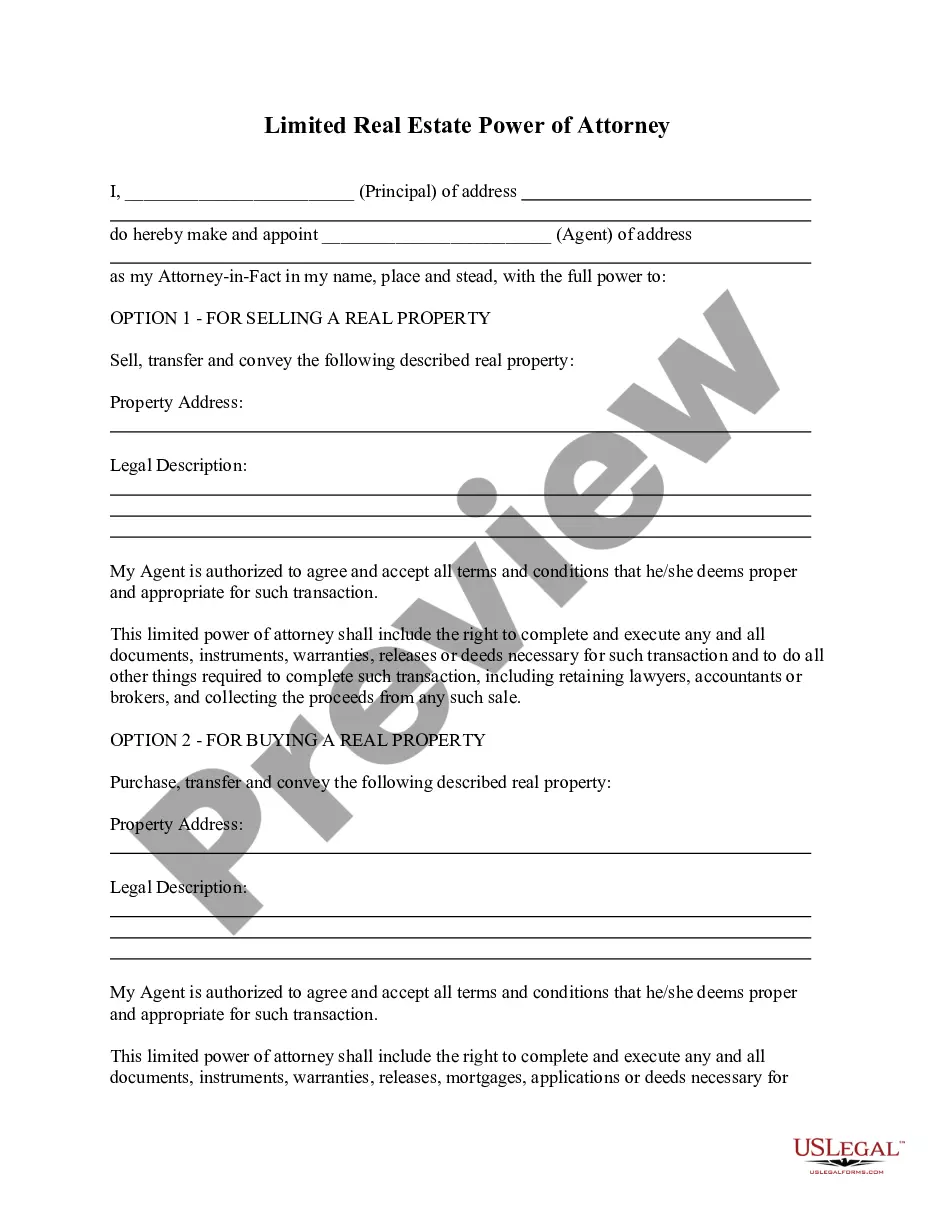

Transferring mineral rights in North Dakota typically involves a formal process that includes drafting a deed to convey the rights. This deed should be recorded with the appropriate county office to ensure legal effectiveness. Using a North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor can streamline this process if the mineral rights are part of an estate, allowing designated individuals to handle these transfers efficiently.

Choosing between a general and durable power of attorney depends on your specific needs. A general power of attorney may become invalid if you become incapacitated, while a durable power of attorney remains effective in such situations. If you seek a reliable solution for managing stock transfers, consider the benefits of a North Dakota Irrevocable Power of Attorney for Transfer of Stock by Executor. This option ensures your financial decisions remain in place even if you cannot act personally.